Is Pet Insurance Worth It In 2025? How Does Pet Insurance Work?

When you purchase through links on our site, we may earn a commission. Here’s how it works.

You never expect a medical emergency—until it happens. Yet, less than half of pet owners feel financially prepared to handle an unexpected veterinary bill. With the average unplanned vet expense totaling $560.80, and emergency treatments often reaching thousands of dollars, many pet parents find themselves making heartbreaking decisions when faced with a sudden illness or injury.

Table of Contents

For around $50 per month, pet insurance can be the difference between life-saving treatment and a financial crisis. Imagine hearing that your dog needs an $8,000 surgery to survive. Without pet insurance coverage, you may be forced to choose between going into debt or saying goodbye far too soon.

No one wants to make that choice. Pet insurance ensures that when an emergency arises, you can focus on your pet’s health, not the cost of care. It can also help prevent “economic euthanasia,” a heartbreaking situation where pet owners have to put down a beloved pet because treatment is unaffordable.

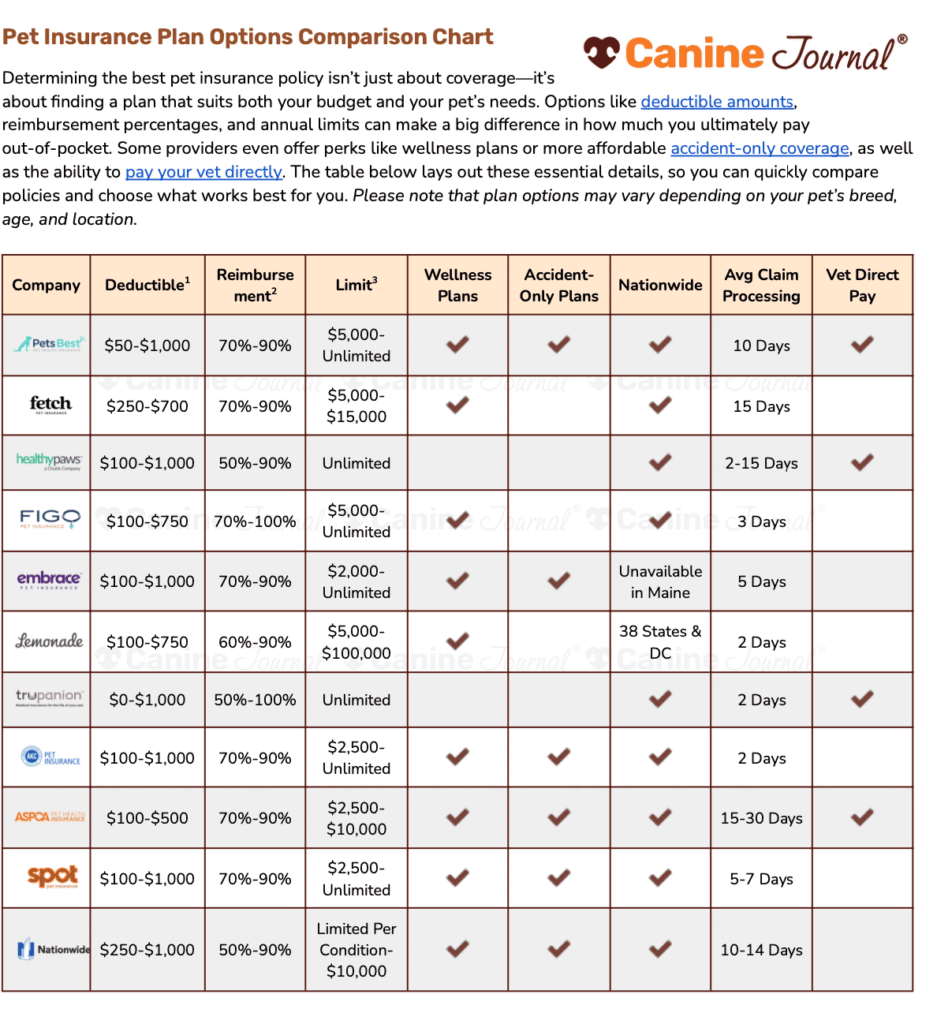

To help pet parents weigh their options, the table below provides a quick comparison of the best pet insurance companies of 2025. After that, we’ll break down the details of whether pet insurance is truly worth it for you and your pet.

| Ranking | Company | Get Quotes | Read In-Depth Reviews |

|---|---|---|---|

| Best Overall |  | Read Review | |

| Best For Puppies & Kittens |  | Read Review | |

| Best Unlimited Payouts | Read Review | ||

| Best Value |  | Read Review | |

| Best Coverage |  | Read Review | |

| Most Affordable |  | Read Review |

What Is Pet Insurance?

Pet insurance helps cover the cost of veterinary care when your pet faces an unexpected illness or injury. Just like we prepare for medical expenses with health insurance, pet insurance ensures that you won’t have to choose between your wallet and your pet’s health when a costly emergency arises.

Unlike human health insurance, pet insurance typically works on a reimbursement model, meaning you pay the vet upfront and then file a pet insurance claim to get reimbursed for eligible expenses.

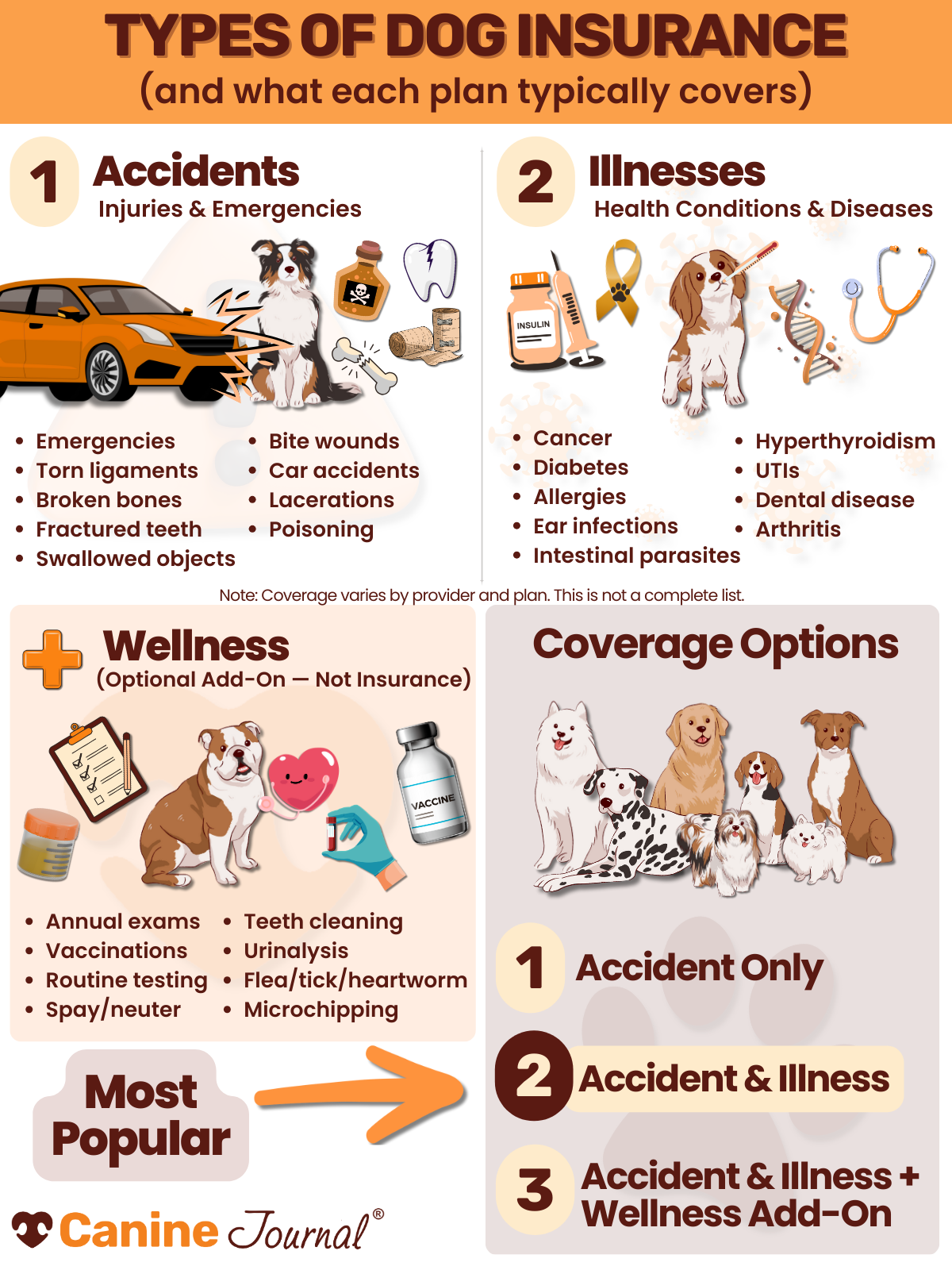

There are two main types of pet insurance plans:

- Accident-only – Covers injuries like broken bones, bite wounds, or swallowing foreign objects.

- Accident and illness – Covers accidents as well as illnesses like cancer, infections, and chronic conditions.

Some pet insurance companies also offer optional wellness plans to help cover routine expenses like vaccinations and annual checkups. While not an insurance product, these plans can be a helpful budgeting tool for preventive care.

1) Accident-Only Insurance

Accidents are unpredictable, but their costs don’t have to be. Accident-only pet insurance helps cover sudden physical injuries, such as torn ligaments, broken bones, bite wounds, and other emergencies. If your pet swallows something they shouldn’t or gets injured in a fall, an accident-only plan ensures you’re financially prepared.

Since accident-only plans exclude illnesses, they are typically more affordable than comprehensive policies. They can also be a good option for pets with pre-existing conditions that would otherwise disqualify them from illness coverage.

2) Accident And Illness Insurance

For more comprehensive protection, accident and illness insurance covers both unexpected injuries and a wide range of medical conditions, including cancer, arthritis, urinary tract infections, allergies, and more. This type of pet insurance provides peace of mind for both emergency and long-term health concerns.

However, many providers reduce illness coverage for pets enrolled at older ages, making it crucial to enroll while your pet is young. Signing up early helps lower your monthly premium and prevents exclusions for pre-existing conditions.

3) Additional Wellness Coverage

Is pet insurance worth it for routine and preventative care? Unlike accident and illness plans, wellness coverage is always optional and designed to help manage predictable, recurring vet expenses.

A pet wellness plan may cover fees associated with:

- Annual wellness exams

- Spay/neuter procedures

- Routine blood panels

- Heartworm testing and treatment

- Fecal testing

- Urinalyses

- Routine vaccinations (e.g., rabies, distemper, hepatitis, leptospirosis, parvovirus, Bordetella)

- Teeth cleanings

- Flea and tick treatments

A single annual vet visit can cost $300+, depending on your location and pet’s needs. Wellness add-ons help spread out these costs, making preventive care more manageable.

However, not all wellness plans cover the same procedures. Before enrolling, review the fine print and consult with your vet’s billing department to confirm what’s covered.

We’ve reviewed the best pet wellness plans to help you compare pricing, coverage, and benefits, so you can decide if one is right for you.

How Does Pet Insurance Work?

Are pet insurance plans worth it? Here’s how it works. Unlike human health insurance, most pet insurance plans operate on a reimbursement model—meaning you pay the vet bill upfront and get reimbursed after filing a claim.

Step-By-Step Process:

- Pay for your pet’s vet visit – After treatment, you’ll request an itemized receipt from your veterinarian.

- Submit a claim – Send your itemized receipt along with a completed claim form to your pet insurance provider.

- Receive reimbursement – Once the claim is approved, your insurer will send a check or direct deposit for the covered amount.

How long does reimbursement take? It varies. Some companies process claims within minutes, while others take several weeks. Some insurers guarantee a payout timeframe as an added benefit.

How Much Will You Get Back?

Your reimbursement amount depends on several factors, including:

- Your policy’s coverage and exclusions

- The type and cost of each procedure

- Your plan’s deductible and co-pay

- Any annual or per-condition payout limits

Understanding these details ensures you maximize your pet insurance benefits and avoid unexpected costs.

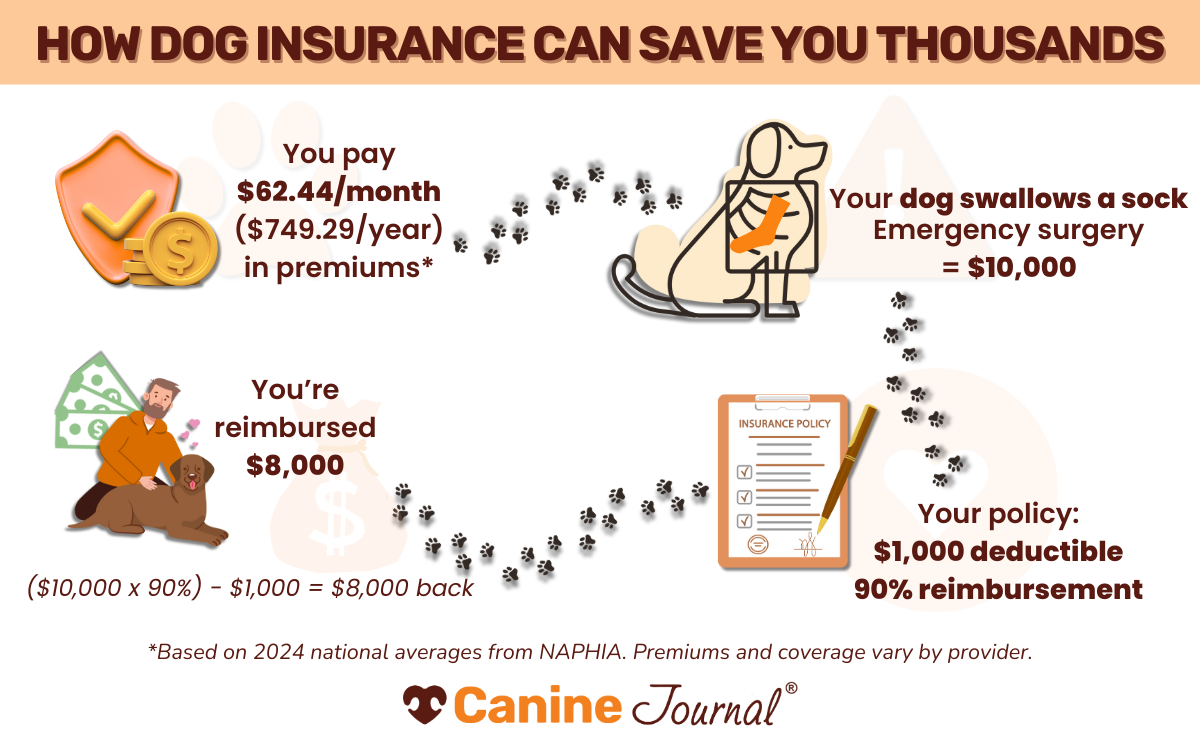

Can You Provide An Example?

Many pet parents wonder, “Why not just save money instead of buying pet insurance?” Let’s break it down with a real-world scenario.

Imagine you save $50 per month in a dedicated vet bill fund. After five years, you have $3,000 —roughly the same amount you would have spent on pet insurance premiums during that time. Sounds like a solid plan, right?

Now, let’s say your pet is suddenly diagnosed with cancer or suffers a serious injury, requiring $10,000 in emergency treatment. Your $3,000 savings might cover initial testing and a few treatments, but it won’t go far beyond that.

With pet insurance, that same $50 monthly investment ensures that a significant portion, if not the majority, of your vet costs are reimbursed. Policies can cover major illnesses, accidents, and chronic conditions. Instead of facing a financial crisis, you can focus on getting your pet the best possible care.

Just like human health insurance, the reimbursement amount varies based on factors such as your policy’s coverage level, deductible, and exclusions for pre-existing conditions. But in most cases, insurance covers far more than what you could realistically save on your own.

Can I Visit Any Vet?

One of the biggest advantages of pet insurance is flexibility. Unlike human health insurance, most pet insurance plans don’t require you to visit an in-network vet.

This means you can go to any licensed veterinarian, specialist, or emergency clinic in the U.S. without worrying about whether they accept your pet insurance. You won’t have to switch vets or travel far to find an in-network provider, giving you peace of mind that your pet can receive care wherever you are.

Why Do I Need Pet Insurance?

Veterinary care is advancing, but with it comes rising costs. Whether it’s a sudden illness, a chronic condition, or an unexpected accident, medical expenses for pets can add up quickly. Without insurance, pet owners may struggle to afford the best care—or be forced to make tough financial decisions.

Pet insurance helps protect both your pet and your wallet, covering a significant portion of eligible vet bills so you can focus on getting your pet the treatment they need. Here are three key reasons why it’s worth considering:

1) You’ll Never Have To Decide Between Your Wallet & Your Pet

Making life-or-death medical decisions for your pet is already difficult, but adding financial stress to the equation makes it even harder. With pet insurance, you won’t have to wonder if you can afford the best care. Instead, you can focus solely on what’s best for your pet, knowing that a significant portion of the costs will be reimbursed.

2) Accidents Happen

It doesn’t matter how well you care for your pet, accidents are unpredictable. Whether it’s a torn toenail from getting caught in a couch cushion or a cruciate ligament tear from jumping off the bed, even minor mishaps can result in massive vet bills.

Unexpected treatments often cost thousands of dollars, but with emergency pet insurance, you can recoup a significant percentage of your expenses, making these unexpected situations much more manageable.

3) Manage Your Annual Vet Budget

Just like with household expenses, having a predictable pet care budget can make a big difference. Pet insurance ensures that a sudden illness or injury won’t derail your finances by covering unexpected medical costs.

Many providers even allow you to customize your policy to fit your budget and your pet’s needs. If you sign up while your pet is young, you’ll have more coverage options, ranging from major accidents and illnesses to routine care like vaccinations and checkups.

What Are The Benefits Of Pet Insurance?

Pet insurance offers financial security and peace of mind, helping pet owners provide the best possible care for their furry companions. Below are some key benefits of having pet insurance and why it’s worth considering.

While most companies allow you to sign up for health insurance at any age, it’s more beneficial to sign them up as young as possible. This is because pre-existing conditions can negate related coverage, and the younger your pet, the less likely they will have health concerns at enrollment.

1) Coverage At Any Age

Some pet insurance companies allow enrollment at any age, but signing up when your pet is young has significant advantages. Pre-existing conditions aren’t covered, so enrolling early ensures your pet gets the most comprehensive coverage before any health issues arise.

However, some insurers have age restrictions for newborn puppies/kittens and senior pets, which can limit coverage options. To help you compare, we’ve created an age limitations chart showing the minimum and maximum enrollment ages for each provider.

2) Peace Of Mind When Emergencies Strike

Pet insurance won’t prevent accidents or illnesses, but it eliminates financial stress when they happen. Instead of delaying treatment due to cost concerns, you can focus on getting your pet the care they need when they need it.

3) Helps You Budget For Veterinary Expenses

Pet insurance premiums can be paid monthly, quarterly, or annually, making it easier to plan for pet-related expenses. Rather than scrambling to cover an unexpected $5,000 vet bill, you’ll have a predictable expense built into your budget, allowing you to prepare financially in advance.

4) May Help Extend Your Pet’s Life

Many pet parents are forced to decline life-saving treatments due to financial constraints. With pet insurance, you won’t have to make that heartbreaking choice. Coverage can help you approve necessary medical treatments, such as cancer surgery or long-term illness management, that could extend your pet’s life.

What Does Pet Insurance Cover?

Not all pet insurance plans cover the same conditions, so it’s important to compare policies before choosing the right one for your pet’s needs.

Most pet insurance policies cover:

- Accidents – Broken bones, bite wounds, swallowed objects, and other injuries.

- Illnesses – Cancer, hereditary disorders, allergies, diabetes, arthritis, infections, digestive issues, and chronic conditions.

- Emergency care & hospitalization – Overnight stays, surgeries, and life-saving treatments.

- Diagnostic tests – X-rays, CT scans, MRIs, bloodwork, and ultrasounds.

- Medications & treatments – Prescription drugs, physical therapy, and alternative therapies.

However, coverage varies by provider, and most policies exclude pre-existing conditions, breeding, training, grooming, and elective procedures.

To help you find the most comprehensive coverage, check out my guide on what pet insurance covers, where I have a comprehensive list of conditions and explain how pet insurance covers or excludes them.

Does Pet Insurance Cover Telehealth?

With the rise of telehealth and online vet services, some pet insurance providers have started offering coverage for virtual vet visits.

For example, Fetch Pet Insurance includes up to $1,000 in telehealth coverage for consultations via video chat, phone calls, or text messaging. As more pet parents turn to remote veterinary care, it’s worth checking if your provider offers similar benefits.

How Much Does Pet Insurance Cost?

Veterinary costs are rising every year, but that doesn’t mean you have to bear the full financial burden of expensive treatments alone. Pet insurance costs vary based on several factors, including:

- Your pet’s breed – Certain breeds are prone to hereditary conditions, which can impact pricing.

- Age – Older pets typically have higher premiums due to increased health risks.

- Location – Vet costs differ by region, affecting insurance rates.

- Coverage level & reimbursement rate – More comprehensive plans cost more but offer better protection.

How Can You Find The Best Price?

The only way to know which provider offers the best deal for your pet is to compare quotes from multiple companies. To make this easier, we’ve added a free quote tool below. Just enter your pet’s details, and you’ll instantly see pricing from top pet insurance providers.

We suggest you get quotes from at least three companies to find the best value (best coverage for the price). Just because the pet insurance company is a household name or has the lowest price doesn’t mean it’s the best for your pet. Learn more about the costs of pet insurance.

We recommend getting quotes from at least three companies to ensure you’re getting the best value, the right balance of coverage and affordability for your pet. Just because a company is well-known or offers the cheapest plan doesn’t mean it’s the best fit for your pet’s needs.

Want to dig deeper into pet insurance pricing? Learn more about pet insurance costs here.

Is It Best To Buy An Accident/Illness Plan Or Wellness Plan If I’m On A Budget?

If you’re on a budget, prioritizing an accident and illness or accident-only plan over a wellness plan is usually the better choice. Why? Unexpected injuries and illnesses can result in major vet bills that you can’t plan for, making them the biggest financial risk. Pet insurance helps protect you from these high, unpredictable costs.

On the other hand, wellness expenses (like annual exams and vaccines) are predictable. You can call your vet to get an estimate for routine care, then set aside savings to cover these known costs. In that sense, some pet owners view a wellness plan as an alternative to self-imposed savings rather than a necessity.

Pet Insurance Comparison Charts

Wondering how different pet insurance providers stack up? I’ve compiled a series of side-by-side comparison charts covering pricing, coverage, waiting periods, plan options, and more. These tables allow you to quickly compare providers and find the best fit for your pet’s needs and budget.

Overview Of Comparison Tables:

- Plan Options – Available add-ons, wellness plans, and customization features.

- Conditions & Treatment – Which medical conditions and treatments each provider includes.

- Dental & Alternative Therapies – Coverage for specialized treatments like dental cleanings and acupuncture.

- Wellness Plans – A detailed look at routine care coverage and options.

- Waiting Periods – How soon coverage begins after enrollment.

- Age Limits – Minimum & maximum enrollment ages per provider.

- Pros & Cons – A quick breakdown of strengths and weaknesses for each provider.

- Pricing & Premiums – Side-by-side sample monthly costs from top providers.

What Are The Top Pet Insurance Companies In 2025?

Looking for the best pet insurance provider for your pet? We continually review and update our top pet insurance recommendations, highlighting category winners based on pricing, coverage, and customer satisfaction.

To narrow down your options, check out our latest pet insurance reviews and follow these key steps to find the right provider for your pet’s needs.

1) Compare Providers & Get Quotes

- Start by gathering quotes from at least three companies to compare pricing and coverage options. (Use our quote form to get pricing from top companies.)

- If you have multiple pets, ask about multi-pet discounts to save on premiums.

2) Request A Policy Review Based On Your Pet’s Medical Records

- Have your vet send your pet’s medical records to the insurance company you’re considering.

- A reputable provider will review these records and clearly outline any excluded conditions (such as pre-existing conditions) before you enroll.

3) Understand The Cost vs Coverage Tradeoff

- Weigh the monthly premium costs against the types of coverage offered (accident, illness, wellness, and add-ons).

- Review deductibles and reimbursement percentages, as these impact your actual out-of-pocket expenses.

4) Sign Up Early To Lock In Lower Premiums

- The younger your pet, the lower the premiums. Consider enrolling before they develop pre-existing conditions.

- Keep in mind that most pet insurance companies raise premiums annually as your pet ages.

Best Insurance For Cats & Other Animals

Is pet insurance worth it for cats? We think so! Cat insurance works just like dog insurance, offering protection against unexpected and costly vet bills.

One of the biggest perks of cat insurance is its lower cost. Most policies cost around $30 or less per month, making it a budget-friendly way to protect your feline in case of an emergency.

Coverage options vary by provider, so we recommend getting a personalized quote to find the best plan for your cat’s needs. Our expert reviews can help you compare top insurers for felines.

Looking for coverage for other pets? We also provide in-depth reviews on exotic pet insurance and horse insurance to help you find the right protection for all your animals.

How Do I Choose The Right Dog Insurance?

Choosing the right pet insurance for your dog starts with understanding what each plan covers and how it aligns with your dog’s health risks. Here’s what to consider:

- Breed-Specific Health Concerns – Even if your puppy is healthy today, certain breeds are prone to conditions like hip dysplasia, heart disease, or cancer. Talk to your vet about potential health risks for your dog’s breed so you can choose a plan that offers the right coverage before issues arise.

- Compare Coverage, Not Just Price – While affordability matters, the cheapest plan isn’t always the best. Look for comprehensive coverage that balances cost and benefits, including accident, illness, and optional wellness plans, so you’re fully protected when unexpected medical expenses arise.

- Know the Fine Print on Pre-Existing Conditions – No pet insurance company covers pre-existing conditions immediately after enrollment. However, waiting periods and definitions of what qualifies as “pre-existing” vary by provider. If you’re unsure, ask before enrolling to avoid surprises later.

See how I helped a new dog owner choose the best pet insurance for her Golden Retriever, Rio.

What Criteria Do I Need To Consider?

When choosing a pet insurance provider, it’s important to evaluate key factors that impact financial stability, coverage, claims processing, and overall value. These are the same criteria we use to assess providers in our reviews.

1) Financial Stability – Can I Trust This Company to Pay When I Need Them Most?

When choosing a pet insurance provider, financial stability is key. You want to ensure the company can pay claims efficiently and remain stable long-term.

- A.M. Best Ratings – A.M. Best has been assessing the financial strength of insurance companies for over 100 years. Their rating system is similar to a credit score but uses letter grades from A++ (Superior) to D (Poor). A higher rating indicates a stronger ability to handle claims and remain financially secure.

- Demotech Ratings – Demotech is another trusted rating agency established in 1985. It specializes in evaluating regional and specialty insurers, offering insight into their ability to meet policyholder obligations. Their rating scale ranges from A” (Exceptional) to L (Licensed but under regulatory supervision).

Since not all pet insurance companies have an A.M. Best rating, checking Demotech ratings provides an additional layer of confidence in a company’s long-term stability and reliability in paying claims.

2) Claim Processing & Reimbursement – How Easy Is It To File A Claim?

When an emergency happens, you want a fast and hassle-free claims process. Here’s what to consider:

- Ease of Filing – Can you submit claims online, via a mobile app, or directly through your vet?

- Processing Time – Do they process claims instantly, within a few days, or take weeks?

- Reimbursement Methods – How do they pay you back? Options may include direct deposit, Venmo, checks, or instant payouts.

- Direct Vet Payments – Some insurers pay vets directly, meaning you don’t have to pay upfront. However, not all vets accept direct payments, so check before enrolling.

If fast claims and seamless payments are a priority for you, compare processing speeds and reimbursement options before choosing a provider.

3) Contract Coverage – What’s Actually Included?

Pet insurance contracts vary by provider, so reading the fine print is crucial. Before signing, carefully review:

- What’s covered vs. what’s excluded (e.g., hereditary conditions, alternative therapies)

- Limits on coverage (e.g., per-condition caps, annual payout maximums)

- Waiting periods & pre-existing condition policies

If anything is unclear, contact the provider. A good company will help you understand your policy before you sign.

4) Customer Service – Can You Get Help When You Need It?

Customer support can make a huge difference in your experience. Look for:

- Ease of reaching support – Do they have live chat, phone, email, or 24/7 service?

- Helpfulness of representatives – Are they friendly, knowledgeable, and efficient?

- Claim dispute handling – How do they resolve issues when problems arise?

5) Deductible Type – Annual vs Per-Incident

The type of deductible in your plan affects how much you pay out of pocket.

- Annual deductible – All claims apply toward one yearly deductible, meaning once you meet it, insurance pays out for the rest of the year.

- Tip: If your pet is accident-prone, an annual deductible may save you money in the long run.

- Per-incident deductible – A new deductible applies for each accident or illness, making it more expensive for pets with multiple vet visits.

Learn more about the differences between deductible types and how they can impact your overall out-of-pocket costs.

6) Pricing – Cost vs Coverage

When evaluating pricing, consider:

- Monthly premiums – How does the cost compare to similar plans?

- Lifetime price increases – How much will the premium rise as your pet ages?

- Reimbursement rates – What percentage of the vet bill will be covered?

- Deductibles & out-of-pocket costs – What’s the total cost before insurance kicks in?

- Extra fees – Are there one-time enrollment or transaction fees?

A lower-cost plan might increase rates significantly over time, so check for long-term affordability instead of focusing only on the initial premium.

7) Plan Customization – Can I Adjust My Policy To Fit My Budget?

Not all pet insurance plans are one-size-fits-all. Some providers let you customize:

- Deductibles – Choose from $250, $500, $1,000, etc.

- Reimbursement rates – Adjust between 70%, 80%, 90%, etc. of covered expenses.

- Annual payout limits – Select coverage from $5,000, $10,000, unlimited, etc.

If flexibility matters to you, look for a plan that allows customization so you can balance coverage and cost.

2025 Pet Insurance Statistics & Facts

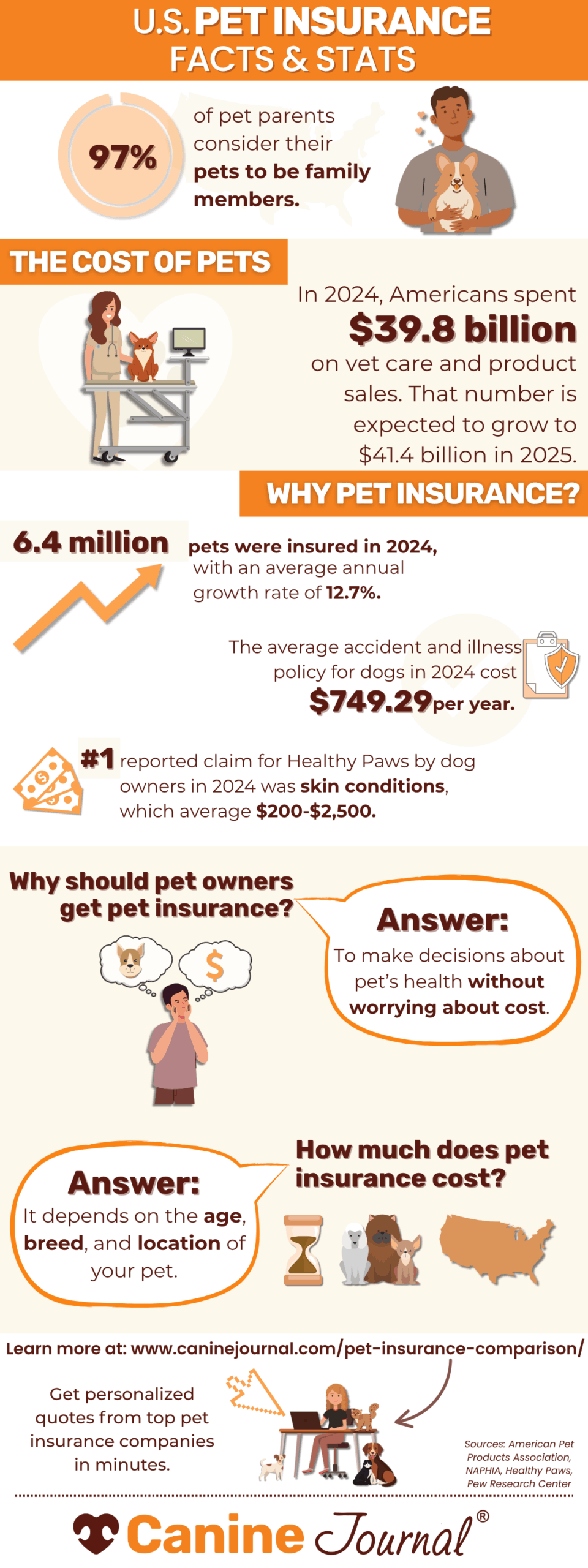

Pet insurance is growing in popularity, yet many pet owners remain uninsured despite the rising costs of veterinary care. Below are some fascinating trends that may surprise you.

Pet Ownership & Family Dynamics

- 97% of U.S. pet parents consider their pets to be a part of their family.1

- 51% of pet owners consider their pets to be just as much a part of their family as human members.1

- 57% of women and 43% of men feel the same way.1

Pet Insurance & Financial Preparedness

- 74% of pet owners do not have pet insurance.2

- 63% of pet parents say they couldn’t afford unexpected vet bills.2

- 36% of pet parents have gone into debt for a pet, with millennials being the most affected (42%).3

- Millennials are more likely to have pet insurance (34%), compared to 18% of Gen Xers and 9% of Baby Boomers.3

Financial Solutions for Emergency Vet Bills

If a $1,000 pet-related emergency came up tomorrow, pet parents would:

- 37% use a credit card

- 28% use cash

- 18% use savings

- 13% take out a personal loan3

The Growing Pet Insurance Industry

- 6.4 million pets were insured in the U.S. in 2024, with an average annual growth rate of 12.7%.6

- 75.6% of insured pets are dogs, while 23.5% are cats.6

- The majority of insured pets are in:

- California (18.3%)

- New York (7.2%)

- Florida (6.3%)6

The Rising Cost of Veterinary Care

- Americans spent $39.8 billion on vet care and product sales in 2024. That number is projected to increase to $41.4 billion in 2025.4

- Dog insurance is, on average, twice as expensive as accident and illness policies for cats.

Common & Costly Pet Health Conditions

- Healthy Paws’ #1 claim for dogs in 2024 was skin conditions ($200 to $2,500).5

- Other top conditions included:

- Stomach issues ($1,600 to $5,000)

- Ear infections ($850).5

What These Stats Mean For Pet Parents

Pet ownership comes with unwavering love and companionship, but it also comes with unexpected financial responsibilities. These statistics highlight why pet insurance is more important than ever.

The bottom line? Having pet insurance can prevent financial stress, ensuring you never have to choose between your wallet and your pet’s health. With customizable plans available, there’s an option to fit nearly any budget.

Ready to protect your pet? Compare top pet insurance providers and find a plan that works for you today.

Sources: [1] Pew Research Center, [2] Liberty Mutual Insurance, [3] Lending Tree, [4] American Pet Products Association, [5] Healthy Paws, [6] NAPHIA

What Are The Disadvantages Of Pet Insurance?

While pet insurance is valuable for most pet owners, there are potential drawbacks to consider:

- Routine Exams & Preventative Care – Standard policies do not cover routine exams, vaccinations, or wellness care unless you purchase an add-on wellness plan for an additional cost.

- Out-of-Pocket Expenses – You’re responsible for deductibles, co-pays, and any costs exceeding your payout limit.

- Pre-Existing Conditions – Any conditions diagnosed before enrollment are typically excluded from coverage, meaning you’ll need to pay for these treatments out of pocket.

- Reimbursement Model – Most pet insurance companies require you to pay upfront and wait for reimbursement, which can take anywhere from minutes to several weeks, depending on the provider.

Are There Situations For Which Pet Insurance Is Not Worth It?

That depends on your pet’s situation and your financial comfort level. The goal of pet insurance is to provide peace of mind for unexpected costs, especially when you wouldn’t otherwise be able to afford care.

- Older Pets – Senior pets have higher premiums and may already have pre-existing conditions that limit coverage. However, they’re also more likely to develop serious health issues, making coverage even more critical.

- Personal Financial Considerations – If you have a large savings fund for emergencies, you may feel comfortable handling vet bills without insurance. However, one major surgery or illness can cost thousands, making coverage a wise safety net.

Ready To Get Pet Insurance?

Navigating insurance jargon, pricing, and coverage options can feel overwhelming, but that’s where we come in!

As pet insurance experts, we love helping pet parents find the perfect policy for their furry companions. If you’re ready to explore your options, check out our latest rankings and top provider recommendations to find the best pet insurance for your needs.

Methodology

My team and I conduct extensive research on the most reputable pet insurance companies, analyzing customer feedback, policy changes, and industry trends. Our licensed insurance agent fact-checks everything, and we update our reviews year-round as insurers adjust premiums, coverage, exclusions, and customer service.

We rank each U.S. pet insurance provider using a 100-point scale, ensuring an unbiased breakdown of how companies perform in real-world claims.

Our Ranking Criteria

- Coverage & Exclusions (30%) – We analyze policies, exclusions, and age restrictions, rewarding companies with fewer coverage limitations.

- Pricing (15%) – We run thousands of sample quotes and factor in extra fees, discounts, and add-ons.

- Customer Service & Reputation (12%) – We review hundreds of customer experiences, assess the sign-up process, and evaluate claim support.

- Financial Strength (10%) – We examine A.M. Best & Demotech ratings to ensure companies can pay claims reliably.

- Customization Options (10%) – Providers with more deductible, reimbursement, and payout flexibility rank higher.

- Waiting Periods (5%) – Shorter illness & accident waiting periods result in a better score.

- Claim Processing (5%) – Companies offering fast reimbursements and direct vet pay score higher.

- Innovation (3%) – We recognize unique offerings and advanced technology in the industry.

Unbiased Pet Insurance Rankings: Putting Pets First

Unlike many review sites, we don’t sell rankings—every provider earns its spot based on real performance. Our in-depth comparisons help pet parents make informed decisions, while insurers use our reviews to improve their policies. We only recommend the best because that’s what our readers deserve.

Why Trust Canine Journal?

Our reviews are conducted in an unbiased fashion by independent researchers who do rigorous analysis and gather consumer feedback from across the internet. Check out our review process for details.

Since 2012, Canine Journal has covered pet insurance long before other media outlets realized how popular pet health care was becoming. Many of our writers possess firsthand knowledge of pet insurance, such as Kimberly Alt, who has been Canine Journal’s pet insurance expert for more than ten years, having covered almost every aspect of pet insurance. Kimberly is so knowledgeable about the topic that she can provide prompt answers to a wide range of inquiries about pet insurance. And thanks to her vast list of resources, in the rare instance that she is unable to find the answer immediately, she can locate it in a matter of minutes.

To guarantee accuracy and provide Canine Journal with the authority to write about and help readers purchase policies that are accurately represented, Kimberly also conferred with Michelle Schenker, the publication’s in-house licensed insurance agent, for additional expertise.