This content was reviewed by veterinarian Dr. JoAnna Pendergrass, DVM.

This content was reviewed by our licensed insurance agent, Michelle Schenker.

When you purchase through links on our site, we may earn a commission. Here’s how it works.

A big misconception about pet insurance is that it’s too expensive. We spend hundreds of dollars on health insurance for ourselves and our families each month, yet we don’t get coverage for our furry “children.” In reality, paying $50 per month for pet insurance could save your pet’s life.

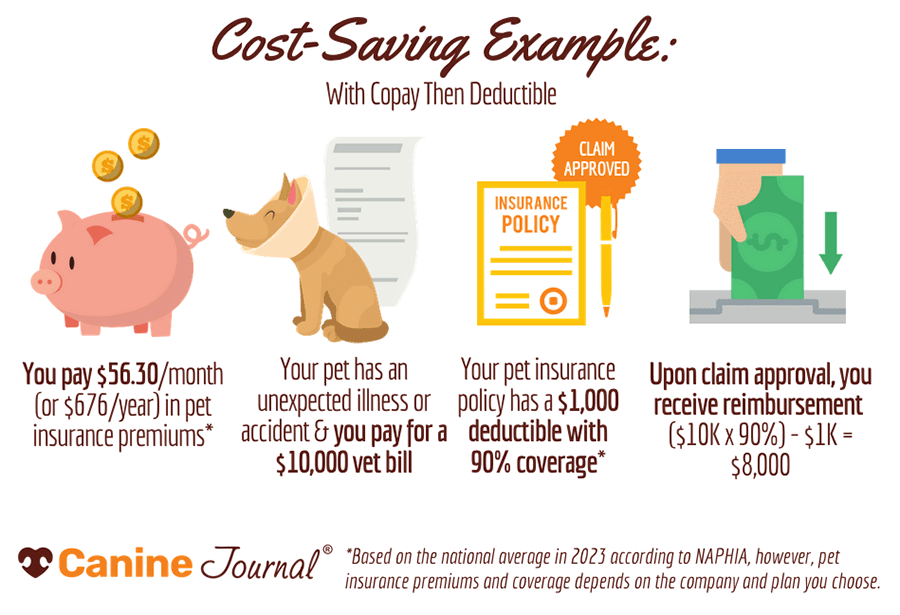

According to NAPHIA (North American Pet Health Insurance Association), the average monthly premium for an accident and illness dog insurance policy in the U.S. is $56.30 ($31.94 for cats).

Instead of being hit with an $8,000 vet bill because your dog needs cancer treatment, you can have the vast majority of it covered through pet insurance. The worst scenario is learning that your dog has cancer but turning down treatment because you can’t afford the bills.

No one wants to face this decision, and signing up for pet insurance can cover much of the cost. Pet insurance allows you to make the best choices when an emergency arises instead of the least expensive ones.

Pet insurance can also prevent a tragedy commonly referred to as “economic euthanasia.” This is when a pet owner can’t afford treatment and asks the vet to put down the pet rather than care for him due to financial limitations.

For this reason, it’s vital to consider buying pet health insurance to protect your canine (and your wallet) from some of the most unfortunate incidents in a pet’s life. The table below shows which companies are in our top picks for the best pet insurance in 2024.

| Pet Insurance Ranking | Best Overall |

Best For Young Pets | Best No-Cap Payouts | Best Coverage |

Best Value |

Best Newcomer |

|---|---|---|---|---|---|---|

| Company |  |

|

|

|

|

|

| Average Policy Price | Variable | Variable | Variable | Higher | Lower | Average |

| Policy Coverage | Extensive | Extensive | Limited | Extensive | Extensive | Limited |

| Customer Service & Reputation | Good | Good | Excellent, Stable | Excellent, Stable | Excellent, Stable | Uncertain, New |

| Average Claim Processing | 18-30 Days | 5-6 Days | 2 Days | 5 Days | 3 Days | 2 Days |

| Vet Direct Pay Option | ||||||

| Plan Customization Options | Many | Many | Restricted | Many | Many | Many |

| Get A Quote | Get A Quote | Get A Quote | Get A Quote | Get A Quote | Get A Quote | |

| Read Review | Read Review | Read Review | Read Review | Read Review | Read Review |

- What Is Pet Insurance?

- How Does Pet Insurance Work?

- Why Do I Need Pet Insurance?

- What Does Pet Insurance Cover?

- How Much Does Pet Insurance Cost?

- Is It Best To Buy An Accident/Illness Plan Or Wellness Plan If I'm On A Budget?

- Compare Pet Insurance Providers Side-By-Side

- What Are The Benefits Of Pet Insurance?

- How Do I Choose The Right Dog Insurance?

- What Are The Top Pet Insurance Companies In 2024?

- What Criteria Do I Need To Consider?

- 2024 Pet Insurance Statistics & Facts

- Pet Insurance Terminology

- Are There Situations For Which Pet Insurance Is Not Worth It?

- What Are The Disadvantages Of Pet Insurance?

- Ready To Get Pet Insurance?

What Is Pet Insurance?

Pet insurance is the pet equivalent to human health insurance. Having your dog or cat protected by a reputable health insurance plan can put your mind at ease by knowing that large, unexpected medical bills will be covered.

There are two types of pet insurance plans: accident-only and accident and illness. Some companies also offer an optional wellness plan but it isn’t an insurance product. You may opt for one or two of these plans depending on your preference.

1) Accident-Only Insurance

You can’t predict an accident, but you can plan for potential incidents that could cost you a fortune. Some pet insurance companies offer accident-only coverage, including torn ligaments, broken bones, bite wounds, and other pressing health needs. So basically, anything associated with a sudden physical injury is covered by an accident-only plan.

Accident-only plans are usually more affordable than accident and illness plans. An accident-only plan can be a good option for pets with pre-existing illnesses that are excluded from a policy’s coverage.

2) Accident And Illness Insurance

Accident and illness policies are the most comprehensive pet insurance plans because they cover items listed in the accident-only plan as well as illnesses like cancer, arthritis, urinary tract infections, allergies, and more.

Many pet insurance companies limit their illness coverage as pets age, which is why it’s essential to get insurance while your pet is young to reduce pre-existing condition exemptions and your monthly cost.

3) Additional Wellness Coverage

Is pet insurance worth it for wellness/preventative coverage? Wellness coverage is always optional because, depending on your preferences, you can pay for wellness expenses on your own or include it as an add-on with your pet insurance premium to avoid paying out of pocket all at once for routine vet visits.

A pet wellness plan may cover fees associated with:

- Annual exams

- Spay/neuter procedures

- Routine blood panels

- Heartworm testing and treatment

- Fecal testing

- Urinalyses

- Routine vaccinations (e.g., rabies, distemper, hepatitis, leptospirosis, parvovirus, Bordetella)

- Teeth cleanings

- Flea and tick treatments

Keep in mind that a single routine annual vet exam can cost upwards of $300 depending on your vet, where you live, and the types of procedures, vaccinations, and tests your pet requires. Wellness plans are becoming increasingly popular for managing these expenses. This is why more companies are offering them, including an add-on to some pet health insurance plans.

But not every company covers every item you might expect in a preventative care package, so be sure to read the fine print before you sign up. It might also be wise to discuss your policy coverage with your vet’s billing department before you opt-in to annual checkup items to make sure they are covered.

We review the best pet wellness plans to help you learn how to cover all your bases. Our article includes pricing, coverage details, and more.

Pet Insurance & Types Of Plans Explained

How Does Pet Insurance Work?

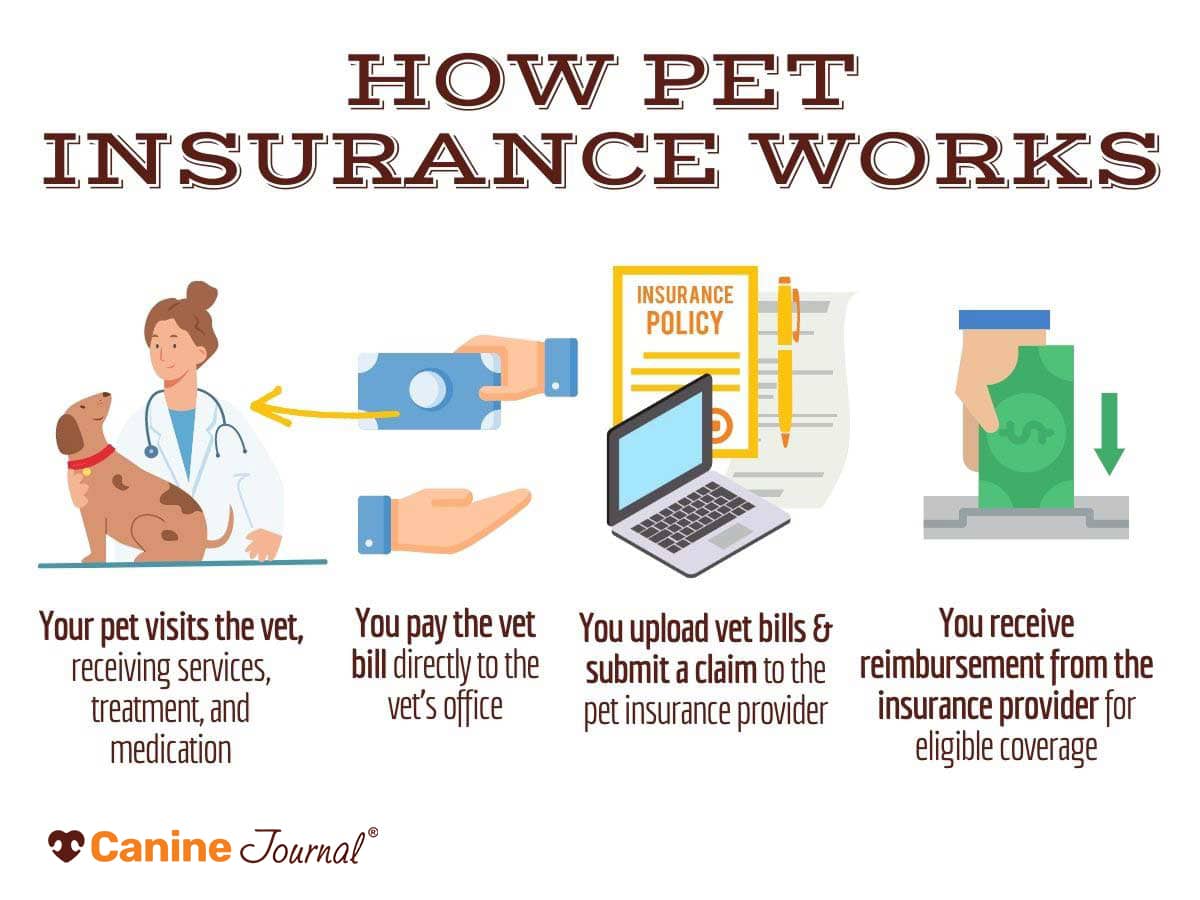

Are pet insurance plans worth it? Unlike human health insurance, with most pet health insurance plans, you pay out of pocket, and the insurance company reimburses you for the cost of veterinary care. After paying the initial price of your pet’s vet visit, you’ll request a duplicate itemized receipt. You’ll then send the itemized receipt to your pet’s insurance company along with a completed claim form. You’ll receive a check or direct deposit after the claim is approved. The amount of time it takes to receive payment can be as fast as minutes or as long as a couple of months.

Some companies guarantee a specific payout turnaround time as an added benefit. Your reimbursement amount depends on your insurance policy details and exclusions, the type and cost of each procedure, your policy’s allowance per procedure, and your plan’s deductible.

Can You Provide An Example?

Let’s say you faithfully saved $50 a month for five years, and your vet bill savings account sits at $3,000 — that’s roughly the equivalent of five years of pet insurance premiums. Unfortunately, your $3,000 in savings won’t stretch beyond initial testing, diagnosis, and a few treatments for most pet illnesses.

With a pet insurance plan, that monthly investment of $50 ensures that your finances are safe, and your pet has coverage for minor and major accidents and illnesses, such as cancer, unexpected injuries, chronic conditions, and, in some cases, even routine visits. So if your cost is $10,000 for emergency treatment, pet insurance would cover far above the $3,000 you saved.

Insurance ensures that you receive a significant portion of what you spend at the vet. Like human health insurance, vet insurance reimbursements can vary based on different factors, such as coverage levels, pre-existing conditions, etc.

Can I Visit Any Vet?

Does pet insurance require me to visit an in-network vet? The majority of pet insurance companies let you choose the vet you want. This makes it so you don’t have to worry about finding a new vet or traveling far from home to find an in-network vet.

Why Do I Need Pet Insurance?

There are many motivating factors when considering obtaining pet insurance, but three of the most significant ones are below.

1) You’ll Never Have To Decide Between Your Wallet & Your Pet

Choosing whether or not to have emergency surgery is one of the hardest decisions you’ll ever make as a pet owner. With pet insurance, you can remove the financial aspect from your consideration and base your medical decisions purely on what’s best for your pet.

2) Accidents Happen

It doesn’t matter how well you take care of your pet; accidents happen. Whether it’s a toenail that gets caught in the couch cushion or a torn cruciate ligament from jumping off the bed, your dog could have an accident that leads to massive vet bills. A pet accident or illness can cost thousands of dollars in vet bills, but having an emergency pet insurance plan ensures that you’re able to recoup a vast percentage of the costs.

3) Manage Your Annual Vet Budget

As with all things in your household, you probably have some sort of budget outlined for all the vet expenses you’ll incur in the coming year (even if it’s only a rough idea). Pet insurance helps ensure your vet costs don’t get out of line should an emergency illness or injury occur.

Also, many providers allow you to tailor your pet insurance policy to fit your budget and needs. If you sign up when your pet is young, you have more options, ranging from significant accidents and illnesses to vaccinations and general checkups.

What Does Pet Insurance Cover?

Want to know if pet insurance will cover what you need? Our pet insurance coverage and exclusions article includes a comparison table to help you see which company will give you the biggest bang for your buck and protect your dog when serious (and expensive) medical issues arise. The table includes all of the top pet insurance companies to give you a quick look at how their policies compare against one another.

Does Pet Insurance Cover Telehealth?

Due to the COVID-19 pandemic, many pet parents began using telehealth and online vet services to satisfy their pet’s needs. Some pet insurance providers have started offering coverage for these services. For example, Fetch covers up to $1,000 in virtual vet visits over video chat, call, or text.

How Much Does Pet Insurance Cost?

Vet costs are on the rise, but that doesn’t mean you should be solely responsible for the costs associated with expensive procedures. Pet insurance prices vary by provider and plan. They’re also unique to your pet’s breed, age, geographical location, pre-existing conditions, and other variables. So, how do you know which is the most affordable?

Well, you don’t until you run quotes with a few companies. We’ve made this easy for you by creating a free quote widget below that pulls prices from our top companies when you fill out one short form with your pet’s details.

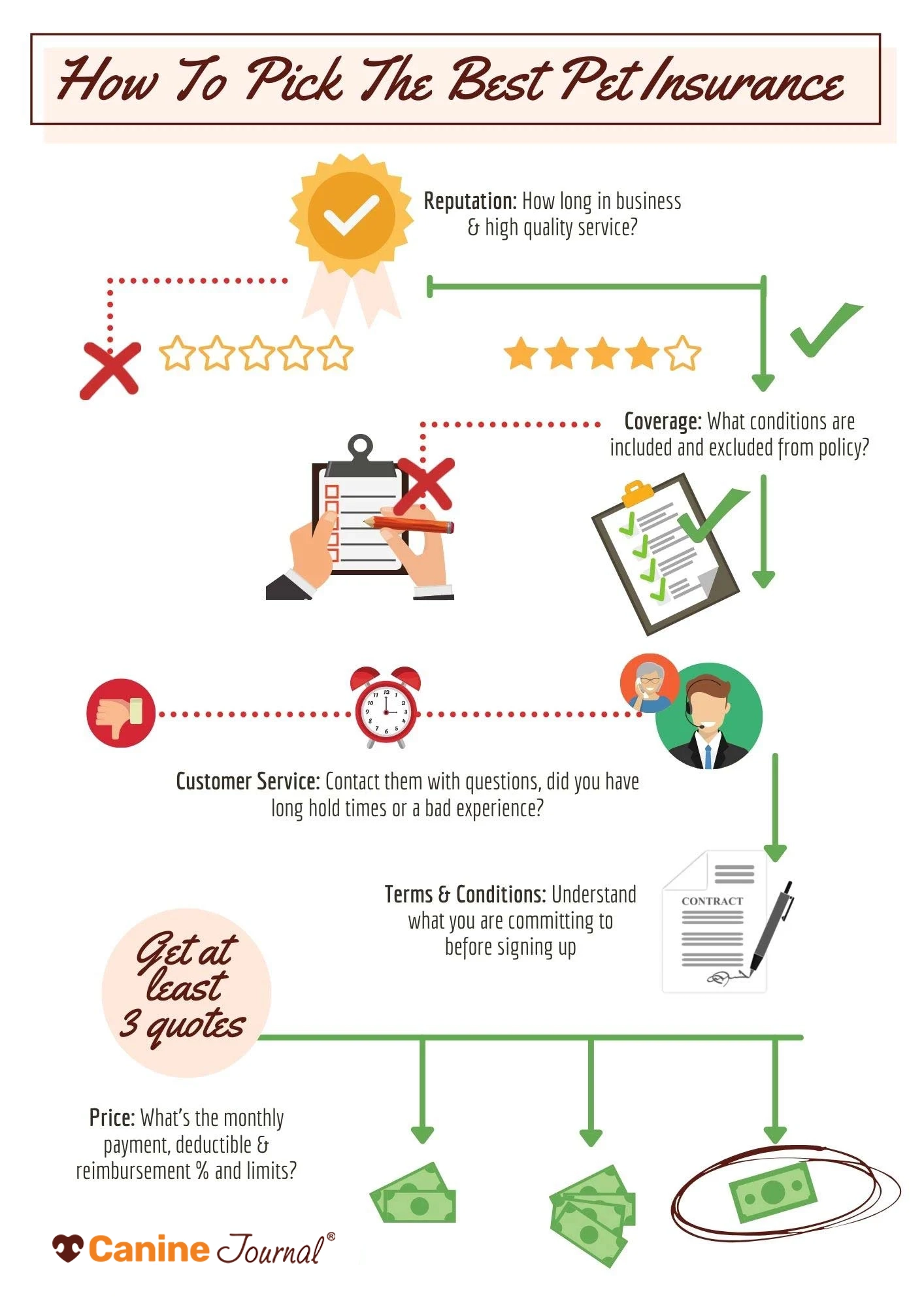

We suggest you get quotes from at least three companies to find the best value (best coverage for the price). Just because the pet insurance company is a household name or has the lowest price doesn’t mean it’s the best for your pet. Learn more about the costs of pet insurance.

Is It Best To Buy An Accident/Illness Plan Or Wellness Plan If I’m On A Budget?

If you’re on a budget, choosing a pet insurance policy (illness/accident or accident-only) instead of a wellness plan (not an insurance product, but an optional add-on) is likely better. Unexpected health issues are the ones you cannot plan and budget for, making them the highest risk to your bank account and your pet’s health.

On the flip side, you can call your vet and get an estimate for an annual exam and vaccines to know what to expect. Then you can use that figure to set aside a portion to cover that known cost. In that way, some may consider a wellness plan an alternative to self-imposed saving.

Compare Pet Insurance Providers Side-By-Side

Ready to start comparing provider pricing? Visit our pet insurance quotes chart to see quote samples from some of the most popular pet insurance companies we review. This side-by-side comparison gives you a better idea of how much monthly premium pricing can vary by provider, which is why it’s crucial to get multiple quotes and to know what’s covered and excluded in your policy. Also, keep in mind that the price will vary based on your pet’s breed, location, age, etc.

What Are The Benefits Of Pet Insurance?

Below are just a few benefits of pet insurance and why we think it’s worth considering.

Can Sign Up Your Pet At Any Age

While most companies allow you to sign up for health insurance at any age, it’s more beneficial to sign them up as young as possible. This is because pre-existing conditions can negate related coverage, and the younger your pet, the less likely they will have health concerns at enrollment.

However, some pet insurance companies have age restrictions (for newborns or seniors). This means coverage may be limited or unavailable depending on the pet’s age, leaving you with fewer options to consider in your purchase decision. We created an age limitations comparison chart to help you see the minimum and maximum ages at which each company allows new enrollment and any other age restrictions they may have.

Offers You Peace Of Mind

Having pet insurance won’t keep accidents and illnesses from occurring, but it will allow you to choose treatment more promptly for your dog if an emergency arises. Instead of worrying about your finances, you can place your concerns on the health and improvement of your dog.

Allows You To Budget For Your Pet

You can pay for your pet insurance policy monthly, quarterly, or annually. Choose which method is best for you and feel more comfortable with your finances. By having your insurance premium included in your budget, you are better able to proactively weigh this expense versus others rather than scrambling to find the money when an emergency hits.

May Help Extend The Life Of Your Pet

Because pet insurance helps you save money on unexpected vet bills, it can also allow you to authorize medical treatment for health conditions you may not approve without pet insurance. In other words, funding an expensive surgery for your dog’s cancer diagnosis could extend his life. In contrast, you may not opt for costly life-saving surgery without pet insurance.

How Do I Choose The Right Dog Insurance?

Before purchasing your dog’s insurance plan, familiarize yourself with what each plan offers. Compare the coverage provided under each plan with individual health concerns for your dog and his breed.

Even if you have a healthy puppy today, knowing what illnesses are prevalent in your dog’s breed will help you select the right plan. Talk with your vet about what you should plan for as your pet ages. For example, some breeds are more susceptible to hip and joint problems and cancer. Although no one wants to anticipate the worst, it’s the best plan of action when shopping for your dog’s insurance policy. Choose the best plan based on the right cost AND coverage benefits, not price alone.

Note: No pet insurance company covers pre-existing conditions immediately after enrollment, but different companies may have other criteria and waiting periods for what they consider a pre-existing condition. If you’re unsure, ask. It’s better to know upfront.

What Are The Top Pet Insurance Companies In 2024?

- Narrow down your choices by reviewing our top provider recommendations and category winners for your specific needs. We continually update our pet insurance reviews, so be sure to check in regularly for new information.

- Contact at least three companies and obtain quotes based on the information you provide about your pet’s breed, age, health, and needs. (Use our quote form to get pricing from top companies.) If you have more than one pet, ask about a multi-pet discount.

- Have your vet send in each of your pet’s records to the company that you’re considering. A company that’s genuinely interested in your business will review your pet’s records and clearly outline any excluded conditions from your pet’s insurance plan (such as pre-existing conditions). It’s important to understand the coverage details before buying any insurance plan.

- Weigh the cost of monthly premiums against the types of coverage offered: accident, illness, and wellness, as well as any add-ons.

- Review plan deductibles and payout percentages that may impact your actual out-of-pocket costs.

- The sooner you sign your pet up for health insurance, the lower the premiums.† Consider purchasing a plan for your puppy before they get too much older and possibly develop pre-existing conditions.

†You should expect annual increases on your premiums from most pet insurance companies. These rates and increases will vary based on your location, changes in vet costs, and more.

Why Trust Our Reviews?

Our reviews are conducted in an unbiased fashion by independent researchers who do rigorous analysis and gather consumer feedback from across the internet. Check out our review process for details.

Best Insurance For Cats & Other Animals

Is pet insurance worth it for cats? We think so! If you’re looking for cat insurance, you’re in luck. Our recommendations for cat insurance are the same as for dogs. Cat insurance works the same way as dog insurance, protecting against unexpected and potentially vast vet bills.

Our reviews can help you decide the best company to cover your feline. We encourage you to get a personalized quote from top companies to help you get specific pricing for your cat.

The nice thing about cat insurance is that you can typically cover your cat for around $30 (or less) per month. Investing $30 per month toward cat insurance will ensure that your feline has protection in the event of an emergency, and you won’t have to think twice about whether you can afford the bill or not.

Are you looking for coverage for your other pets? We cover several less common pets in our overviews of insurance for exotic pets and horse insurance.

What Criteria Do I Need To Consider?

These are the most important factors to consider when choosing an insurance company. They’re also the criteria we use to evaluate the companies included in our reviews.

A.M. Best Ratings

How stable is the company? Can I trust them to pay when an emergency happens? A.M. Best has reported on the insurance industry’s financial stability for over 100 years to give consumers insight into insurers’ financial strength and durability. They report on more than 16,000 insurance companies in over 100 countries.

An insurance company’s A.M. Best rating is similar to an individual’s credit score, except a letter grade instead of a number. Ratings range from A++ (superior) to D (poor).

Claim Processing Reputation

Are claims easy to submit? Does the company process claims promptly and cover all claims as outlined in the policy? What type of reimbursement method is available (e.g., check, direct deposit, Venmo, etc.)? Can the company pay the vet directly, completely eliminating the longer claims process?

If these things matter to you, it’s worth it to find out ahead of time because they vary by company.

Contract Coverage

It’s essential to thoroughly read through the fine print of every insurance contract before signing to ensure it covers everything you’re expecting.

When it comes to contracts, it’s critical that you understand coverage specifics, especially what’s not included (in the exclusions), before you sign on the dotted line. This way, there are no surprises when an urgent situation presents itself. It might take a little upfront work but it will save you in the long run.

Contact the pet insurance company if you have any questions or concerns about the contract. If they truly want your business, they’ll take the time to make sure you fully understand the contract before you sign it.

Customer Service

Look for current customer feedback. How do customers feel about the way companies treat them when problems or questions arise? Are they able to reach someone quickly who can help? Are there many different communication channels available to contact a customer service representative? Are the reps friendly and helpful?

Frequency Of Vet Visits

If your pet is accident-prone or not the healthiest, you’ll want to make sure you find a policy that pays claims with an annual deductible vs a per-incident deductible. This means that if you have three separate accidents in one year, all claims will be applied to one annual deductible. After that’s met, the company will pay in full for all covered portions of the vet bill.

In contrast, per-incident policies restart the dollar count on the deductible for every new claim.

Price

How expensive is the policy on a monthly, annual, and lifetime basis? How does this monthly cost compare to that of other companies with comparable coverage? How much do annual premiums increase over the life of the pet? What do I expect to get back in the case of emergency treatment (reimbursement percentage amount), and how much am I willing to pay out-of-pocket before insurance comes into play (i.e., deductible)?

Are there any one-time fees or transaction fees? Additional fees can be why a company may be more expensive than another. Overall, you’ll want to determine if a particular pet insurance company is worth the cost for your family and if there is a more reasonably priced company with similar coverage available.

Plan Customization

Pet insurance isn’t a one-size-fits-all solution. It’s nice to have options to adjust your reimbursement percentage, deductible, and annual payout limit to an amount you’re comfortable with, so the monthly premium fits within your budget. Some companies have set amounts, which can cause them to be out of your budget or not entirely meet your concerns.

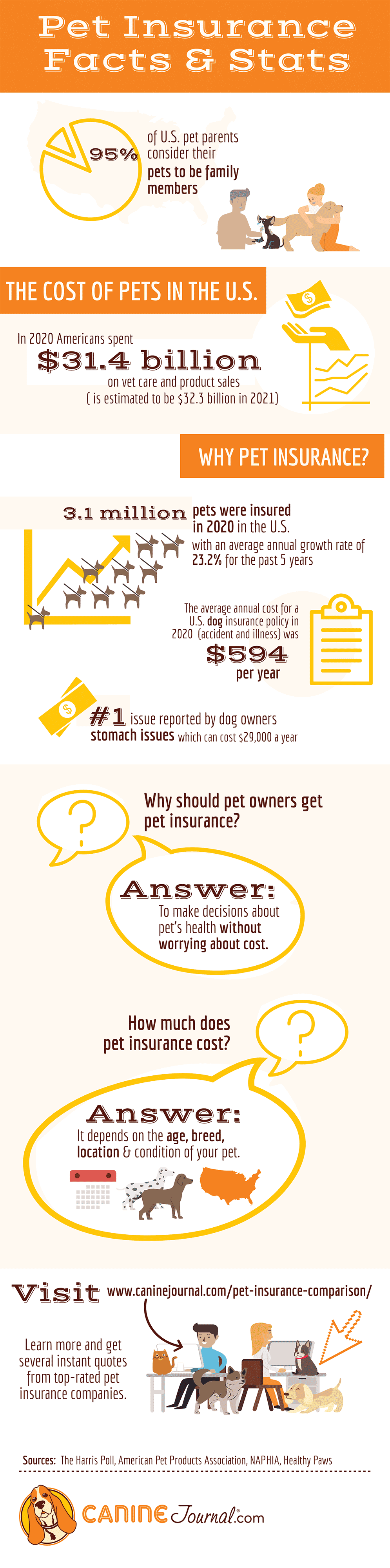

2024 Pet Insurance Statistics & Facts

Below are some pet insurance trends that fascinate us, and we think they may surprise you too.

- 95% of U.S. pet parents consider their pets to be family members.1

- 33% of U.S. consumers adopted or considered adopting a pet during the COVID-19 pandemic. Most of those pet parents chose not to insure their new family members.2

- 67% of pet owners say they know about pet insurance, but only 26% have it.2

- 63% of pet parents say they couldn’t afford unexpected medical care for their pets.2

- 36% of all pet parent age groups have been in debt for a pet, and 42% of millennial pet owners have been in pet-related debt.3

- Millennials are more likely to have pet insurance (34%), while 18% of Gen Xers and 9% of Baby Boomers have it.3

- If a $1,000 pet-related emergency were to come up tomorrow:

- 37% would use a credit card

- 28% would use cash

- 18% would use savings

- 13% would take out a personal loan3

- Americans spent $35.9 billion on vet care and product sales in 2022 (it is estimated to be $37 billion in 2023).4

- Some of the basic annual expenses for dog and cat owners include:4

- Surgical vet visits: $458 for dogs and $201 for cats

- Routine vet visits: $242 for dogs and $178 for cats

According to NAPHIA (North American Pet Health Insurance Association), the average monthly premium for an accident and illness dog insurance policy in the U.S. is $56.30 ($31.94 for cats).

- Dog insurance is about 76% more expensive, on average, than accident and illness policies for cats.

- 5.67 million pets were insured in 2023 in the U.S., with an average annual growth rate of 17.1% (78.6% insured dogs vs 21.4% cats).

- The majority of insured pets in the U.S. reside in California (18.3%), New York (7.5%), and Florida (6.2%).

- The #1 issue reported by dog owners is stomach issues (which, according to Healthy Paws, can cost more than $29,000 a year), followed by skin conditions and pain.5

The video below shares more stats about pet insurance and why you should consider getting it for your dog.

Pet Insurance Stats For 2024 (Infographic)

Pet Insurance Terminology

We know that insurance can be a confusing topic. Here’s a breakdown of any terms you might encounter so you have a better understanding of the jargon.

- Code: The word “code” is listed on your schedule of benefits with most pet insurance companies. Underneath this term, you’ll see a number listed. This is the “code” the company uses to identify the diagnosis given to your pet.

- Co-Payment: The co-pay is the amount of out-of-pocket expense you must cover per incident after your deductible. The co-payment is usually listed as a percentage. For example, 80/20 means that the insurance company will cover 80% of the remaining balance after you pay your deductible, and you must pay the remaining 20%.

- Deductible: The deductible is the amount of money you must pay out-of-pocket before you’re eligible to receive reimbursement from your pet’s insurance plan. For most companies, this deductible must be paid annually rather than per incident. Be sure to understand your agreement, as the annual vs per-incident deductible is a big deal.

- Elective Procedures: Elective surgeries and procedures can be scheduled in advance. Examples of elective procedures include spaying, neutering, declawing, dewclaw removal, ear cropping, and more.

- Endorsements: Depending upon the insurance company you choose, you may have the opportunity to purchase an “endorsement.” This is like an add-on to your purchased insurance plan and extends the amount of coverage your pet receives for the specific illness listed.

- Exclusions: Exclusions are items that are not covered by your policy. This can include pre-existing conditions, certain musculoskeletal disorders, congenital disorders, hereditary disorders, intentional injuries caused by you or your family, and elective or cosmetic procedures. Again, be sure to request a quote and review all exclusions in detail before signing up.

- Incidents: The term incident refers to the condition causing you to visit the veterinarian. Chronic diseases, such as skin allergies, are considered single incidents even if you make multiple vet visits for that condition.

- Pre-Existing Conditions: Every major company in this category excludes pre-existing conditions from their coverage. This means that any ongoing condition your dog or cat was diagnosed with before being covered by their policy will not be covered in future claims. For example, if your dog has already been diagnosed with hip dysplasia, any costs associated with this condition will not be covered by most insurance.

- Preventative/Routine/Wellness Care: Anything that pet parents and vets medically do that helps prevent disease. Examples of preventive care include vaccinations, heartworm prevention, flea control, annual vet checkups, and teeth cleanings.

- Primary Diagnosis or Condition: This term appears on your schedule of benefits and refers to the financial limit that the company places on a primary diagnosis or condition, which includes injections, hospitalization, exams, surgery, and treatment.

- Primary Diagnostic Testing Maximums: This term also appears on your schedule of benefits and refers to the company’s cost limit on primary diagnostic testing. This allowance is generally made per bodily system. This benefit limit does not extend to specialized diagnostic tests in many cases.

- Schedule of Benefits: The schedule of benefits is a document that the company provides to you when you sign up for your policy. This document outlines the covered conditions under your plan and the monetary allowance for each diagnosis.

- Secondary Diagnosis or Condition: If your pet receives treatment for a second condition resulting from the primary diagnosis, it will be covered under the benefits listed as a secondary diagnosis or condition. This secondary condition will receive financial reimbursement in addition to the primary diagnosis or condition.

- Secondary Insurance: Some may choose to purchase a second pet insurance policy to help cover the costs not covered by the primary insurer. It’s important to understand that the secondary insurer may not fully pay the outstanding amount from the primary insurance; coverage depends on your policy’s details.

Are There Situations For Which Pet Insurance Is Not Worth It?

That’s a personal decision you’ll have to make. Insurance can always be worth it, given a particular set of circumstances. Keep in mind that the whole point of any insurance policy is to provide peace of mind for unexpected incidents that you otherwise wouldn’t be able to afford.

For example, if you have an older dog, your premium will be higher, and, given how much time you have left with your pup, you may question whether obtaining pet insurance is worth it. But aging pets are also more susceptible to developing health concerns.

What Are The Disadvantages Of Pet Insurance?

We feel that pet insurance is beneficial and worth it for most, but here are possible negatives for some:

- Routine exams that cover preventative care and other associated expenses are excluded from coverage unless you purchase a wellness plan for an additional cost.

- You are responsible for paying out-of-pocket expenses, including your deductible and any amount that surpasses your payout limit.

- Pre-existing conditions may be excluded from coverage, and you are responsible for all associated costs.

- Most pet insurance companies require you to pay the vet costs upfront and then wait for reimbursement, which can range from minutes to weeks (depending on the company). Some pet insurance providers offer a vet direct pay option to eliminate the reimbursement process.

Ready To Get Pet Insurance?

It’s easy to become confused with all the insurance jargon, pricing, coverage, etc. That’s why we’re here to help. We’re pet insurance experts and enjoy helping pet parents find the perfect policy for their furry companions. If you’re ready, head on over to find the best pet insurance for your needs. It includes current rankings of our top recommendations and why we think they’re the best in the business.

Sources: [1] The Harris Poll, [2] Liberty Mutual Insurance, [3] Lending Tree, [4] American Pet Products Association, [5] Healthy Paws

Tagged With: Reviewed By Dr. Pendergrass, DVM, Reviewed By Insurance Agent