This content was reviewed by our licensed insurance agent, Michelle Schenker.

When you purchase through links on our site, we may earn a commission. Here’s how it works.

My team reviews the pet insurance industry’s most reputable companies, researches extensively, and analyzes customer feedback. Our licensed insurance agent fact-checks everything, and I update our coverage throughout the year as providers change their policies, premiums, payout limits, reimbursements, customer service experience, and more. Who are the best pet insurance companies this year? Let’s find out.

| Pet Insurance Ranking | Best Overall |

Best For Young Pets | Best No-Cap Payouts | Best Coverage |

Best Value |

Best Newcomer |

|---|---|---|---|---|---|---|

| Company |  |

|

|

|

|

|

| Average Policy Price | Variable | Variable | Variable | Higher | Lower | Average |

| Policy Coverage | Extensive | Extensive | Limited | Extensive | Extensive | Limited |

| Customer Service & Reputation | Good | Good | Excellent, Stable | Excellent, Stable | Excellent, Stable | Uncertain, New |

| Average Claim Processing | 18-30 Days | 5-6 Days | 2 Days | 5 Days | 3 Days | 2 Days |

| Vet Direct Pay Option | ||||||

| Plan Customization Options | Many | Many | Restricted | Many | Many | Many |

| Get A Quote | Get A Quote | Get A Quote | Get A Quote | Get A Quote | Get A Quote | |

| Read Review | Read Review | Read Review | Read Review | Read Review | Read Review |

- Best Pet Insurance Reviews

- Pet Insurance Companies (All Of Your Options)

- AKC Pet Insurance Review

- Animalia Pet Insurance Review

- ASPCA Pet Health Insurance Review

- Bivvy Review

- CarePlus Review

- Companion Protect Review

- Hartville Review

- ManyPets Review

- MetLife Review

- Nationwide Review

- Odie Review

- Paw Protect Review

- Petco Review

- PetPartners Review

- Prudent Pet Review

- Pumpkin Review

- Spot Review

- Toto Review

- Trupanion Review

- Wagmo Review

- 24Petprotect Review

- Cost And Coverage Comparisons

- Free Pet Insurance Quotes

- What Are The Different Types Of Pet Insurance Plans?

- What Does Pet Insurance Cover?

- How Does Pet Insurance Work?

- How To Choose The Best Pet Insurance For You

- Frequently Asked Questions

- Best Pet Insurance Providers By Value And Needs

- Why Trust Canine Journal?

Best Pet Insurance Reviews

The number of pet insurance companies to choose from is overwhelming. People often decide to go with the largest, most well-known company, failing to spend the essential time needed to consider their options fully.

Below, I highlight a brief snapshot of each major U.S. company, including what stands out regarding coverage and exclusions, what may sway you to choose a company, and any discounts the provider offers. I encourage you to get quotes and compare rates from at least three companies and read our in-depth reviews of those you are interested in before signing up.

Companies are listed according to our rankings followed by alphabetically.

Pets Best Review

Pets Best is the best overall pick for pet insurance because it offers extensive coverage at an affordable price on average compared to the competition. Its plans are completely customizable, so you pay for the coverage you want and what you can afford. There are no upper age limits, so even if you adopt a senior dog or decide you want coverage for your pet when they’re older, you won’t be limited in your coverage options.

Pets Best also has some unique plans and features. In fact, it’s one of the few pet insurance providers to offer an accident-only plan, which can be helpful for those wanting a true emergency-only option at a lower price. Additionally, it provides coverage for curable pre-existing conditions once healed or cured.

Wellness plans are also available through Pets Best as an add-on to your pet insurance policy. This may be a convenient option for your household and help you budget for routine expenses like vaccinations, flea/tick prevention, heartworm testing, and more. Pets Best has much to offer to fit each pet parent’s needs, so it’s worth your consideration.

Pets Best also administers policies through Farmers Insurance, PEMCO, and Progressive.

Our Personal Experience With Pets Best

| Pros | Cons |

|---|---|

| Customize your plan to fit your budget and needs with different deductible, reimbursement, and payout options | Longer than average claim processing averages (18-30 days) |

| May have option for Pets Best to pay your vet directly to avoid waiting for reimbursement | Excludes alternative/holistic therapies and C-sections |

| Accident-only plan available | |

| Optional wellness plans available as an add-on | |

| Shorter than average waiting periods (3 days for accidents and 14 days for hip dysplasia) | |

| Consistently among the lowest prices |

Pets Best offers the following discounts:

- 5% off for multiple pets

- 5% off for military members and their families

Use this link to take advantage of the best possible price. No promo code is needed. You can also visit our dedicated Pets Best discounts page to learn more.

In-Depth Review Of Pets Best

Fetch Review

Fetch is excellent if you want coverage for a very young puppy because it offers coverage as young as six weeks old. In comparison, you have to wait until eight weeks with most competitors.

Another unique feature of Fetch policies is its VirtualVet visit coverage. You can cover up to $1,000 in virtual vet visits, whether over video chat, call, or text.

Fetch offers coverage for several conditions commonly excluded by other providers without requiring an extra fee. If you want a pet insurance policy without worrying about add-ons and extra fees, Fetch is worth your consideration.

| Pros | Cons |

|---|---|

| Customize your plan to fit your budget and needs with different deductible, reimbursement, and payout options | Can't have Fetch pay your vet directly to avoid waiting for reimbursement |

| Behavioral therapies, alternative/holistic therapies, C-sections, sick visit exam fees, and gum disease are included in coverage | No accident-only plan available |

| Optional wellness plans available as an add-on | Longer than average accident waiting period (15 days) |

Fetch offers the following discounts:

- Up to 10% off for animal shelter adoptees and employees, corporate benefit plans, medical services pets, strategic partners, military, veterinary staff, and students

- 10% off premiums for Walmart shoppers

- Save $25 or more when you pay quarterly or annually

- 10% off for AARP members for life

Use this link to take advantage of the best possible price. No promo code is needed. Alternatively, call 800-237-1123. You can also visit our dedicated Fetch promotion page to learn more.

In-Depth Review Of Fetch

Healthy Paws Review

All of Healthy Paws’ plans include unlimited payouts. An insurance plan with no cap on payouts means you never have to worry about hitting the maximum on your coverage payouts, and you can always expect to be reimbursed for covered costs after you have met your deductible.

In my research, Healthy Paws often had the lowest prices compared to other providers’ unlimited annual coverage. Healthy Paws helps reduce economic euthanasia because pet owners aren’t stressed about the cost of a life-saving procedure that could be restricted by policies with lower payout limits.

Healthy Paws also has one of the fastest claim processing timelines, averaging only two days. Compared to competitors, this is a speedy turnaround and prevents further financial stress one might experience while waiting for a claim to be considered and paid back.

The company is known for being consistent in its offerings and not rocking the boat. It hasn’t undergone significant turbulence with underwriter changes or price fluctuations as many of its competitors have.

Customer service is a top priority for Healthy Paws, and it has some of the best reviews in the business. Healthy Paws minimizes customers’ risk of unexpected financial consequences when using pet insurance.

| Pros | Cons |

|---|---|

| May have option for Healthy Paws to pay your vet directly and avoid waiting for reimbursement | Limited customization options based on your pet's age |

| Shorter than average CCL surgery waiting period (15 days) | No accident-only plan available |

| Shorter than average claim processing (2 days) | Not enrolling pets older than 14 years old |

| Unlimited payouts for all plans | Excludes behavioral therapies, alternative/holistic therapies, C-sections, exam fees, and gum disease |

| Longer hip dysplasia waiting periods than average (12 months) and pets enrolled after age 6 are ineligible for hip dysplasia coverage (MD doesn't have this age limitation) | |

| Longer than average accident waiting period (15 days) |

Use this link to take advantage of the best possible price and get a quote for your pet from Healthy Paws. You can also visit our dedicated Healthy Paws promotion page to learn more.

In-Depth Review Of Healthy Paws

Embrace Review

Embrace has the most comprehensive coverage for accidents and illnesses, including $1,000 yearly for dental illness coverage. For conditions that some insurers exclude from their policies, Embrace maintains coverage.

There are several ways to customize your Embrace plan to fit your budget and coverage needs. It’s one of the few insurers offering both a routine care and accident-only plan in addition to its accident and illness plans.

Embrace is also a great option, as it covers behavioral therapy and training diagnosed by a licensed veterinarian for a covered condition. So, suppose your dog is anxious, aggressive, or destructive when you leave them. In that case, it may be due to a behavioral issue that may be covered under an Embrace policy under the right conditions. Behavioral therapy and training aren’t commonly covered by most pet insurance providers.

Embrace also administers policies through Allstate, American Family, Geico, and USAA.

Our Personal Experience With Embrace

| Pros | Cons |

|---|---|

| Customize your plan to fit your budget and needs with different deductible, reimbursement, and payout options | Restricted to accident-only coverage if you enroll your dog after their 15th birthday |

| May have option for Embrace to pay your vet directly to avoid waiting for reimbursement | C-sections are excluded |

| Optional wellness plans available as add-on | |

| Shorter than average accident waiting period (2 days) and claim processing (5 days) | |

| Behavioral therapies, alternative/holistic therapies, exam fees, gum disease, and tooth extractions are included |

Embrace offers the following discounts:

- 10% off (5% off in NY) for multiple pets

- 5% off for military and veterans (NY and TN excluded)

- 10% off if your company or clinic offers Embrace as an employee benefit (FL, ND, NY, and TN excluded)

- 5% off in NY if you pay annually

- Up to 25% off for eligible USAA customers

- Your deductible automatically goes down $50 each year you don’t receive a claim payment

Use this link to take advantage of the best possible price. No promo code is needed. You can also visit our dedicated Embrace discount page to learn more.

In-Depth Review Of Embrace

Figo Review

I’ve chosen Figo for the best value in pet insurance because it offers extensive coverage, low pricing, excellent customer service, and fast claim processing (averages three days). Figo’s plans are customizable, with several options to fit your budget and coverage needs, plus two optional preventative care plans. There are no upper age limits, and the minimum age to enroll your dog is eight weeks.

Figo offers coverage for conditions sometimes excluded by other providers, such as behavioral therapies, alternative/holistic therapies, and C-sections. It’s also one of the only companies to offer a 100% reimbursement option. Additionally, Figo offers coverage for curable pre-existing conditions free of treatment and symptoms after one year.

Figo has a one-day waiting period for accidents, the shortest length of any company included in this article. Overall, Figo has thorough coverage and competitive pricing, which makes it an excellent option for pet parents.

Figo also administers policies through Costco.

My Personal Experience With Figo

Unfortunately, Sally’s health has deteriorated as she has aged. I have filed three claims within the first four months of her insurance policy. Thankfully, Figo has followed through on their promise to cover all these claims, which has provided me with peace of mind.

| Pros | Cons |

|---|---|

| Customize your plan to fit your budget and needs with different deductible, reimbursement, and payout options | Can't have Figo pay your vet directly to avoid waiting for reimbursement |

| Optional wellness plans available as an add-on | No accident-only plan available |

| Shorter than average accident waiting period (1 day) | |

| Consistently among the lowest prices | |

| Shorter than average claim processing (3 days) | |

| Behavioral therapies, alternative/holistic therapies, and C-sections are included in coverage | |

| Diminishing deductible for each year a policyholder is claim free, decreasing by $50 until it is $0 |

Figo offers the following discounts:

- 5% off any new Figo pet insurance policy (exclusive for Canine Journal readers – use this link)

- 5% off for multiple pets

- Your deductible automatically goes down $50 each year you don’t receive a claim payment

Use this link to take advantage of the best possible price. No promo code is needed. You can also visit our dedicated Figo discount page to learn more.

In-Depth Review Of Figo

Lemonade Pet Insurance Review

Lemonade began selling insurance in 2015 and branched into pet insurance in 2020, offering low prices, which made it appealing to many customers. After a couple of years in business, their prices fall towards the mid-range, but the company is still creating a lot of buzz with its AI-driven claim process.

Lemonade’s Artificial Intelligence (AI) speeds up the reimbursement process. Most Lemonade claims are processed within two days, but many are processed within minutes of submission. Beyond speed, another unique thing about Lemonade is that you can bundle your pet insurance policy with your Lemonade homeowners, renters, co-op, or condo insurance, which might save you 10%.

Our Personal Experience With Lemonade

| Pros | Cons |

|---|---|

| Customize your plan to fit your budget and needs with different deductible, reimbursement, and payout options | Can't have Lemonade pay your vet directly to avoid waiting for reimbursement |

| Optional wellness plans available as an add-on | No accident-only plan available |

| Shorter than average waiting periods (2 days for accidents and 14 days for hip dysplasia) | Only available in 37 states and Washington DC |

| Shorter than average claim processing (2 days) | Breed restrictions based on age |

| Behavioral therapies, alternative/holistic therapies, exam fees, and gum disease coverage are available for an extra fee |

Lemonade offers the following discounts:

- 10% off if you bundle with your renters, homeowners, auto, condo, or co-op insurance

- 5% off for multiple pets

- 5% off if you pay annually

Use this link to take advantage of the best possible price. No promo code is needed.

In-Depth Review Of Lemonade

Pet Insurance Companies (All Of Your Options)

Besides the insurers listed above, many other competitors exist in the marketplace. The remaining U.S. pet insurance providers are listed below and on our dedicated pet insurance companies page alphabetically. Included are links to our in-depth individual reviews if you’d like to learn more about a company.

If you live outside of the U.S. and want to learn about your options, below are pet insurers you can consider.

| AUSTRALIA | Petsy Pet Insurance | RSPCA | Tesco | |

| CANADA | OVMA Pet Health Insurance | Peppermint | Pets Plus Us | PHI Direct |

| HONG KONG | Blue Cross | OneDegree | PetbleCare | Prudential |

| IRELAND | Allianz | |||

| UNITED KINGDOM | Agria | Itch | Petplan | Waggel |

AKC Pet Insurance Review

AKC Pet Insurance is the only provider to offer coverage for pre-existing conditions after one year of continuous coverage. This can be life-changing for customers with dogs suffering from chronic illnesses or other pre-existing conditions. If your dog has a pre-existing condition, AKC Pet Insurance could be an excellent option for your household.

| Pros | Cons |

|---|---|

| No vet records or exam required to enroll | No illness coverage option for dogs enrolled after age 9 |

| Optional wellness plans available as add-on | Must purchase coverage or congenital and hereditary conditions separately |

| Claims are typically paid within 7 days | Exam fee coverage is available for an additional fee |

| Your pet is covered when they travel with you in the U.S. or Canada | $3 - $4 monthly transaction fee (depending on the state) - highest in the pet insurance space, waived if paid annually |

| Offers coverage for pre-existing conditions after 365 days of continuous pet insurance coverage (not in FL and WA) |

AKC offers the following discounts:

- 5% off for multiple pets

- 5% off for dogs who pass the AKC Canine Good Citizen test

- 10% off for puppies coming from breeders who participate in the AKC Bred with H.E.A.R.T or AKC Breeder of Merit programs

In-Depth Review Of AKC Pet Insurance

Animalia Pet Insurance Review

Animalia is one of the newest pet insurance providers available. It’s currently only available in 39 states. However, it’s one of the only insurers to provide coverage for prescription food and dietary supplements. Animalia is a good option for those who have pets with bilateral conditions (such as hip dysplasia, canine cruciate ligaments, cataracts, etc.) because it has no bilateral exclusions in its policy.

| Pros | Cons |

|---|---|

| No lifetime limits on any plan | Pets aren’t eligible for enrollment after 15th birthday |

| Discounts available for multi-pets | No optional wellness plan |

| Electronic claim filing | Additional cost for dental coverage |

| Covers the exam fees for accidents and illnesses | 30 day waiting period for cancer coverage |

| Covers virtual vet visits, prescription food, and dietary supplements | Only available in 39 states |

| Shorter than average waiting periods (5 days for illnesses, accidents, cruciate ligament injuries, and hip dysplasia) | Not covered when traveling with your pet outside of the U.S. |

| No online portal for policyholders |

Animalia offers the following discount:

- Multiple pets enrolled

Use this link to take advantage of the best possible price. No promo code is needed.

In-Depth Review Of Animalia Pet Insurance

ASPCA Pet Health Insurance Review

ASPCA Pet Health Insurance has a big name behind its pet insurance product, which may give you the assurance you need to choose them. Their policies are thorough, and they offer coverage for many conditions often excluded by other providers.

As for pricing, ASPCA Pet Health Insurance typically falls more in the middle, but that can vary based on your pet’s details and the plan customizations you choose. For example, an accident-only policy will be less expensive than an accident and illness policy with a $100 deductible, 90% reimbursement, and a $10,000 annual coverage limit.

Optional wellness plans are also available to help you budget for routine expenses, such as dental cleanings, annual vet checkups, flea/heartworm prevention, and more. You can adjust your coverage to fit the cost of pet insurance into your budget in many ways.

ASPCA Pet Insurance also administers policies through Travelers and Waffle.

| Pros | Cons |

|---|---|

| Customize your plan to fit your budget and needs with different deductible, reimbursement, and payout options | Longer than average accident waiting period (14 days) |

| May have option for ASPCA Pet Health Insurance to pay your vet directly to avoid waiting for reimbursement | Longer than average claim processing (15-30 days) |

| Accident-only plan available | C-sections, gum disease, and tooth extractions are excluded |

| Optional wellness plans available as add-on | |

| Shorter than average CCL surgery and hip dysplasia waiting periods (14 days) | |

| Behavioral therapies, alternative-holistic therapies, and exam fees are included |

ASPCA Pet Insurance offers the following discount:

- 10% off for multiple pets

Use this link to take advantage of the best possible price. No promo code is needed.

In-Depth Review Of ASPCA Pet Insurance

Bivvy Review

Bivvy is no longer providing pet insurance. Current Bivvy policies will end on their policy anniversary date (stated on the declaration page). Bivvy will notify you of that non-renewal date and will continue processing claims that occur and are treated before that date.

CarePlus Review

CarePlus is Chewy’s wellness and insurance brand offering Trupanion and Lemonade policies. The brand is still new and undergoing regular changes. However, the big selling point of a CarePlus policy is that 100% of the prescriptions purchased through Chewy.com are covered by your CarePlus pet insurance plan.

| Pros | Cons |

|---|---|

| Unlimited payouts for all plans | Quotes tend to be among the most expensive compared to competitors |

| May have option for Trupanion to pay your vet directly to avoid waiting for reimbursement | Must upgrade plans to have coverage for exam fees, behavioral treatments, and physical and rehab therapies |

| Shorter than average CCL surgery and hip dysplasia waiting periods (14 or 30 days) | Only available in 42 states currently |

| Optional wellness plan available as a stand-alone plan | |

| Accident-only plan available | |

| Claim processing averages 3-7 days but often paid in 24 hours | |

| 100% of prescriptions covered when purchased through Chewy.com | |

| Covers your pet if they travel outside the U.S. with you |

In-Depth Review Of CarePlus By Chewy Pet Insurance

Companion Protect Review

Companion Protect offers a very unique policy. Pricing isn’t based on pet breed, it has no waiting periods, and its base plan includes an annual wellness exam. However, you must use an in-network vet to get claims reimbursed and only recently adopted pets from one of their participating shelter partners can sign up.

| Pros | Cons |

|---|---|

| Premiums don’t increase due to your pet aging | Lifetime payout limits |

| No waiting periods | No information about annual payout limits |

| No upper age limits | Using an out-of-network vet can be pricey |

| Good in-network benefits | Inflexible policy options |

| Multi-pet discount up to 15% | Strict prior approval requirements |

| Free annual wellness exam (with in-network vet) | No wellness plans available |

| Coverage for holistic and alternative therapies | Doesn’t cover your pet if they travel outside the U.S. with you |

In-Depth Review Of Companion Protect

Hartville Review

Hartville offers similar products to ASPCA Pet Health Insurance with the same coverage, exclusions, etc. Policies are comprehensive, and you can choose from optional wellness plans. The biggest complaint from customers is that reimbursements are lower than they expected.

| Pros | Cons |

|---|---|

| Customize your plan to fit your budget and needs with different deductible, reimbursement, and payout options | Low reimbursements reported by customers |

| May have option for Hartville to pay your vet directly to avoid waiting for reimbursement | Longer than average accident waiting period (14 days) |

| Pet is covered when they travel with you in the U.S., Guam, Puerto Rico, U.S. Virgin Islands, and Canada | Longer than average claim processing (15-30 days) |

| Accident-only plan available | C-sections, gum disease, and tooth extractions are excluded |

| Optional wellness plans available as add-on | |

| Shorter than average CCL surgery and hip dysplasia waiting periods (14 days) | |

| Behavioral therapies, alternative-holistic therapies, and vet exam fees are included |

Hartville offers the following discount:

- 10% off for multiple pets

In-Depth Review Of Hartville

ManyPets Review

ManyPets is a leading pet insurance provider in the U.K. and Sweden and has branched into the U.S. market. One unique feature provided is grief counseling upon the death of a pet. No other company offers this. Additionally, a family plan covers up to three pets under one annual limit.

| Pros | Cons |

|---|---|

| No transaction or one-time fees | Not enrolling pets older than 14 years old |

| Pets enrolled after 6 aren’t eligible for hip dysplasia coverage | |

| Not available in all 50 states |

In-Depth Review Of ManyPets

MetLife Review

MetLife has a healthy pet incentive, which lowers the deductible by $50 each policy year you don’t receive a claim reimbursement. If your policy limit is $5,000 or more and you have an unused amount of $1,000 or more at the end of the policy period, MetLife will increase your policy limit by $500 at no extra cost when you renew.

| Pros | Cons |

|---|---|

| Optional wellness plans available as add-on | Doesn’t cover treatment, services, or supplies provided outside the U.S. |

| 80% of claims are processed within 10 days | |

| Diminishing deductible |

MetLife offers the following discounts:

- 10% off for vets, shelter personnel, etc.

- For military, veterans, first responders, and healthcare workers

In-Depth Review Of MetLife

Nationwide Review

Nationwide is the only pet insurance provider we review that offers exotic pet insurance and dog and cat insurance. If you have a rabbit, bird, reptile, ferret, or another small mammal, consider insurance through Nationwide.

Like dog or cat insurance, exotic pet insurance covers unexpected visits to the vet that are subject to the insurance plan you choose. Depending on your selections, this may include accidents, illnesses, the death of your pet, and more.

Nationwide is also the only company we review to offer a traditional pet insurance product and a benefit schedule-style plan similar to a wellness plan with monetary coverage limits per condition/treatment. Suppose you’re already familiar with Nationwide’s insurance products in other areas of your life. In that case, it may be worth considering sticking with them, but it’s also worth getting multiple quotes from others.

| Pros | Cons |

|---|---|

| Optional wellness plan available as add-on | Can't have Nationwide pay your vet directly to avoid waiting for reimbursement |

| Shorter than average hip dysplasia waiting period (14 days) | Restricted to accident-only coverage for pets 10 and older |

| Behavioral therapies, alternative-holistic therapies, and exam fees are included in coverage | Longer than average waiting periods (14 days for accidents and 12 months for CCL surgery) |

| Shorter than average claim processing (4 days) | C-sections, gum disease, and tooth extractions are excluded |

| One of the only pet health insurance companies to offer exotic pet insurance |

Nationwide Pet Insurance offers the following discounts:

- 5% off for 2-3 pets covered

- 10% off for 4 or more pets covered

Use this link to take advantage of the best possible price. No promo code is needed.

In-Depth Review Of Nationwide

Odie Review

Odie requires add-ons for basic coverage that competitors include in their policies automatically. Plan customization options are limited. Accident-only plans are available, and you can add a wellness plan onto your insurance policy. Wishbone Pet Insurance is also managed by Odie.

| Pros | Cons |

|---|---|

| Average premium pricing is often lower than other providers | Must pay extra for office visits, prescription medication, rehab, acupuncture, and chiropractic care coverage |

| No age restrictions and coverage starts as early as 7 weeks | Behavioral conditions are excluded |

| Claim processing averages 4-5 business days | No unlimited payout limits |

| Optional wellness plans available as add-on | Bilateral conditions are excluded |

| Your pet is covered when they travel with you in the U.S., Canada, or Puerto Rico |

Looking for an Odie Pet Insurance promo code? Click here for the best deal we could find.

In-Depth Review Of Odie

Paw Protect Review

Paw Protect administers Embrace pet insurance policies. The only difference is that Paw Protect offers a credit line called Paytient that you can use with 0% interest to pay the vet bills upfront instead of paying out of pocket. Customers have access to $2,000 to help pay their vet bills until they have the cash to pay off the debt.

| Pros | Cons |

|---|---|

| No per-incident limits on their claims as they use an annual deductible | $25 enrollment fee |

| No lifetime limit | Only covers enrolled pets age 14 and younger for accidents and illnesses (accident only may be available for ages 15+) |

| Optional wellness plans available as add-on (not available in RI) | If one leg has a CCL (ACL) injury prior to enrollment, the other leg will not be covered even if there are no prior issues; it’s considered a pre-existing condition |

| Pays claims within 10-15 days on average | Pricing for mixed breeds sometimes varies between Embrace and Paw Protect |

| Covers your pet if they travel outside the U.S. with you | |

| Eligible to apply for a virtual Paytient Visa card to pay for vet bills |

Paw Protect has the following discounts:

- 10% off (5% off in NY) for multiple pets

- 5% off for military and veterans (NY and TN excluded)

No promo code is needed. Use this link to take advantage of the best possible price.

In-Depth Review Of Paw Protect

Petco Review

Petco administers Nationwide pet insurance policies. The only difference is that Petco offers discounts and savings on veterinary services available through Petco’s network of hospitals and clinics. If you live near one of Petco’s facilities and think you could take advantage of their vet services, then Petco’s pet insurance through Nationwide could help you get discounts on vet care.

| Pros | Cons |

|---|---|

| Optional wellness plan available as add-on | Longer than average waiting periods (14 days for accidents and 12 months for CCL surgery) |

| Shorter than average hip dysplasia waiting period (14 days) | C-sections, gum disease, and tooth extractions are excluded |

| Behavioral therapies, alternative-holistic therapies, and exam fees are included in coverage | Pets older than 10 are ineligible for illness enrollment |

| Shorter than average claim processing (4 days) | |

| Exotic pet insurance available | |

| Discounts available through Petco vet services |

In-Depth Review Of Petco

PetPartners Review

PetPartners offers similar products to AKC Pet Insurance with the same coverage, exclusions, etc. Policies are comprehensive, and you can choose from optional wellness plans. Like AKC Pet Insurance, you receive coverage for pre-existing conditions after one year of continuous coverage.

| Pros | Cons |

|---|---|

| No vet records or exam required to enroll | No illness coverage option for dogs enrolled after age 9 |

| Optional wellness plans available as add-on | Must purchase coverage or congenital and hereditary conditions separately |

| Claims are typically paid within 7 days | Exam fee coverage is available for an additional fee |

| Your pet is covered when they travel with you in the U.S. or Canada | $3 - $4 monthly transaction fee (depending on the state) - highest in the pet insurance space, waived if paid annually |

| Offers coverage for pre-existing conditions after 365 days of continuous pet insurance coverage (not in FL and WA) |

PetPartners offers the following discount:

- 5% off for multiple pets

In-Depth Review Of PetPartners

Prudent Pet Review

Prudent Pet has impressive coverage but is more expensive than its competitors. Claim processing customer feedback is sporadic, with some saying it’s fast and others saying it’s sluggish. However, it’s showing some promise for being newer to the pet insurance industry.

| Pros | Cons |

|---|---|

| No lifetime payout limits on any plans | Premiums were significantly higher than average when I ran quotes |

| No upper age limits | Longer than average accident waiting period (5 days) |

| 60% of claims are processed within 1 day | If there’s a knee injury prior to enrollment or during the waiting period, they won’t cover the second leg if an injury occurs (considered bilateral condition) |

| Your pet is covered when they travel with you in the U.S., Canada, Puerto Rico, and other U.S. territories | No mobile app |

| Competitively priced wellness plans | $2 transaction fee |

Prudent Pet offers discounts to military and veterinarians and their staff.

In-Depth Review Of Prudent Pet

Pumpkin Review

Pumpkin is the first pet insurance producer to incorporate under a global pharmaceutical giant. It has many plan customizations and coverage for conditions often excluded by competitors. Pumpkin has comprehensive coverage, but technology needs to catch up and get a mobile app for consumers to file claims.

| Pros | Cons |

|---|---|

| 90% reimbursement for all plans | Price quotes tend to be more expensive than most competitors but this may be due to only offering 90% |

| Optional wellness plan available as add-on | $2/month transaction fee |

| Your pet is covered when they travel with you in the U.S., Canada, Puerto Rico, Guam, and U.S. Virgin Islands | Longer than average accident and illness waiting periods (14 days) |

| No upper age limits | No app |

| Excludes routine dental procedures |

In-Depth Review Of Pumpkin

Spot Review

Spot Pet Insurance was founded in 2019 and offers many ways to customize your plan. You can choose an accident-only policy or accident and illness policy, add on a wellness plan, and adjust your deductible, reimbursement, and payout options. These options provide a wide range of ways to help fit Spot into your budget.

Spot also has relatively short 14-day waiting periods for CCL surgery and hip dysplasia compared to many other pet insurance providers. So if either of these conditions concerns your dog, Spot may be worth considering.

| Pros | Cons |

|---|---|

| Customize your plan to fit your budget and needs with different deductible, reimbursement, and payout options | Can't have Spot pay your vet directly to avoid waiting for reimbursement |

| Accident-only plan available | Longer than average accident waiting period (14 days) |

| Optional wellness plans available as add-on | Longer than average claim processing (10-14 days) |

| Shorter than average CCL surgery and hip dysplasia waiting periods (14 days) | C-sections, gum disease, and tooth extractions are excluded |

| Behavioral therapies, alternative-holistic therapies, and exam fees are included |

Spot offers the following discount:

- 10% multi-pet discount when you use this link.

- 10% off for eligible Purina customers

- Up to 20% off for eligible AAA customers

Use this link to take advantage of the best possible price. No promo code is needed.

In-Depth Review Of Spot

Toto Review

Toto has more limitations for its pet insurance policies than other insurers. However, it is one of the only providers to offer Final Respects coverage, which reimburses a portion of money for the cost of an autopsy, cremation, and urns. Finally, Toto may change your premium, reimbursement rate, annual deductible, and policy terms and conditions at renewal.

| Pros | Cons |

|---|---|

| No lifetime or per-incident payout limits for accident or illness plans | Longer than average illness waiting period (14 days) |

| Optional wellness plan available as add-on | 180-day waiting period for IVDD and CCL injuries |

| Your pet is covered when they travel with you in the U.S., Canada, and other U.S. territories | Coverage is restricted to accidents only for pets over 9 years old at enrollment |

| Final Respect coverage is available for pets enrolled before their 5th birthday | Bilateral conditions excluded |

| No mobile app | |

| No unlimited payout limit option |

In-Depth Review Of Toto

Trupanion Review

One of Trupanion’s most talked about features is Trupanion’s Vet Direct Pay, which eliminates the claim processing wait time. Many other pet insurance companies offer a vet direct pay option. Still, Trupanion’s Vet Direct Pay is the only option that allows payment during checkout. If Trupanion’s Vet Direct Pay isn’t available at your vet’s office, you can call to ask about it or speak with your vet about them setting it up.

Trupanion is also an excellent choice for breeds with a past injury or ailment to one side of their body but not the other. This pet would be considered predisposed to a bilateral condition, but many Trupanion policies have no bilateral exclusions. A bilateral condition is any condition or disease that could affect both sides of the body. Examples include hip dysplasia, CCL injuries, cataracts, and more. Most pet insurance providers exclude bilateral coverage because if something happens on one side of the body, there is a solid chance it could also happen to the other over time. However, Trupanion is willing to take this risk.

Finally, Trupanion is commonly selected by breeders because of its Breeder Support Program. The program’s primary focus is the Go Home Day Offer, which lets breeders provide buyers with an offer for Trupanion enrollment without waiting periods. This means a pet parent can pick up their puppy from the breeder and get pet insurance immediately without any waiting periods. Additionally, Trupanion policies cover breeding-related health conditions, another perk for breeders.

Trupanion also administers policies through Geico and State Farm.

| Pros | Cons |

|---|---|

| 90% reimbursement with unlimited payouts for all plans | No accident-only plan available |

| May have option for Trupanion to pay your vet directly to avoid waiting for reimbursement | Pets older than 14 are ineligible for enrollment |

| Shorter than average CCL surgery and hip dysplasia waiting periods (30 days) | Longer than average illness waiting period (30 days) |

| Shorter than average claim processing averages (2 days) | Consistently among the most expensive |

| Behavioral therapies, C-sections, and tooth extractions are included in coverage | Exam fees are excluded |

Use this link to take advantage of the best possible price and get a quote for your pet from Trupanion. You can also visit our dedicated Trupanion promotions page to learn more.

In-Depth Review Of Trupanion

Wagmo Review

Wagmo has per-incident deductibles and lifetime payout limits, so this could be an excellent option for your pet if you’re worried about chronic conditions. However, if you anticipate requiring a lifetime payout beyond $100,000, then assess other options.

| Pros | Cons |

|---|---|

| Claim repayment averages 1 day for wellness and 3-5 business days for accidents and illnesses, after the claim is approved | No unlimited payout option |

| Optional wellness plan available as add-on | Per-incident deductible and lifetime payout limits |

| Longer than average accident waiting period (15 days) | |

| Pets older than 15 are ineligible for enrollment | |

| 30-day waiting period for cancer treatment | |

| Hip dysplasia isn’t covered for pets older than 6 |

In-Depth Review Of Wagmo

24Petprotect Review

24Petprotect provides accident and illness plans as well as accident-only insurance policies to help supply your coverage and budget needs. There are also multiple deductible, payout, and reimbursement options to help you get the plan you need.

| Pros | Cons |

|---|---|

| Optional wellness plan available as add-on | $2 transaction fee (waived if paying annually) |

| Covers curable pre-existing conditions that are free of symptoms and treatment for 180 days | No unlimited payout option |

| Your pet is covered when they travel with you in the U.S., Canada, Guam, Puerto Rico, and U.S. Virgin Islands | Longer than average accident waiting period (14 days) |

| Higher premiums compared to others | |

In-Depth Review Of 24Petprotect

Cost And Coverage Comparisons

I have compiled a couple of comparison tables that address cost and coverage issues:

If you’re unsure where to start, you should read if it’s worthwhile having pet insurance. It addresses common questions such as how pet insurance works, what it covers, statistics, whether it’s worth it for everyone, and more.

Free Pet Insurance Quotes

My coverage comparison is relatively straightforward, but pricing comparisons can get complicated. Why? Pricing quotes are unique because they’re based on a pet’s age, breed, geographic location, the provider and plan you select, and several other factors.

For this reason, I encourage you to get quotes from multiple companies before deciding on a pet insurance provider. Our team has made this easy for you by creating a free quote form that pulls quotes from top pet insurance companies when you fill out your pet’s details. You can better understand the coverage needed by entering your pet’s specific characteristics.

What Are The Different Types Of Pet Insurance Plans?

There are two pet insurance plans: accident-only and accident and illness. Some companies also offer an optional wellness plan for an extra charge, but it isn’t an insurance product. Since several pet insurance providers offer wellness plans during enrollment, I included them to ensure you know the full range of options during new enrollment.

What Do Accident-Only Pet Insurance Plans Cover?

An accident-only plan only covers vet bills associated with an accident, such as torn ligaments, broken bones, foreign body ingestion, poisoning, injuries, bite wounds, and more. Illnesses are excluded from this coverage. An accident-only pet insurance plan is typically less expensive than an accident and illness one since it covers fewer expenses. However, only some companies offer this policy type.

What Do Accident & Illness Pet Insurance Plans Cover?

This is the most common and popular type of pet insurance plan. It covers injuries (like broken bones, foreign body ingestion, and other items covered in accident-only plans) and sickness-related conditions (like cancer, allergies, urinary tract infections, arthritis, skin infections, ear infections, and more). This type of policy is more comprehensive than an accident-only one.

What Do Wellness Plans Cover?

Wellness coverage is purchased as an add-on or a standalone product and comes with an incremental fee. Typically, this program covers things that occur during an annual exam, such as vaccination, flea/tick/heartworm treatment, teeth cleaning, and spay/neuter procedures. A wellness plan is a financial tool to help cover the costs associated with preventative measures that assist your dog’s overall health and prevent illnesses where possible. Regular vet visits, especially ones covered with a wellness plan, also encourage owners to be more proactive with their pet’s health. Wellness plans are not pet insurance as they don’t cover costs associated with accidents or illnesses.

| Plan Type/Need | Accident-Only | Accident & Illness (most popular) | Wellness |

|---|---|---|---|

| Injury-related conditions (broken bones, foreign body ingestion, poisoning, bite wounds, etc.) | | ||

| Sickness-related conditions (allergies, urinary tract infections, arthritis, cancer, ear infections, etc.) | | | |

| Preventative measures (annual exams, vaccination, flea/tick/heartworm prevention, teeth cleaning, spay/neuter procedures, etc.) | | | |

| Cost | $ | $$ | $$$* |

What Does Pet Insurance Cover?

Pet insurance coverage varies based on the policy type and the company you choose. The majority of accident and illness pet insurance plans cover the following items when deemed medically necessary. However, this coverage may have limitations, so please check your policy.

I have put together a comprehensive guide to what pet insurance covers. You’ll also find cost and reimbursement examples, criteria to consider, alternatives to pet insurance, wellness plans, and more.

| Covered | Excluded |

|---|---|

| Blood tests | Boarding |

| Cancer (chemo & radiation) | Cremation & burial costs |

| CAT scans | Elective procedures (e.g., declawing, ear cropping, spaying/neutering, tail docking, etc.) |

| Chronic conditions | Food & supplements |

| Congenital conditions | Grooming |

| Emergency care | Pre-existing conditions* |

| Euthanasia | Pregnancy & breeding |

| Hereditary conditions | Vaccines |

| MRIs | |

| Non-routine dental treatment | |

| Prescription medications | |

| Rehabilitation | |

| Specialized exams & care | |

| Surgery & hospitalization | |

| Ultrasounds | |

| X-rays |

Did You Know?

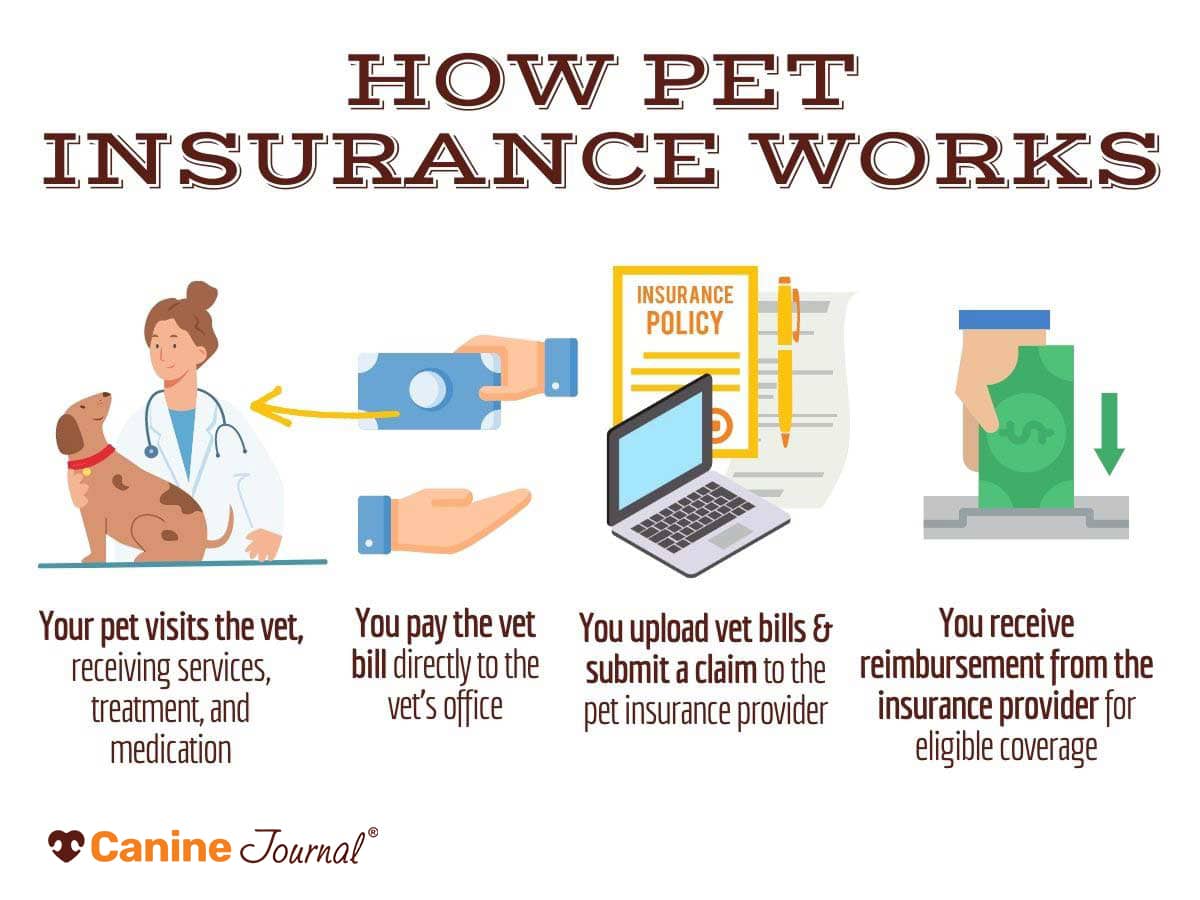

How Does Pet Insurance Work?

- Visit the vet and pay your bill at the time of service.

- Send a completed claim form and an itemized receipt to your insurance company. Some companies require a signature from your vet, so it is wise to take a printed copy of your claim form to your visit.

- Once the claim is approved, the insurance company will send your reimbursement* via your chosen payment method (check, direct deposit, etc.).

*The reimbursement timeline can vary from a few minutes to a few weeks, depending on the complexity of your claim and the promised processing time. The reimbursement amount depends on your policy details, including deductible, annual payout, reimbursement percentage, coverage, and exclusions.

Pet Insurance Claim Example

Let’s walk through an example to better understand how it works.

Suppose your policy has the following coverage:

- $250 annual deductible

- 80% reimbursement

- $5,000 payout limit

In that case, you’re responsible for the following:

- Any unplanned vet bills related to covered items up to $250,

- 20% of the total vet bill up to $5,000, and then

- 100% above the $5,000 payout limit.

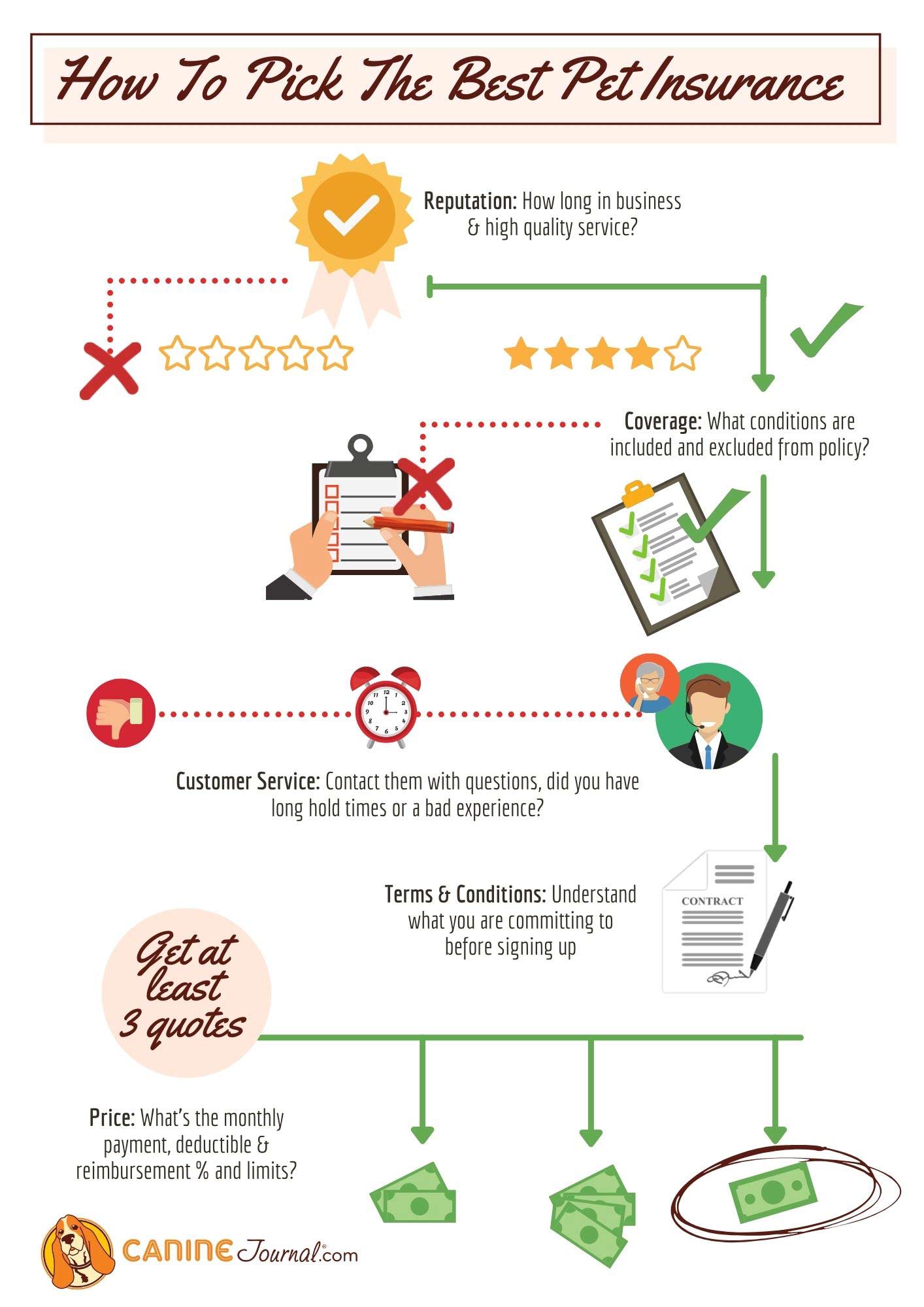

How To Choose The Best Pet Insurance For You

How can one decide with so many pet insurance companies to choose from? This is why it’s crucial to take the time to consider your options carefully. By understanding the key considerations and committing to the research, you may find a provider that fits your breed and health concerns.

It is wise to consider any illnesses your dog’s breed may be predisposed to. For example, suppose your pet is predisposed to hip dysplasia. In that case, you’ll want to ensure you’re satisfied with the terms associated with hip dysplasia coverage. Some companies add additional waiting periods to hip dysplasia or consider it a bilateral condition, thus excluding it from coverage as a pre-existing condition. Additionally, consider a conversation with your vet about any potential conditions they’d recommend covering based on the breed or mix.

After you have a list of your must-haves, you’re ready to narrow down your list of options.

- Your biggest concern as a pet parent should be the reputation of the pet insurance provider. Have you heard of them? Do family and friends use them? What has their experience been when they’ve had to file a claim? Getting a pet insurance policy is only useful if it covers what you expect it to cover and if you can afford the monthly premium. Remember, although the monthly cost is important, it’s not the most crucial factor when choosing insurance. The whole point of any insurance policy is ensuring you have the coverage to pay for otherwise unaffordable bills in emergencies.

- Decide what type of coverage you want for your dog and which additional perks may be negotiable to lower your costs. If you’d like to learn more about what some of the commonly referenced terms in pet insurance mean, check out our terminology 101 section that breaks the lingo down into layperson’s terms for you.

- Obtain quotes from at least three companies to get an idea of how much your monthly premium will be. Pricing varies drastically, and just because a company charges you more doesn’t mean the coverage is more thorough.

- Don’t hesitate to contact potential providers with any questions before signing up. And pay close attention to that experience — it may reflect customer service quality down the road.

- Consider the claim reimbursement process, including how it works, the average processing timeline, and whether there’s an option for the company to pay the vet directly. If a company takes longer than you can wait for reimbursement, you may want to seek other options.

Picking a pet insurance plan is a personal choice, and no one knows what your dog needs better than you. Take the time to make an informed decision, and know it’ll be worth the added protection in the long run.

Frequently Asked Questions

Here are some questions we’ve received from our readers regarding pet insurance. Don’t see yours? Ask us in the comments.

Can I Go To Any Vet With Pet Insurance?

Most pet insurance companies allow you to choose any licensed vet for your pet’s health care needs. I know one company, Companion Protect, that is the exception to this rule. Companion Protect claims to cover more of the cost within its approved network of vets. While they allow you to use an out-of-network vet, it may cost you more money.

What Are The Disadvantages Of Pet Insurance?

Although our team feels that pet insurance is valuable and worth it for most, here are four cons to be aware of:

- Routine preventative exams and associated expenses aren’t included in your pet insurance policy. You must purchase a wellness plan at an incremental cost to cover these.

- You will still have out-of-pocket expenses, including your deductible and any amount that surpasses your payout limit. You will also be responsible for covering the balance of the reimbursement amount (i.e., if you chose an 80% plan and your provider agrees to cover your claim, you will still owe 20%).

- Most pet insurance providers exclude pre-existing conditions from coverage, and you are responsible for associated costs.

- Unlike human health care, most pet insurance companies require you to pay vet expenses upfront and wait for reimbursement. Some companies offer a vet direct pay option as an alternative to this standard reimbursement model. Still, you must work with your vet to ensure this is in place before you begin treatment.

What Should I Ask Before Buying Pet Insurance?

These are questions I recommend asking your provider before you sign up.

- Can I choose my vet?

- What are the waiting periods?

- What’s excluded from coverage?

- Are there extra fees for coverage related to exam fees, prescription medication, or other items?

- Can you show me an example of how a claim is handled?

- What will I be responsible for paying?

- What happens if I buy a policy after my pet gets sick or hurt?

- Are there any limits on benefits (per-incident, annual, or lifetime)?

- How fast will my claim be processed and repaid?

Is It Worth Making A Pet Insurance Claim?

If you have a pet insurance policy, it’s almost always worth it to make a pet insurance claim. Providers have made filing claims reasonably simple. Even if you know you won’t get reimbursed because you have yet to hit your deductible, the claim will go toward your deductible. It may not be worth filing a claim if your policy has any limits (per policy period or per condition) and you have already hit the maximum.

Are New Companies Eligible To Win Categories?

No. Historically, new companies have entered the pet insurance space by offering low prices to gain market share. However, after some time in the business with more paid claims, these companies tend to increase rates to improve their profitability. This hurts you, the customer, because this causes their premiums to increase significantly — and if you visited your vet or submitted a claim, your pet now has a pre-existing condition. So, if you wish to change providers to find a more competitive rate, that condition is unlikely to be covered. Ultimately, you may have been better off starting with a different, more well-established company.

Because of these issues, we’ve decided only to include pet insurance companies in our top spots with at least five full years of national experience. This approach gives companies time to establish a consistent pricing system and reputation, giving you and our team a better idea of what to expect.

Our experts will still cover new entrants (subject to reader demand) and bring you everything we can find on these companies in our reviews because we want you to know all the available options. Further, we added a “Best Newcomer” category to our rankings to provide a recommendation among new entrants in the pet insurance space. We also consider whether a company is new to the insurance industry or just the pet insurance sector.

Best Pet Insurance Providers By Value And Needs

I also review providers based on value and special needs. Head to our best pet insurance by value and needs article to see providers ranked based on young pets, coverage, value, vet direct pay, pre-existing condition coverage, and more.

Why Trust Canine Journal?

Choosing the right pet insurance policy for your pet is a personal decision. That’s why we value your trust in us to provide all the objective information you need to make an informed choice.

Canine Journal has been covering the topic of pet insurance since 2012, well before other conglomerates discovered the rising popularity of health care for our pets. Many of our authors have personal experience with pet insurance, including Kimberly Alt, who has been Canine Journal’s go-to author for pet insurance for over a decade, having written about nearly every possible facet related to pet insurance. Kimberly knows the subject so well that she can answer a breadth and depth of pet insurance questions immediately. And on the rare occasion she doesn’t know the answer off the top of her head, she can find it within minutes due to her extensive list of resources.

Kimberly also consulted with Michelle Schenker, Canine Journal’s in-house licensed insurance agent, for additional expertise, to ensure accuracy, and give Canine Journal the authority to write about and assist readers in purchasing policies legally.

Here is a quick comparison table showing what we offer compared to the competition.

| Canine Journal | Pawlicy Advisor | Pet Insurance Review | Forbes | |

|---|---|---|---|---|

| Began Covering Pet Insurance | 2012 | 2018 | 2005 | 2021 |

| Website’s Focus | Covers Everything Dog-Related | Sells Pet Insurance Policies | Aggregates Pet Insurance Consumer Reviews | Finance, Investing, Technology, Science, Politics, Law |

| # Of Pet Insurance Companies Covered | 44 | 7 | 19 | 10 |

| # Of Pet Insurance Comparisons | 37 | 0 | 0 | 2 |

| # Of Individual Pet Insurance Reviews | 30 | 7 | 0 | 16 |

| Personalized Quotes | ||||

| Expert Assistance | ||||

| Pros & Cons | ||||

| Discounts | ||||

| Pet Insurance Company Directory | ||||

| Coverage Comparison | ||||

| Plan Customization Comparison | ||||

| Waiting Period Comparison | ||||

| Licensed Insurance Agent | ||||

| Licensed Veterinarian Consultant | ||||

| Compare Providers Side-By-Side | ||||

| Customer Reviews | ||||

| Engagement with Companies |