This content was reviewed by our licensed insurance agent, Michelle Schenker.

When you purchase through links on our site, we may earn a commission. Here’s how it works.

Fetch and Nationwide are two powerhouse pet insurance providers. While they each offer unique pet insurance plans, they also have many similarities in their coverage and policies.

We compare Fetch and Nationwide’s coverage, customer service and reputation, claim processing average, price, and plan customizations to help you clearly see what similarities and differences they have. We also choose a winner and explain why we think one company comes out on top of the other.

| Fetch | Nationwide | |

|---|---|---|

| Policy Coverage | Extensive | Limited |

| Customer Service & Reputation | Good | Good |

| Claim Processing Average | 5-6 Days | 4 Days |

| Average Policy Price | Variable | Lower |

| Plan Customization Options | Many | Restricted |

| Overall Winner | ||

| Get Fetch Quote | Get Nationwide Quote | |

| Compare Quotes | Compare Quotes |

Policy Coverage

Plan Coverage Winner

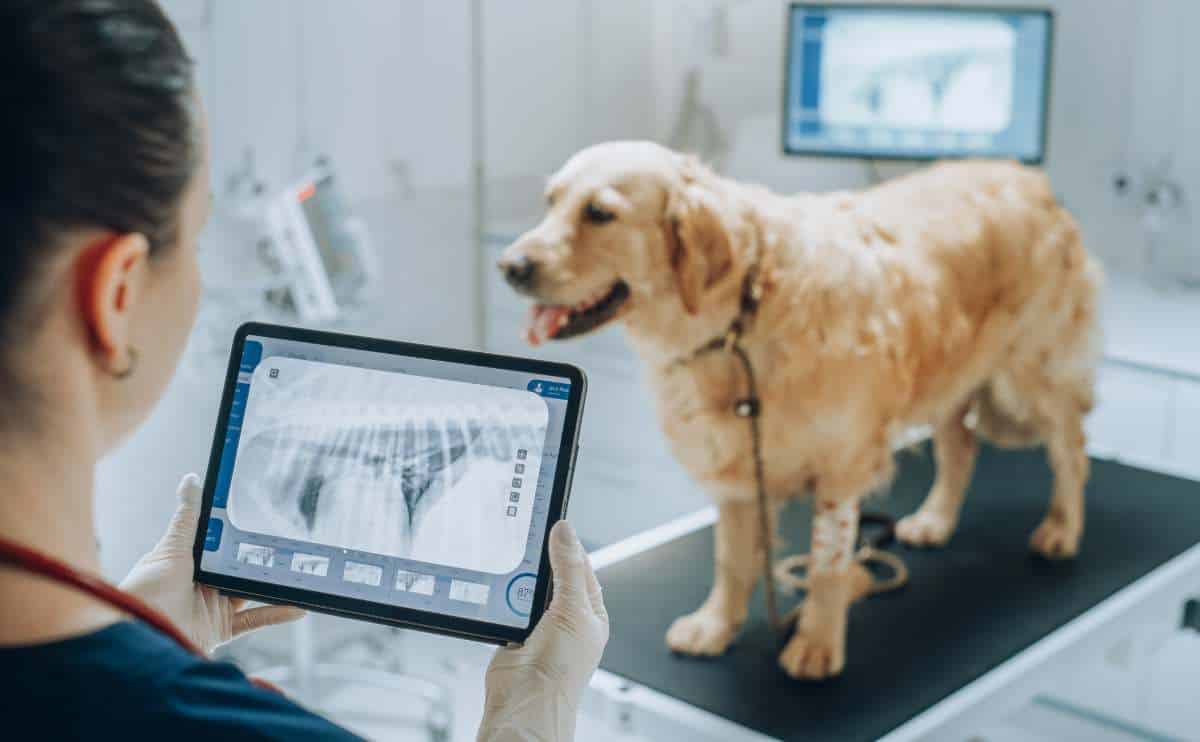

The table below shows what Fetch and Nationwide cover. Both companies cover emergency care, surgery and hospitalization, specialized exams and specialty care, X-rays, blood tests, ultrasounds, cat scans, MRIs, rehabilitation, cancer, chronic conditions, euthanasia, hereditary conditions, congenital conditions, non-routine dental treatment, and prescription medications. Neither covers pre-existing conditions, cremation and burial costs, pregnancy and breeding, or unnecessary cosmetic procedures.

| Fetch | Nationwide | |

|---|---|---|

| Illness Waiting Period* | 15 Days | 14 Days |

| Accident Waiting Period* | 15 Days | 14 Days |

| Hip Dysplasia Waiting Period* | 6 Months | 14 Days |

| CCL Surgery Waiting Period* | 6 Months | 12 Months |

| Behavioral Therapies | ||

| Alternative/Holistic Therapy | ||

| Wellness Care For An Extra Fee | ||

| Exam Fees | ||

| Underwriter | XL Specialty Insurance Company AXIS Insurance Company | National Casualty Company Veterinary Pet Insurance Company (California only) |

| A.M. Best Rating | A+ A | A+ A+ |

*Waiting periods for California, Delaware, Louisiana, Maine, Mississippi, Nebraska, New Hampshire, and Washington are as follows:

- Accidents - 0 days

- Illnesses - 14 days

- Cruciate Ligament Conditions - 30 days

- Routine Care - 0 days

Both Fetch and Nationwide have thorough coverage. Most pet insurance companies have an accident waiting period of five days or less, so the fact that both companies are two weeks is rather long.

A bonus for Fetch is that it offers a few unique perks compared to other pet insurance providers. Examples include coverage for virtual vet visits, reimbursement for your pet if they’re stolen or go missing, the cost of advertising and paying a reward for a stolen or lost pet, and more.

Age restrictions should also be considered. Fetch pets must be six weeks or older to enroll, while Nationwide has no minimum age restriction. On the flip side, Fetch has no maximum age restrictions, but Nationwide won’t sign up pets older than ten years old upon enrollment.

Fetch wins this category because of its bonus coverage and no maximum age restrictions.

Customer Service & Reputation

Customer Service & Reputation Tie

Fetch was previously licensed under a different brand name (Petplan). During that time, it experienced underwriter changes that resulted in premium increases and many upset customers. It’s common for prices to fluctuate when an underwriter change occurs, so this isn’t unheard of. Time passed, and the company bounced back, but at the beginning of 2022, it rebranded as Fetch Pet Insurance. It bounced back quickly again, which is impressive.

As for Nationwide, there are various complaints regarding reimbursement concerns, unexpected renewal changes, drastic premium increases, and more. However, Nationwide has remained stable with its customer service and reputation and hasn’t undergone massive changes. Because of this, we declare this category a tie.

Claim Processing

Nationwide Winner

Fetch allows up to 30 days for claim processing, but most claims are repaid in an average of 5-6 days.

Nationwide allows 30 days to process its claims too but averages 4 days, slightly faster than Fetch. Because Nationwide has a shorter claim processing period, it’s the winner of this category.

Price Of Policy

Price Of Policy Winner

Neither Fetch nor Nationwide have one-time enrollment fees for new customers. Fetch also has no transaction fees, but Nationwide has a $2 transaction fee that will be tacked onto your monthly premium bill.

Your premium price quote is based on your pet’s details (age, breed, location, etc.). We recommend obtaining quotes from each company for your specific pet. You can also visit our pet insurance comparison quotes to see a few sample prices we’ve gathered. Then use our pet insurance quote form to see how other top companies compare for your beloved pet.

On average, Fetch and Nationwide vary on price. Sometimes they’re among the lowest and other times they’re in the middle of the pack. They’re rarely among the most expensive providers. We declare Fetch the winner of this category because Nationwide’s transaction fees can add up over time.

Discounts

Fetch

Fetch offers the following discounts:

- Up to 10% off for animal shelter adoptees and employees, corporate benefit plans, medical services pets, strategic partners, military, veterinary staff, and students

- 10% off premiums for Walmart shoppers

- Save $25 or more when you pay quarterly or annually

- 10% off for AARP members for life

No promo code is needed. Use this link to take advantage of the best possible price. Alternatively, call 800-237-1123. You can also visit our dedicated Fetch promotions page to learn more.

Nationwide

Nationwide Pet Insurance offers the following discounts:

- 5% off for 2-3 pets covered

- 10% off for 4 or more pets covered

No promo code is needed. Use this link to take advantage of the best possible price.

Plan Customization

Plan Customization Winner

Finding a company with the coverage you need that fits your budget is essential. Look below to see what plan options are offered by each provider.

| Fetch | Nationwide | |

|---|---|---|

| Deductible Options | $300, $500, $700 | $100, $250, $500 |

| Payout Options | $5,000, $10,000, $15,000 | Limited Per Condition, $5,000, Unlimited |

| Reimbursement Options | 70%, 80%, 90% | 50%, 70%, 80%, 90% |

Fetch offers multiple plan customizations to help you find the perfect coverage to fit your budget. On the other hand, Nationwide uses a benefit schedule for some plans, which limits your customization options. And for its other plans, Nationwide still has minimal customizations. This is why Fetch wins this category.

What’s The Verdict?

Overall Winner

Overall, Fetch wins this comparison against Nationwide due to its thorough coverage and customization options. If you didn’t find what you were looking for, our experts dig deeper into each company in our individual reviews of Fetch and Nationwide.

Our experts have spent thousands of hours researching to bring you our comprehensive and frequently updated pet insurance reviews, including our top picks, along with details on each of the most popular pet insurance companies. So, if you want to know how other providers compare against one another, you may find this review helpful in your pet insurance search.

Tagged With: Reviewed By Insurance Agent, Vs