This content was reviewed by our licensed insurance agent, Michelle Schenker.

When you purchase through links on our site, we may earn a commission. Here’s how it works.

Lemonade hit the pet insurance market in July 2020 with a unique artificial intelligence (AI)-driven claims process and four solid years of providing reputable homeowners’ and renters’ insurance. For pet insurance, they offer affordable premiums, customizable policies, a wellness plan add-on, and a fast claims process they handle through their smartphone app. But does Lemonade provide all the coverage you’ll need for your pet? And how do they stack up against their competitors?

- Key Features

- Where Is Lemonade Pet Insurance Available? (Map)

- Waiting Periods*

- What Does Lemonade Cover?

- Pricing Quotes

- Discounts

- Our Experience With Lemonade Pet Insurance

- How Is Lemonade's Business Model Unique?

- How Does The Claim & Reimbursement Process Work?

- How To Sign Up With Lemonade

- Lemonade vs Other Companies

- What's Our Final Verdict?

- Why Trust Canine Journal?

Lemonade Pet Insurance Review

Product Name: Lemonade Pet Insurance

Product Description: Lemonade offers pet insurance for dogs and cats.

Summary

Lemonade’s pet insurance has affordable premiums, optional wellness plans, and a unique AI-driven claims process. Since their pet insurance is relatively new, they’re gradually expanding to all 50 states. There’s still time to establish a solid reputation, but pet parents are already excited about the offerings from Lemonade.

Our pet insurance experts read through each pet insurance company’s policy to provide detailed comparisons and information regarding how a provider fares against others in the industry. We also speak with customers, read online feedback, and communicate one-on-one with pet insurance companies to obtain a well-rounded, unbiased analysis of a company’s standings.

Our team rates pet insurance companies based on several factors, including A.M. Best ratings (an indicator of financial stability), claim processing reputations, contract coverage, customer service, pricing, plan customizations, and more.

Overall Score

Pros

- Annual deductible (not per incident)

- No lifetime payout limits on any plan

- Wellness coverage available as an add-on

- Company makes sizeable charitable contributions to causes of their customers’ choosing

- Lower than average pricing

- Coverage available for pets aged 8 weeks to 20+ years (depending on breed)

Cons

- Vet exams for accidents and illnesses only covered in extended add-on plan

- Must pay extra for physical therapy, acupuncture, and hydrotherapy coverage

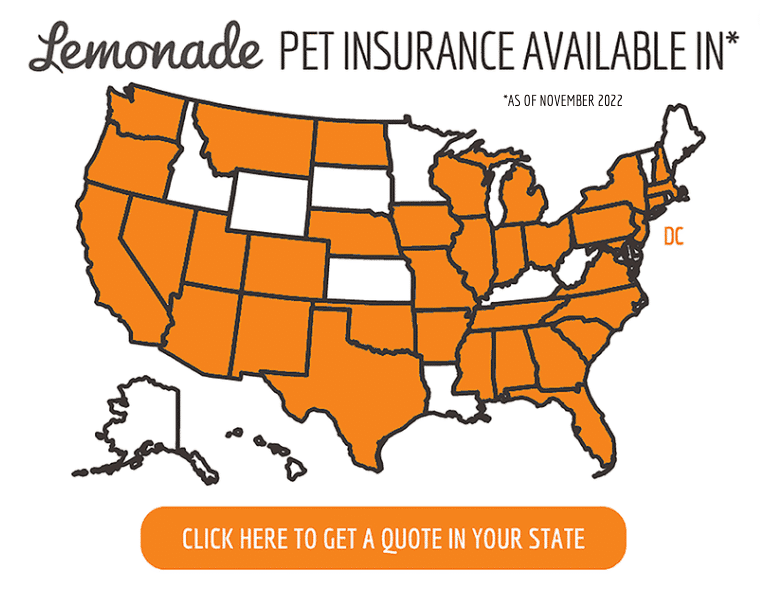

- Only available in 37 states and DC

- Not covered when traveling with your pet outside of the U.S.

- Doesn’t enroll some breeds once they hit a certain age, but they never terminate coverage for pets as they age

Key Features

- Underwriter: Lemonade Insurance Agency LLC

- A.M. Best rating (a measure of financial stability): Unrated

- Requires a full medical exam from the past 12 months for pets older than one

- Bilateral exclusions (a condition or disease that affects both sides of the body) are considered pre-existing

- Claims process:

- You can only submit claims through their app, and you must file claims within 180 days of an accident or illness occurring

- Claim processing averages 2 days

- Direct deposit and check options available for repayment

- Also offers homeowners and renters insurance, and you can get a 10% discount if you bundle pet insurance with one of these other policies

- Doesn’t offer pre-approval of estimates/procedures in advance of treatment

- Covers curable pre-existing conditions that are considered cured after 1 year (chronic and knee-related conditions are exempt from coverage)

Where Is Lemonade Pet Insurance Available? (Map)

Customer Service Options & Hours

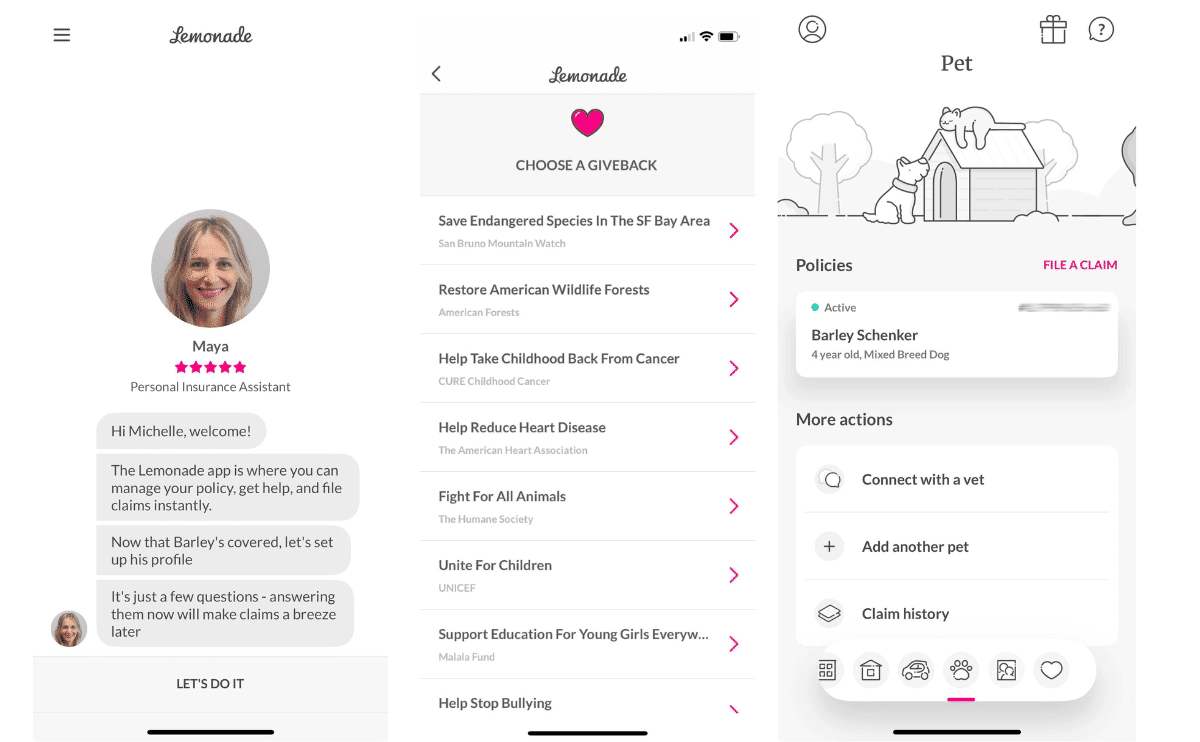

Lemonade offers fewer customer service options than most pet insurance providers because it’s structured largely as a digital company. All claims are handled through its app, which has an AI-driven chatbot.

- Phone: 1-844-733-8666

- Email: help@lemonade.com

- Monday-Friday: 8am-8pm EST

- Saturday & Sunday: Closed

- Live chat with medical experts on the app

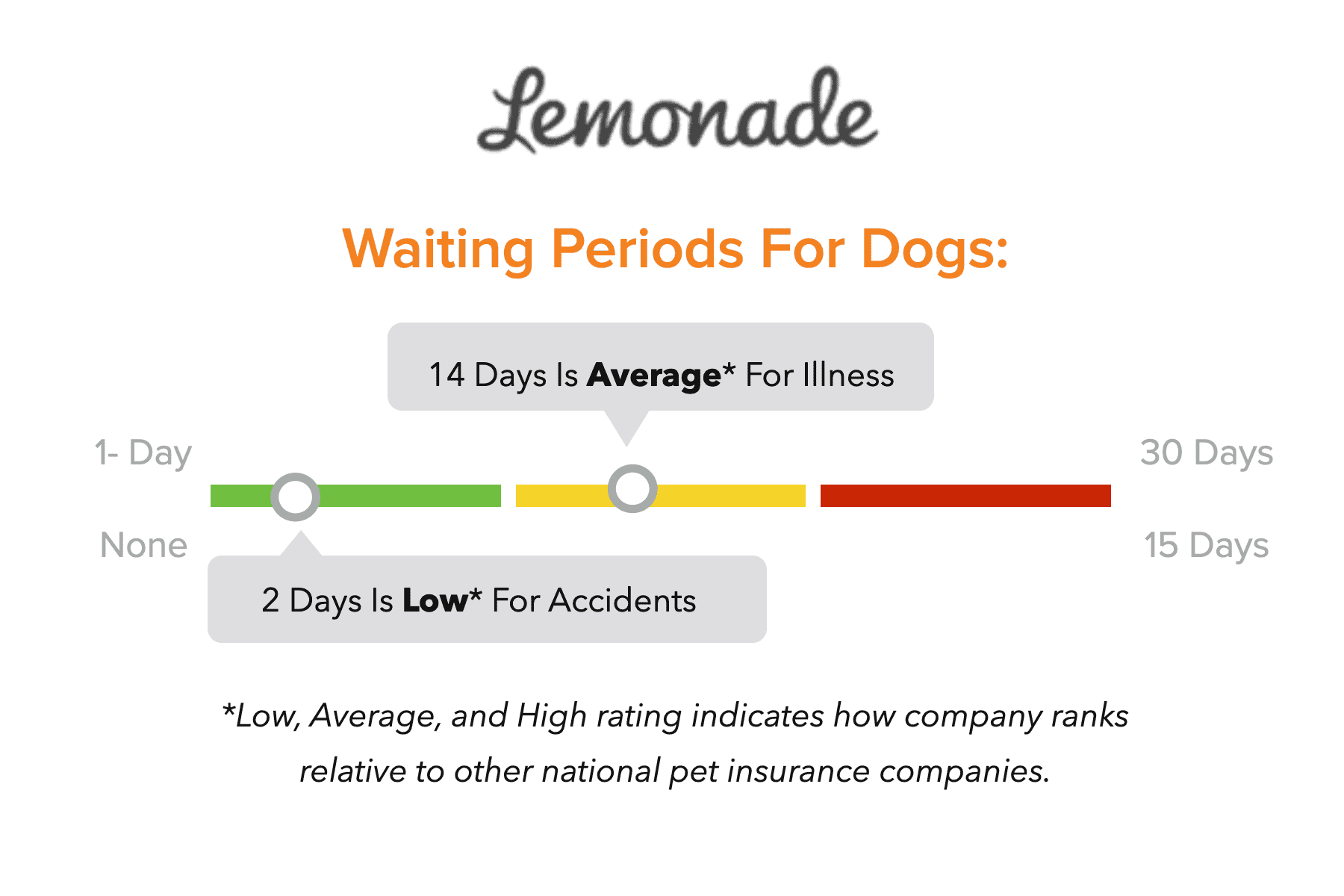

Waiting Periods*

- Accidents: 2 days

- Illnesses: 14 days

- Cruciate Ligament Events (bilateral exclusion for pre-existing cruciate ligament injuries and lameness): 6 months

- Hip Dysplasia: 14 days

- Wellness: 1 day

*Waiting periods for California, Delaware, Louisiana, Maine, Mississippi, Nebraska, New Hampshire, and Washington are as follows:

- Accidents - 0 days

- Illnesses - 14 days

- Cruciate Ligament Conditions - 30 days

- Routine Care - 0 days

What Does Lemonade Cover?

Please know that none of the providers in our pet insurance reviews cover pre-existing conditions, pregnancy and breeding, or unnecessary cosmetic procedures.

All of them cover the following items when deemed medically necessary: emergency care, surgery and hospitalization, specialized exams and specialty care, X-rays, blood tests, ultrasounds, cat scans, MRIs, rehabilitation, cancer, chronic conditions, euthanasia, hereditary conditions, congenital conditions, non-routine dental treatment, and prescription medications. However, this coverage may have limitations, so please check your policy.

| Condition | Covered By Lemonade |

|---|---|

| Behavioral Therapies | Extra Fee |

| Alternative/Holistic Therapies | |

| Exam Fees | Extra Fee |

| Wellness Care | Extra Fee |

Optional Coverage

Lemonade also offers optional add-ons.

Vet Visit Fees

For an additional fee, you can purchase coverage for vet visits pertaining to eligible accidents or illnesses.

Physical Therapy

For an extra fee, you can purchase supplemental coverage for physical treatments such as acupuncture, chiropractic care, and more.

Dental Illness

For coverage of an additional $1,000 limit toward dental illness such as gum disease or stomatitis, you can add on to your policy.

End Of Life & Remembrance

Lemonade will cover euthanasia, cremation, and memorial items totaling up to $500 if you purchase this add-on.

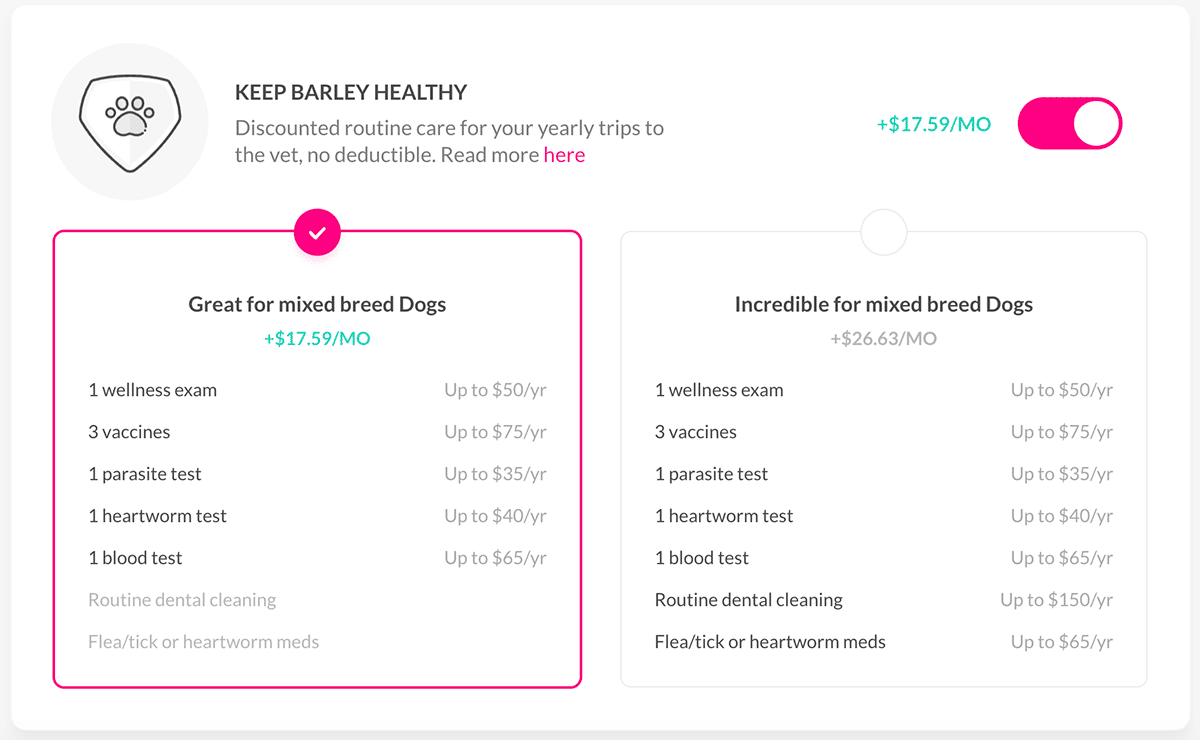

Preventative Care Plan

You can add-on preventative coverage for your pet to get up to 80% covered costs with no deductible. Lemonade’s Preventative Care plans may vary based on your location, pet species/breed, age, etc.

| Great For Dogs & Cats | Ideal For Dogs & Cats | Great For Puppies & Kittens | |

|---|---|---|---|

| Price Per Month For Canines | $16 | $24.33 | $44 |

| Price Per Month For Felines | $10 | $16 | $34 |

| Wellness Exam | 1 up to $50 | 1 up to $50 | 2 up to a total of $100 |

| Fecal or Internal Parasite Test | 1 up to $35 | 1 up to $35 | 2 up to a total of $70 |

| Vaccines or Boosters | 3 up to a total of $75 | 3 up to a total of $75 | 6 up to a total of $150 |

| 1 Heartworm or FeLV/FIV Test | |||

| 1 Blood Test | |||

| Spay/Neuter | |||

| Microchip | |||

| Flea/Tick or Heartworm Meds | |||

| Routine Dental Cleaning |

Pricing Quotes

Lemonade has no one-time fees or monthly transaction fees. Your monthly premium is based on the deductible, reimbursement percentage, and annual payout options that you choose from the table below.

| Deductible Options | Payout Options | Reimbursement Options |

|---|---|---|

| $100 $250 $500 | $5,000 $10,000 $20,000 $50,000 $100,000 | 70% 80% 90% |

Pricing is also based on your pet’s details (age, breed, location, pre-existing conditions, etc.). We recommend obtaining quotes from Lemonade for your specific pet to get an idea of how much a policy would cost you.

You can also use our pet insurance quote form below to see how top providers compare for your actual pet.

Discounts

Lemonade offers the following discounts:

- 10% off if you bundle with your renters, homeowners, auto, condo, or co-op insurance

- 5% off for multiple pets

- 5% off if you pay annually

Use this link to take advantage of the best possible price. No promo code is needed.

Our Experience With Lemonade Pet Insurance

Michelle Schenker, a dog mom and co-founder of Canine Journal, shopped around for the best insurance policy for her dog. Here is her experience and why she chose Lemonade as her pet insurance provider.

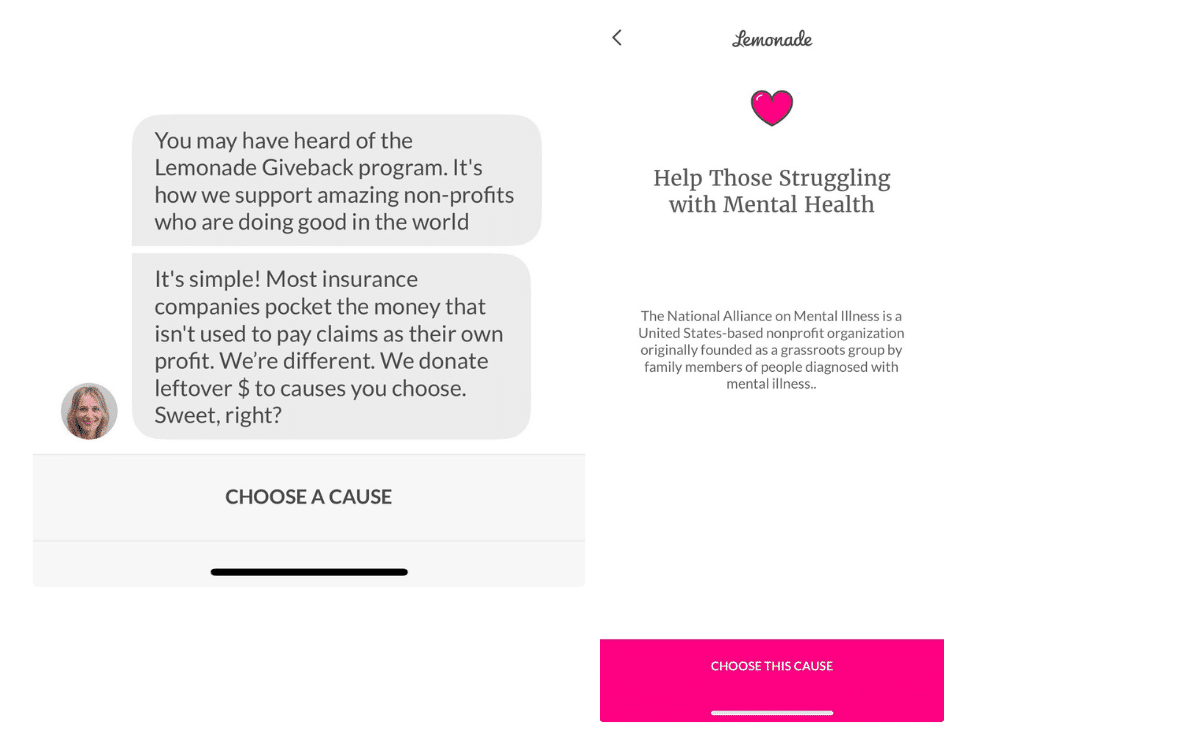

When shopping for pet insurance for our 4-year-old mixed-breed dog, Barley, I got quotes from 10 companies offering great coverage. Lemonade’s prices were hard to beat, and I knew they would offer the coverage we sought. We also like that NAMI is among the charities you can contribute to as a customer.

Fortunately, I haven’t had to file any claims for Barley, and I hope I never have to. But I feel good knowing that if he suffered an accident or illness, he’d be insured through Lemonade.

How Did The Lemonade Quote Compare Against Other Pet Insurers?

Below are the quotes I got from ten different pet insurance companies. Coverage is for accidents and illnesses and pricing does not include a wellness plan. Lemonade was the least expensive for both accident and illness coverage.

How Is Lemonade’s Business Model Unique?

Lemonade isn’t your traditional insurance company in several ways. See how they stand out for their AI-driven process, digital claims processing, and commitment to charitable contributions in this four-minute video of Lemonade’s CEO, Daniel Schreiber, on CNBC.

You Can Bundle Several Insurance Policies With Lemonade

One of the biggest differentiators with Lemonade is that it also offers renters, homeowners, car, and life insurance, so you can bundle your pet insurance with your other policies. This can simplify things instead of having several insurance companies for your assets. Best of all, Lemonade offers a 10% discount if you bundle your pet insurance with another policy.

Artificial Intelligence Allows For Speedy Claim Processing

Lemonade is able to process many of its claims within minutes of submission because of the use of artificial intelligence. For more straightforward claims, you may see a near-instantaneous approval of your claim submission. However, more complicated claims may take a couple of days. But this is still an excellent claim processing average and among the fastest in the industry.

How Does The Claim & Reimbursement Process Work?

Lemonade uses a “copay then deductible” reimbursement method. This is calculated in the following manner:

- (Eligible vet expenses x Reimbursement percentage) – Remaining annual deductible = Reimbursement amount

Let’s say you chose a $100 deductible with an 80% reimbursement percentage. You take Fido to the vet, and the vet bill is $200. Out of this total, $40 are for the vet visit fee, which is ineligible for coverage unless you opt for the Vet Visit add-on. That means $160 is eligible for coverage, so here’s how your reimbursement would be calculated.

- $160 (eligible vet expenses) x 80% (reimbursement percentage) – $100 (remaining annual deductible) = $28 (reimbursement amount

Now that your deductible has been met, any future eligible vet expenses for the policy period will not require you to pay the deductible again.

How To Sign Up With Lemonade

Lemonade’s sign-up process is extremely simple. Go to Lemonade’s website and click “Check Our Prices.” Lemonade will ask you basic questions like if you’re an existing Lemonade customer, your name, your pet’s name, dog or cat, address, age, gender, breed, weight, and more.

You can then choose your coverage and add any extra coverage (e.g., vet visit fees, physical therapy, behavioral conditions, dental illness, and end-of-life and remembrance).

After you’ve signed up, you’ll want to note the Start Date and Waiting Periods for your policy. Michelle had the following waiting periods in North Carolina, but these vary by the state laws adopted, so yours could be different.

- Accidents: 2 days (11/19/2023)

- Illnesses: 14 days (12/1/2023)

- Cruciate Ligament Events: 6 months (5/17/2024)

Lemonade vs Other Companies

Interested in seeing how Lemonade stacks up against other popular pet insurance companies? We’ve written comparison articles for you to see how Lemonade and other leading pet insurance companies compare in coverage, customer service and reputation, claim processing, plan customization, and price.

- Lemonade vs Embrace

- Lemonade vs Healthy Paws

- Lemonade vs Nationwide

- Lemonade vs Pets Best

- Lemonade vs Pumpkin

- Lemonade vs Trupanion

What’s Our Final Verdict?

Because Lemonade is so new to the pet insurance industry, there’s still a lot of room for this company to experience changes before establishing a solid reputation for handling claims and customer issues. However, their current pricing, coverage, and flexible policies are worth considering if you’re comfortable with fewer customer service options.

If you’re unsure if Lemonade is the right pet insurance provider for you or if it’s not available in your state, you’ve got lots of options. Check out our comparison of pet insurance companies to learn about other national providers. We compare the top ten pet insurance providers and rank them, explaining each company’s strengths and weaknesses. We also have many comparison tables to help you see where pet insurance companies differ. We answer frequently asked questions, walk you through a pet insurance claim example, list out all of your pet insurance options in an easy-to-digest directory format, and more. We’re sure we can answer all your pet insurance questions, so you feel equipped to make the best decision for your pet.

Why Trust Canine Journal?

Canine Journal has been covering the topic of pet insurance since 2012, well before other conglomerates discovered the rising popularity of health care for our pets. Many of our authors have personal experience with pet insurance, including Kimberly Alt, who has been Canine Journal’s go-to author for pet insurance for over a decade, having written about nearly every possible facet related to pet insurance. Kimberly knows the subject so well that she can answer a breadth and depth of pet insurance questions immediately. And on the rare occasion she doesn’t know the answer off the top of her head, she can find it within minutes due to her extensive list of resources.

Kimberly also consulted with Michelle Schenker, Canine Journal’s in-house licensed insurance agent, for additional expertise, to ensure accuracy, and give Canine Journal the authority to write about and assist readers in purchasing policies legally.

Tagged With: Reviewed By Insurance Agent