Best Pet Insurance Companies In June 2025: Reviews, Pros, Cons & Personal Experience

When you purchase through links on our site, we may earn a commission. Here’s how it works.

Unexpected vet bills can be a pet owner’s worst nightmare. With the rising costs of pet healthcare, choosing the right insurance is more crucial than ever.

Table of Contents

Dive into our comprehensive guide to discover the top pet insurance providers of 2025 and ensure your furry friend is protected.

Compare top plans or skip ahead to what you need to know.

Key Takeaways

Here’s what you need to know at a glance:

- We reviewed 45+ pet insurance providers

- Best overall: Pets Best (customizable + affordable)

- Other top picks: Fetch, Healthy Paws, Embrace, and more

- Compare at least 3 quotes to find your best fit

- Enroll before your pet shows symptoms—pre-existing conditions aren’t covered

Best Pet Insurance Winners

Pets Best topped the list in our research, but the “best” really depends on your pet. What works for a senior Golden Retriever might not cut it for a rambunctious kitten.

The key? Compare pricing, dig into coverage details, and see how each provider stacks up for your specific needs. Use this review as your launchpad, because your pet deserves more than a one-size-fits-all plan.

Best Overall: Pets Best Review

| Plan Options | Accident & illness Accident-only Wellness add-on |

| Payout Limits | $5,000, $10,000, or unlimited |

| Deductibles | $50 to $1,000 |

| Reimbursement Levels | 70%, 80%, or 90% |

| Waiting Periods | 14 days for illnesses 3 days for accidents 6 months for CCL injuries |

| Average Claim Processing | 10 days |

| Eligibility | At least 7 weeks old |

| Discounts | 5% off for multiple pets 5% off for military members and their families |

Pets Best discount may not be available in all states, and the discount amount may vary by state. More information is available in enrollment.

Pets Best offers extensive coverage without the high price tag.

Plans are affordable and fully customizable, so you only pay for what your pet needs. You can add coverage for exam fees, acupuncture, rehab, and chiropractic care.

There are no upper age limits, making it ideal for senior pets or late-life enrollments.

Flexible, affordable, and age-inclusive—Pets Best stands out for value.

Pets Best also administers policies through Farmers Insurance, PEMCO, and Progressive.

| Pros | Cons |

|---|---|

| Highly customizable plans (deductible, reimbursement, payout) | Claims may take up to 10 days to process |

| Direct vet payment option available | Massage therapy not covered |

| Accident-only and wellness add-ons offered | |

| Short waiting periods (3 days for accidents, 14 for hip dysplasia) | |

| One of the most affordable pet insurance options | |

| Optional coverage for exam fees, acupuncture, rehab, and chiropractic care |

What Pets Best Customers Are Saying

Pets Best covers over 900,000 pets. Customers praise the easy-to-use app and simple claims process.

However, some report reimbursements taking up to a month.

Despite this, most are happy with their coverage and value the multi-pet and military discounts.

I signed up when Georgie was two because of the great rates and reviews. Within months, he had kennel cough, a heart murmur, a ruptured anal gland, stomach issues—you name it.

We had three ER visits, a cardiologist, and a follow-up echo. The bills hit $4,588, but Pets Best reimbursed $2,595 after my deductible.

I can’t imagine managing all that without coverage.

– Sadie Cornelius, pet parent to Georgie (Cavalier King Charles Spaniel) and Canine Journal’s graphic designer

How Much Does Pet Insurance Cost From Pets Best?

Below are monthly rates for the Essential plan (accidents + illnesses):

- $500 deductible

- $5,000 annual limit

- 90% reimbursement

| French Bulldog | Yorkshire Terrier | English Bulldog | Dachshund | Ragdoll Cat | |

|---|---|---|---|---|---|

| 6 Month Old in California | $94.20 | $29.07 | $85.63 | $37.49 | $24.81 |

| 1 Year Old in New York | $53.70 | $19.12 | $53.70 | $24.66 | $14.37 |

| 2 Year Old in Florida | $44.17 | $20.97 | $57.81 | $21.89 | $16.50 |

| 5 Year Old in Texas | $100.76 | $25.53 | $100.77 | $26.66 | $28.38 |

| 8 Year Old in New Jersey | $80.89 | $44.36 | $182.98 | $58.11 | $39.49 |

Younger pets usually get lower premiums. But a young Frenchie in California costs more than older Frenchies in New York, Florida, or New Jersey.

This is likely due to California’s higher cost of living, Frenchie-specific health risks, breed popularity, and state-level underwriting restrictions.

In the Northeast, Pets Best had the lowest premiums for the following sample dogs:

- 1-year-old Frenchie & English Bulldog (NY)

- 8-year-old Frenchie (NJ)

- 1-year-old Dachshund (NY)

- 8-year-old Dachshund (NJ)

- 1-year-old Yorkie (NY)

Since premiums can vary significantly based on your pet’s breed, age, and location, it’s crucial to get a custom quote to understand the actual cost.

In-Depth Review Of Pets Best

Read my full Pets Best review for details on coverage, reimbursements, FAQs, and more.

You’ll also find Sadie’s full story, including why she chose Pets Best, how the signup and claims process went, and why she renewed Georgie’s policy.

Best For Puppies & Kittens: Fetch Review

| Plan Options | Accident & illness Wellness add-on |

| Payout Limits | $5,000, $10,000, $15,000, or unlimited |

| Deductibles | $250 to $700 |

| Reimbursement Levels | 70%, 80%, or 90% |

| Waiting Periods | 15 days for illnesses 0 days for accidents 6 months for CCL injuries and hip dysplasia |

| Average Claim Processing | 6 days |

| Eligibility | At least 6 weeks old |

| Discounts | Up to 10% off for animal shelter adoptees and employees, corporate benefit plans, medical services pets, strategic partners, military, veterinary staff, and students 10% off for Walmart shoppers Save $25+ when paying quarterly or annually 10% lifetime discount for AARP members |

Fetch is great for puppies and kittens, with coverage starting at just 6 weeks old—earlier than most insurers.

A standout perk: VirtualVet coverage reimburses up to $1,000 for vet consults by video, phone, or text.

Fetch also includes exam fees, alternative therapies, and other commonly excluded conditions.

No hidden fees. No hoops. Just early, comprehensive protection.

| Pros | Cons |

|---|---|

| Customizable plans with flexible deductibles, reimbursements, and payout limits | No direct vet payment option (reimbursement only) |

| Covers behavioral therapy, complementary care, C-sections, supplements, exam fees, and gum disease | No accident-only plan offered |

| Optional wellness add-ons available |

What Fetch Customers Are Saying

Fetch covers over 450,000 cats and dogs. Customers love the easy-to-use app, which is among the highest rated.

However, many report unwanted policy changes at renewal—including shifts in coverage limits, deductibles, co-pays, and premiums.

On the positive side, reimbursements are often fast, and many policyholders praise Fetch’s claims turnaround.

How Much Does Pet Insurance Cost From Fetch?

Fetch states that the average monthly premium is:

- $35 for dogs

- $20 for cats

These rates are lower than national averages, according to NAPHIA.

Below are sample monthly premiums from Fetch for 25 pets, based on:

- $500 deductible

- $5,000 annual limit

- 90% reimbursement

| French Bulldog | Yorkshire Terrier | English Bulldog | Dachshund | Ragdoll Cat | |

|---|---|---|---|---|---|

| 6 Month Old in California | $70.52 | $37.26 | $78.13 | $40.08 | $19.51* |

| 1 Year Old in New York | $65.02 | $32.40 | $76.00 | $29.15 | $23.75* |

| 2 Year Old in Florida | $79.23 | $33.71 | $79.23 | $35.06 | $22.55* |

| 5 Year Old in Texas | $115.86 | $36.46 | $85.90 | $32.87 | $21.66* |

| 8 Year Old in New Jersey | $231.42 | $93.12 | $231.42 | $83.08 | $51.98* |

Zip codes: California 92121, New York 14211, Florida 33604, Texas 78703, New Jersey 07108

You might notice in the table that younger pets sometimes cost more to insure than older pets of the same breed in different locations—especially for Frenchies, Yorkies, Bulldogs, and Dachshunds.

This highlights how much location impacts pricing.

To see what you’d actually pay, use Fetch’s quote form below for a personalized rate.

In-Depth Review Of Fetch

Read my full Fetch review for details on coverage, FAQs, claims process, and how reimbursements are calculated.

Best Unlimited Payouts: Healthy Paws Review

| Plan Options | Accident & illness |

| Payout Limits | Unlimited |

| Deductibles | $250 to $1,000 |

| Reimbursement Levels | 50%, 60%, 70%, or 80% |

| Waiting Periods | 15 days for illnesses and accidents 12 months for hip dysplasia |

| Average Claim Processing | 2-15 days |

| Eligibility | 8 weeks to 14 years old* |

| Discounts | Use this link to take advantage of the best possible price |

Healthy Paws keeps it simple:

Every plan includes unlimited annual and lifetime coverage—no caps, no fine print.

You’ll never have to choose between saving your pet and draining your savings.

Even with unlimited payouts, Healthy Paws is still one of the most affordable options in its class.

| Pros | Cons |

|---|---|

| May offer direct vet payments to skip reimbursements | Coverage limits based on pet’s age, breed, and location |

| Short 15-day CCL surgery waiting period | No accident-only plan |

| Most claims are processed within 2 days | No coverage for behavioral therapy, exam fees, or gum disease |

| Unlimited payouts on all plans | Not available for pets over 14 |

| 12-month wait for hip dysplasia; not covered if enrolled after age 6 (except in MD) | |

| 15-day wait for accident coverage (longer than average) |

What Healthy Paws Customers Are Saying

Healthy Paws covers over 620,000 pets.

iOS users love the app, but Android users report it’s clunky and hard to use.

Many customers complain of steep premium hikes as pets age.

On the plus side, customer support is highly responsive. The team actively engages online and often resolves issues one-on-one.

How Much Does Pet Insurance Cost From Healthy Paws?

Monthly premiums below are based on a $500 deductible, unlimited annual coverage, and 90% reimbursement.

Note: Healthy Paws no longer offers 90% reimbursement for new enrollments.

Some pets in this sample were grandfathered in—differences are noted where applicable.

| French Bulldog | Yorkshire Terrier | English Bulldog | Dachshund | Ragdoll Cat | |

|---|---|---|---|---|---|

| 6 Month Old in California | $114.20* | $32.68‡ | $114.20* | $38.90* | $23.23‡ |

| 1 Year Old in New York | $75.54* | $22.79‡ | $75.54* | $31.92* | $15.83‡ |

| 2 Year Old in Florida | $62.42 | $40.89 | $62.42 | $36.76* | $24.15 |

| 5 Year Old in Texas | $130.99* | $33.18‡ | $132.09* | $40.76* | $22.32‡ |

| 8 Year Old in New Jersey | $188.50† | $43.39† | $188.50† | $64.65† | $31.89† |

†50% reimbursement and $1,000 deductible was the only option

‡80% was the highest reimbursement percentage option

Zip codes: California 92121, New York 14211, Florida 33604, Texas 78703, New Jersey 07108

You’ll see a big price difference for insuring a five-year-old pet in Texas with Healthy Paws.

Yorkies, Dachshunds, and Ragdolls are far more affordable than French or English Bulldogs, which cost significantly more.

That’s why it’s essential to get a personalized quote—your pet’s breed makes a big impact on cost.

In-Depth Review Of Healthy Paws

Read my full Healthy Paws review to explore coverage details, restrictions, and how reimbursements work.

I also break down the most common claims, what they cost, and how Healthy Paws handles high vet bills.

Best Value: Figo Review

| Plan Options | Accident & illness Wellness add-on |

| Payout Limits | $5,000, $10,000, or unlimited |

| Deductibles | $100 to $750 |

| Reimbursement Levels | 70%, 80%, 90%, or 100% |

| Waiting Periods | 14 days for illnesses 1 day for accidents 6 months for CCL injuries, hip dysplasia, and orthopedic conditions |

| Average Claim Processing | 3 days |

| Eligibility | 8+ weeks old |

| Discounts | 5% off any new policy (exclusive for Canine Journal readers – use this link) 5% off for multiple pets Deductible drops $50 each year you go without a claim payment |

Figo stands out for its broad coverage, affordable pricing, and quick claims, averaging just three days.

Plans are highly customizable, and Figo covers things many others don’t—like alternative therapies.

There are no upper age limits, and it’s one of the few insurers offering 100% reimbursement.

That’s why I chose Figo for my dog.

Figo also administers policies through Costco.

| Pros | Cons |

|---|---|

| Customizable plans (deductible, reimbursement, payout) | No direct vet payment option (reimbursement only) |

| Wellness add-ons available | No accident-only plan |

| 1-day accident waiting period (faster than most) | |

| Among the lowest-priced providers | |

| Fast claim processing (average 3 days) | |

| Covers alternative therapies and C-sections | |

| Diminishing deductible: drops $50/year when no claims, down to $0 |

What Figo Customers Are Saying

Figo customers often praise the easy-to-use Pet Cloud app—and I agree, having used it many times to file and track claims.

Some policyholders report frustration with claims being denied as pre-existing, even when they believe they shouldn’t be.

That said, Figo’s customer support earns consistently high marks for responsiveness and helpfulness.

I chose Figo for my Coonhound mix, Sally, because it offered great coverage at a fair price. I added extras for exam fees and preventive care.

With 80% reimbursement, a $500 deductible, and $5,000 limit, I hit my deductible after three claims in four months.

The app made filing claims quick and easy—under 5 minutes. Figo kept me updated and reimbursed fast.

It’s given me peace of mind knowing Sally’s covered.

How Much Does Pet Insurance Cost From Figo?

The rates below show monthly premiums for Figo’s Essential plan, which covers accidents and illnesses.

Plan details:

- $500 deductible

- $5,000 annual coverage

- 90% reimbursement

| French Bulldog | Yorkshire Terrier | English Bulldog | Dachshund | Ragdoll Cat | |

|---|---|---|---|---|---|

| 6 Month Old in California | $80.78 | $34.89 | $97.31 | $34.32 | $34.00 |

| 1 Year Old in New York | $82.47 | $28.32 | $95.98 | $28.97 | $20.96 |

| 2 Year Old in Florida | $53.82 | $22.64 | $76.69 | $23.15 | $17.66 |

| 5 Year Old in Texas | $87.24 | $29.31 | $103.61 | $30.14 | $18.01 |

| 8 Year Old in New Jersey | $193.07 | $86.89 | $242.38 | $85.50 | $57.67 |

In my sample data, Frenchies and English Bulldogs cost more to insure with Figo than Yorkies and Dachshunds.

But pricing varies by breed, age, and location, so your pet’s cost may differ.

That’s why it’s essential to get a personalized quote using Figo’s form below.

In-Depth Review Of Figo

Read my full Figo review to learn more about Figo’s coverage, reimbursement process, and FAQs—plus my personal experience.

I break down how Figo’s pricing compared to other providers and share a photo of the explanation of benefits from one of my claims.

Best Coverage: Embrace Review

| Plan Options | Accident & illness Accident-only Wellness add-on |

| Payout Limits | $2,000, $5,000, $8,000, $10,000, $15,000, or unlimited |

| Deductibles | $100 to $1,000 |

| Reimbursement Levels | 70%, 80%, or 90% |

| Waiting Periods | 14 days for illnesses 2 days for accidents 6 months for CCL injuries, hip dysplasia, IVDD, and patellar luxation |

| Average Claim Processing | 5 days |

| Eligibility | 6 weeks to 14 years old for illness coverage* |

| Discounts | 10% off for multiple pets (5% in NY) 5% off for military and veterans (excludes NY and TN) 10% off if your employer offers Embrace (excludes FL, ND, NY, TN) 5% off in NY for paying annually Up to 25% off for eligible USAA customers Deductible drops $50 each year you don’t file a claim |

Embrace offers some of the most comprehensive accident and illness coverage available.

It includes $1,000 per year for dental illness and covers tooth extractions, even when caused by illness—not just accidents. It also includes endodontic disease coverage for all teeth.

Unlike many competitors, Embrace covers behavioral therapy and training for dogs with anxiety, aggression, or destructive behavior.

Embrace also administers policies through Allstate, American Family, Geico, and USAA.

| Pros | Cons |

|---|---|

| Customizable plans with flexible deductibles, reimbursement rates, and payout limits | Dogs enrolled after age 15 are limited to accident-only coverage |

| Optional wellness add-ons available | Coverage for exam fees and prescriptions must be added |

| Covers behavioral therapy, complementary care, gum disease, and tooth extractions | Massage therapy not covered |

| Short waiting period (2 days for accidents) and quick claims (avg. 5 days) |

What Embrace Customers Are Saying

Embrace insures over 500,000 pets, and customers love the user-friendly app, which gets high ratings on both Google Play and the App Store.

Some policyholders complain about high premiums and rate hikes at renewal.

Still, many say the coverage is reliable and praise Wellness Rewards for covering a wide range of costs—from cremation and grooming to training, acupuncture, and prescription food.

I chose Embrace for my Cavalier, Lexie, because the rates were affordable. Within a year, she was diagnosed with cancer and needed specialists, chemo, and ongoing care.

Without insurance, none of it would’ve been possible. Thanks to Embrace, I gave her the best treatment without financial worry.

Lexie has since crossed the rainbow bridge, but I’m deeply grateful for the time we had

– Sadie Cornelius, pet parent to Lexie (Cavalier King Charles Spaniel) & Canine Journal’s graphic designer

How Much Does Pet Insurance Cost From Embrace?

Below are monthly premiums for Embrace’s accident and illness plan, based on:

- 90% reimbursement

- $500 deductible

- $5,000 annual coverage

| French Bulldog | Yorkshire Terrier | English Bulldog | Dachshund | Ragdoll Cat | |

|---|---|---|---|---|---|

| 6 Month Old in California | $68.50 | $26.78 | $58.07 | $37.76 | $26.54 |

| 1 Year Old in New York | $65.16 | $31.73 | $65.16 | $44.73 | $23.57 |

| 2 Year Old in Florida | $57.81 | $22.50 | $57.81 | $26.99 | $22.11 |

| 5 Year Old in Texas | $95.71 | $26.87 | $69.05 | $32.24 | $19.29 |

| 8 Year Old in New Jersey | $101.50 | $55.37 | $142.31 | $66.45 | $50.95 |

Premiums vary widely by breed—even within the same zip code.

Frenchies are popular but come with higher premiums due to their health risks. Meanwhile, Yorkshire Terriers, though also popular, tend to cost less to insure.

Among all the providers I compared, Embrace had the lowest rates for Bulldog breeds in California.

So if you’re a Californian with a Bulldog, Embrace is a great place to start for a quote.

In-Depth Review Of Embrace

Read my full Embrace review for a closer look at Embrace’s coverage, reimbursement process, and FAQs.

I also share the most common claims, average vet bill costs, and what policyholders are typically reimbursed.

Most Affordable: Lemonade Pet Insurance Review

| Plan Options | Accident & illness Wellness add-on |

| Payout Limits | $5,000, $10,000, $20,000, $50,000, or $100,000 |

| Deductibles | $100 to $750 |

| Reimbursement Levels | 60%, 70%, 80%, or 90% |

| Waiting Periods | 14 days for illnesses 2 days for accidents 6 months for CCL injuries 30 days for hip dysplasia and other orthopedic conditions |

| Average Claim Processing | 2 days |

| Eligibility | 8+ weeks old, age restrictions based on breed |

| Discounts | 10% off when you bundle with renters, homeowners, auto, condo, or co-op insurance 5% off for multiple pets 5% off when you pay annually |

Lemonade entered the pet insurance space in 2020 and quickly gained attention for its low premiums and AI-powered claim processing—with some reimbursements happening in minutes.

It’s not yet available in all 50 states, which reflects the time needed to scale and stabilize.

Still, with its strong coverage and cutting-edge tech, Lemonade is a standout option—if it’s offered in your state.

| Pros | Cons |

|---|---|

| Customizable plans (deductible, reimbursement, payout) | No direct vet payments (reimbursement only) |

| Wellness add-ons available | No accident-only plan |

| 2-day accident waiting period (faster than average) | Only available in 39 states + DC |

| Fast claims—processed in as little as 2 days | Breed restrictions based on age |

| Coverage available for alternative therapies, exam fees, and gum disease (for an added fee) | Quote process is slower than most competitors |

| Massage therapy not covered |

What Lemonade Customers Are Saying

Customers love the easy-to-use app and how simple it is to file claims.

Because of its AI-driven system, some say it’s hard to reach a real person when needed.

Still, people rave about the low premiums, fast reimbursements, and the End Of Life & Remembrance rider, which covers euthanasia, cremation, and memorial items—up to $500.

Lemonade offered the best price and coverage for our mixed-breed dog.

I compared several top providers, and while Pets Best and Spot were close, Lemonade had the edge—perfect for our wild 5-year-old, Barley.

Our plan covers 80% of care, with a $500 deductible and $5,000 annual limit.

We’ve had the policy for over a year, so waiting periods are behind us, and while we haven’t filed any claims yet, it’s a comfort knowing Barley’s protected.

– Michelle Schenker, pet parent to Barley (mixed breed) & co-founder of Canine Journal

Lemonade Pet Insurance Is NOT Available In: AK, DE, HI, ID, KS, KY, ME, SD, VT, WV, WY

How Much Does Pet Insurance Cost From Lemonade?

Lemonade says policies start at $10/month. On average, a four-year-old Golden Retriever in Chicago costs around $77/month.

Below are monthly premiums for 25 sample pets, based on:

- $500 deductible

- $5,000 annual coverage

- 90% reimbursement

| French Bulldog | Yorkshire Terrier | English Bulldog | Dachshund | Ragdoll Cat | |

|---|---|---|---|---|---|

| 6 Month Old in California | $75.06 | $24.12 | $58.69 | $28.73 | $20.23 |

| 1 Year Old in New York | $54.32 | $22.80 | $54.04 | $26.96 | $16.13 |

| 2 Year Old in Florida | $40.02 | $15.33 | $39.40 | $19.49 | $11.61 |

| 5 Year Old in Texas | $43.98 | $18.55 | $40.22 | $17.80 | $13.00 |

| 8 Year Old in New Jersey | $110.18 | $40.08 | Uninsurable | $75.71 | $36.09 |

Across dozens of sample pets, Lemonade offered the lowest premiums about 50% of the time—far more often than any other provider.

That said, prices vary based on your pet’s breed, age, and location, so it’s smart to get quotes from at least three insurers before choosing a plan.

In-Depth Review Of Lemonade

Read my full Lemonade review to explore Lemonade’s coverage, reimbursement process, FAQs, and more.

You’ll also learn about Michelle’s experience—including why she chose Lemonade for Barley’s policy and how it compares to other top providers.

Best Vet Direct Pay: Trupanion Review

| Plan Options | Accident & illness |

| Payout Limits | Unlimited |

| Deductibles | $0-$1,000 (in $5 increments) |

| Reimbursement Levels | 50%, 60%, 70%, 80%, 90%, 100% |

| Waiting Periods | 30 days for illnesses, 5 days for accidents |

| Average Claim Processing | 2 days |

| Age Limitations | 14 years old or younger |

| Discounts | Use this link to take advantage of the best possible price |

One of Trupanion’s most talked about features is Trupanion’s Vet Direct Pay, which eliminates the claim processing wait time. Many other pet insurance companies offer a direct pay option for vets. Still, Trupanion’s Vet Direct Pay is the only option that allows payment during checkout. If Trupanion’s Vet Direct Pay isn’t available at your vet’s office, you can call to ask about it or speak with your vet about them setting it up.

Trupanion also administers policies through Geico and State Farm.

| Pros | Cons |

|---|---|

| Unlimited payouts for all plans | No accident-only plan is available |

| May have an option for Trupanion to pay your vet directly to avoid waiting for reimbursement | Pets older than 14 are ineligible for enrollment |

| Shorter than average CCL surgery and hip dysplasia waiting periods (30 days) | Longer than average illness waiting period (30 days) |

| Shorter than average claim processing averages (2 days) | Consistently among the most expensive |

| Behavioral therapies, C-sections, supplements, and tooth extractions are included in coverage | Exam fees and massage therapy are excluded |

| Breeder Support Program lets breeders provide buyers with an offer for Trupanion enrollment without waiting periods (pet parents can pick up their puppy from the breeder and get insurance without any waiting periods) | |

| The only provider to cover holistic treatment such as herbal therapy, naturopathy, and homeopathy | |

| Covers 50% of prescription food |

What Trupanion Customers Are Saying

Trupanion has some of the most customers, with over 2.7 million insured pets. Its app is rated lower by customers compared to other insurers, and there are complaints of high premiums and high increases at renewal, too. However, Trupanion policyholders are extremely happy with their coverage and say filing claims is easy.

How Much Does Pet Insurance Cost From Trupanion?

Below are monthly costs for Trupanion with a $500 deductible, unlimited annual coverage, and 90% reimbursement for 25 sample pets.

| French Bulldog | Yorkshire Terrier | English Bulldog | Dachshund | Ragdoll Cat | |

|---|---|---|---|---|---|

| 6 Month Old in California | $193.76 | $57.69 | $126.66 | $67.40 | $49.94 |

| 1 Year Old in New York | $151.23 | $67.39 | $149.54 | $76.68 | $44.42 |

| 2 Year Old in Florida | $284.51* | $173.11* | $457.54* | $201.28* | $110.34* |

| 5 Year Old in Texas | $210.76 | $99.61 | $222.32 | $115.65 | $41.93 |

| 8 Year Old in New Jersey | $454.15 | $192.24 | $451.13 | $220.73 | $111.45 |

Zip codes: California 92121, New York 14211, Florida 33604, Texas 78703, New Jersey 07108

In the hundreds of sample pets I’ve run, Trupanion is almost always the most expensive. However, it can be tricky to compare providers’ coverage because Trupanion has fewer customization options and offers unlimited payouts for all plans. Although Trupanion offers some of the best coverage, I still recommend getting a quote from it to see where your pet’s premium falls.

In-Depth Review Of Trupanion

Read my complete review of Trupanion to learn more about this provider and its coverage, reimbursement process, FAQs, and more. I also go more in-depth on Trupanion’s plan options, including The Trupanion Plan, which is gradually becoming available in all 50 states.

Best For Pre-Existing Conditions: AKC Pet Insurance Review

| Plan Options | Accident & illness, accident-only, wellness add-on |

| Payout Limits | $2,500, $5,000, $7,500, $10,000, $15,000, $17,500, $20,000 |

| Deductibles | $100, $250, $300, $400, $500, $600, $750, $1,000 |

| Reimbursement Levels | 70%, 80%, 90% |

| Waiting Periods | 14 days for illnesses, 2 days for accidents, 30 days for hip dysplasia and alternative therapies coverage, 180 days for IVDD and CCL injuries |

| Average Claim Processing | 2 days |

| Age Limitations | 14 years old or younger |

| Discounts | 5% off for multiple pets; 5% off for dogs who pass the AKC Canine Good Citizen test; 10% off for puppies coming from breeders who participate in the AKC Bred with H.E.A.R.T or AKC Breeder of Merit programs |

AKC Pet Insurance is the only provider to offer coverage for pre-existing conditions after one year of continuous coverage. This can be life-changing for customers with dogs suffering from chronic illnesses or other pre-existing conditions. Different companies cover curable conditions, but AKC Pet Insurance offers complete coverage after one year. FL and WA are excluded from this.

| Pros | Cons |

|---|---|

| No vet records or exam required to enroll | No illness coverage option for dogs enrolled after age 9 |

| Optional wellness plans are available as extras | Must purchase coverage for congenital, hereditary, and chronic conditions separately |

| Claims are typically paid within 2 days | Exam fee coverage is available for an additional fee |

| Your pet is covered when they travel with you in the U.S. or Canada | $3 – $4 monthly transaction fee (depending on the state) – highest in the pet insurance space, waived if paid annually |

| Offers coverage for pre-existing conditions after 365 days of continuous pet insurance coverage (not in FL and WA) | Excludes massage therapy |

| Can purchase coverage for accidents, sickness, and complications related to breeding | |

| Covers supplements |

Customer Experience

AKC Pet Insurance has over 32,000 insured pets. It uses the same Pet Cloud app that Figo uses, which, in my experience, is very user-friendly, and other customers agree. The biggest complaint from policyholders is that AKC Pet Insurance incorrectly denies claims, so they have to submit an appeal. However, customers say filing a claim is easy, and customer service is very communicative.

How Much Does AKC Pet Insurance Cost?

AKC Pet Insurance states premiums for accident and illness plans start as low as $10 per month. I gathered monthly bills for 25 sample pets with a $500 deductible, $5,000 annual coverage, and 90% reimbursement from AKC Pet Insurance below.

| French Bulldog | Yorkshire Terrier | English Bulldog | Dachshund | Ragdoll Cat | |

|---|---|---|---|---|---|

| 6 Month Old in California | $73.67 | $36.88 | $88.34 | $34.16 | $38.78 |

| 1 Year Old in New York | $53.28 | $24.64 | $68.96 | $24.96 | $24.44 |

| 2 Year Old in Florida | $62.90 | $30.24 | $86.80 | $33.05 | $28.90 |

| 5 Year Old in Texas | $117.78 | $45.45 | $136.90 | $49.66 | $41.42 |

| 8 Year Old in New Jersey | $208.19 | $92.47 | $235.28 | $106.02 | $67.78 |

In the many sample pets I ran, AKC Pet Insurance’s premiums were typically in the lower to middle of the pack. It’s interesting to see the cost difference between six-month-old pets in California and one-year-olds in New York. Premiums were consistently higher in California than in New York, even though the pets were younger in California. This doesn’t mean that all California pets have higher premiums than other locations through AKC Pet Insurance, so getting a quote for your pet will ultimately give you the best idea of cost.

In-Depth Review Of AKC Pet Insurance

Read my complete review of AKC Pet Insurance to learn more about this provider, its coverage, key features, rider options, and whether your dog is eligible for coverage.

Best Accident-Only Plan: ASPCA Pet Health Insurance Review

| Plan Options | Accident & illness, accident-only, wellness add-on |

| Payout Limits | $2,500, $5,000, $7,000, $10,000 |

| Deductibles | $100, $250, $500 |

| Reimbursement Levels | 70%, 80%, 90% |

| Waiting Periods | 14 days for illnesses and accidents |

| Average Claim Processing | 15-30 days |

| Age Limitations | At least 8 weeks old |

| Discounts | 10% off for multiple pets |

ASPCA Pet Health Insurance’s Accident-Only policy is the most customizable and has the fewest restrictions (even covering cruciate ligaments). Unlike other accident-only policies, ASPCA Pet Health Insurance lets you select your annual deductible ($100-$500), reimbursement (70%-90%), and annual limit ($2,500-$10,000). Additionally, no upper age limits force you into accident-only insurance if you enroll your pet after they reach a certain age. You can also add an optional wellness plan to this plan, something other providers only allow to add to their accident and illness policies. Overall, ASPCA Pet Health Insurance’s Accident-Only plan is an excellent value and option for pet owners wanting more options for this insurance type.

ASPCA Pet Insurance also administers policies through Travelers and Waffle.

| Pros | Cons |

|---|---|

| Customize your plan to fit your budget and needs with different deductible, reimbursement, and payout options | Longer than average accident waiting period (14 days) |

| May have an option for ASPCA Pet Health Insurance to pay your vet directly to avoid waiting for reimbursement | Longer than average claim processing (15-30 days) |

| Accident-only plan is available | Gum disease and tooth extractions are excluded |

| Optional wellness plans are available as add-on | |

| Shorter than average CCL surgery and hip dysplasia waiting periods (14 days) | |

| Behavioral therapies, alternative therapies, supplements, prescription food, and exam fees are included |

What ASPCA Pet Health Insurance Customers Are Saying

Since its founding in 1997, ASPCA Pet Health Insurance has insured over 600,000 pets. Unfortunately, pet owners complain that reimbursement takes a month and rate the app lower than other insurers. However, customer service reps are active in online forums, helping customers resolve any outstanding issues they may have.

How Much Does ASPCA Pet Health Insurance Cost?

Below are monthly premiums for an accident and illness ASPCA Pet Health Insurance plan with a $500 deductible, $5,000 annual coverage, and 90% reimbursement for 25 sample pets.

| French Bulldog | Yorkshire Terrier | English Bulldog | Dachshund | Ragdoll Cat | |

|---|---|---|---|---|---|

| 6 Month Old in California | $60.93 | $33.13 | $76.07 | $33.13 | $19.65 |

| 1 Year Old in New York | $79.91 | $42.23 | $76.74 | $42.23 | $24.18 |

| 2 Year Old in Florida | $80.03 | $32.37 | $94.14 | $32.37 | $19.90 |

| 5 Year Old in Texas | $122.13 | $31.50 | $97.35 | $31.50 | $18.30 |

| 8 Year Old in New Jersey | $193.77 | $78.37 | $227.94 | $78.37 | $43.77 |

ASPCA Pet Health Insurance costs are typically priced competitively amongst others. I found it interesting how much more affordable Yorkies, Doxies, and Ragdolls are through ASPCA Pet Health Insurance than Bulldog breeds.

Additionally, Yorkie and Doxie premiums were the same for the pets I ran. This is the first time I’ve noticed this happen in the thousands of quotes I’ve run over the past decade (except for Spot below). Grab an ASPCA Pet Health Insurance quote for your furry pal to see what it could cost you monthly.

Full Review Of ASPCA Pet Health Insurance

Read my ASPCA Pet Health Insurance Review to learn more about this provider and its connection to Hartville and Waffle.

Best For Customizable Plans: Spot Review

| Plan Options | Accident & illness, accident-only, wellness add-on |

| Payout Limits | $2,500, $3,000, $4,000, $5,000, $7,000, $10,000, unlimited |

| Deductibles | $100, $250, $500, $750, $1,000 |

| Reimbursement Levels | 70%, 80%, 90% |

| Waiting Periods | 14 days for illnesses and accidents |

| Average Claim Processing | 5-7 days |

| Age Limitations | At least 8 weeks old |

| Discounts | 10% off for multiple pets; 10% off for Purina customers; Up to 20% off for eligible AAA customers |

Spot Pet Insurance was founded in 2019 and offers many ways to customize your plan. You can choose an accident-only policy or accident and illness policy, add on a wellness plan, and adjust your deductible, reimbursement, and payout options. These options provide a wide range of ways to help fit Spot into your budget.

| Pros | Cons |

|---|---|

| Customize your plan to fit your budget and needs with different deductible, reimbursement, and payout options | Can’t have Spot pay your vet directly to avoid waiting for reimbursement |

| Accident-only plan is available | Longer than average accident waiting period (14 days) |

| Optional wellness plans are available as a rider | Gum disease and tooth extractions are excluded |

| Shorter than average CCL surgery and hip dysplasia waiting periods (14 days) | |

| Behavioral therapies, alternative therapies, supplements, prescription food, and exam fees are included | |

| Claims are typically paid within 5-7 days |

What Spot Pet Insurance Customers Are Saying

The difference in Spot’s customer reviews and app ratings has improved quite a bit within the past year alone. Customers rave about how easy the app is to use, how fast claims are processed, and how courteous Spot’s customer service team is. I’ve also noticed that Spot has cut its average claim processing time in half. Previously, it had been 10-14 days, but more recently, it’s been 5-7 days. Overall, I’m pleased with the improvements I’ve seen over the last year from Spot, especially with it being a newer provider.

How Much Does Pet Insurance Cost From Spot?

Below are monthly premiums for Spot’s accident and illness plan with a $500 deductible, $5,000 annual coverage, and 90% reimbursement for 25 sample pets.

| French Bulldog | Yorkshire Terrier | English Bulldog | Dachshund | Ragdoll Cat | |

|---|---|---|---|---|---|

| 6 Month Old in California | $62.93 | $35.13 | $78.07 | $35.13 | $21.65 |

| 1 Year Old in New York | $81.91 | $44.23 | $78.74 | $44.23 | $26.18 |

| 2 Year Old in Florida | $81.45 | $34.13 | $95.46 | $34.13 | $21.64 |

| 5 Year Old in Texas | $121.98 | $32.94 | $97.62 | $32.94 | $19.79 |

| 8 Year Old in New Jersey | $176.73 | $72.67 | $207.54 | $72.67 | $41.65 |

The pricing for Yorkies and Doxies was identical in the sample pets I ran. I’ve never noticed this happen in the thousands of quotes I’ve run over the past decade. This happened with ASPCA Pet Health Insurance, also administered by Crum & Forster (C&F) Insurance Agency. Snag a quote for your pet from Spot to see if it fits your needs.

Full Review Of Spot

Read my Spot Pet Insurance Review to go more in-depth about this provider and its coverage, including its wellness plan options, plan customizations, and more.

Best For Exotic Pets: Nationwide Review

| Plan Options | Accident & illness, accident-only, wellness add-on |

| Payout Limits | $2,500, $5,000, $10,000, benefit schedule |

| Deductibles | $250, $500, $1,000 |

| Reimbursement Levels | 50%, 70%, 80% |

| Waiting Periods | 14 days for illnesses and accidents, 12 months for CCL injuries |

| Average Claim Processing | 10-14 days |

| Age Limitations | At least 8 weeks old and no older than 10 years old for illness coverage* |

| Discounts | 5% off for 2-3 pets; 10% off for 4 or more pets |

Nationwide is one of the only U.S. pet insurance providers offering exotic pet insurance and dog and cat insurance. If you have a rabbit, bird, reptile, ferret, or another small mammal, consider insurance through Nationwide. Like dog or cat insurance, exotic pet insurance covers unexpected visits to the vet that are subject to the insurance plan you choose. Depending on your selections, this may include accidents, illnesses, the death of your pet, and more.

| Pros | Cons |

|---|---|

| Optional wellness plan is available as add-on | Can’t have Nationwide pay your vet directly to avoid waiting for reimbursement |

| Shorter than average hip dysplasia waiting period (14 days) | Restricted to accident-only coverage for pets 10 and older |

| Behavioral therapies, alternative therapies, and exam fees are included in coverage | Longer than average waiting periods (14 days for accidents and 12 months for CCL surgery) |

| One of the only pet health insurance companies to offer exotic pet insurance | Gum disease, tooth extractions, and massage therapy are excluded |

| Currently dropping 100,000 pets from coverage and leaving them stranded |

What Nationwide Pet Insurance Customers Are Saying

Many customers dislike the Major Medical plan’s benefit schedule because they hit limits for conditions and incidents. However, Nationwide also offers a more traditional insurance plan that allows you to select your accident and illness coverage individually. Plan options vary based on your pet and location. Currently, Nationwide insures more than one million pets and has one of the highest-rated apps in the industry.

How Much Does Pet Insurance Cost From Nationwide?

Nationwide states on its website that pet insurance starts at $13 per month. Below are monthly premiums for Nationwide’s Major Medical plan, which uses a benefit schedule with a $250 annual deductible. The plan covers accidents and illnesses. You must call them directly to get a price for your bird or exotic pet.

| French Bulldog | Yorkshire Terrier | English Bulldog | Dachshund | Ragdoll Cat | |

|---|---|---|---|---|---|

| 6 Month Old in California | $60.15 | $28.51 | $57.65 | $29.30 | $18.60 |

| 1 Year Old in New York | $56.72 | $38.33 | $66.70 | $40.38 | $22.75 |

| 2 Year Old in Florida | $55.57 | $35.46 | $84.78 | $33.06 | $18.32 |

| 5 Year Old in Texas | $82.87 | $38.16 | $120.33 | $38.69 | $19.14 |

| 8 Year Old in New Jersey | $109.18 | $47.74 | $126.05 | $77.96 | $38.61 |

Comparing Nationwide against other insurers is difficult because it primarily offers a benefit schedule for its insurance in the top five states with the most insured pets and highest gross written premiums for pet insurance. Get a quote for your pet to see what plans Nationwide offers for you.

Full Review Of Nationwide Pet Insurance

Read my Nationwide Pet Insurance Review to learn more about this insurer, including how its benefit schedule works and a list of all pets eligible for its insurance.

What Is Pet Insurance?

There are many unknowns in owning a pet. Will Fido be diagnosed with a chronic condition? Will he tear his ACL during a game of fetch? Will he develop an appetite for eating shoes, wood chips, and other objects? All of these can result in unplanned trips to the veterinarian, which means unexpected costs and stress for you.

This is where pet insurance can ease your mind. Instead of facing hundreds or thousands of dollars in vet bills, you can focus on your pet’s health.

Pet insurance helps pay for covered veterinary treatment of the insured pet’s sicknesses and/or injuries. Insuring your pet can help you save money on unexpected vet bills during a medical emergency.

But, pet insurance does not cover routine care like wellness exams, related lab work, or vaccinations. Further, it does not cover the deductible portion outlined in your policy, the remaining reimbursement percentage, or anything beyond your annual payout limit.

What Are The Different Types Of Pet Insurance Plans?

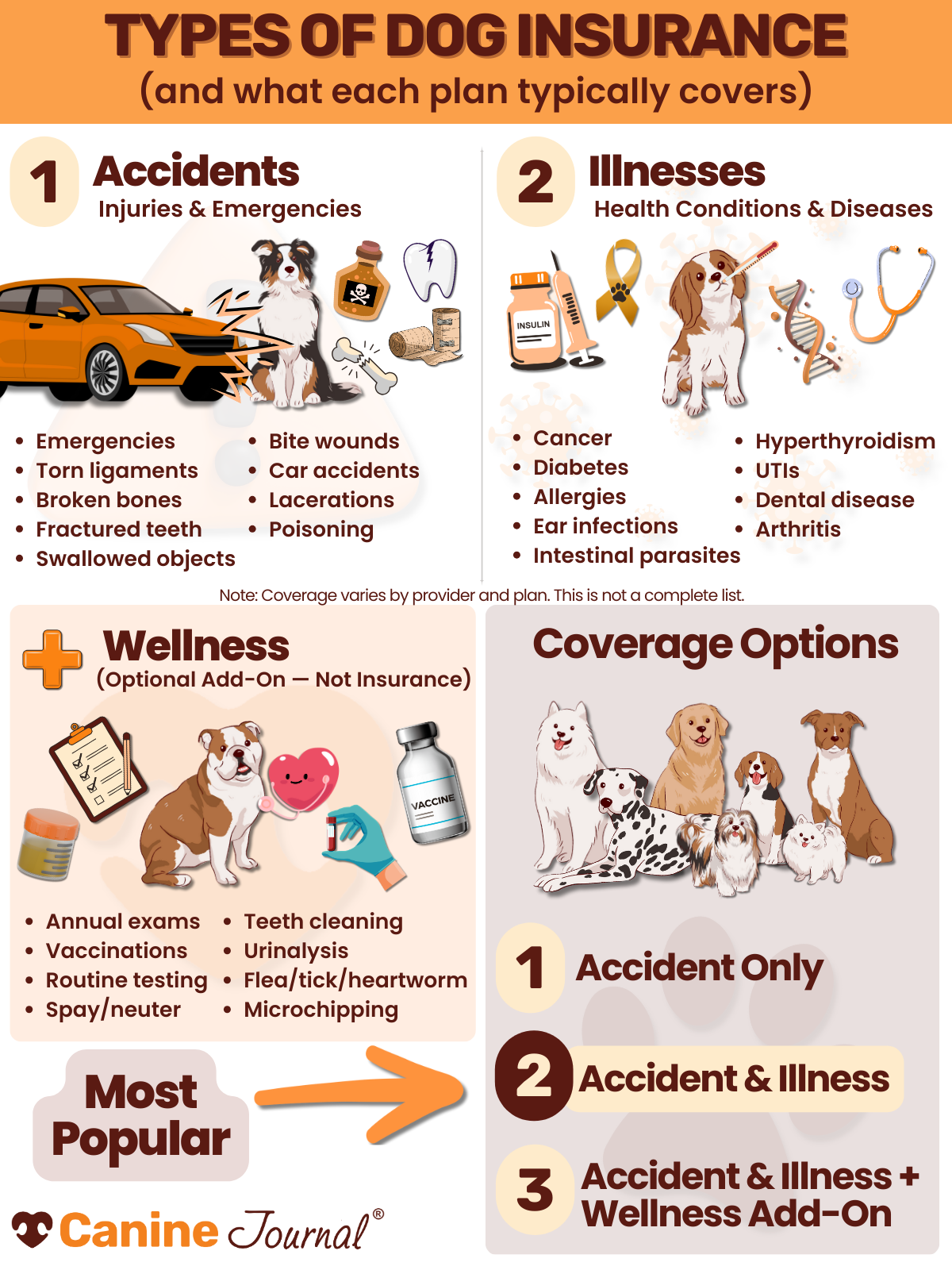

There are two pet insurance plans: accident-only and accident and illness. Some companies also offer an optional wellness plan for an extra charge, but it isn’t an insurance product. Since several pet insurance providers offer wellness plans during enrollment, I included them to ensure you know the full range of options during new enrollment.

What Do Accident-Only Pet Insurance Plans Cover?

An accident-only plan only covers vet bills associated with an accident, such as torn ligaments, broken bones, foreign body ingestion, poisoning, injuries, bite wounds, and more. Illnesses are excluded from this coverage. An accident-only pet insurance plan is typically less expensive than an accident and illness one since it covers fewer expenses. However, only some companies offer this policy type.

What Do Accident & Illness Pet Insurance Plans Cover?

This is the most common and popular type of pet insurance plan. It covers injuries (like broken bones, foreign body ingestion, and other items covered in accident-only plans) and sickness-related conditions (like cancer, allergies, urinary tract infections, arthritis, skin infections, ear infections, and more). This type of policy is more comprehensive than an accident-only one.

What Do Wellness Plans Cover?

Wellness coverage is purchased as an add-on or a standalone product and comes with an incremental fee. Typically, this program covers things that occur during an annual exam, such as vaccination, flea/tick/heartworm treatment, teeth cleaning, and spay/neuter procedures. A wellness plan is a financial tool to help cover the costs associated with preventative measures that assist your dog’s overall health and prevent maladies where possible. Regular vet visits, especially ones covered with a wellness plan, also encourage owners to be more proactive with their pet’s health. Wellness plans are not pet insurance as they don’t cover costs associated with accidents or illnesses.

| Plan Type/Need | Accident-Only | Accident & Illness (most popular) | Wellness |

|---|---|---|---|

| Injury-related conditions (broken bones, foreign body ingestion, poisoning, bite wounds, etc.) |  |  | |

| Sickness-related conditions (allergies, urinary tract infections, arthritis, cancer, ear infections, etc.) |  | ||

| Preventative measures (annual exams, vaccination, flea/tick/heartworm prevention, teeth cleaning, spay/neuter procedures, etc.) |  | ||

| Cost | $ | $$ | $$$* |

What Does Pet Insurance Cover?

Pet insurance coverage varies based on the policy type and the company you choose. The majority of accident and illness pet insurance plans cover the following items when deemed medically necessary. However, this coverage may have limitations, so please check your policy.

I have put together a comprehensive guide to what pet insurance covers. You’ll also find cost and reimbursement examples, criteria to consider, alternatives to pet insurance, wellness plans, and more.

| Covered | Excluded |

|---|---|

| Blood tests | Boarding |

| Cancer (chemo & radiation) | Cremation & burial costs |

| CAT scans | Elective procedures (e.g., declawing, ear cropping, spaying/neutering, tail docking, etc.) |

| Chronic conditions | Food & supplements |

| Congenital conditions | Grooming |

| Emergency vet visits | Pre-existing conditions* |

| Euthanasia | Pregnancy & breeding |

| Hereditary conditions | Vaccines |

| MRIs | |

| Non-routine dental treatment | |

| Prescription medications | |

| Rehabilitation | |

| Specialized exams & care | |

| Surgery & hospitalization | |

| Ultrasounds | |

| X-rays |

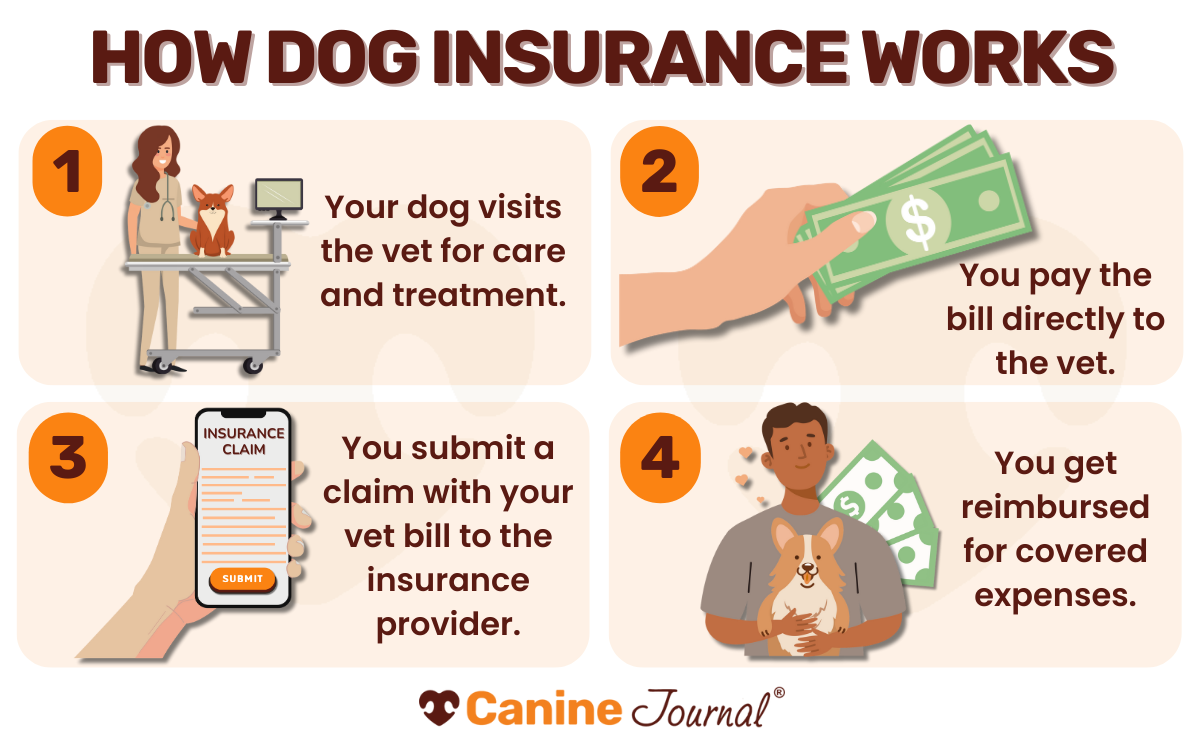

How Does Pet Insurance Work?

Here’s a simplified explanation of how to file a claim to get reimbursed by your insurer.

- Visit the vet for treatment.

- Pay your bill at checkout.

- Submit your claim to the insurance company:

- Include the completed claim form and an itemized receipt.

- Get reimbursed once your claim is approved—via check, direct deposit, or another preferred method.

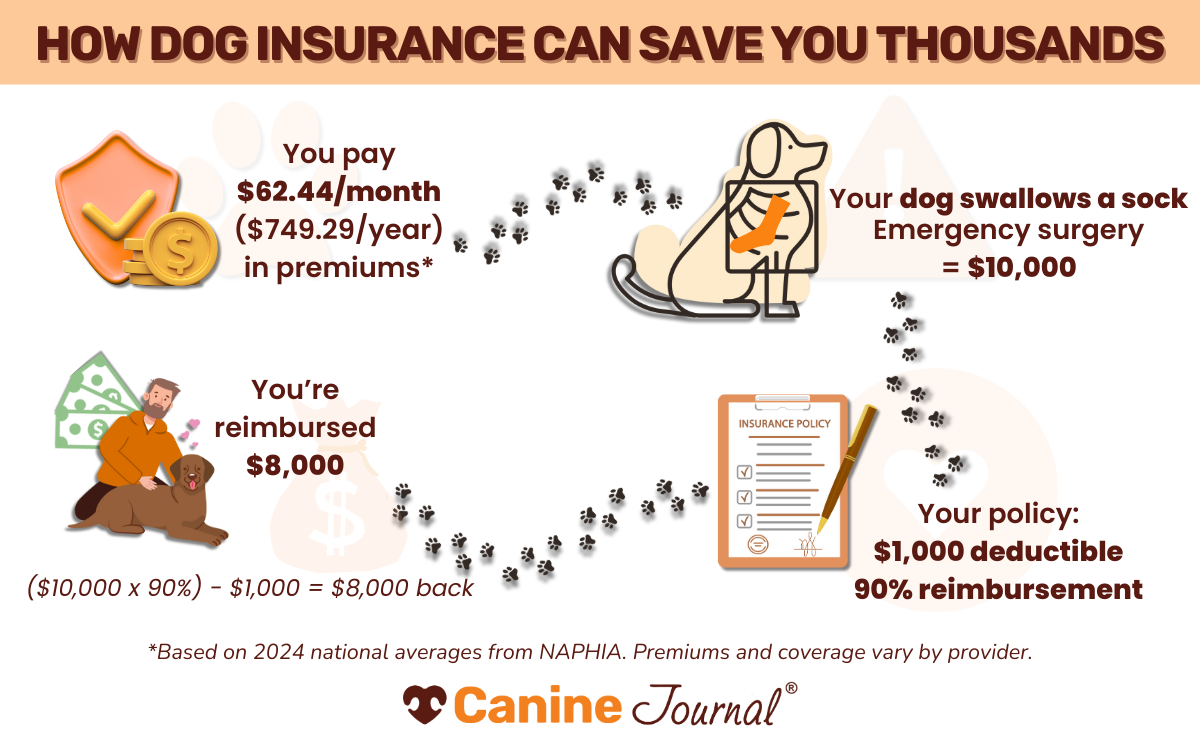

Pet Insurance Claim Example

Let’s walk through an example to better understand how it works.

Suppose your policy has the following coverage:

- $250 annual deductible

- 80% reimbursement

- $5,000 payout limit

In that case, you’re responsible for the following:

- Any unplanned vet bills related to covered items up to $250,

- 20% of the total vet bill up to $5,000, and then

- 100% above the $5,000 payout limit

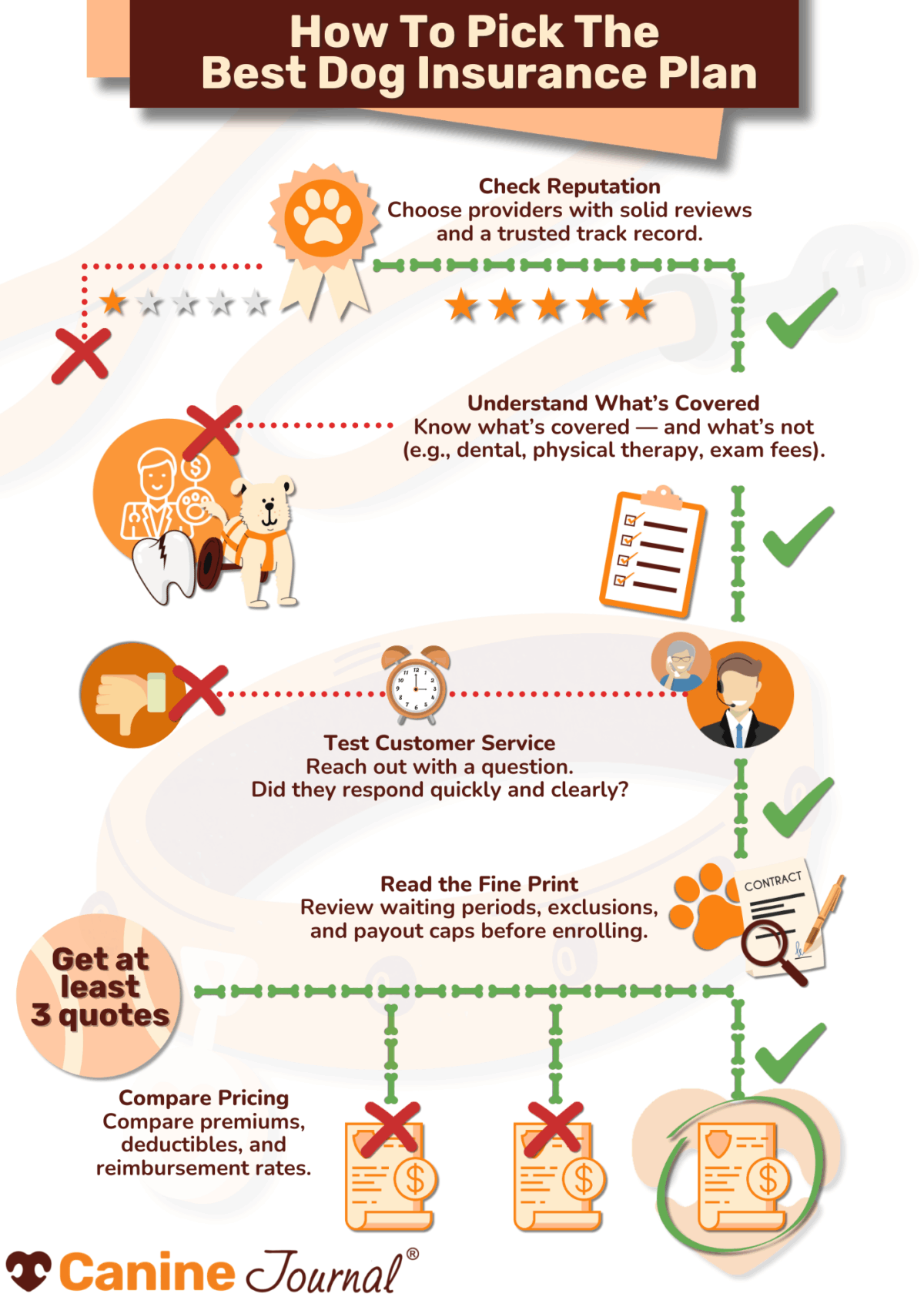

How To Choose The Best Pet Insurance For You

How can one decide with so many pet insurance companies to choose from? This is why it’s crucial to take the time to consider your options carefully. By understanding the key considerations and committing to the research, you may find a provider that fits your breed and health concerns.

It is wise to consider any illnesses your dog’s breed may be predisposed to. For example, suppose your pet is predisposed to hip dysplasia. In that case, you’ll want to ensure you’re satisfied with the terms associated with hip dysplasia coverage. Some companies add additional waiting periods to hip dysplasia or consider it a bilateral condition, thus excluding it from coverage as a pre-existing condition. Additionally, consider a conversation with your vet about any potential conditions they’d recommend covering based on the breed or mix.

After you have a list of your must-haves, you’re ready to narrow down your list of options.

- Your biggest concern as a pet parent should be the reputation of the pet insurance provider. Have you heard of them? Do family and friends use them? What has their experience been when they’ve had to file a claim? Getting a pet insurance policy is only useful if it covers what you expect it to cover and if you can afford the monthly bill. Remember, although the monthly cost is important, it’s not the most crucial factor when choosing insurance. The whole point of any insurance policy is ensuring you have the coverage to pay for otherwise unaffordable bills in emergencies.

- Decide what type of coverage you want for your dog and which additional perks may be negotiable to lower your costs. Our pet insurance comparison tables can help highlight the key differences between providers, including plan options, coverage, waiting periods, age restrictions, and quotes.

- Obtain price estimates from at least three companies to get an idea of how much your monthly cost will be. Pricing varies drastically, and just because a company charges you more doesn’t mean the coverage is more thorough.

- Don’t hesitate to contact potential providers with any questions before signing up. Pay close attention to that experience—it may reflect customer service quality down the road.

- Consider the claim reimbursement process, including how it works, the average processing timeline, and whether the company can pay the vet directly. If a company takes longer than you can wait for reimbursement, you may want to seek other options.

Picking a pet insurance plan is a personal choice, and no one knows what your dog needs better than you. Take the time to make an informed decision, and know it’ll be worth the added protection in the long run.

Frequently Asked Questions

Here are some questions we’ve received from our readers regarding pet insurance. Don’t see yours? Ask our experts in the comments.

What Are Pet Insurance Waiting Periods?

Waiting periods in pet insurance help exclude recent or previous illnesses or accidents, keeping costs lower and ensuring proper coverage. Pet insurance companies can effectively pay for claims and remain profitable by charging and receiving policy premiums.

Pet insurance companies have two primary waiting periods: one for illnesses and one for accidents. Additional waiting periods are common for more serious health conditions (e.g., hip dysplasia, CCL tears, Intervertebral Disc Disease [IVDD], and other orthopedic conditions).

Generally, pet insurance companies have a 14-day waiting period for illnesses and around a 3-day waiting period for accidents. The waiting period for hip dysplasia, CCL injuries, IVDD, and other orthopedic conditions can range from 14 days to 12 months. However, some U.S. states are gradually adopting a Model Law for pet insurance, which attempts to standardize each state’s regulations. The Model Law has a standard for waiting periods that all companies must follow. This means that if you live in one of these states, waiting periods don’t need to be a deciding factor since all companies offer the same waiting periods for your state.

*States are gradually adopting a Model Law for pet insurance, aiming to standardize regulations, including uniform waiting periods. In California, Delaware, Louisiana, Maine, Mississippi, Nebraska, New Hampshire, Washington, Rhode Island, and Maryland, waiting periods are:

- Accidents: 0 days

- Illnesses: 14 days

- Cruciate Ligament Conditions: 30 days

- Routine Care: 0 days

How Do Pet Insurance Companies Know About Pre-Existing Conditions?

Upon enrollment, insurers may require a vet exam or your pet’s medical records. If a vet exam is required for enrollment, the insurer typically requests it be within 30 days of the policy’s effective date. During this appointment, your vet will assess your dog’s overall health and note any abnormalities. Some providers require a detailed exam of your dog’s legs and hips for orthopedic issues.

Additionally, providers may collect this information by analyzing your dog’s past vet records. If your dog hasn’t had a recent vet exam, the insurer may ask you to have your dog assessed.

Generally speaking, pre-existing conditions are determined as accidents and illnesses that have manifested before the policy’s effective date or during the waiting period. For example, suppose your dog was diagnosed with hip dysplasia in June, and you bought pet insurance in the following month of the same year. In that case, the condition won’t be covered.

However, a few insurers offer coverage for curable pre-existing conditions if they are free from treatment and symptoms for a set period. Conditions that may be covered include ear infections, urinary tract infections, kennel cough, gastrointestinal issues, and more. Furthermore, AKC Pet Insurance is entering new territory for the industry and offering coverage for pre-existing conditions after 365 days of continuous pet insurance coverage.

Is Pet Insurance Tax Deductible?

No, pet insurance is not tax deductible.

According to IRS publication 502, if you have a guide dog or service animal, you may be able to deduct expenses related to buying, training, and maintaining the animal. This can include any costs, including food, grooming, and veterinary care.

Does Pet Insurance Cover Only Dogs And Cats?

Most insurers limit pet insurance policies to dogs and cats. However, Nationwide also offers pet insurance for exotic pets, including reptiles, birds, rabbits, ferrets, miniature pigs, guinea pigs, goats, sugar gliders, chinchillas, and other small mammals. Nationwide’s exotic pet insurance policy has a 90% reimbursement rate, and the average cost is $11 per month for reptiles, $13 per month for birds, and $19 for rabbits.

You can also purchase horse insurance if you have a passion for horses, but it is a different type of policy. So be sure to do your homework before registering.

Does Pet Insurance Cover Dental?

Pet insurance companies generally cover a portion of non-routine dental-related claims. However, the extent of coverage varies by provider. Embrace, Fetch, and Pets Best offer some of the best dental coverage for pet insurance.

Pet insurance doesn’t cover dental cleanings. However, if you have a wellness plan (as a standalone product or added to your pet insurance policy), it may include coverage for a portion or all dental cleanings.

Does Pet Insurance Cover Spaying And Neutering?

No, accident and illness plans don’t cover spaying and neutering. However, you can purchase a wellness plan as a standalone product or add it to your pet insurance policy, which may cover a portion of your dog’s spaying/neutering procedure. My Does Pet Insurance Cover Spaying & Neutering article details this.

Can I Go To Any Vet With Pet Insurance?

Most pet insurance companies allow you to choose any licensed vet for your pet’s health care needs. I know one company, Companion Protect, that is the exception to this rule. Companion Protect claims to cover more of the cost within its approved network of vets. While they allow you to use an out-of-network vet, it may cost you more money.

What Are The Disadvantages Of Pet Insurance?

Although my team feels that pet insurance is valuable and worth it for most, here are four cons to be aware of:

- Routine preventative exams and associated expenses aren’t included in your pet insurance policy. You must purchase a wellness plan at an incremental cost to cover these.

- You will still have out-of-pocket expenses, including your deductible and any amount that surpasses your payout limit. You will also be responsible for covering the balance of the reimbursement amount (i.e., if you chose an 80% plan and your provider agrees to cover your claim, you will still owe 20%).

- Most pet insurance providers exclude pre-existing conditions from coverage, and you are responsible for associated costs.

- Unlike human health care, most pet insurance companies require you to pay vet expenses upfront and wait for reimbursement. Some companies offer a vet direct pay option as an alternative to this standard reimbursement model. Still, you must work with your vet to ensure this is in place before you begin treatment.

What Should I Ask Before Buying Pet Insurance?

These are questions I recommend asking your provider before you sign up.

- Can I choose my vet?

- What are the waiting periods?

- What’s excluded from coverage?

- Are there extra fees for coverage related to exam fees, prescription medication, or other items?

- Can you show me an example of how a claim is handled?

- What will I be responsible for paying?

- What happens if I buy a policy after my pet gets sick or hurt?

- Are there any limits on benefits (per-incident, annual, or lifetime)?

- How fast will my claim be processed and repaid?

Is It Worth Making A Pet Insurance Claim?

If you have a pet insurance policy, making a pet insurance claim is almost always worth it. Providers have made filing claims reasonably simple. Even if you know you won’t get reimbursed because you have yet to hit your deductible, the claim will go toward your deductible. It may not be worth filing a claim if your policy has any limits (per policy period or per condition) and you have already hit the maximum.

Should I Get Pet Insurance & A Wellness Plan Or Use A Savings Account Instead?

Our readers often ask this, so describing a scenario could be helpful.

Let’s say you save $55 each month (the average pet insurance premium) for 5 years, totaling $3,300 in your vet bill savings account. What if your dog experiences an emergency, such as a life-threatening condition like cancer? The average cancer treatment plan can cost $6,000-$10,000. Unfortunately, your savings account with $3,300 won’t cover the high vet bills that are piling up.

Meanwhile, investing $55 monthly into a pet insurance policy could ensure your dog has more coverage for emergency vet visits, even a cancer diagnosis. So, if your dog’s cancer treatment costs $6,000, a pet insurance policy would cover beyond the $3,300 you saved.

Is Pet Insurance Worth It?

According to Canine Journal’s Economic Euthanasia Study, 36% of respondents are willing to spend up to $1,000 on their dog’s medical needs to avoid euthanasia. Unfortunately, veterinary care costs are only increasing, and an unexpected accident or illness can quickly exceed $1,000. However, pet insurance can help reduce the burden.

As a licensed insurance agent who specializes in pet insurance, I’ve seen countless pet owners struggle with the cost of caring for their dog when an emergency hits. Here’s a real story to help you better understand how it can hit hard for real people.

A friend’s 2-year-old dog was hit by a car and they had to have emergency surgery to save his life. The estimate was $2,000 for the surgery, but they had to decide quickly. They proceeded with the surgery but then had to pay off their credit card for 6 months, paying a nearly 20% premium in fees for the balance. If they had signed up for pet insurance even a month earlier, this accident would have been covered by their policy and their out-of-pocket cost after reimbursement would have been limited to their deductible plus the percent of cost they had selected to cover during enrollment. So, rather than paying $2,000, the total cost for a $250 deductible and 80% reimbursement percentage, would have been only $650 ($2,000*80%=$1,600 – $250 deductible=$1,350 paid by insurance).

While everyone hopes they never actually need to use their insurance, accidents and illnesses are inevitable. Being prepared for these circumstances helps you to be ready to make the quick choices during emotional times with confidence, knowing your bank account can handle the financial aspect. Peace of mind is priceless when it comes to your furry family member’s health.

– Michelle Schenker, Licensed Insurance Professional & Co-Founder of Canine Journal

What would you do if you encountered a $1,500 pet-related emergency tomorrow? Would it crush your budget and leave you in a difficult place financially? Would you hesitate to move forward with an expensive vet treatment?

If you answered yes to any of these questions, then pet insurance is worth it if you can afford the monthly bill for your dog. Having your dog insured can help you prepare financially and benefit your dog with more well-rounded health coverage. It also provides peace of mind during already stressful times.

I have an entire article dedicated to helping you decide if pet insurance is worth it. It can help you understand how pet insurance works and how it can benefit your pet’s life and your own.

5 Ways To Buy Pet Insurance

There are five ways to buy the best pet insurance policy to fit your needs.

- Use our free pet insurance comparison form to answer a few quick questions about your dog and compare pricing from multiple providers.

- Go directly to insurers’ websites and fill out their free quote forms.

- Call or email pet insurance providers to speak with them directly and get all of your questions answered.

- Ask your employer if pet insurance is offered as an employee benefit.

- If you feel overwhelmed, contact an independent insurance agent for guidance.

Pet Insurance Companies (All Of Your Options)

Didn’t see the company you were looking for? Wondering what happened to Animalia, Bivvy, CarePlus, Companion Protect, Doggo, Hartville, ManyPets, MetLife, Odie, Paw Protect, Petco, PetPartners, PetPremium, Physicians Mutual Pet, Prudent Pet, Pumpkin, Spokk, Toto, TrustedPals, Wagmo, 24Petprotect, or policies offered by Allstate, American Family, Farmers Insurance, Geico, PEMCO, Progressive, State Farm, Travelers, USAA, Waffle, Costco, or Wishbone? Don’t worry; we’ve got you covered. I have stats and full reviews on all of these companies on my complete pet insurance companies list.

Methodology

My team and I extensively review the pet insurance industry’s most reputable companies, research, and analyze customer feedback. Our licensed insurance agent fact-checks everything. I update our coverage throughout the year as providers change their policies, premiums, payout limits, reimbursements, customer service experience, and more.

My team and I conduct extensive research on the most reputable pet insurance companies, analyzing customer feedback, policy changes, and industry trends. Our licensed insurance agent fact-checks everything, and we update our reviews year-round as insurers adjust premiums, coverage, exclusions, and customer service.

We rank each U.S. pet insurance provider using a 100-point scale, ensuring an unbiased breakdown of how companies perform in real-world claims.

Our Ranking Criteria

- Coverage & Exclusions (30%) – We analyze policies, exclusions, and age restrictions, rewarding companies with fewer coverage limitations.

- Pricing (15%) – We run thousands of sample quotes and factor in extra fees, discounts, and add-ons.

- Customer Service & Reputation (12%) – We review hundreds of customer experiences, assess the sign-up process, and evaluate claim support.

- Financial Strength (10%) – We examine A.M. Best & Demotech ratings to ensure companies can pay claims reliably.

- Customization Options (10%) – Providers with more deductible, reimbursement, and payout flexibility rank higher.

- Waiting Periods (5%) – Shorter illness & accident waiting periods result in a better score.

- Claim Processing (5%) – Companies offering fast reimbursements and direct vet pay score higher.

- Innovation (3%) – We recognize unique offerings and advanced technology in the industry.

Unbiased Pet Insurance Rankings: Putting Pets First

Unlike many review sites, we don’t sell rankings—every provider earns its spot based on real performance. Our in-depth comparisons help pet parents make informed decisions, while insurers use our reviews to improve their policies. We only recommend the best because that’s what our readers deserve.

Why Trust Canine Journal?

Choosing the right pet insurance policy for your pet is a personal decision. That’s why we value your trust in us to provide all the objective information you need to make an informed choice.

Canine Journal has been covering the topic of pet insurance since 2012, well before other conglomerates discovered the rising popularity of health care for our pets. Many of our authors have personal experience with pet insurance, including Kimberly Alt, who has been Canine Journal’s go-to author for pet insurance for over a decade, having written about nearly every possible facet related to pet insurance. Kimberly knows the subject so well that she can answer a breadth and depth of pet insurance questions immediately. And on the rare occasion she doesn’t know the answer off the top of her head, she can find it within minutes due to her extensive list of resources.

Kimberly also consulted with Michelle Schenker, Canine Journal’s in-house licensed insurance agent, for additional expertise, to ensure accuracy, and give Canine Journal the authority to write about and assist readers in purchasing policies that are accurately represented.

Here is a quick comparison table showing what we offer compared to the competition.

| Canine Journal | Pawlicy Advisor | Pet Insurance Review | Forbes | |

|---|---|---|---|---|

| Began Covering Pet Insurance | 2012 | 2018 | 2005 | 2021 |

| Website’s Focus | Covers Everything Dog-Related | Sells Pet Insurance Policies | Aggregates Pet Insurance Consumer Reviews | Finance, Investing, Technology, Science, Politics, Law |

| # Of Pet Insurance Companies Covered | 47 | 7 | 19 | 10 |

| # Of Pet Insurance Comparisons | 39 | 0 | 0 | 2 |

| # Of Individual Pet Insurance Reviews | 36 | 7 | 0 | 16 |

| Personalized Quotes | ||||

| Expert Assistance | ||||

| Pros & Cons | ||||

| Discounts | ||||

| Pet Insurance Company Directory | ||||

| Coverage Comparison | ||||

| Plan Customization Comparison | ||||

| Waiting Period Comparison | ||||

| Licensed Insurance Agent | ||||

| Licensed Veterinarian Consultant | ||||

| Compare Providers Side-By-Side | ||||

| Customer Reviews | ||||

| Engagement with Companies |

Pets Best Underwriter Disclosure – Waiting periods, annual deductible, co-insurance, benefit limits, and exclusions may apply. For all terms visit www.petsbest.com/policy. Products, schedules, discounts, and rates may vary and are subject to change. More information is available at checkout. Premiums are based on and may increase or decrease due to the age of your pet, the species or breed of your pet, and your home address.

Pet insurance coverage offered and administered by Pets Best Insurance Services, LLC is underwritten by American Pet Insurance Company (NAIC #12190), a New York insurance company headquartered at 6100 4th Ave. S. #200 Seattle, WA 98108, or Independence American Insurance Company (NAIC #26581), a Delaware insurance company located at 11333 N. Scottsdale Rd. #160 Scottsdale, AZ 85254. Pets Best Insurance Services, LLC (NPN #8889658, CA agency #0F37530) is a licensed insurance agency located at 11333 N. Scottsdale Rd. #160 Scottsdale, AZ 85254. Each insurer has sole financial responsibility for its own products. Please refer to your declarations page to determine the underwriter for your policy. Terms and conditions apply. See your policy for details.

Canine Journal® is a trademark of Cover Story Media, Inc.® All insurance applications and solicitations are entrusted to Michelle Schenker (NPN #19494757; CA license #4071990), a licensed insurance agent representing Cover Story Media, Inc.® Canine Journal® does not underwrite pet insurance or pay claims but receives compensation on sale and/or renewal.