This content was reviewed by our licensed insurance agent, Michelle Schenker.

When you purchase through links on our site, we may earn a commission. Here’s how it works.

I got quotes from ten pet insurance companies and chose Figo for my dog’s coverage. I chose Figo because it was the best value for the coverage and money I wanted to spend. I like many things about Figo, which led to me signing up for a policy with them.

Figo offers customizable coverage and even has up to 100% reimbursement, which most providers don’t provide. Figo will even help identify any pre-existing conditions for your pet so you know precisely what is and isn’t eligible for coverage. I’ll go into detail on how Figo’s coverage, service, and cost compare to other top pet insurance companies.

Get A Free Figo Quote For Your Pet

- Get A Free Figo Quote For Your Pet

- Key Features

- What Are Figo's Waiting Periods*?

- What Does Figo Cover?

- What Does Figo Pet Insurance Cost?

- How Did My Dog's Figo Quote Compare Against Other Pet Insurers?

- Is There A Way To Get A Discount?

- How Does The Claim & Reimbursement Process Work?

- How To Sign Up With Figo

- Pet Cloud Dashboard

- Frequently Asked Questions

- Figo vs Other Companies

- Is Figo The Best Pet Insurance?

Figo Pet Insurance Review

Product Name: Figo Pet Insurance

Product Description: Figo offers pet insurance for dogs and cats.

Summary

Figo is one of the only pet insurance providers to offer 100% reimbursement as an option. It could be an excellent option if you want more if your vet bill reimbursed.

Our pet insurance experts read through each pet insurance company’s policy to provide detailed comparisons and information regarding how a provider fares against others in the industry. We also speak with customers, read online feedback, and communicate one-on-one with pet insurance companies to obtain a well-rounded, unbiased analysis of a company’s standings.

Our team rates pet insurance companies based on several factors, including A.M. Best ratings (an indicator of financial stability), claim processing reputations, contract coverage, customer service, pricing, plan customizations, and more.

Overall Score

Pros

- Annual deductible (not per-incident)

- Claim processing averages 3 days

- Diminishing deductible

- Vet exam fee can be covered for an additional cost

- Optional wellness plan (not available in all states) can be purchased as an add-on

- 5% multi-pet discount

- Your pet is covered anywhere in the world

- No upper age limits (pets must be 8 weeks or older)

Cons

- If there is a knee injury prior to enrollment or during the 6-month waiting period, both knees are excluded from coverage

- $2/month transaction fee (can be waived if you pay annually)

- $15 administration fee

Key Features

- Underwriters and A.M. Best ratings (a measure of financial stability):

- Independence American Insurance Company (IAIC): A-

- Market American Insurance Company: A

- Markel Insurance Company: A

- An exam within the last 12 months is used as your pet’s baseline (if there is no exam within the last 12 months, the first exam after the effective policy period is used as a baseline)

- Bilateral exclusions (a condition or disease that affects both sides of the body): luxating patellas, cruciate ligament tears or ruptures, cataracts, glaucoma, cherry eye, entropion, ectropion, hip dysplasia, elbow dysplasia, and osteochondritis dissecans

- Claims process:

- Must submit claims within 180 days

- Submit claims via Figo Pet Cloud app, email, or fax

- Processes the majority of claims within 3 days (closes nearly half in 24 hours)

- Direct deposit or check reimbursement is available

- Diminishing deductible: for each year a policyholder is claim free, the deductible decreases $50 until it is $0

- Offers pre-approval of estimates/procedures in advance of treatment

- Covers curable pre-existing conditions if there have been no signs or symptoms within the last year

- Policies bought via Costco are serviced by Figo

- Upon sign-up, Figo sends a pet tag to help reunite you and your pet should they go missing

Customer Service Options & Hours

- Phone, text, live chat, email:

- Monday – Friday 7am to 7pm CST

- Saturday 8am to 6pm CST

- Text only:

- Sunday 11am to 3pm CST

- Fax

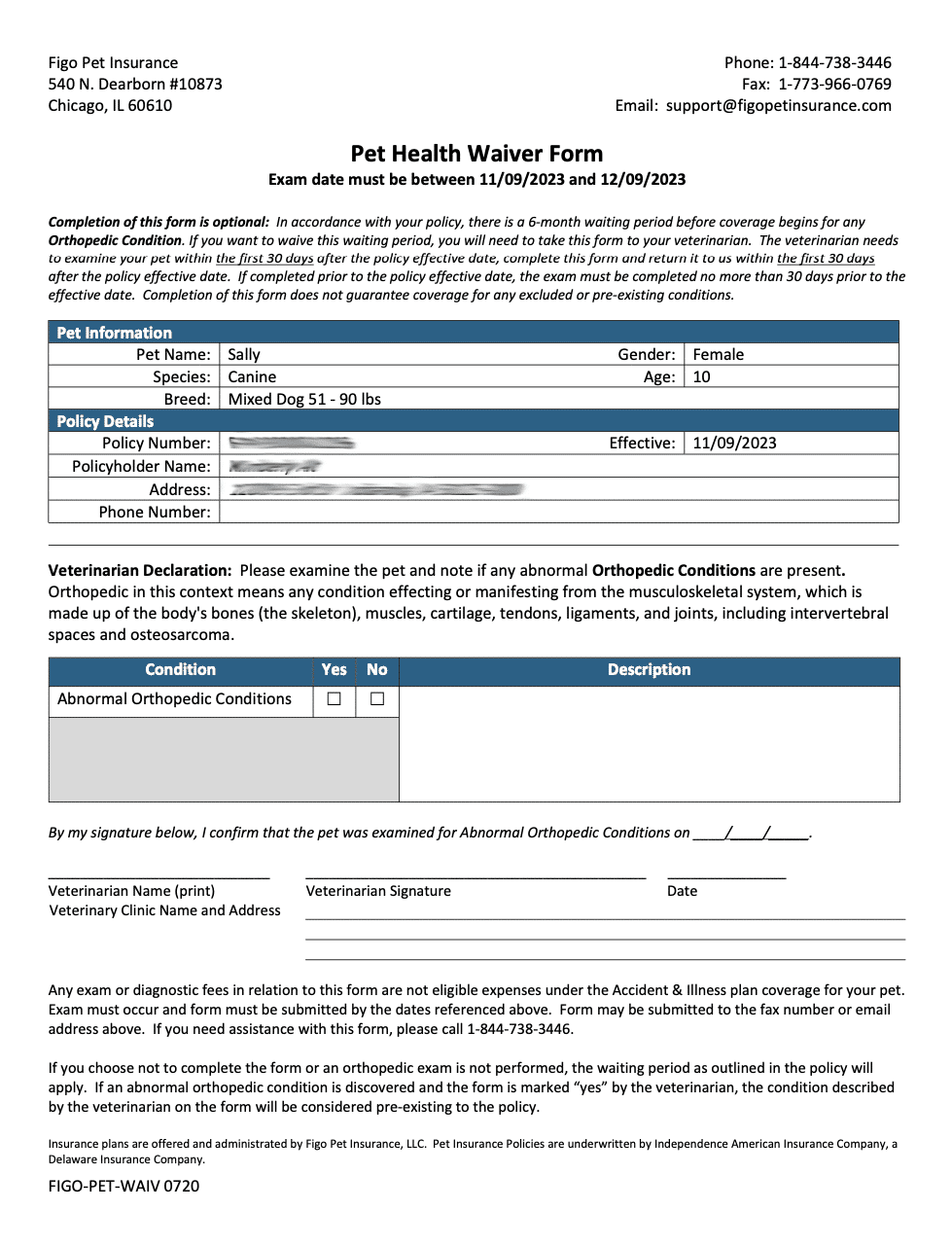

What Are Figo’s Waiting Periods*?

- Illness: 14 days

- Accidents: 1 day

- Orthopedic Conditions (including cruciate ligament, knee, hip dysplasia, and more): 6 months†

- Wellness: 0 days

*Waiting periods for California, Delaware, Louisiana, Maine, Mississippi, Nebraska, New Hampshire, and Washington are as follows:

- Accidents - 0 days

- Illnesses - 14 days

- Cruciate Ligament Conditions - 30 days

- Routine Care - 0 days

†Ability to waive if a veterinarian completes exam/waiver form within the first 30 days of the policy period and there are no pre-existing conditions.

What Does Figo Cover?

Please know that none of the providers in our pet insurance comparison charts cover pre-existing conditions, cremation and burial costs, pregnancy and breeding, or unnecessary cosmetic procedures.

All of them cover the following items when deemed medically necessary: emergency care, surgery and hospitalization, specialized exams and specialty care, X-rays, blood tests, ultrasounds, cat scans, MRIs, rehabilitation, cancer, chronic conditions, euthanasia, hereditary conditions, congenital conditions, non-routine dental treatment, and prescription medications. However, this coverage may have limitations, so please check your policy.

| Condition | Covered By Figo |

|---|---|

| Behavioral Therapies | |

| Alternative/Holistic Therapies | |

| Sick Exam Fees | Extra Fee |

| Wellness Care | Extra Fee |

Optional Coverage

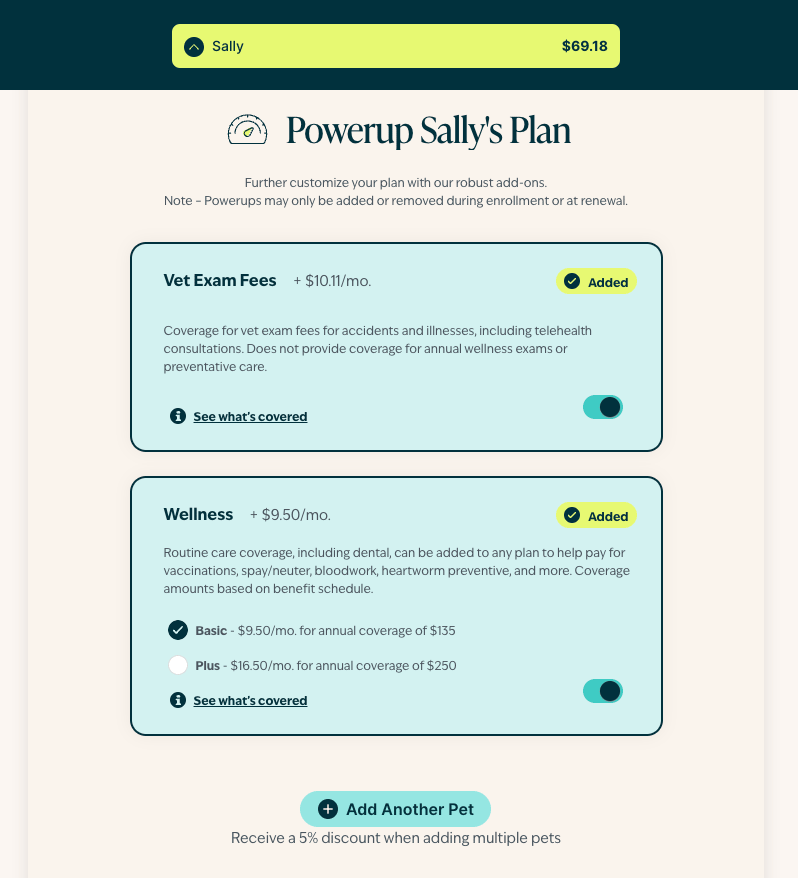

Figo also offers optional “power-ups” for Wellness and Veterinary Exam Fees.

Wellness

There are two wellness plans to choose from. The table below includes the maximum amounts that Figo will pay for specific routine items each year.

| Basic | Plus | |

|---|---|---|

| Monthly Price | $9.50 | $16.50 |

| Wellness Exams | $20 | $40 |

| Vaccines* | $30 | $50 |

| Tests** | $20 | $45 |

| Spay/Neuter or Teeth Cleaning | $40 | $75 |

| Microchip/Health Certificate | $15 | $30 |

| Deworming | $10 | $10 |

| Annual Wellness Coverage | $135 | $250 |

*Vaccines include titers, rabies, and other vaccines approved for general use by AVMA (American Veterinary Medical Association) or equivalent industry regulating entity. This category also includes flea, tick, and heartworm preventatives.

**Tests include heartworm test, FELV screen, blood, fecal, and parasite exam, urinalysis, or ERD.

My Experience With Figo

I chose to add Basic Wellness coverage for my dog because I wanted to better budget for her annual check-up. I typically spend around $200 for her yearly check-up, including the exam, vaccines, and tests. Having the Basic Wellness plan will result in a much lower out-of-pocket cost for me when it’s time for her annual check-up.

Veterinary Exam Fees For Accident & Illness Visit

Vet exam fees are something you may assume are included with most pet insurance policies, but each company handles it differently. For an added fee, you can have exam or consultation fees associated with diagnosing your pet’s eligible illness or accident covered.

My Experience With Figo

I included Vet Exam Fees in my dog’s coverage because I know last-minute vet exams related to accidents or illnesses can be hundreds of dollars, and that’s not a bill I want to pay in addition to whatever potential medication and other treatment she may need.

What Does Figo Pet Insurance Cost?

Figo has a $15 one-time fee and a $2 transaction fee for every payment. Your monthly premium is based on the deductible, reimbursement percentage, and annual payout options that you choose from the table below.

Figo is one of the only providers we’ve reviewed to offer a 100% reimbursement option. Please know that all deductible and reimbursement options aren’t available in every state.

| Deductible Options | Payout Options | Reimbursement Options |

|---|---|---|

| $100 $250 $500 $750 | $5,000 $10,000 Unlimited | 70% 80% 90% 100% |

Pricing is also based on your pet’s details (age, breed, location, pre-existing conditions, etc.). We recommend obtaining quotes from Figo for your specific pet to get an idea of how much a policy would cost you.

You can also use our pet insurance quote form below to see how top providers compare for your actual pet.

My Experience With Figo

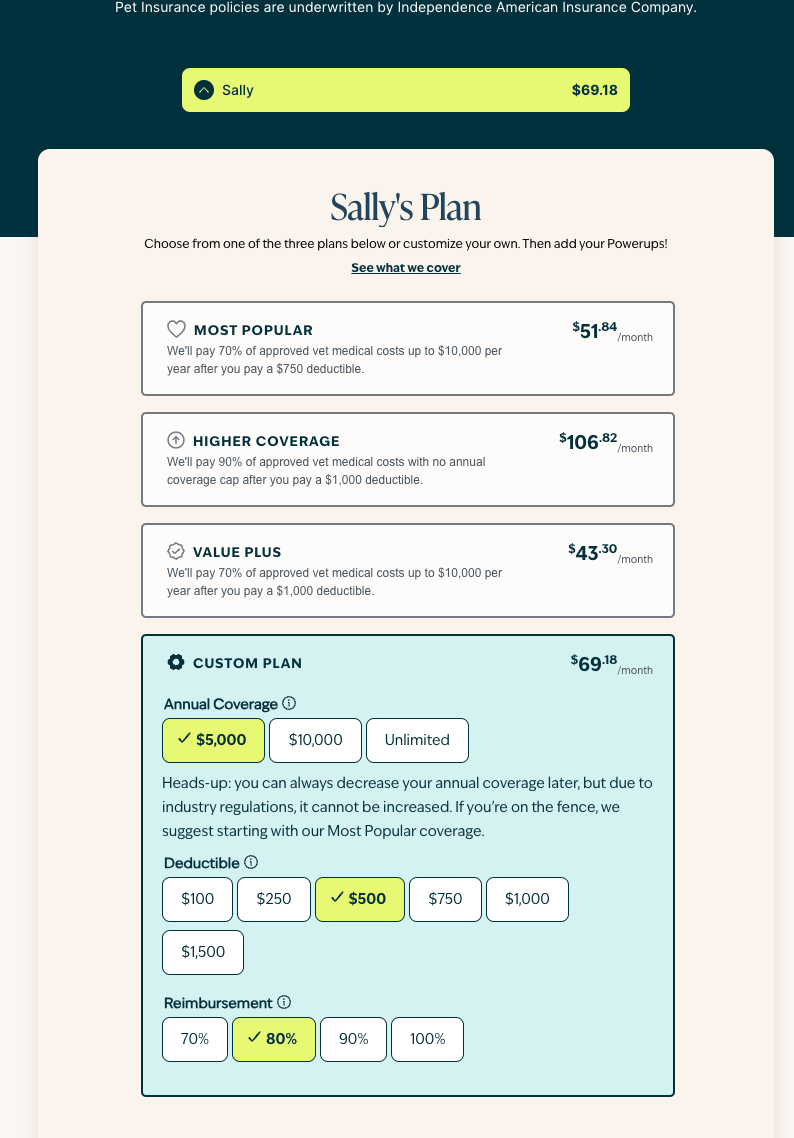

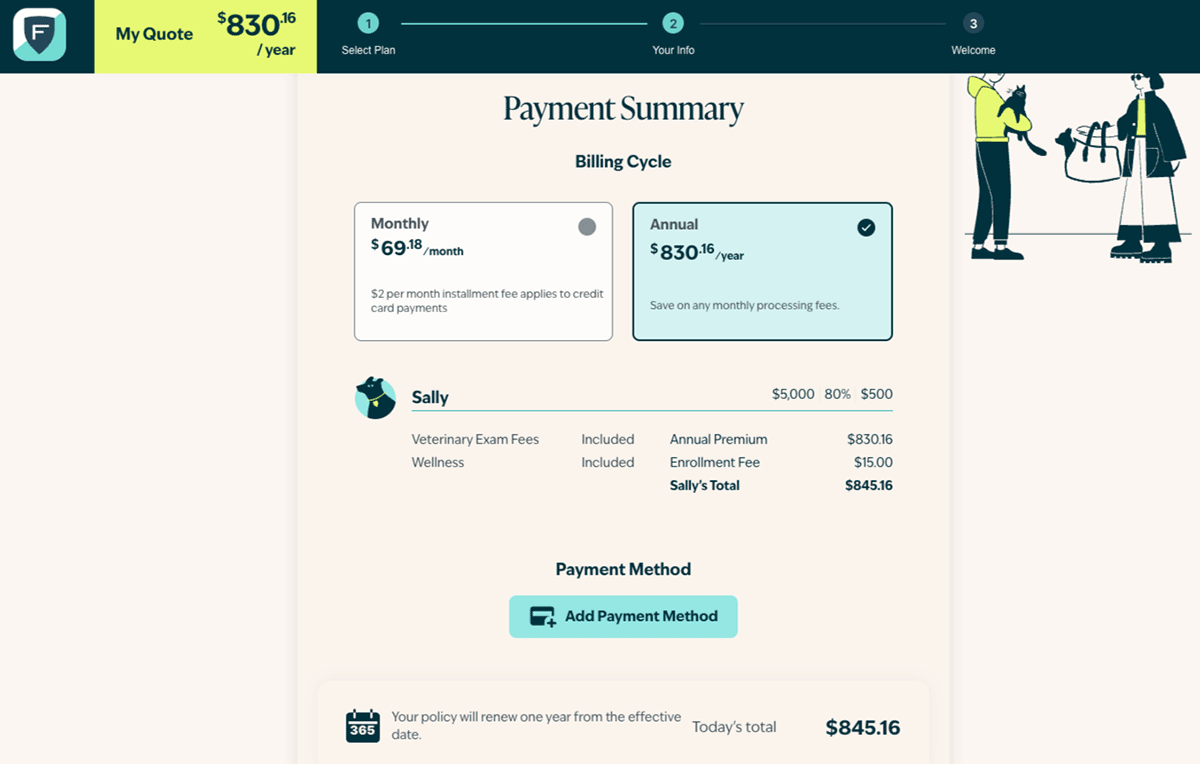

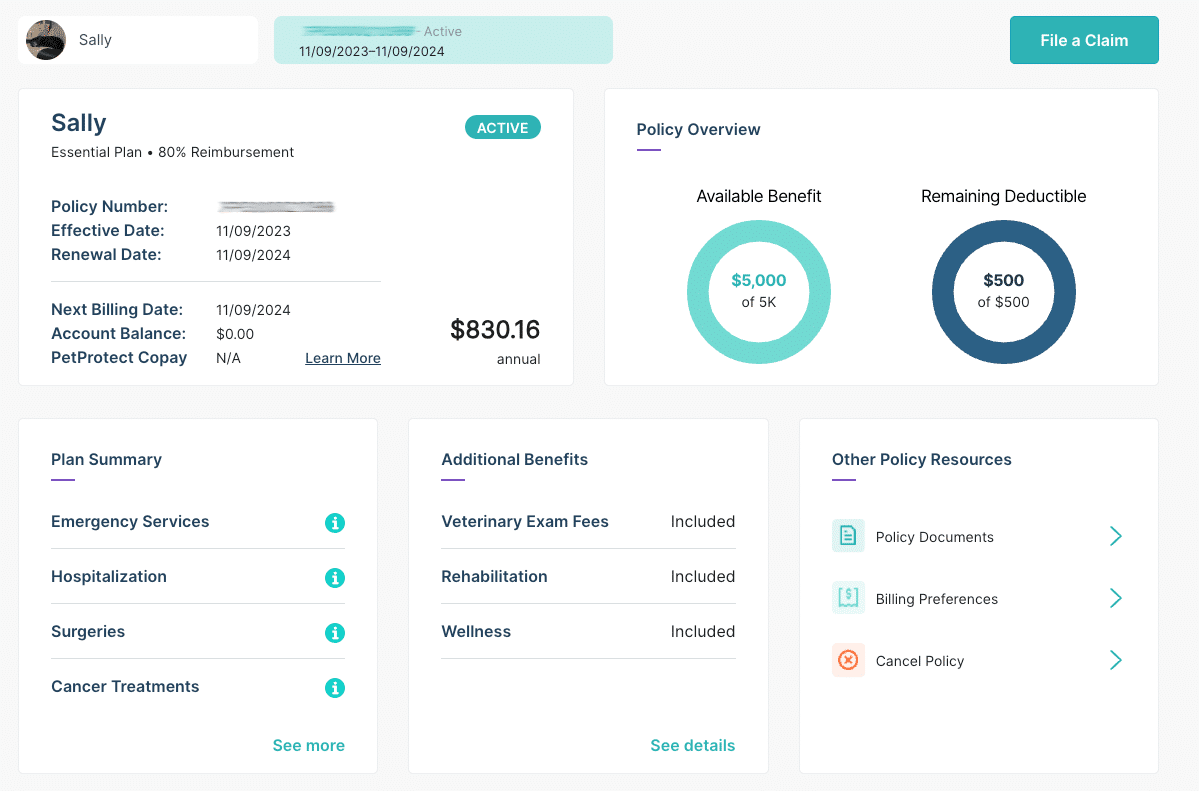

My 10-year-old, 65-pound Coonhound mix’s Figo policy costs $69.18 monthly ($830.16 annually). That price includes $5,000 annual coverage, a $500 deductible, and 80% reimbursement with Vet Exam Fees and Basic Wellness Powerups.

How Did My Dog’s Figo Quote Compare Against Other Pet Insurers?

Below are the quotes I got from ten different pet insurance companies. Coverage is for accidents and illnesses unless otherwise noted (pricing does not include a wellness plan). Figo was the least expensive option by $10 or more from competitors for both accident and illness coverage.

Lemonade said they couldn’t insure my dog at this time after I filled out their quote form.

My dog was too old for illness coverage from Nationwide.

Is There A Way To Get A Discount?

Figo offers the following discounts:

- 5% off any new Figo pet insurance policy (exclusive for Canine Journal readers – use this link)

- 5% off for multiple pets

- Your deductible automatically goes down $50 each year you don’t receive a claim payment

Use this link to take advantage of the best possible price. No promo code is needed.

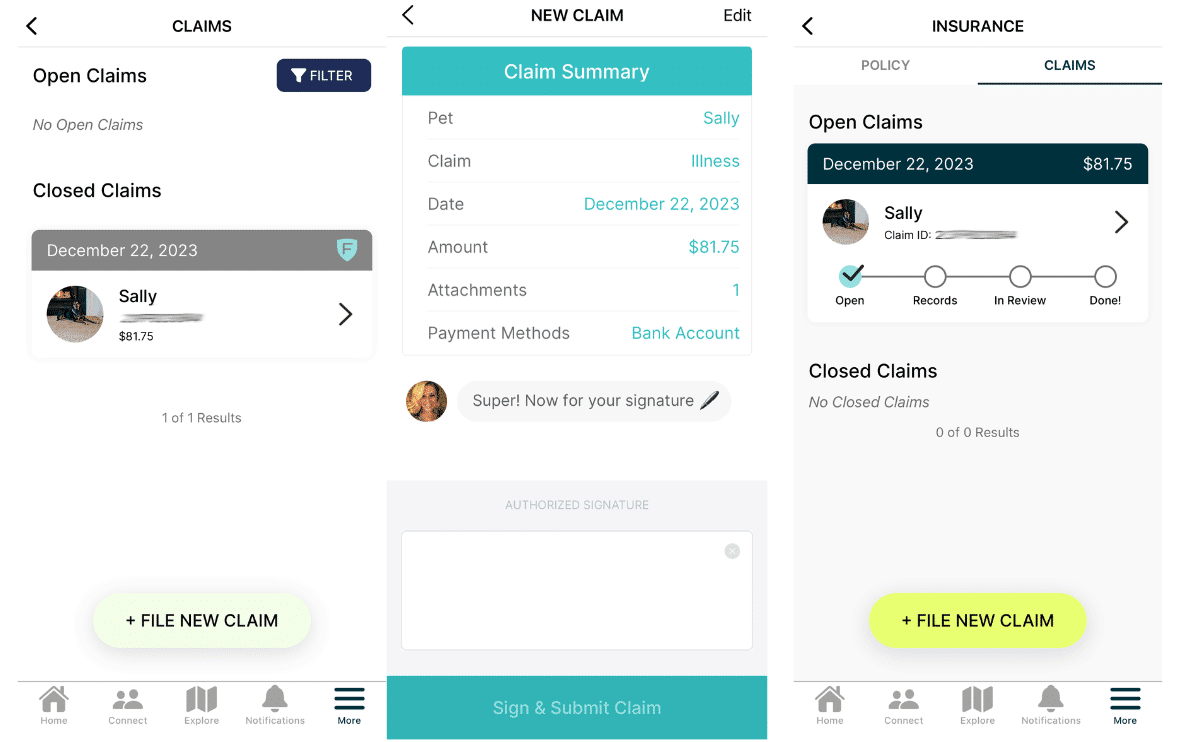

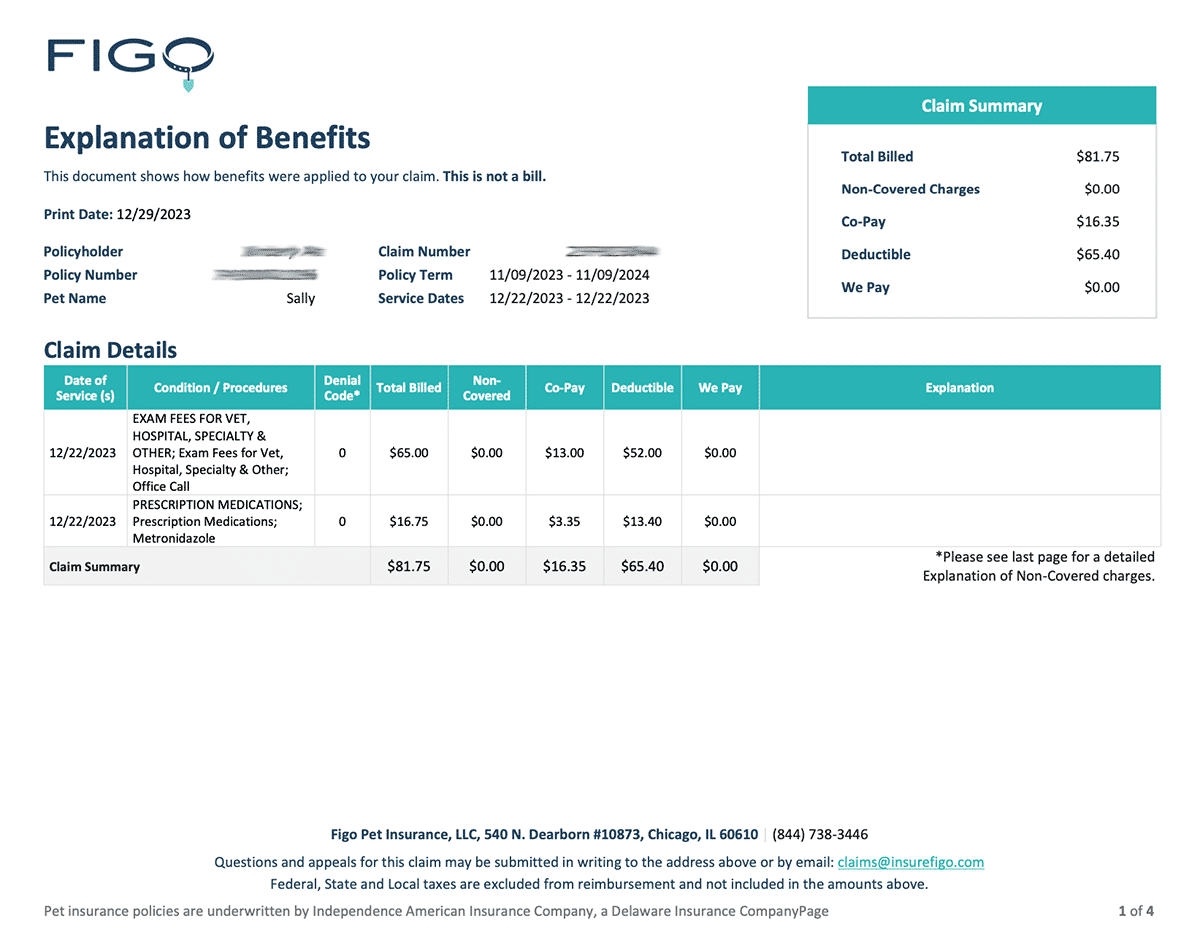

How Does The Claim & Reimbursement Process Work?

Figo uses both a “copay then deductible” reimbursement method and a “deductible then copay” method, depending on your policy.

- Copay Then Deductible is calculated the following way:

- (Eligible vet expenses x Reimbursement percentage) – Remaining annual deductible = Reimbursement amount

- Deductible Then Copay is calculated the following way:

- Actual vet bill amount – Remaining annual deductible – Copay = Reimbursement amount

Reimbursement Example

- Dog: Bowie, 7-year-old Saint Bernard mix

- Diagnosis: Torn CCL surgery

- Total Vet Cost: $4,899.17

- Total Reimbursed By Figo: $4,251.78

What Are The Most Common Claims Submitted To Figo?

- Allergies: $500-$1,000

- GI Conditions: $500-$1,000

- TPLO Surgeries: $3,000-$5,000

My Experience With Figo

I filed my first claim with Figo when Sally got sick and had unexplainable diarrhea. I knew the claim wouldn’t be reimbursed since I needed to meet my deductible. However, I was pleased with the ease of the claim process and how quickly it was closed. Figo also sent me an explanation of benefits to further explain the amount I paid toward the co-pay and deductible. Figo did an excellent job explaining everything to me.

How To Sign Up With Figo

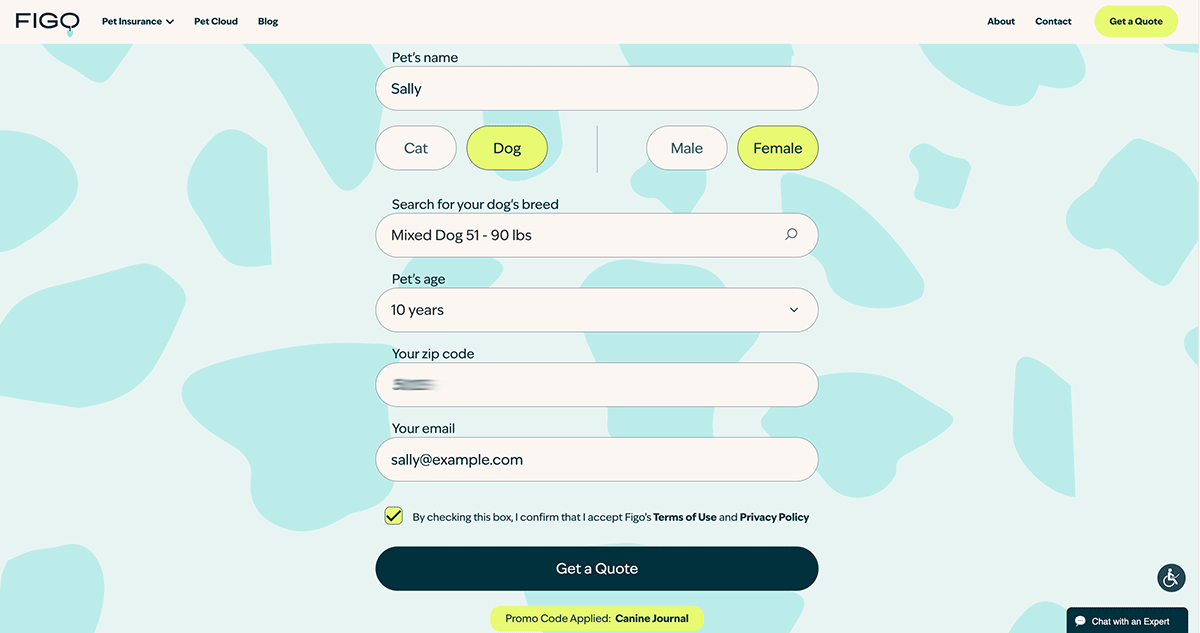

Figo makes sign-up extremely simple. Go to Figo’s website, fill in your pet’s name, and click “Get a Quote.”

Next, fill in your dog’s information.

The next screen shows your customization options. You can select the coverage you want and adjust it based on your budget.

You can also select an additional Powerups you may want for your plan.

After you’ve customized your plan, you fill out the rest of your information, including your address, email, and phone number. You can also add a secondary pet parent to the policy. This person has access to review and modify any policies in your account.

Next, you will see your Payment Summary, which will add a one-time enrollment fee of $15. Add your payment method and choose whether you’d like to pay monthly or annually. Figo doesn’t give any discount for paying annually, so if paying monthly is more manageable, you can do so without missing out on a discount.

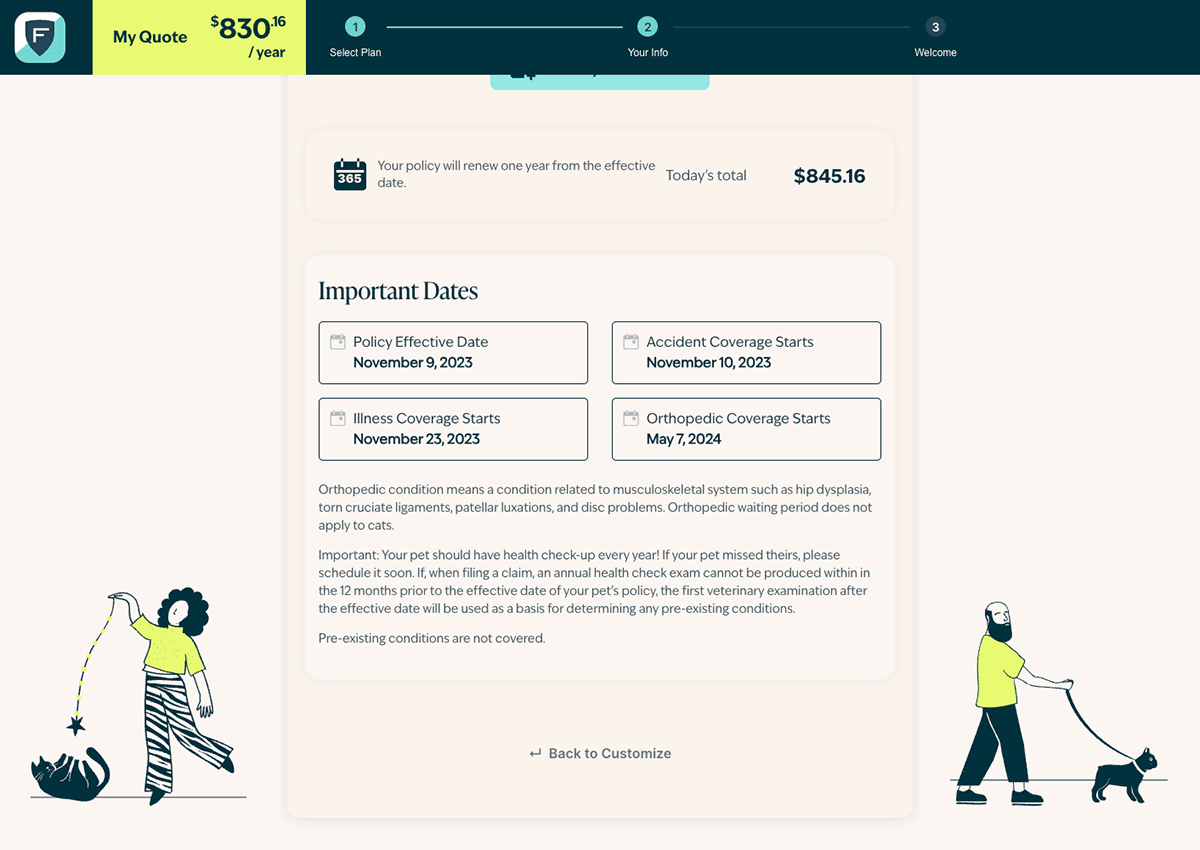

You’ll also want to take note of the Important Dates Figo lists. Included is the policy effective date, accident coverage start date, illness coverage start date, and orthopedic coverage start date. Remember, you can shorten the orthopedic start date by filling out the knee waiver.

Voila! Your pet is now signed up for a Figo pet insurance policy.

Pet Cloud Dashboard

Next, download Pet Cloud (Figo’s app and online portal) onto your phone and email any medical records for your pet to your Pet Cloud email to be added to your Figo account. This will help speed up the claim reimbursement process because Figo will have access to your pet’s past vet visits and know your pet’s pre-existing conditions.

I’ve found the app and online dashboard user-friendly and have seamless functionality. There are many things I can do in the Pet Cloud app, including:

- Live chat with a vet

- File a claim

- View policy documents and medical records

- View plan details

- Text or call Figo

- See billing details and payment history

Frequently Asked Questions

Here are some frequently asked questions regarding Figo pet insurance from our readers.

Where Is Figo Accepted?

You can visit any licensed vet and submit your claim to Figo for reimbursement.

What Does Figo Not Cover?

Figo excludes the following but is not limited to:

- Pre-existing conditions

- Rehabilitation and physical therapy treatments

- Holistic and alternative medications

- Behavioral problems and any related treatment

- Air ambulance and ground pet ambulance

- Cost of disposing of your pet’s remains

- Boarding

- Cosmetic, aesthetic, or elective surgery

- Natural supplements, vitamins, and food

- Treatment for any illness for which a vaccine is available (e.g., bordetella, parvovirus, rabies, etc.)

- Obedience or training classes, unless prescribed by a vet for the treatment of a covered incident

- Grooming

- Costs or fees for treatments for parasites (e.g., heartworms, fleas, ticks, roundworms, tapeworms, hookworms, etc.)

Does Figo Cover Heartworm?

Figo’s accident and illness pet insurance plans don’t cover heartworms because they can be prevented through medication. Heartworm preventatives are eligible for coverage through Figo’s wellness plan. However, should your dog be diagnosed with heartworms, any treatment for it will be excluded from coverage in your accident and illness policy.

What Does Figo Stand For?

We reached out to Figo, and according to them, it’s a play on the popular dog name “Fido.” An astute marketer might note the integration of the word “go” as in “move forward.”

Does Figo Cover Dental?

Figo covers non-routine dental treatment and trauma to the teeth, face, and jaw. It also covers tooth extractions due to an accident. The key to dental procedure coverage is that it must be part of a non-routine situation.

How To Cancel Figo Pet Insurance?

You may cancel your policy at any time by emailing Figo at support@figopetinsurance.com. You can also reach them at (844) 738-3446. Any pro-rated refunds for pre-payment of your annual policy will be granted based on your policy contract conditions.

If you’d like a replacement for your Figo insurance policy, take a look at our pet insurance reviews to see which pet insurance companies we recommend.

Does Figo Have A Wellness Plan?

Figo offers two optional wellness plans in some states. It also offers a wellness plan for canines and felines as an add-on in its employee benefit plans.

Who Owns Figo Pet Insurance?

JAB Holding Company acquired Figo Pet Insurance on October 19, 2021. JAB Holding Company is a privately held group focusing on long-term investments in companies. The same company is a majority shareholder in PetPartners, Inc., which owns AKC Pet Insurance and PetPartners Group Pet Insurance.

Figo vs Other Companies

Interested in seeing how Figo stacks up against other popular pet insurance companies? We’ve written comparison articles for you to see how Figo and other leading pet insurance companies compare in coverage, customer service and reputation, claim processing, plan customization, and price.

Is Figo The Best Pet Insurance?

Since entering the marketplace, Figo has set a reputation for lower prices without sacrificing coverage. You have complete control over your policy’s deductible, reimbursement, and annual payout.

We’ve compared Figo against other top pet insurance companies and explained how they stack up in our pet insurance reviews. We rank the best providers and compare them against one another to show you where the companies differ. We address your frequently asked questions, explain how pet insurance works from start to finish, discuss the different types of pet insurance, and more. We’re confident we can answer all your pet insurance questions so you feel knowledgeable in making the right decision for you and your pet.

Tagged With: Reviewed By Insurance Agent