MetLife Pet Insurance Review: Entering A New Industry But Has Experience Too

When you purchase through links on our site, we may earn a commission. Here’s how it works.

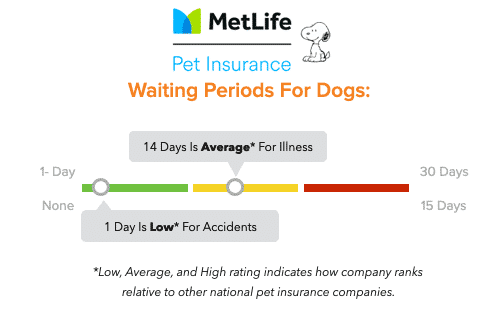

PetFirst was founded in 2004 and bought by MetLife in December 2019. MetLife Pet Insurance has a shorter waiting period for accidents compared to other insurers (only one day after enrollment). But is it best pet insurance for your dog or cat?

Table of Contents

MetLife Pet Insurance Review

Summary

MetLife is a newer name in the pet insurance industry, which means there’s only a little history to get a complete idea of what to expect from the company. Other providers often have lower prices, better coverage, and more stable reputations.

Overall Score

Pros

- Optional wellness plan (must purchase in conjunction with pet insurance)

- Most claims are processed within 5 days

- Diminishing deductible

Cons

- Doesn’t cover treatment, services, or supplies provided outside the U.S.

- Excludes working pets (e.g., law enforcement, racing, etc.)

Alternatives To MetLife Pet Insurance

Don’t like the score you’re seeing? Our experts have analyzed over a dozen pet insurance providers. Check out our pet insurance reviews to learn more about this year’s top-ranked companies or click here to get instant quotes.

Key Features

- Underwriter: Independence American Insurance Company (IAIC)

- A.M. Best rating (a measure of financial stability): A-

- Bilateral conditions (a condition or disease that affects both sides of the body) may be covered in some cases

- Claims process:

- Submit claims via email, app, mail, MyPets account, or fax

- Most claims are processed within 5 days

- Reimbursement is available via direct deposit, check, or Zelle

- Healthy pet incentive: Deductible decreases by $50 each policy year you don’t receive a claim reimbursement (may not be available in all U.S. states)

- Automatic policy limit increase: if your policy limit is $5,000 or more and you have an unused amount of $1,000 or more at the end of the policy period, then MetLife Pet Insurance will increase your policy limit by $500 at no extra cost to you when you renew

- Offers coverage for advertising and reward if your pet is lost (due to theft or straying), grief counseling when your pet passes away, and more

Customer Service Options & Hours

- Phone

- Monday-Friday: 8am-9pm EST

Saturday & Sunday: 10am-7pm EST

- Monday-Friday: 8am-9pm EST

- Live chat

Waiting Periods*

- Illnesses: 14 days

- Accidents: 1 day

- Cruciate Ligament: 6 months

- Hip Dysplasia: 1 day

- Wellness: 1 day

*States are gradually adopting a Model Law for pet insurance, aiming to standardize regulations, including uniform waiting periods. In California, Delaware, Louisiana, Maine, Mississippi, Nebraska, New Hampshire, Washington, Rhode Island, and Maryland, waiting periods are:

- Accidents: 0 days

- Illnesses: 14 days

- Cruciate Ligament Conditions: 30 days

- Routine Care: 0 days

What Does MetLife Pet Insurance Cover?

Please know that none of the providers in our pet insurance comparison charts cover pre-existing conditions, cremation and burial costs, pregnancy and breeding, or unnecessary cosmetic procedures.

All of them cover the following items when deemed medically necessary: emergency care, surgery and hospitalization, specialized exams and specialty care, X-rays, blood tests, ultrasounds, cat scans, MRIs, rehabilitation, cancer, chronic conditions, euthanasia, hereditary conditions, congenital conditions, non-routine dental treatment, and prescription medications. However, this coverage may have limitations, so please review your policy carefully.

| Condition | Covered By MetLife Pet Insurance |

|---|---|

| Behavioral Therapies | |

| Alternative/Holistic Therapies | |

| Cremation/Burial | |

| Exam Fees | |

| Wellness Care | Extra Fee |

Routine Care

MetLife Pet Insurance offers a routine care package as an add-on to your pet insurance policy, but doesn’t share specific details about what’s offered in this wellness plan.

Pricing Quotes

From the options below, MetLife Pet Insurance lets you choose your deductible, annual payout, and reimbursement amount. What you select will help determine your monthly cost.

| Deductible Options | Payout Options | Reimbursement Options |

|---|---|---|

| $50 $100 $250 $500 | $2,000 $5,000 $10,000 | 70% 80% 90% |

Pricing is based on your pet’s details. Use our pet insurance quote form below to see how it compares against other providers.

Discounts

Offers a 10% discount for vets, shelter personnel, etc. It also offers discounts for those serving in the military, veterans, first responders, and healthcare workers.

How Does The Claim & Reimbursement Process Work?

Uses a “deductible then copay” reimbursement method. This is calculated in the following way:

- Actual vet bill amount – Remaining annual deductible – Copay = Reimbursement amount

What’s Our Final Verdict?

MetLife Pet Insurance isn’t our top pick for pet insurance but why? Other companies can offer lower prices, more comprehensive coverage, and have longer, more stable reputations in the pet insurance industry. We rate the best pet insurance companies based on coverage, customer service and reputation, claim processing, price, plan customizations, and more. Find out who we chose as our top picks in our pet insurance reviews.