This content was reviewed by our licensed insurance agent, Michelle Schenker.

When you purchase through links on our site, we may earn a commission. Here’s how it works.

Bivvy is no longer providing pet insurance. Current Bivvy policies will end on their policy anniversary date (stated on the declaration page). Bivvy will notify you of that non-renewal date and will continue processing claims that occur and are treated before that date. To find a new pet insurance provider, read our pet insurance reviews.

Bivvy offers an affordable pet insurance policy (in some states) with the option of adding on a wellness plan. However, it places limits annually and over the lifetime of a pet, which other providers do not.

Is Bivvy still worth it, or would it be best for you to choose a more traditional pet insurance company?

We don’t include Bivvy or any company with less than five years experience in our annual pet insurance rankings because it takes time for policies to establish consistency of premiums. In our experience new companies’ premiums, and thereby your monthly costs, tend to fluctuate the first few years.

Bivvy Pet Insurance Review

Product Name: Bivvy Pet Insurance

Product Description: Bivvy offers pet insurance plans for dogs and cats.

Summary

Bivvy has more limitations to its plans than other insurers. However, its plans are rather affordable, costing only $9-$20 per month.

Our pet insurance experts read through each pet insurance company’s policy to provide detailed comparisons and information regarding how a provider fares against others in the industry. We also speak with customers, read online feedback, and communicate one-on-one with pet insurance companies to obtain a well-rounded, unbiased analysis of a company’s standings.

Our team rates pet insurance companies based on several factors, including A.M. Best ratings (an indicator of financial stability), claim processing reputations, contract coverage, customer service, pricing, plan customizations, and more.

Overall Score

Pros

- $9-20/month for any pet insurance policy (price varies by state)

Cons

- Only covers expenses up to $1,000-5,000 (varies by state) per policy term

- No customer service phone number listed on website

- Not available in all 50 states

- $25,000 lifetime payout limit

- 14-day waiting period for accidents in most states and 30 days for illnesses in most states

- 6-12 month waiting period for CCL injuries and hip dysplasia (varies by state)

- No BBB rating

Alternatives To Bivvy

Don’t like the cons or uncertainty of a new company? Our pet insurance experts have analyzed over a dozen established pet insurance providers. Check out our pet insurance reviews to learn more about this year’s top-ranked companies. You can also use our free tool below to get multiple pet insurance quotes instantly.

Key Features

- Underwriter: CUMIS Insurance Society, Inc.

- No exam required

- All policies are one price per month, regardless of type of pet, breed, or age (price varies by state: $9-20/month)

- Annual payout limits vary by state ($1,000-$5,000) and a lifetime payout limit of $25,000 (competitors don’t place as many payout limits on pets)

- Per claim deductible varies by state ($50-250)

- No bilateral exclusions (a condition or disease that affects both sides of the body) listed in sample policy

- Claims process:

- Bivvy begins reviewing claims within 1 business day of being filed

- Must submit claims within 90 days of the date of service

- Submit claims via online account

- Only available in the following states: AZ, CO, CT, GA, IL, IN, IA, KS, MD, MI, MN, NC, OR, SC, TX, VA, WI

- Unrated by the Better Business Bureau (likely because Bivvy is so new)

Customer Service Hours

- Email and FAQ (hours not listed)

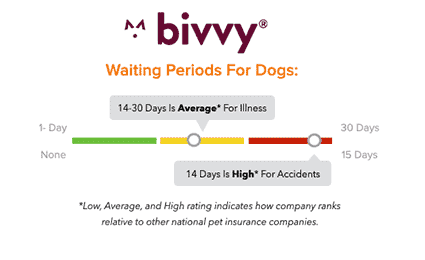

Waiting Periods*

- 14 days: accidents (AZ: 3 days)

- 14 or 30 days: illnesses (length varies by state)

- 6 or 12 months: dog orthopedic conditions (e.g., cruciate ligament, hip dysplasia, etc.) unless the injury is the direct result of a trauma (length varies by state)

*Waiting periods for California, Delaware, Louisiana, Maine, Mississippi, Nebraska, New Hampshire, and Washington are as follows:

- Accidents - 0 days

- Illnesses - 14 days

- Cruciate Ligament Conditions - 30 days

- Routine Care - 0 days

What Does Bivvy Cover?

Please know that none of the providers in our pet insurance comparison cover pre-existing conditions or cremation and burial costs. All of them cover the following items when deemed medically necessary: X-rays, blood tests, ultrasounds, cat scans, MRIs, rehabilitation, specialized exams, surgery, hospitalization, emergency care, specialty care, hydrotherapy, chronic conditions, cancer, diagnostic treatment, alternative/holistic therapy, and euthanasia. However, there may be limitations to this coverage, so please check your policy.

| Condition | Covered By Bivvy |

|---|---|

| Exam Required To Set Health Baseline | |

| Behavioral Therapies | |

| Exam Fees | |

| Wellness Care Available For An Extra Fee | |

| Non-Routine Dental Treatment | |

| Hereditary Conditions | |

| Congenital Conditions | |

| Prescription Medication | |

| Breed, Whelping, Pregnancy | |

| Cosmetic Procedures (e.g., Tail Docking, Ear Cropping, Dew Claw Removal) Unless Medically Necessary |

Wellness Care

Bivvy offers one plan to cover routine and preventative expenses. The current cost for Wellness Care is $9 per month. Included are the maximum amounts that Bivvy will pay each year for specific treatments.

| Wellness Care Annual Limit | |

|---|---|

| Price Per Month | $9 |

| Wellness Exam | $40 |

| Vaccinations | $15 Rabies $15 Other |

| Flea, Tick & Heartworm Prevention | $15 |

| FELV Screen | $15 |

| Heartworm Test | $10 |

| Microchip | $20 |

| Urinalysis or ERD | $15 |

| Deworming | $20 |

| Total Annual Benefit Available | $165 |

Pricing Quotes

Bivvy charges $9-20 per month (depending on what state you are in) for pet insurance, regardless of dog or cat, age, size, gender, or breed. The reimbursement level is 50% (most competitors offer multiple, higher reimbursement options). The deductible varies by state from $50-$250 (again, most competitors offer multiple deductible options in each state).

You have the option to add on Bivvy’s Wellness Care plan for $9 per month to help cover routine and preventative expenses.

Both the insurance and wellness plans are among your least expensive options in many states, making Bivvy a good option to reduce your risk at a lower price.

You can get a pet insurance quote for your pet(s) from several top-ranked companies when you fill out just one short form.

Our Final Verdict On Bivvy

Since it was recently founded in 2019, we’d like to see how Bivvy handles claim repayment, pricing, and customer service in the coming years. If you don’t feel that Bivvy is the best choice for your pet, check out our recommendations for the best pet insurance.

Tagged With: Reviewed By Insurance Agent