This content was reviewed by our licensed insurance agent, Michelle Schenker.

When you purchase through links on our site, we may earn a commission. Here’s how it works.

Pets Best and Lemonade Pet Insurance have both caused positive disruptions in the pet insurance marketplace. Pets Best entered the industry with low prices and excellent coverage, instantly attracting customers to purchase a policy from them. Meanwhile, Lemonade introduced the quickest way to payout claims using artificial intelligence. But is one of these innovative companies better than the other?

We compare Pets Best and Lemonade head-to-head and choose a winner. We explain our reasoning along with each company’s strengths and weaknesses.

Remember, you should always get quotes for your specific pet and location and read the policy before signing up. Ultimately, we feel that coverage should be a leading factor for you to consider before purchasing, but we also realize that cost is important.

| Pets Best | Lemonade | |

|---|---|---|

| Policy Coverage | Extensive | Limited |

| Customer Service & Reputation | Good | Uncertain, New |

| Claim Processing Average | 18-30 Days | 2 Days |

| Average Policy Price | Lower | Average |

| Plan Customizations | Many | Many |

| Overall Winner | ||

| Get Pets Best Quote | Get Lemonade Quote | |

| Compare Quotes | Compare Quotes |

Policy Coverage

Policy Coverage Winner

The table below shows what Lemonade Pet Insurance and Pets Best cover.

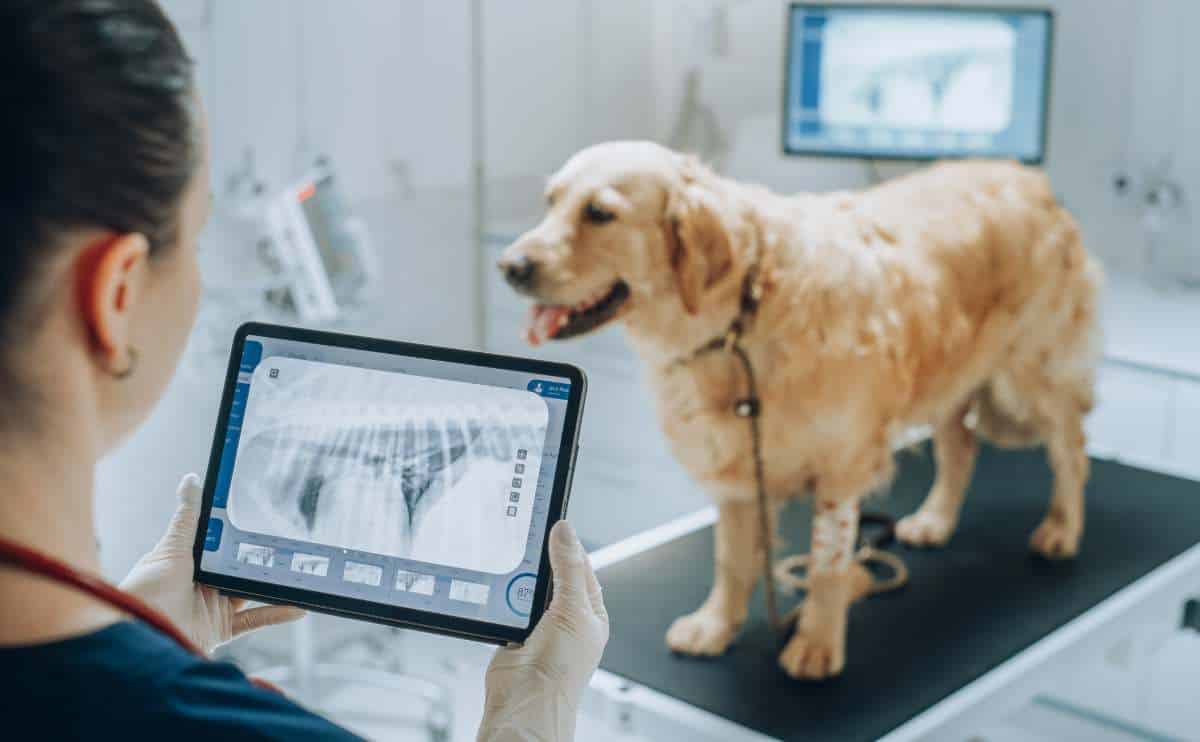

Note: Both companies cover emergency care, surgery and hospitalization, specialized exams and specialty care, X-rays, blood tests, ultrasounds, cat scans, MRIs, rehabilitation, cancer, chronic conditions, euthanasia, hereditary conditions, congenital conditions, non-routine dental treatment, and prescription medications.

Neither covers pre-existing conditions, burial costs, pregnancy and breeding, or unnecessary cosmetic procedures.

| Pets Best | Lemonade Pet Insurance | |

|---|---|---|

| Illness Waiting Period* | 14 Days | 14 Days |

| Accident Waiting Period* | 3 Days | 2 Days |

| Hip Dysplasia Waiting Period* | 14 Days | 14 Days |

| CCL Surgery Waiting Period* | 6 Months | 6 Months |

| Behavioral Therapies | Extra Fee | |

| Alternative/Holistic Therapy | ||

| Wellness Care For An Extra Fee | ||

| Cremation | Extra Fee | |

| Exam Fees | Extra Fee | Extra Fee |

| Underwriter | American Pet Insurance Company Independence American Insurance Company (IAIC) (CA only) | Lemonade Insurance Agency LLC |

| A.M. Best Rating | Unrated & A- | Unrated |

*Waiting periods for California, Delaware, Louisiana, Maine, Mississippi, Nebraska, New Hampshire, and Washington are as follows:

- Accidents - 0 days

- Illnesses - 14 days

- Cruciate Ligament Conditions - 30 days

- Routine Care - 0 days

Pets Best comes out ahead in this category because it offers behavioral therapy coverage at no extra cost. Meanwhile, Lemonade has some breed and plan restrictions for specific ages.

Additionally, Pets Best is available in all 50 states, whereas Lemonade is only available in 37 states and Washington, D.C. Because of this geographic limitation, Pets Best wins this category.

Customer Service & Reputation

Customer Service & Reputation Winner

Lemonade Pet Insurance was founded in 2020, so it’s hard for us to gauge if they will offer consistent coverage and pricing for the long haul. It doesn’t have the longstanding reputation that Pets Best has (founded in 2005).

As for Pets Best, its biggest complaint is its long claim processing times at present. Pet parents are impressed with Pets Best’s thorough coverage and lower prices, which is why so many sign-up.

However, this results in more filed claims, overloading their system and delaying claim processing. Fortunately, Pets Best is actively hiring and training more people to return to a more competitive claim processing timeline, and we’ve already witnessed vast improvements.

Claim Processing

Claim Processing Winner

Lemonade averages two days for claim processing, a speedy timeline compared to competitors. A big selling point for Lemonade is that it has an Artificial Intelligence (AI) -driven claim process. AI allows Lemonade to pay the most straightforward claims within seconds of submission. This has really disrupted the pet insurance space and caused competitors to look for ways to step it up.

Pets Best averages 18-30 days for claim processing, which is longer than many others in the industry. However, Pets Best also offers an option to pay vets directly, so you don’t have to wait for reimbursement. This may be a good option if you don’t want to wait for your claim to be processed. But be sure to confirm your vet can work in this manner before you make any assumptions.

Price Of Policy

Price Of Policy Winner

Lemonade doesn’t have any one-time or recurring transaction fees. It offers a 5% discount if you pay your premium annually. On the other hand, Pets Best has no enrollment fee but does charge a $2 monthly transaction fee unless you pay your annual premium upfront.

Your premium price quote is based on your pet’s details (age, breed, location, etc.). We recommend obtaining quotes from each company for your specific pet using our free tool below. You can also visit our pet insurance comparison quotes to see a few sample prices we’ve gathered.

Pets Best almost always came out less expensive than Lemonade in the quotes we’ve run. However, remember that it’s always best to get quotes for your specific dog to compare what pet insurance could cost you since they can vary widely. You can use our pet insurance quote form to get multiple company quotes when you complete this one quick form.

Coupons

Pets Best

Pets Best offers the following discounts:

- 5% off for multiple pets

- 5% off for military members and their families

Use this link to take advantage of the best possible price. No promo code is needed. You can also visit our dedicated Pets Best promotions page to learn more.

Lemonade Pet Insurance

Lemonade offers the following discounts:

- 10% off if you bundle with your Lemonade renters, homeowners, auto, condo, or co-op insurance

- 5% off for multiple pets

- 5% off if you pay annually

Use this link to take advantage of the best possible price. No promo code is needed.

Plan Customization

Plan Customization Winner

Finding a company with the coverage you need that fits your budget is crucial. Look below to see what plan options each of these providers offer.

| Pets Best | Lemonade | |

|---|---|---|

| Deductible Options | $50, $100, $200, $250, $500, $1,000 | $100, $250, $500 |

| Payout Options | $5,000, Unlimited | $5,000, $10,000, $20,000, $50,000, $100,000 |

| Reimbursement Options | 70%, 80%, 90% | 70%, 80%, 90% |

Both companies offer multiple plan customizations to help you find the best option for your budget. And although Lemonade provides numerous payout choices, it’s disappointing there’s no unlimited option for customers who prefer no limit on their annual coverage amount. Because of this, Pets Best wins this category.

What’s The Verdict?

Overall Winner

Overall, Pets Best wins our comparison due to its thorough coverage, low prices, and customization options. However, we always recommend getting multiple quotes from pet insurance providers, so it’s good to consider Lemonade too. And if fast reimbursement is crucial to your financial situation, definitely keep Lemonade in mind.

If you didn’t find what you were looking for, our experts dig even deeper into each company in our individual reviews of Lemonade and Pets Best.

Our experts have spent thousands of hours researching to bring you our comprehensive and frequently updated pet insurance reviews, including our top picks and details on each of the most popular pet insurance companies. We give awards for the best value, multi-pet discounts, fastest claim processing, and best newcomer. You’ll even see winners for exotic pets and cats.

Tagged With: Reviewed By Insurance Agent, Vs