Fetch vs Lemonade Pet Insurance: Which One Truly Has Your Pet’s Back?

When you purchase through links on our site, we may earn a commission. Here’s how it works.

When it comes to protecting your pet, Fetch and Lemonade Pet Insurance are two top contenders, each with their own standout strengths.

Table of Contents

Fetch offers all-inclusive policies packed with unique perks, while Lemonade shines with customizable plans and budget-friendly pricing.

Below, I break down their key differences to help you choose the best fit for your furry companion.

†Lemonade Plan Restrictions: Some breeds have specific age limitations for enrollment.

Coverage Comparison

Both Fetch and Lemonade offer one accident and illness pet insurance policy and optional wellness plan add-ons.

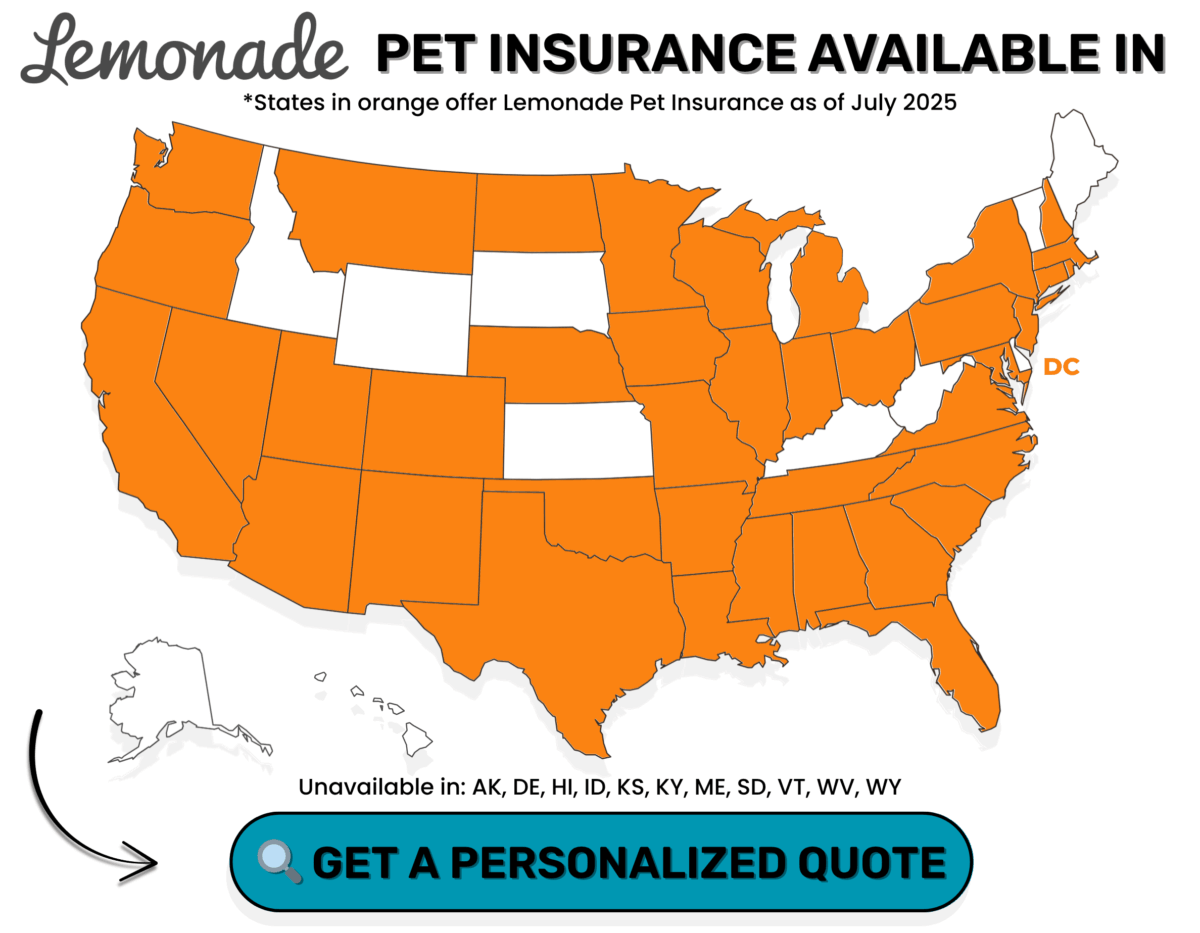

Fetch’s policy is available in all 50 states, while Lemonade’s is available in 39 states and the District of Columbia.

Both plans cover new accidents and illnesses, including diagnostics and treatment for health conditions.

Coverage includes:

- Emergency care

- Surgery & hospitalization

- Specialty care

- Blood & urine testing

- X-rays, ultrasounds, CT scans, MRIs

- Prescription medications

- Non-routine dental treatment *

- Illness/accident exam fees *

- Rehabilitation *

- And more

* These items are included in Fetch’s base policy but require add-ons with Lemonade.

Neither insurer covers pre-existing conditions, pregnancy, breeding, or unnecessary cosmetic procedures (e.g., tail docking, dew claw removal, ear cropping).

Covered Conditions

Examples of covered conditions from both providers’ base pet insurance policies include:

- Chronic conditions (allergies, diabetes, etc.)

- Hereditary conditions

- Congenital conditions

- Cancer

- Heart disease

- Hip dysplasia

- Cranial cruciate ligament (CCL) tears

- Curable pre-existing conditions* (e.g., ear infections)

*Curable pre-existing conditions: if there have been no signs or symptoms within the last year.

Any condition with symptoms before enrollment or during the waiting period is not covered.

Policy Coverage Differences

One major difference between the two: Fetch includes all of these items in its base policy, while Lemonade requires separate add-ons (called riders) for some of them.

With Lemonade, you’ll need to pay extra to cover:

- Vet exam fees

- Dental illness

- Complementary care

- Behavioral therapy

- End-of-life care

This means Fetch takes an all-inclusive approach, giving you broad coverage from the start. Lemonade, on the other hand, lets you customize coverage based on your needs and budget, which could save you money if you don’t want everything.

Additionally, both Fetch and Lemonade offer optional wellness plans to help pay for routine and preventive care.

Fetch offers three tiers, while Lemonade has two. Depending on which you choose, coverage can include things like:

- Annual exams

- Vaccinations

- Dental cleanings

- Heartworm meds

- Spay/neuter surgery

Fetch vs Lemonade Coverage Comparison Chart

Waiting Periods For Coverage

A waiting period is the time between when you enroll in a pet insurance policy and when your coverage officially begins. It helps protect insurers from fraud and immediate high-cost claims.

Want coverage to start ASAP? Here’s what you need to know about pet insurance with no waiting periods.

How do Fetch and Lemonade compare?

| Waiting Period For: |  |  |

|---|---|---|

| Accidents | 0 Days | 2 Days |

| Illnesses | 15 Days | 14 Days |

| Hip Dysplasia, Patellar Luxation & Other Orthopedic Conditions | 6 Months | 30 Days |

| CCL Tears | 6 Months | 6 Months |

Premiums & Pricing

Your monthly premium depends on the coverage level you choose and your pet’s age, breed, and location.

From the hundreds of quotes I ran, Lemonade’s base pricing was often more affordable than Fetch. But it’s important to note that Fetch’s base policy includes more, you get broader coverage without needing add-ons.

When comparing Fetch’s base plan to Lemonade with all add-ons included, results were split. In some cases, Fetch was cheaper. In others, Lemonade came out ahead.

This pricing trend held true across different payout limits and reimbursement percentages. Bottom line: it depends on your pet and how much coverage you need. Get quotes from both to see which is a better fit.

Premium Pricing Comparison Tables

The table below shows monthly premiums for Fetch vs. Lemonade, using sample quotes.

You’ll see pricing for:

- Lemonade’s base policy

- Lemonade with all add-ons (except wellness coverage)

- Fetch’s base policy (which includes those extras)

This gives you a more apples-to-apples comparison based on actual coverage, not just the base price.

You’ll also find quotes for different dog breeds, ages, and locations, which helps highlight how these factors impact pricing.

Unless otherwise noted, all plans include:

$5,000 annual payout, 90% reimbursement, and a $500 deductible.

†Lemonade add-ons unavailable in FL: dental illness, behavioral therapy & end-of-life care.

French Bulldog: 6-month-old male in 92121 zip code (San Diego, CA)

Labrador Retriever: 2-year-old female in 14211 zip code (Buffalo, NY)

Golden Retriever:4-year-old male in 33604 zip code (Tampa, FL)

Yorkshire Terrier: 5-year-old female in 07108 zip code (Newark, NJ)

Ragdoll Cat: 7-year-old male in the 78703 zip code (Austin, TX)

The following quotes include lower coverage options:

$5,000 payout, 70% reimbursement, and a $500 deductible.

†Lemonade add-ons unavailable in FL: dental illness, behavioral therapy & end-of-life care.

French Bulldog: 6-month-old male in 92121 zip code (San Diego, CA)

Labrador Retriever: 2-year-old female in 14211 zip code (Buffalo, NY)

Golden Retriever:4-year-old male in 33604 zip code (Tampa, FL)

Yorkshire Terrier: 5-year-old female in 07108 zip code (Newark, NJ)

Ragdoll Cat: 7-year-old male in the 78703 zip code (Austin, TX)

The following quotes include higher coverage options:

$10,000 payout, 90% reimbursement, and a $500 deductible.

†Lemonade add-ons unavailable in FL: dental illness, behavioral therapy & end-of-life care.

French Bulldog: 6-month-old male in 92121 zip code (San Diego, CA)

Labrador Retriever: 2-year-old female in 14211 zip code (Buffalo, NY)

Golden Retriever:4-year-old male in 33604 zip code (Tampa, FL)

Yorkshire Terrier: 5-year-old female in 07108 zip code (Jersey City, NJ)

Ragdoll Cat: 7-year-old male in the 78703 zip code (Austin, TX)

The best way to compare pet insurance costs is to get personalized quotes for your dog. Use our quote form below to easily request estimates from multiple providers.

Discounts

Both Fetch and Lemonade offer discounts for certain circumstances. Here’s how they compare.

Fetch Discounts

- Up to 10% off for animal shelter adoptees and employees, corporate benefit plans, medical services’ pets, strategic partners, military, veterinary staff, and students

- 10% off premiums for Walmart shoppers

- Save $25 or more when you pay quarterly or annually

- 10% off for AARP members for life

Lemonade Discounts

- 10% off if you bundle with your renters, homeowners, auto, condo, or co-op insurance

- 5% off for multiple pets

- 5% off if you pay annually

Customer Service & Reputation

It’s easy to focus on a low premium, but customer service matters, especially when you’re filing a claim.

Even the best price won’t help if you can’t get support when you need it.

Both Fetch and Lemonade offer:

- A 30-day money-back guarantee (if no claims have been filed or paid)

- Phone, email, and live chat support

I scoured hundreds of customer reviews from the Better Business Bureau (BBB), Yelp, Trustpilot, and Reddit to see what real users are saying.

What Do Customers Say About Fetch Pet Insurance?

Fetch’s feedback is mostly positive. Fetch has a 4.4/5.0 review on Trustpilot (out of over 4,600 reviews) and is rated A+ on BBB.

| Pros | Cons |

|---|---|

| Excellent coverage | High renewal premium increases |

| Easy claim filing process | Fetch requesting information multiple times that has previously been submitted |

| Timely reimbursement | Charging $3 per check reimbursement |

| Helpful, patient, and knowledgeable support team |

What Do Customers Say About Lemonade Pet Insurance?

It’s a bit tougher to find Lemonade-specific pet insurance reviews, since the company offers multiple types of insurance and only began selling pet policies in 2020.

Still, the feedback available gives insight into the company’s overall service and reputation.

Like Fetch, Lemonade receives mostly positive reviews, but the ratings aren’t quite as strong. Fetch’s Trustpilot rating is 4.1/5.0 (out of over 2,600 reviews) and it has a B- rating on BBB.

These scores suggest that while Lemonade’s pet insurance is well-received overall, it may not offer the same level of support or consistency as Fetch based on customer experience so far.

| Pros | Cons |

|---|---|

| Affordable premium prices | Several complaints about denying coverage for “pre-existing conditions” for unrelated health issues |

| Simple, fast claim & reimbursement process | Hard to reach a human to speak to for customer service |

| User-friendly app | Complaints about multiple requests for medical records that have been sent |

Claim Processing

The time it takes for an insurer to reimburse claims can impact some pet owners’ decisions. This is crucial if you can’t wait long for reimbursement. Lemonade generally comes out ahead of Fetch if you need speedy claim processing.

Although it averages two days, Lemonade can sometimes reimburse almost instantaneously due to its AI technology.

|  | |

|---|---|---|

| Avg. Claim Processing | 6 Days | 2 Days |

| Filing Deadline | Within 90 Days | Within 180 Days |

| Filing Method | App, Online Acct. | App |

| Reimbursement | Direct Deposit, Check | Direct Deposit, Check |

Options For Deductibles, Payouts & Reimbursement

In addition to various items you can or cannot choose for your policy (e.g., vet exam fees), most pet insurance providers allow you to select the deductible, annual payout, and reimbursement options to fit your needs and your policy premium price.

Fetch and Lemonade have annual deductibles. An annual deductible is helpful if your pet encounters multiple accidents or illnesses during the policy period (one year) because you’re responsible for paying the deductible once per policy term.

How do your choices with each option affect your policy’s price?

- Deductible

- A lower deductible means you’ll pay less out of pocket when your dog needs care

- But it also means a higher monthly premium

- Reimbursement Percentage

- A lower reimbursement rate gives you a lower premium

- But you’ll pay more out of pocket when filing claims

- Annual Payout

- A lower payout limit can save money monthly

- But if your vet bills go over that amount, you’ll be responsible for anything above your limit

These are your options with each provider:

Frequently Asked Questions

This Fetch vs Lemonade Pet Insurance FAQ covers the most common questions dog parents have when comparing these two providers.

Don’t see your question here? Drop it in the comments, and we’ll help you out!

Is Lemonade Pet Insurance Good?

Yes, Lemonade’s pet insurance is comparable to other providers and covers similar conditions.

While it only launched pet insurance in 2020, the company has been selling other types of insurance since 2015, giving it solid industry experience.

Why Won’t Lemonade Insure My Dog?

Lemonade has age restrictions for enrollment. Pets must be at least 8 weeks old, and some older pets may be ineligible.

One of our team members experienced this firsthand. Her 10-year-old Coonhound mix was not eligible for coverage.

Do Fetch Or Lemonade Require Vet Exams For Enrollment?

Yes, Fetch requires a vet exam within 6 months before or 30 days after enrollment. Lemonade requires a medical exam from the past 12 months for pets older than 1 year of age.

Do All Vets Accept Fetch & Lemonade?

Yes, both companies allow you to visit any licensed vet or emergency clinic in the U.S.. You just submit your claim afterward.

Is Fetch Or Lemonade Better For Your Pet?

Choosing between Fetch and Lemonade depends on what matters most to you. If you want a comprehensive, all-inclusive policy with fewer add-ons and more built-in coverage, Fetch is a strong pick.

On the other hand, if affordability and fast claims are your priorities, Lemonade’s customizable plans and speedy reimbursements are hard to beat.

Ultimately, both providers offer solid coverage for accidents and illnesses, but they go about it in very different ways. By weighing your pet’s needs, your budget, and how much customization you prefer, you can pick the plan that gives you the best peace of mind.

Want to dig deeper?

Check out our in-depth reviews of Fetch and Lemonade to expand your comparison. You can also read about the best pet insurance, including our top picks and details on the most popular pet insurance companies.

Methodology

My team and I conduct extensive research on the most reputable pet insurance companies, analyzing customer feedback, policy changes, and industry trends. Our licensed insurance agent fact-checks everything, and we update our reviews year-round as insurers adjust premiums, coverage, exclusions, and customer service.

We rank each U.S. pet insurance provider using a 100-point scale, ensuring an unbiased breakdown of how companies perform in real-world claims.

Our Ranking Criteria

- Coverage & Exclusions (30%) – We analyze policies, exclusions, and age restrictions, rewarding companies with fewer coverage limitations.

- Pricing (15%) – We run thousands of sample quotes and factor in extra fees, discounts, and add-ons.

- Customer Service & Reputation (12%) – We review hundreds of customer experiences, assess the sign-up process, and evaluate claim support.

- Financial Strength (10%) – We examine A.M. Best & Demotech ratings to ensure companies can pay claims reliably.

- Customization Options (10%) – Providers with more deductible, reimbursement, and payout flexibility rank higher.

- Waiting Periods (5%) – Shorter illness & accident waiting periods result in a better score.

- Claim Processing (5%) – Companies offering fast reimbursements and direct vet pay score higher.

- Innovation (3%) – We recognize unique offerings and advanced technology in the industry.

Unbiased Pet Insurance Rankings: Putting Pets First

Unlike many review sites, we don’t sell rankings—every provider earns its spot based on real performance. Our in-depth comparisons help pet parents make informed decisions, while insurers use our reviews to improve their policies. We only recommend the best because that’s what our readers deserve.