This content was reviewed by our licensed insurance agent, Michelle Schenker.

When you purchase through links on our site, we may earn a commission. Here’s how it works.

Pets Best offers many ways to customize your plan to fit your budget. With inflation driving the price of everything up, it’s nice to have control over how much your pet insurance costs without sacrificing coverage. If waiting on reimbursement is an issue for you, you can utilize Pets Best’s Vet Direct Pay option.

Let’s dive deeper into what you can expect from Pets Best, including price, coverage, customer service, claim processing, customization options, and more. I even share personal experience from someone on our team who has unfortunately filed eight claims with Pets Best during one policy period.

- Pets Best Overall Rating

- What Does Pets Best Accident Insurance Cover?

- What Does Pets Best Accident & Illness Plans Cover?

- How Is Pets Best's Pricing Determined?

- Does Pets Best Have Any Discounts?

- Customer Service Options & Hours

- What Do Customers Think Of Pets Best?

- How Do I Submit A Claim To Pets Best?

- What Are The Most Common Claims Submitted To Pets Best?

- Who Is The Underwriter For Pets Best Insurance?

- What Are Pets Best's Waiting Periods*?

- Does Pets Best Offer Wellness Plans?

- Our Personal Experience With Pets Best

- Frequently Asked Questions About Pets Best

- Pets Best vs Other Companies

- Our Final Verdict On Pets Best

- Methodology

- Why Trust Canine Journal?

Pets Best Overall Rating

Pets Best Review

Product Name: Pets Best Insurance

Product Description: Pets Best offers pet insurance for dogs and cats.

Summary

Pets Best is a popular pet insurance pick among pet parents due to its lower quotes and extensive coverage. If your budget is tight, you can purchase an accident-only plan from Pets Best. If routine expenses are a concern, you may be interested in adding a wellness plan to your insurance policy. There are many ways to customize your plan to fit your needs and budget.

Overall Score

Pros

- No lifetime limits on any plan

- Competitive pricing

- Discounts available for multi-pets and military

- Multiple forms of customer support

- Electronic claim filing and direct deposit options

- 30-day money-back guarantee

- No upper age limits (pets must be 7 weeks or older)

- Your pet is covered when they travel with you in the U.S., Canada, and Puerto Rico

- Optional wellness plan

- No exam is required at enrollment

- Can transfer ownership of a pet, and pet insurance coverage will continue if the new pet owner contacts the company within 30 days

Cons

- $2 transaction fee (waived if pay annually or live in MD or AK)

- Alternative/holistic therapies are not covered

- Average claim processing is longer than competitors

What Does Pets Best Accident Insurance Cover?

Pets Best offers several plans to fit your needs and budget, including an accident-only plan and varying accident and illness plans. Let’s review Pets Best’s accident-only plan first and provide examples of covered accidents, including diagnostics and treatment.

Pets Best is one of the few pet insurance companies that offer an Accident Only plan. It doesn’t cover any illnesses, routine care, acupuncture, or chiropractic care. This plan has a flat rate of $9 per month for dogs and $6 per month for cats. Pets Best’s Accident Only plan has a 3-day waiting period before coverage kicks in. Plan coverage details are:

- Deductible: $250

- Reimbursement Rate: 90%

- Annual Payout Coverage Limit: $10,000

Examples of covered accidents include, but are not limited to:

- Bite (by animal, insect, snake, etc.)

- Broken bones

- Cuts

- Dental trauma

- Exam fees (for covered accidents)

- Foreign body ingestion

- Hit by vehicle

- Poisoning

- Prescription medications

- Torn nail

Note: This plan does not cover torn ligaments (i.e., cruciate ligament tears).

Diagnostics & Treatment

Examples of covered diagnostics and treatment related to accidents include, but are not limited to:

- CT scans

- Emergency care

- Medication injections

- MRIs

- Outpatient care

- Prescription medications

- Surgery & hospitalization

- Specialty care

- X-rays

Note: Acupuncture and chiropractic treatment are not covered in this plan.

Accident Only Plan Exclusions

Below is a list of the major conditions and services Pets Best excludes in their Accident Only plan:

- Acupuncture

- Cancer

- Chiropractic care

- Cruciate ligament tears

- Diseases

- Illnesses

- Infectious bacterial or viral disease

- Metabolic disorder

- Parasitic infection

- Routine care

What Does Pets Best Accident & Illness Plans Cover?

Pets Best offers three accident and illness packages. Essential is the basic plan, followed by Plus and Elite plans. Plus is a level up from Essential and covers exam fees, and Elite is a level up from Plus and covers rehab, acupuncture, and chiropractic care. The table below highlights the key differences between the plans.

| Condition | Essential | Plus | Elite |

|---|---|---|---|

| Accidents, Illnesses, Cancer, Hereditary Conditions, Emergency Care, Surgeries & Rx Meds | |||

| Accident & Illness Exam Fees | |||

| Rehabilitative, Acupuncture & Chiropractic Coverage |

These Pets Best policies cover many of the same diagnostics, conditions, and treatments as other insurers. Everything included above in the Accident Only plan is included in Pets Best’s accident and illness plans. Additionally, illness-related conditions where treatment is deemed medically necessary are eligible for coverage as long as it is not pre-existing, excluded, or occurring during the waiting period. Examples of covered illnesses include, but are not limited to:

- Allergies

- Arthritis

- Behavioral therapies

- Cancer

- Chronic conditions

- Congenital conditions

- Cruciate ligament tears

- Diabetes

- Ear infections

- Euthanasia

- Gastrointestinal issues (e.g., vomiting, diarrhea)

- Hereditary conditions

- Hip dysplasia

- Urinary tract infection

Diagnostics & Treatment

Examples of covered diagnostics and treatment include, but are not limited to:

- Blood tests

- CT scans

- Emergency care

- MRIs

- Prescription medications

- Surgery & hospitalization

- Specialty care

- Ultrasounds

- X-rays

Unique Coverage

Pets Best covers curable pre-existing conditions that are healed or are curable and require no further treatment (e.g., broken legs, kennel cough, etc.). This isn’t something widely offered by all insurance companies.

Pets Best Insurance Exclusions

Below is a list of the major conditions and services Pets Best excludes in insurance policies:

- Alternative and holistic treatments

- Ambulance transportation

- Bilateral conditions (a condition or disease that affects both sides of the body) if your pet had any pre-existing conditions on either side of the body

- Breeding and conditions related to pregnancy

- Cremation and burial

- Cruciate ligaments during the first 6 months of the policy

- Elective, cosmetic, and preventive procedures (e.g., tail docking, dewclaw removal, ear cropping)

- Endodontic treatments and extractions if any pre-existing dental disease

- Endodontic treatment for teeth other than the canines and carnassials

- Food

- Herbal, holistic, and experimental therapies and medications

- Intervertebral disc conditions if your pet had any pre-existing condition involving the intervertebral discs due to degeneration or trauma

- Medications (prescription or over-the-counter) that aren’t included in their formulary of covered meds

- Parasites (e.g., heartworms, fleas, ticks, roundworms, tapeworms, hookworms)

- Pre-existing conditions

- Prophylaxis (i.e., scaling, cleaning, and polishing of the teeth)

- Routine care

- Special diets

- Tooth extractions for deciduous teeth, dentigerous cysts, enamel hypoplasia, and unerupted teeth if your pet is enrolled after they’re six months old

- Vitamins and supplements

How Is Pets Best’s Pricing Determined?

Pets Best has no one-time fees and a $2 transaction fee for every payment (waived if you pay annually or live in AK or MD). Your monthly premium is based on the deductible, reimbursement percentage, and annual limit options that you choose from the table below.

| Deductible Options | Payout Options | Reimbursement Options |

|---|---|---|

| $50 $100 $200 $250 $500 $1,000 | $5,000 Unlimited | 70% 80% 90% |

Pricing is also based on your pet’s details (age, breed, location, pre-existing conditions, etc.). I recommend obtaining quotes from Pets Best for your specific pet to get an idea of how much a policy would cost you.

You can also use our pet insurance quote form below to see how top providers compare for your actual pet.

Does Pets Best Have Any Discounts?

Pets Best offers the following discounts:

- 5% off for multiple pets

- 5% off for military members and their families

Use this link to take advantage of the best possible price. No promo code is needed.

Customer Service Options & Hours

You can reach Pets Best’s support team via phone, email, live chat, mail, and fax. Hours are Monday through Friday from 6 a.m. to 7 p.m. MST and Saturday from 6 a.m. to 2 p.m. MST. Pets Best’s customer support is closed on Sundays.

Pets Best also has an extensive FAQ section on its website and a 24/7 Pet Helpline for policyholders. The latter allows you to speak with a vet expert day or night about your pet’s health or behavioral concerns.

What Do Customers Think Of Pets Best?

I scoured the internet for Pets Best reviews and here is what customers had to say about them.

Praise From Pet Owners

The positive reviews for Pets Best primarily discuss the excellent coverage and competitive pricing. Many policyholders sign up for Pets Best after having a previous policy with another insurer that has significantly increased premiums at renewal. Customers are pleased with their coverage and state Pets Best follows through with their promises, noting that reading the contract is integral.

Policyholder Complaints

By far, customers’ most significant issue with Pets Best is the time it takes for claims to be processed and for them to receive reimbursement. I read hundreds of online reviews, and the vast majority of negative ones were about this.

To explain how this came to be, Pets Best had an influx of new customers during the COVID-19 pandemic in conjunction with a staffing shortage. As a result, more claims were being submitted than they were used to which caused a backlog of claims.

I’ve spoken to Pets Best about this extensively over the past few years and have been told that they are actively investing in hiring more people and improving their process and technology to improve the flow of claims. Today, Pets Best claim processing averages 18-30 days.

How Do I Submit A Claim To Pets Best?

Before submitting a claim, you’ll need a copy of your dog’s medical records detailing their medical history. You’ll also need a copy of your finalized invoice from your vet showing what your dog was treated for and how much it cost. The invoice must show a zero balance for Pets Best to accept it.

Claims must be submitted within 180 days of the service date via Pets Best’s mobile app, online, mail, email, or fax. Pets Best typically processes claims within 18-30 days. You can be reimbursed by check or direct deposit.

Watch this quick video to see how easy the claim submission process is (from a current customer).

Vet Direct Pay

Pets Best can pay your vet directly through its Vet Direct Pay feature. To do so, you must send them a signed copy of the veterinarian reimbursement release form along with your completed claim. This option eliminates waiting for Pets Best to reimburse you directly for covered services.

How Does Pets Best Reimbursement Work?

Pets Best uses a “copay then deductible” reimbursement method. This is calculated in the following way:

- (Eligible vet expenses x Reimbursement percentage) – Remaining annual deductible = Reimbursement amount

Claim Reimbursement Example

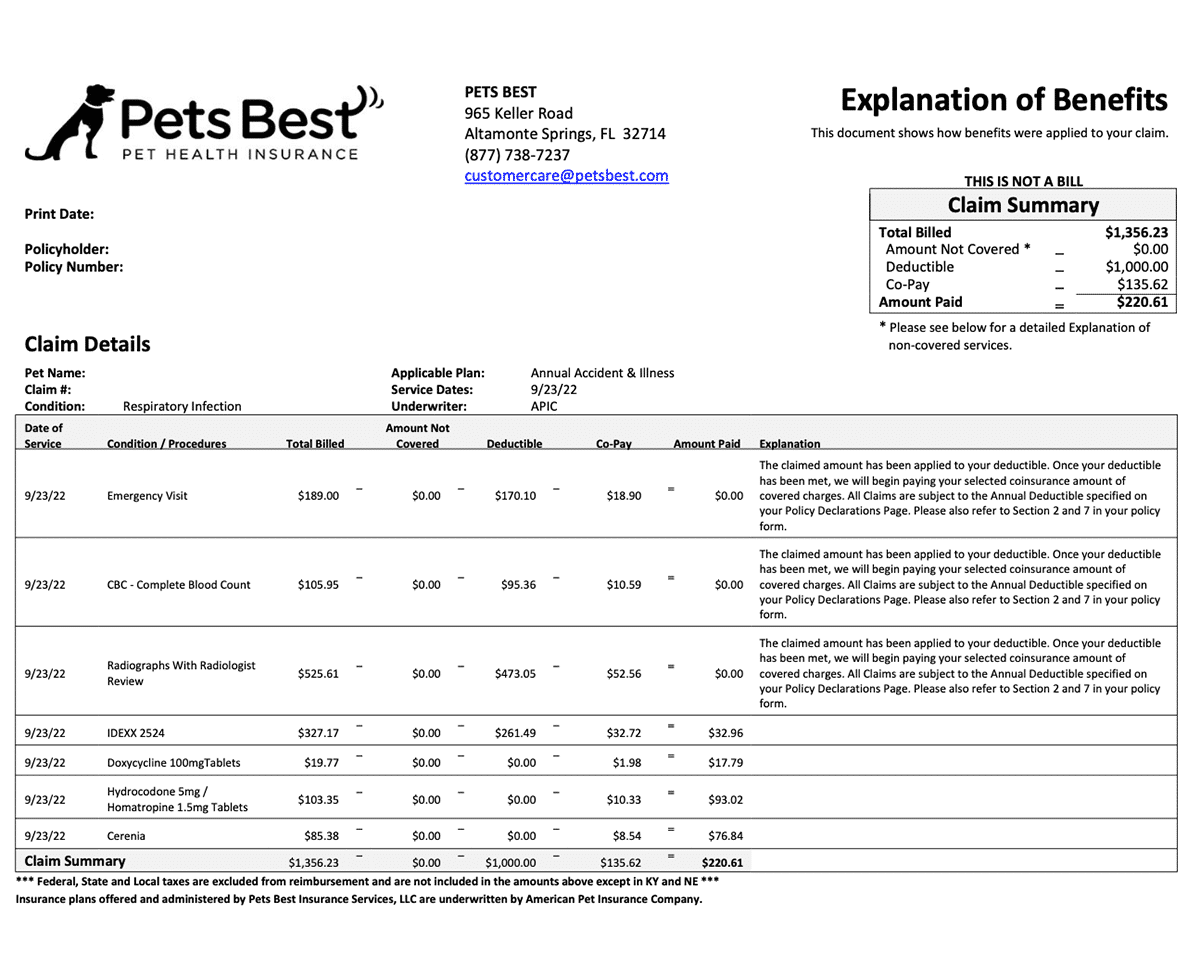

For example, let’s say your dog gets kennel cough, and the vet bill includes sick exam fees, blood work, and other diagnostic testing. Your plan has 90% coverage, a $1,000 deductible, and unlimited annual payouts.

- You pay the total vet bill to your vet’s office, which is $1,356.23 in this example.

- In your Pets Best account under Claim Center -> Submit a Claim, you fill out the information asked for (type of claim, date of vet service, health condition, name of vet clinic) and upload the paid itemized vet bill.

- A Pets Best specialist reviews the claim and your policy coverage to determine any eligible reimbursement. If the claim is approved, you will receive an email with an Explanation of Benefits (EOB) showing how your benefits were applied to your claim.

- In this case, the waiting period has passed, and kennel cough qualifies as an illness with no pre-existing conditions, so you receive the following reimbursement:

- [$1,356.23 (eligible vet expenses) x 90% (reimbursement percentage)] – $1,000 (remaining annual deductible) = $220.61 (reimbursed amount)

- Any eligible vet bills will be reimbursed 90% for the remainder of the policy period. Only 10% will be due out of pocket because the deductible has been met for the year.

What Are The Most Common Claims Submitted To Pets Best?

| Average Cost For Dogs | Average Cost For Cats | |

|---|---|---|

| Cancer | $4,137 | $3,282 |

| Stomach Foreign Object | $3,262 | $2,955 |

| Diabetes | $2,892 | $1,634 |

| Broken Bone | $2,371 | $2,257 |

Who Is The Underwriter For Pets Best Insurance?

Pets Best has two underwriters, Independence American Insurance Company (IAIC) and American Pet Insurance Company (APIC). IAIC has an A- rating from A.M. Best (a measurement of financial stability), and APIC is unrated.

Pets Best is working toward having all of its policies underwritten by IAIC. New Jersey and New York are states pending approval for implementation and are still underwritten by APIC. At this time, Pets Best does not plan on transitioning new policy sales in Washington to IAIC, but it will continue to be an APIC product.

What Are Pets Best’s Waiting Periods*?

Insurers utilize waiting periods to help determine pre-existing conditions sustained before obtaining insurance. If a pet owner misrepresents their pet’s condition during the enrollment process, they are guilty of insurance fraud, which is a felony in most U.S. states.

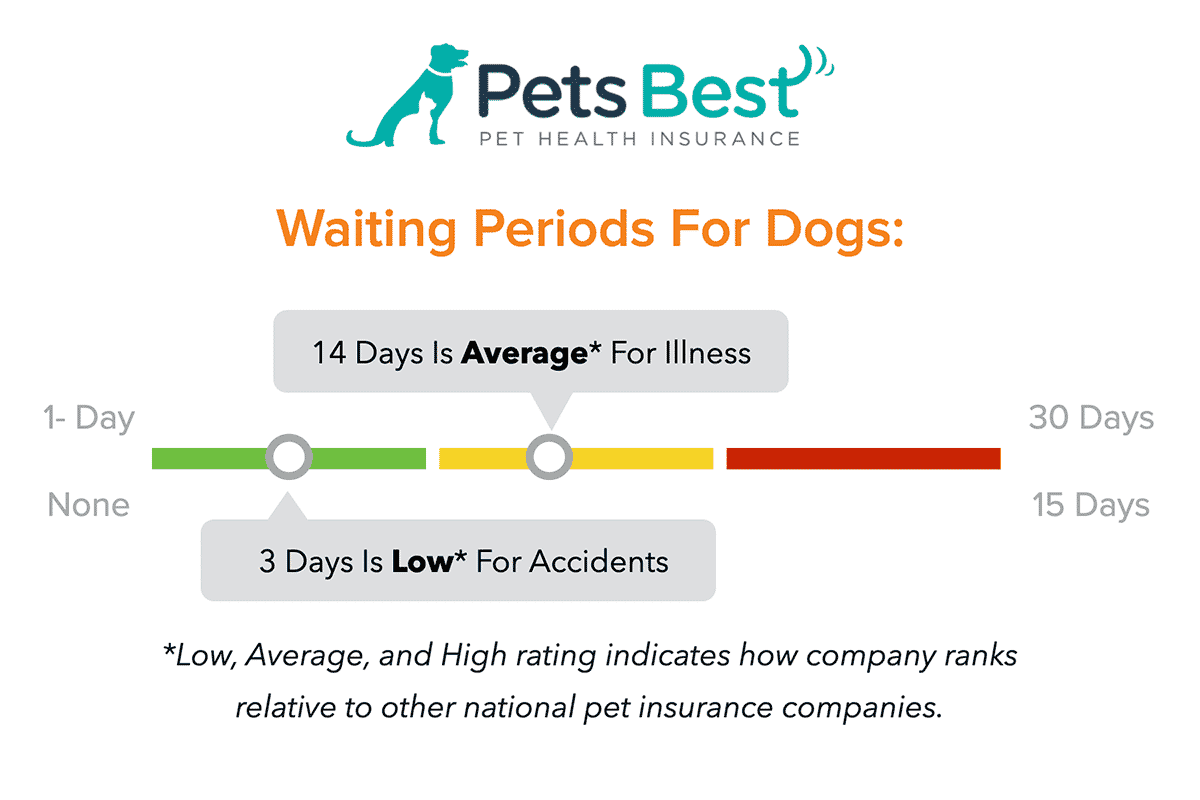

Pet insurance companies have waiting periods for accidents and illnesses. Pets Best’s waiting period for illnesses is 14 days and 3 days for accidents, which are also the industry averages.

Some providers have additional waiting periods for more serious health issues (e.g., CCL tears, Intervertebral Disc Disease [IVDD], hip dysplasia, etc.). Pets Best has a 6-month waiting period for cruciate ligaments, and if you sign up for a wellness plan, there is a 1-day waiting period.

*Waiting periods for California, Delaware, Louisiana, Maine, Mississippi, Nebraska, New Hampshire, and Washington are as follows:

- Accidents - 0 days

- Illnesses - 14 days

- Cruciate Ligament Conditions - 30 days

- Routine Care - 0 days

Waiting periods for North Dakota are as follows:

- Accidents – 3 days

- Illnesses – 14 days

- Cruciate Ligament Conditions – 30 days

- Routine Care – 0 days

Does Pets Best Offer Wellness Plans?

Pets Best offers two wellness plans, as shown in the table below. The maximum amounts that Pets Best will pay yearly for that specific routine care are included.

| EssentialWellness | BestWellness | |

|---|---|---|

| Price Per Month | $14 – $21.75 | $26 – $32.58 |

| Spay/Neuter – Teeth Cleaning | $0 | $150 |

| Rabies | $15 | $15 |

| Flea/Tick Prevention | $50 | $65 |

| Heartworm Prevention | $30 | $30 |

| Vaccination/Titer | $30 | $40 |

| Wellness Exam | $50 | $50 |

| Heartworm Test or FELV Screen | $25 | $30 |

| Blood, Fecal, Parasite Exam | $50 | $70 |

| Microchip | $20 | $40 |

| Urinalysis or ERD | $15 | $25 |

| Deworming | $20 | $20 |

| Total Annual Benefits | $305 | $535 |

Our Personal Experience With Pets Best

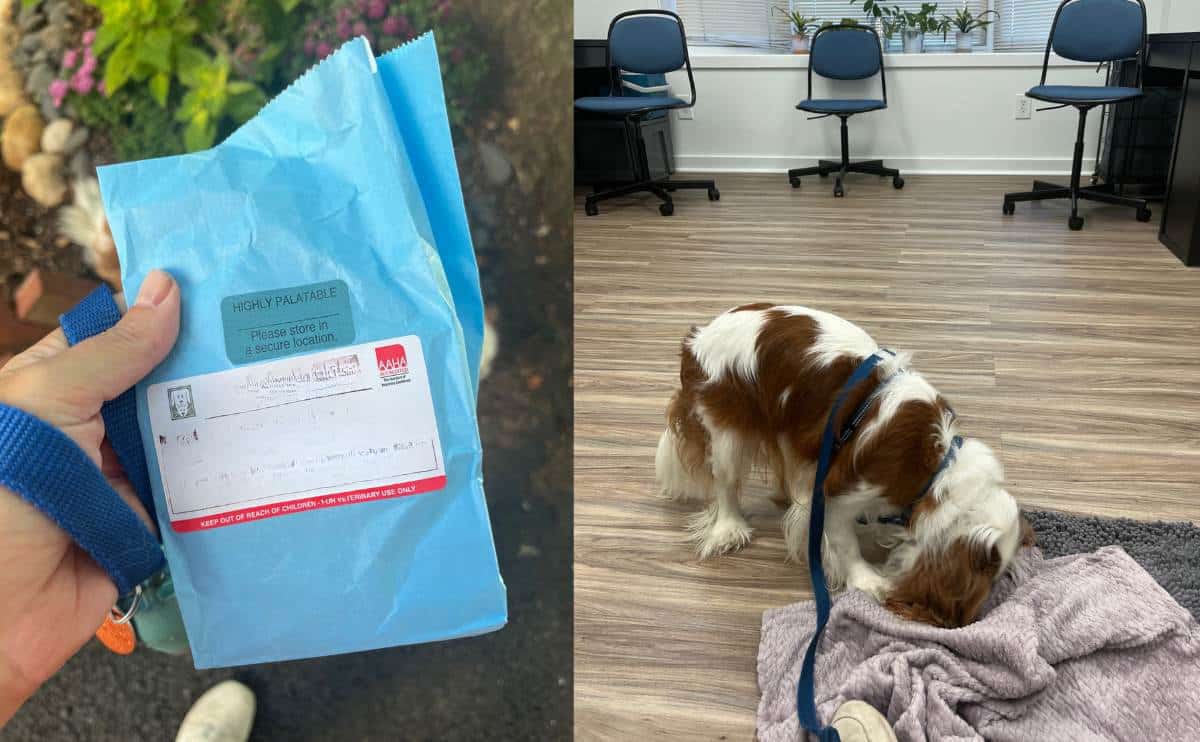

Below is how Pets Best helped our team member save on eight claims filed with her two-year-old Cavalier King Charles Spaniel within the first year of coverage.

Previous Experience With Pet Insurance

I had pet insurance with my previous Cavalier King Charles Spaniel, and it was sadly needed within a year of adopting her since she was diagnosed with cancer shortly after signing up. I couldn’t imagine not giving her access to specialists and chemo treatment, which wouldn’t have been financially feasible without having insurance to rely on that covered the expensive vet bills.

Signing Up For Pets Best

I wanted to sign my new dog up while he was still a puppy, and the rates would be less expensive, given that he’s relatively healthy. After shopping around and comparing pet insurance plans and pricing options, I went with Pets Best because they had the best rates and a good customer service reputation.

I enrolled him with an accident and illness coverage plan for his second birthday in early September 2022, not thinking I’d have to use it anytime soon.

Many Health Issues Occurred In The First Year Of Being Insured

Within weeks, I needed to see a behaviorist for anxiety issues. Sadly, those were not covered since it was during the waiting period. I had a follow-up visit with our behaviorist for a medication refill, but that wasn’t covered because it was a condition that he had treated while he was under the waiting period (and therefore considered a pre-existing condition).

Shortly after that, he got kennel cough (while at the groomer) and found himself in the emergency room for bloodwork, tests, and medication. That visit alone met my annual deductible ($1,000), so any other new illnesses or accidents would be covered at 90%.

During his spring 2023 annual checkup, they detected a heart murmur. I was encouraged to see a cardiologist for further testing and diagnosis. Knowing I would have 90% of the bills covered because it was a covered illness (and no previous history of heart conditions), I scheduled an appointment with a cardiologist for a consultation and echocardiogram. Thankfully, 90% of the total bill was reimbursed because it was another pricey visit.

Without pet insurance, I may have thought twice about making an appointment with a specialist, given he’s so young to be considered at risk for heart issues. But knowing the breed is susceptible to heart murmurs, I was glad I could get a second opinion without worrying about how much it would cost. He then had a follow-up with his primary vet about his heart murmur, which was covered 90% as well.

Shortly after that, his anal glands ruptured, and we were back at the ER. He had anal gland issues before (and ruptured previously), but since it’s a curable condition, Pets Best covered it.

Another month or so later, he got an upset stomach from switching dog food brands (because of his anal gland issues) and was in the ER again for the third time in less than a year. While the vet visit was covered at 90%, the medication wasn’t since it was just an over-the-counter supplement to help with his tummy.

Finally, in August 2023, we were back at the cardiologist for a six-month re-check to do another echocardiogram and see if there were any changes in his heart valve leak. They covered 90% of the bill since the deductible was already met.

Thousands Of Dollars Saved Thanks To Pets Best

Overall, the total cost of our first year covered by Pets Best was well worth it, and I’m so glad I signed him up.

- Monthly Premium – $21.51 ($258.12 for the year)

- Total Cost For All Vet Visits – $4,588

- Final Vet Cost For Pet Parents (10% copay and $1,000 deductible) – $1,993

- Pets Best Reimbursed – $2,595

I Renewed His Policy

I just renewed his plan, and his monthly premium didn’t increase. I hope he won’t have as many claims to file in the future, but I have peace of mind knowing that his now lifelong heart murmur will be covered going forward in addition to any other unexpected emergencies.

Frequently Asked Questions About Pets Best

Here are some frequently asked questions regarding Pets Best pet insurance from our readers.

Is Pets Best The Same As Progressive?

Progressive partnered with Pets Best to offer their pet insurance policies. Pets Best has also partnered with Farmers Insurance to sell policies.

How Do I Cancel Pets Best Insurance?

Pets Best has a pretty straightforward cancellation policy. Simply fill out this online form, and Pets Best will cancel your policy the day it receives your notice.

If you’d like a replacement for your Pets Best insurance policy, take a look at our pet insurance reviews to see which pet insurance companies we recommend.

Does Pets Best Premium Increase?

Your premium won’t increase based on the number of claims filed. However, as your pet ages, it will adjust to account for the increased likelihood of age-related health issues.

How Long Does It Take For Pets Best To Process A Claim?

Pets Best’s current claim processing average is 18-30 days. The amount of time it takes to process a claim depends on its type.

Pets Best vs Other Companies

Interested in seeing how Pets Best compares against other popular pet insurance companies? We’ve written comparison articles to help you compare Pets Best and other leading pet insurance companies in coverage, customer service and reputation, claim processing, plan customization, and price.

- Pets Best vs ASPCA

- Pets Best vs Embrace

- Pets Best vs Fetch

- Pets Best vs Figo

- Pets Best vs Healthy Paws

- Pets Best vs Lemonade

- Pets Best vs Nationwide

- Pets Best vs Pumpkin

- Pets Best vs Trupanion

Our Final Verdict On Pets Best

We recommend Pets Best for its extensive coverage, customizable plans, and highly competitive pricing. This company also offers an optional wellness plan. However, in recent years, Pets Best has received negative customer feedback regarding its lengthy claim repayment timeline.

If you want to know how Pets Best stacks up against other pet insurance carriers, check out the best pet insurance providers. We compare and rank the top ten pet insurance providers, explaining each company’s strengths and weaknesses. We also have many comparison tables to help you see where the best pet insurance companies differ. We answer frequently asked questions, walk you through a pet insurance claim example, list out all of your pet insurance options in an easy-to-digest directory format, and more. We’re sure we can answer all your pet insurance questions, so you feel equipped to make the best decision for your pet.

Methodology

We review each U.S. pet insurance company to provide an unbiased breakdown of providers' performance in real claim situations. We use a 100-point scale for each pet insurance company to rank them. Our in-depth research includes:

- Coverage & Exclusions (30%) - We scrutinize every policy from top to bottom and read all the fine print, carefully noting each exclusion. We factor in any age restrictions, required add-ons for basic coverage, and whether a company is available nationwide. Insurers with fewer exclusions receive more points in this category than those with less coverage.

- Pricing (15%) - We evaluate pricing by running thousands of sample quotes for dogs and cats of various breeds, sizes, locations, and ages. We analyze which companies charge extra fees and discounts and consider which companies nick and dime pet owners with add-on coverage. Providers with the lowest premiums, fewest extra fees, most discounts, and fewer add-ons receive more points in this category.

- Customer Service & Reputation (12%) - We assess hundreds of customer reviews, scope out the sign-up process, speak with representatives, and factor in company history and years in the pet insurance marketplace to determine the points in this category. Companies with an easy sign-up process, highly rated mobile apps, multiple ways to reach customer service, positive consumer feedback, and a seamless claim filing process score high in this category.

- Financial Strength (10%) - Insurance is only beneficial if you can count on reimbursed claims. Companies with at least five years of nationwide experience and high A.M. Best and Demotech ratings receive high remarks in this category.

- Customization Options (10%) - We consider customizations available to adjust your coverage to fit your budget. Companies with fewer restrictions based on breed, age, location, etc., multiple plan options, and more reimbursement, deductible, and payout options earn the highest scores.

- Waiting Periods (5%) - Providers with the shortest illness and accident waiting periods and fewer additional waiting periods for other conditions merit high remarks.

- Claim Processing (5%) - We share our firsthand experience submitting claims with companies and examine how long it takes to be reimbursed. Insurers with a vet direct pay option and short claim processing averages earn the most points.

- Innovation (3%) - We meet with company representatives to discuss changes related to the industry, their company, and their offerings. Providers offering unique, comprehensive coverage and utilizing advanced technology receive more points.

Unlike many other review sites, we refuse to let pet insurance companies pay for the top spot in our rankings. Companies must earn their position in our comparisons by performing well in the marketplace. We also highlight each company’s pros and cons in light of their competitor’s strengths. In doing so for over a decade, we’ve helped pet parents make more educated decisions among the top pet insurance options. Pet insurance providers read our reviews, regularly check them for accuracy, and value our input to help create positive industry changes and better protect your pets. We only recommend the best of the best because it’s what our readers deserve.

Why Trust Canine Journal?

Canine Journal has been covering the topic of pet insurance since 2012, well before other conglomerates discovered the rising popularity of health care for our pets. Many of our authors have personal experience with pet insurance, including Kimberly Alt, who has been Canine Journal’s go-to writer for pet insurance for over a decade, having written about nearly every possible facet related to pet insurance. Kimberly knows the subject so well that she can answer a breadth and depth of pet insurance questions immediately. And on the rare occasion she doesn’t know the answer off the top of her head, she can find it within minutes due to her extensive list of resources. Kimberly also consulted with Michelle Schenker, Canine Journal’s in-house licensed insurance agent, for additional expertise, to ensure accuracy, and give Canine Journal the authority to write about and assist readers in purchasing insurance policies legally. Kimberly has spent over 100 hours researching Pets Best, reading every line in their policy, speaking with their operation team, and gathering quotes to bring you the most accurate information.

Tagged With: Reviewed By Insurance Agent