Fetch Pet Insurance Reviews: Coverage, Wellness Rewards, Plans, Reimbursement, Coupon, Complaints, And More

When you purchase through links on our site, we may earn a commission. Here’s how it works.

Founded in 2003, Fetch licensed the Petplan name from Petplan UK until it became Fetch Pet Insurance in early 2022. Today, Fetch is one of the largest U.S. pet insurance companies and has some of the most extensive coverage. However, many competitors have stepped up in recent years.

Table of Contents

Why do we think Fetch still deserves your consideration? Read my review to see why you might choose Fetch, especially if you’re signing up as a new customer or adding a new pet.

Get A Free Fetch Quote For Your Pet

Fetch Pet Insurance Reviews

Summary

Fetch offers unique features like coverage for virtual vet appointments and curable pre-existing conditions after one year. There are no add-ons required with a Fetch policy because several conditions often excluded by competitors are included by Fetch.

Overall Score

Pros

- No lifetime or per-condition payout limit

- Covers the exam fees for sick visits ($50-$250 on average)

- Your pet is covered when they travel with you in the U.S. or Canada

- Covers up to $1,000 in VirtualVet visits over video chat, call, or text

- 30-day money-back guarantee

- Optional wellness plan

- Offers pre-approval of estimates/procedures in advance of treatment

Cons

- No multi-pet discount

- Dogs must have annual health and dental check-ups for coverage to apply. Failure to do so may mean your dog won’t get insurance coverage until that checkup is done.

- Only covers CCL (ACL) on a second leg if the first leg remains healed for 12 months (if your pet received treatment for a cruciate or soft tissue injury to one knee before policy inception, then the other knee is automatically excluded)

- Requires a vet exam within 6 months before or 30 days after enrollment

What Does Fetch Pet Insurance Cover?

Fetch’s accident and illness policies cover many of the same conditions, treatments, and diagnostics as other insurers plus some unique offerings. Conditions where treatment is deemed medically necessary are eligible for coverage as long as it is not pre-existing, excluded, or occurring during the waiting period. Examples of covered accidents and illnesses include:

- Allergies

- Arthritis

- Broken bones

- Cancer

- Chronic conditions

- Congenital conditions

- Cruciate ligament tears

- Cuts

- Diabetes

- Dental trauma

- Ear infections

- Euthanasia

- Exam fees (for covered accidents and illnesses)

- Foreign body ingestion

- Gastrointestinal issues (e.g., vomiting, diarrhea)

- Hereditary conditions

- Hip dysplasia

- Poisoning

- Prescription medications

- Urinary tract infection

Diagnostics & Treatment

Examples of covered diagnostics and treatment include:

- Blood tests

- CT scans

- Emergency care

- MRIs

- Rehabilitation (e.g., acupuncture, behavioral therapy, chiropractic care, physical therapy, etc.)

- Surgery & hospitalization

- Specialty care

- Ultrasounds

- X-rays

Unique Coverage

Fetch offers coverage for unique items that other providers do not, including:

- Advertising and reward for a stolen or lost pet (up to $1,000)

- Boarding your pet while you are in a hospital for your own health concern (up to $1,000)

- COVID-19 in pets should an enrolled pet be diagnosed with the virus

- Curable pre-existing conditions after 1 year

- Loss of your pet due to theft or straying for the amount you paid for your pet up to $1,000

- Vacation cancellation due to your pet’s health condition (up to $1,000)

- VirtualVet visits up to $1,000 per policy year with no co-pay or deductible

Exclusions

Below is a list of the major conditions and services Fetch excludes:

- Pre-existing conditions

- Cruciate ligaments, luxation of the patellas, and other soft tissue disorders during the first 6 months of the policy (can be waived with an exam)

- Hip dysplasia during the first 6 months of the policy

- Bilateral exclusion (a condition or disease that affects both sides of the body) for cruciate or soft tissue injury to one knee if one side were pre-existing or injured during the first 6 months of the policy

- IVDD when another disc in the same neighboring spinal region was previously treated or showing clinical signs before the policy’s effective date or during the waiting period

- Dental disease, malocclusions and deciduous teeth, where clinical signs were observed before the policy’s effective date or during the waiting period

- Prescription food

- Illnesses contracted outside of the U.S. or Canada that wouldn’t normally be contracted in the U.S. or Canada

- Breeding, pregnancy, whelping, nursing

- Parasites that have preventive medication (e.g., heartworms, fleas, ticks, roundworms, tapeworms, hookworms)

- Elective and cosmetic procedures (e.g., tail docking, dewclaw removal, ear cropping)

- Therapies not administered by a veterinarian

- Physical therapy and holistic therapy to treat weight loss

What Does Fetch Cost?

Pricing is based on your pet’s details (age, breed, location, pre-existing conditions, etc.) and the plan you select. I recommend obtaining quotes from Fetch for your specific pet to get an idea of how much a policy would cost you.

Fetch has no one-time fees or transaction fees. Your monthly premium is based on the deductible, reimbursement rate, and annual limit payout options that you choose from the table below.

There may be more possibilities available to you based on your circumstances, so be sure to reach out to Fetch by phone at 800-237-1123 to explore potential plan customizations.

| Deductible Options | Payout Options | Reimbursement Options |

|---|---|---|

| $250 $300 $400 $500 $700 | $5,000 $10,000 $15,000 Unlimited | 70% 80% 90% |

Does Fetch Have A Coupon Code?

Fetch offers the following discounts:

- Up to 10% off for animal shelter adoptees and employees, corporate benefit plans, medical services pets, strategic partners, military, veterinary staff, and students

- 10% off premiums for Walmart shoppers

- Save $25 or more when you pay quarterly or annually

- 10% off for AARP members for life

Use this link to take advantage of the best possible price. No promo code is needed. Alternatively, call 800-237-1123.

Customer Service Options

You can reach Fetch’s support team multiple ways, including email, live chat, and phone, all of which are available Monday through Friday from 9am to 6pm EST. Fetch’s customer service is closed on Saturday and Sunday.

What Do Customers Think Of Fetch?

The majority of feedback for Fetch is positive. I read hundreds of online reviews and here is what customers had to say about Fetch.

Praise From Pet Owners

- Helpful, patient, and knowledgable support team

- Easy claim filing process

- Timely reimbursement

- Excellent coverage

Policyholder Complaints

- Premium charges after policy cancelation

- High renewal premium increases

- Fetch requesting information multiple times that has previously been submitted

- Charging $3 per check reimbursement

How Do I Submit A Claim To Fetch Insurance?

Before submitting a claim, you’ll need a copy of your dog’s medical records detailing their medical history. You’ll also need a copy of your finalized invoice from your vet showing what your dog was treated for and how much it cost. The invoice needs to show a zero balance for Fetch to accept it.

Claims must be submitted within 90 days following treatment via Fetch’s mobile app or online. Fetch typically processes claims within 6 days. You can be reimbursed by check or direct deposit; however, direct deposit is quicker and can get you paid back 5-10 days faster than a check.

How Does The Reimbursement Process Work?

Fetch uses a “deductible then co-pay” reimbursement method. This is calculated in the following way:

- Actual vet bill amount – Remaining annual deductible – Co-pay = Reimbursement amount

Reimbursement Story

When her mother injured her back and landed in the hospital, Delaney, a five-year-old Golden Retriever, took out her stress on the holiday décor. A belly full of garland later, Delaney needed X-rays, emergency surgery, and medication to save her life. Luckily, Delaney’s family had pet insurance and could say yes to the care their precious pup needed to make a full recovery.

- Dog: Delaney, 5-year-old Golden Retriever

- Diagnosis: Foreign Body Ingestion

- Treatment Cost: $3,409

- Fetch Reimbursed: $2,568

- Final Cost For Pet Parents: $841

What Are The Most Common Claims Submitted To Fetch?

- Mass lesions and swelling: $1,219

- Oral inflammation (most likely periodontal disease): $815

- GI conditions: $814

Is Fetch Insurance The Same As Petplan?

Petplan UK licensed the Petplan name to Fetch until it rebranded to Fetch Pet Insurance. Overall, the company have been providing pet insurance policies in the United States for more than two decades.

Who Is The Underwriter For Fetch Pet Insurance?

Fetch has two underwriters, XL Specialty Insurance Company and AXIS Insurance Company. XL Specialty Insurance Company has an A+ rating from A.M. Best (a measurement of financial stability), and AXIS Insurance Company has an A rating.

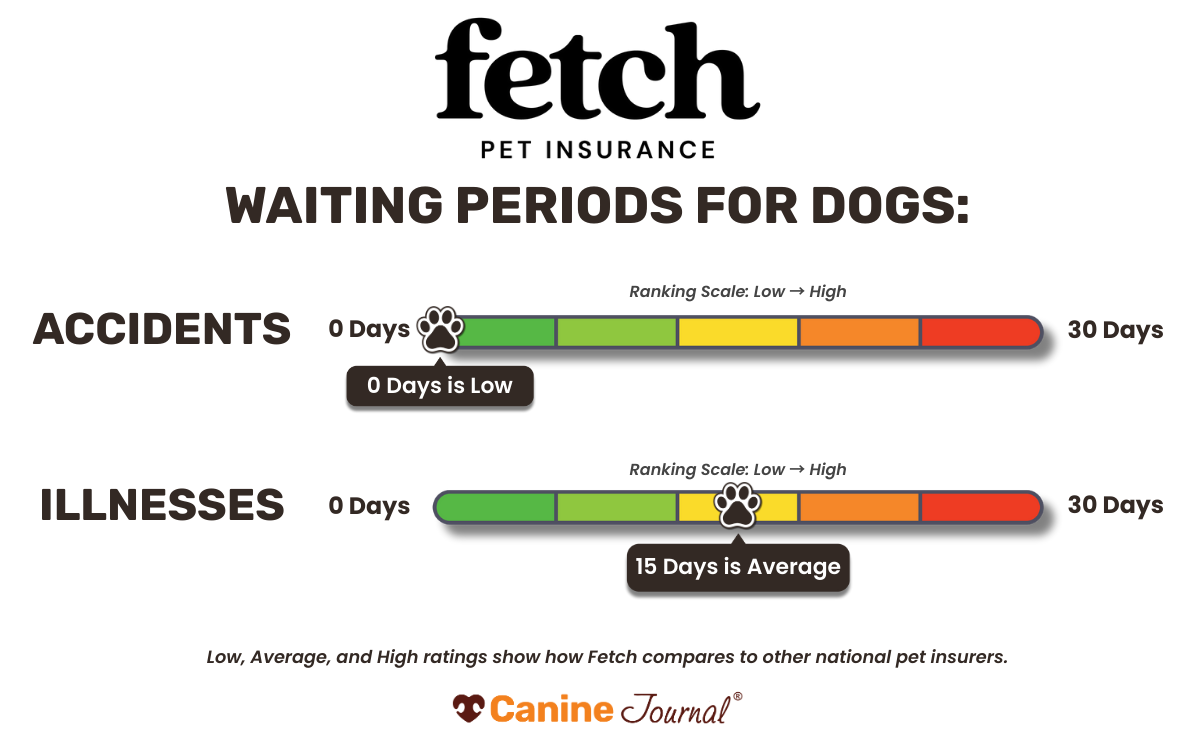

What Are Fetch’s Waiting Periods*?

Insurers utilize waiting periods to help determine pre-existing conditions sustained before obtaining insurance. If a pet owner misrepresents their pet’s condition during the enrollment process, they are guilty of insurance fraud, which is a felony in most U.S. states.

Pet insurance companies have waiting periods for accidents and illnesses. Some providers have additional waiting periods for more serious health issues (e.g., CCL tears, Intervertebral Disc Disease [IVDD], hip dysplasia, etc.). The average waiting period is around 14 days for illnesses and 3 days for accidents.

Fetch’s waiting period for illnesses is up to 15 days and there is no waiting period for accidents (varies by state). Fetch has a 6 month waiting period for hip dysplasia, cruciates, and patellas. The waiting period for cruciates and patellas can be waived if your vet examines your pet within 30 days of policy issuance and notes explicitly that there’s no indication of any knee problem.

*States are gradually adopting a Model Law for pet insurance, aiming to standardize regulations, including uniform waiting periods. In California, Delaware, Louisiana, Maine, Mississippi, Nebraska, New Hampshire, Washington, Rhode Island, and Maryland, waiting periods are:

- Accidents: 0 days

- Illnesses: 14 days

- Cruciate Ligament Conditions: 30 days

- Routine Care: 0 days

Does Fetch Offer Wellness Plans?

Fetch offers three wellness plans shown below in the table. Included are the maximum amounts that Fetch will pay each year for that specific routine care per year.

| Essentials | Advantage | Prime | |

|---|---|---|---|

| Annual Exam | $30 | $50 | $50 |

| Bordetella/FELV Vaccines | $10 | $20 | $25 |

| DHLPP/FVRCP Vaccines | $10 | $20 | $25 |

| Rabies Vaccine | $10 | $20 | $25 |

| Lyme/FIP Vaccines | $10 | $20 | $25 |

| Heartworm, Flea & Tick Prevention | $30 | $50 | $60 |

| Heartworm Tests | $10 | $25 | $30 |

| Dental Cleaning | $75 | $100 | $125 |

| Spaying or Neutering | $100 | $100 | $125 |

| Blood Test | $10 | $25 | $30 |

| Urinalysis | $10 | $25 | $30 |

| Fecal Test | $10 | $25 | $30 |

| Microchipping | $20 | $30 | |

| Anal Gland Expression | $20 | $20 | |

| Behavioral Exam | $25 | ||

| Health Certificate | $30 | ||

| Activity Monitor | $50 | ||

| Total Annual Benefits | $315 | $520 | $735 |

Frequently Asked Questions About Fetch Pet Insurance

Here are some frequently asked questions regarding Fetch pet insurance from our readers.

Does Fetch Cover Neutering?

No, Fetch pet insurance plans don’t cover neutering or spaying. But you can add one of Fetch’s wellness plans which include an alottment that can be used for neutering and spaying.

How Do I Cancel Fetch Policy?

You can cancel Fetch insurance by calling 1-866-467-3875.

If you notify Fetch within 30 days from the effective date shown on your policy declarations page and haven’t submitted a claim, the company will refund your premium. After 30 days, Fetch will return the pro-rata premium based upon the date of termination of the policy.

If you are transitioning from Fetch to a new provider, take a look at our pet insurance reviews to see which pet insurance companies we recommend.

Fetch vs Other Companies

Interested in seeing how Fetch stacks up against other popular pet insurance companies? We’ve written comparison articles for you to see how Fetch and other leading pet insurance companies compare in coverage, customer service and reputation, claim processing, plan customization, and price.

- Fetch vs Embrace

- Fetch vs Figo

- Fetch vs Healthy Paws

- Fetch vs Lemonade

- Fetch vs Nationwide

- Fetch vs Pets Best

- Fetch vs Trupanion

What’s Our Final Verdict On Fetch?

Call: 800-237-1123

Fetch’s pricing is competitive, especially for younger pets. We think Fetch’s detailed pet insurance coverage is tough to beat and certainly worth considering.

Ultimately, whether you pick Fetch for your pet is up to you; however, here at Canine Journal, we always advocate some form of insurance. See how Fetch stacks up against other pet insurance companies in our detailed comparison.

Methodology

My team and I conduct extensive research on the most reputable pet insurance companies, analyzing customer feedback, policy changes, and industry trends. Our licensed insurance agent fact-checks everything, and we update our reviews year-round as insurers adjust premiums, coverage, exclusions, and customer service.

We rank each U.S. pet insurance provider using a 100-point scale, ensuring an unbiased breakdown of how companies perform in real-world claims.

Our Ranking Criteria

- Coverage & Exclusions (30%) – We analyze policies, exclusions, and age restrictions, rewarding companies with fewer coverage limitations.

- Pricing (15%) – We run thousands of sample quotes and factor in extra fees, discounts, and add-ons.

- Customer Service & Reputation (12%) – We review hundreds of customer experiences, assess the sign-up process, and evaluate claim support.

- Financial Strength (10%) – We examine A.M. Best & Demotech ratings to ensure companies can pay claims reliably.

- Customization Options (10%) – Providers with more deductible, reimbursement, and payout flexibility rank higher.

- Waiting Periods (5%) – Shorter illness & accident waiting periods result in a better score.

- Claim Processing (5%) – Companies offering fast reimbursements and direct vet pay score higher.

- Innovation (3%) – We recognize unique offerings and advanced technology in the industry.

Unbiased Pet Insurance Rankings: Putting Pets First

Unlike many review sites, we don’t sell rankings—every provider earns its spot based on real performance. Our in-depth comparisons help pet parents make informed decisions, while insurers use our reviews to improve their policies. We only recommend the best because that’s what our readers deserve.

Why Trust Canine Journal?

Canine Journal has been covering the topic of pet insurance since 2012, well before other conglomerates discovered the rising popularity of health care for our pets. Many of our authors have personal experience with pet insurance, including Kimberly Alt, who has been Canine Journal’s go-to writer for pet insurance for over a decade, having written about nearly every possible facet related to pet insurance. Kimberly knows the subject so well that she can answer a breadth and depth of pet insurance questions immediately. And on the rare occasion she doesn’t know the answer off the top of her head, she can find it within minutes due to her extensive list of resources. Kimberly also consulted with Michelle Schenker, Canine Journal’s in-house licensed insurance agent, for additional expertise, to ensure accuracy, and give Canine Journal the authority to write about and assist readers in purchasing insurance policies legally. Kimberly has spent more than 100 hours researching Fetch, reading every line in their policy, speaking with their operation team, and gathering quotes to bring you the most accurate information.