Pumpkin Pet Insurance Review: A Newer Pet Insurance Option

When you purchase through links on our site, we may earn a commission. Here’s how it works.

Pumpkin is a relative newcomer, entering the pet insurance world in 2020. Their wellness program brings something unique to the industry, and they are the first pet insurance producer to incorporate under a global pharmaceutical giant. At first glance, Pumpkin appears to offer a solid and innovative product to help protect pet owners, but let’s dig in to learn more.

Table of Contents

Pumpkin Pet Insurance Review

Summary

As a newcomer to the pet insurance space, Pumpkin has some unique offerings, including its wellness program. With many plan customizations and coverage for conditions often excluded by competitors, Pumpkin may be worth considering for your pet.

Overall Score

Pros

- Optional non-insurance wellness plan called Preventative Essentials can be purchased as an add-on

- 30-day money-back guarantee

- 10% multi-pet discount for all additional pets

- Your pet is covered when they travel with you in the U.S., Canada, Puerto Rico, Guam, and U.S. Virgin Islands

- No upper age limits for enrollment (pets must be 8 weeks or older)

Cons

- Price quotes tend to be more expensive than most competitors

- $2/month transaction fee

- Policies have a 14-day waiting period for accidents and illnesses

- No app (most competitors have an app)

- Excludes dental procedures

Key Features

- Underwriter: United States Fire Insurance Company, a Crum & Forster company

- A.M. Best rating: A

- Bilateral exclusions (a condition or disease that affects both sides of the body): ligament and knee conditions

- Claims process:

- Must submit claims within 270 days of the service date

- Direct deposit or check reimbursement is available

- Curable conditions term: Pre-existing conditions are not covered. However, an injury or illness that is cured and free of treatment and symptoms for 180 days will no longer be regarded as pre-existing, with the exception of knee and ligament conditions. If a knee or ligament condition occurs before the coverage effective date or during a waiting period, any future ones won’t be covered.

- Pumpkin agency is formed under Zoetis, the world’s largest global animal health company

Customer Service Options & Hours

- Email: help@pumpkin.care

- FAQ

- Phone: 866‑273‑6369

- Monday – Friday from 8 am to 8 pm EST

- Live Chat

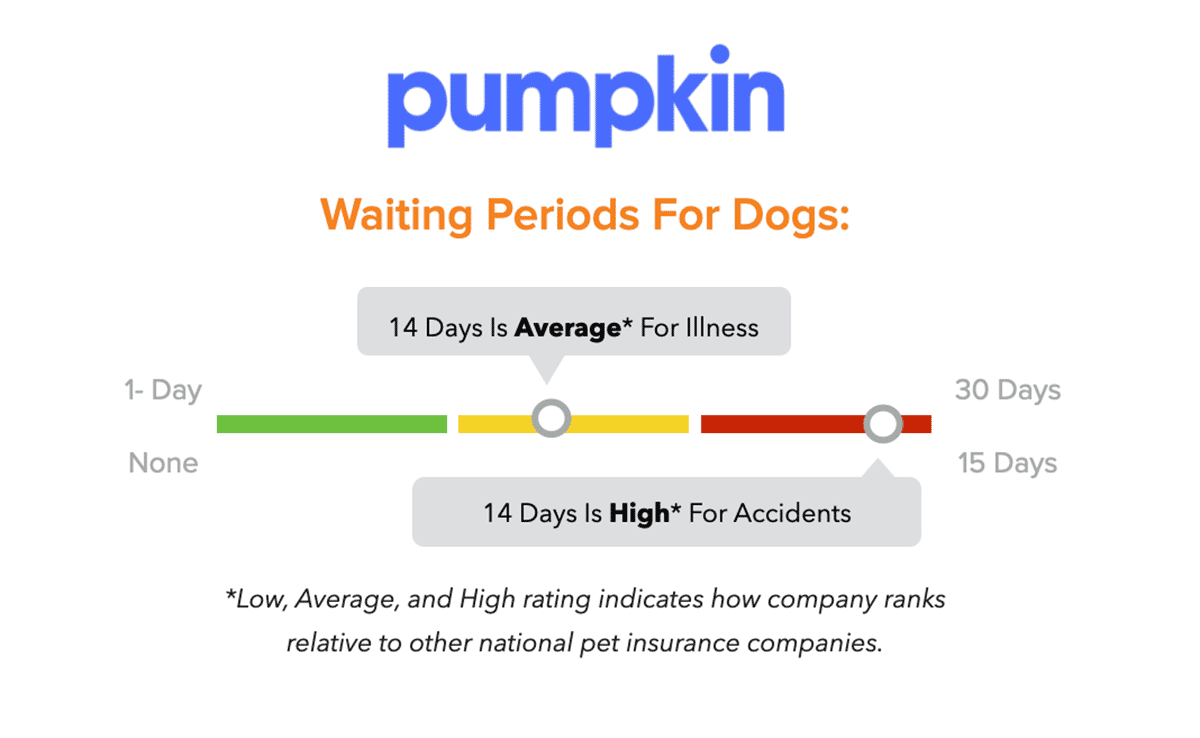

What Are Pumpkin’s Pet Insurance Waiting Periods*?

- Illness: 14 days

- Accidents: 14 days

- Cruciate Ligament Events: 14 days

- Hip Dysplasia: 14 days

- Wellness: 0 days (Wellness is not insurance, so there is no waiting period associated with it)

*States are gradually adopting a Model Law for pet insurance, aiming to standardize regulations, including uniform waiting periods. In California, Delaware, Louisiana, Maine, Mississippi, Nebraska, New Hampshire, Washington, Rhode Island, and Maryland, waiting periods are:

- Accidents: 0 days

- Illnesses: 14 days

- Cruciate Ligament Conditions: 30 days

- Routine Care: 0 days

What Does A Pumpkin Plan Cover?

Please know that none of the pet insurance plans offered by providers in our pet insurance comparison charts cover pre-existing conditions, cremation and burial costs, pregnancy and breeding, or unnecessary cosmetic procedures.

All of them cover the following items when deemed medically necessary and prescribed to treat a covered condition: emergency care, surgery and hospitalization, specialized exams and specialty care, X-rays, blood tests, ultrasounds, cat scans, MRIs, rehabilitation, cancer, chronic conditions, euthanasia, dental illnesses, and prescription medications. However, this coverage may have limitations, so please check your policy.

| Condition | Covered By A Pumpkin Plan |

|---|---|

| Behavioral Issues | |

| Alternative/Holistic Therapies (prescribed for covered conditions) | |

| Exam Fees (for covered conditions) |

Preventative Essentials Add-On

Preventive Essentials is Pumpkin’s wellness package. It’s not insurance, but an optional benefit you can add to your Pumpkin plan if you want refunds for certain routine care your dogs need to stay healthy. If you opt to pay $18.95 per month for Pumpkin’s Preventative Essentials plan, here is what you’ll be reimbursed for.

- 1 annual wellness exam fee

- 4 vaccines

- 1 blood test for heartworm and tick disease

- 1 fecal test for intestinal worms

How Much Is Pumpkin Pet Insurance?

Pumpkin has no one-time enrollment fee but a $2 transaction fee for every premium payment. Your monthly premium is based on the deductible, reimbursement percentage, and annual payout options that you choose from the table below.

| Deductible Options | Payout Options | Reimbursement Options |

|---|---|---|

| $100 $250 $500 $1,000 | $5,000 $10,000 $20,000 Unlimited | 80% 90% |

Pricing is also based on your pet’s details (age, species, breed, location, etc.). We recommend obtaining quotes from Pumpkin for your specific pet to get a more accurate idea of how much a policy would cost you.

Compare Pet Insurance Quotes From Multiple Providers

Pumpkin vs Other Companies

Interested in seeing how Pumpkin stacks up against other popular pet insurance companies? We’ve written comparison articles to show how Pumpkin and other leading pet insurance companies compare in coverage, customer service and reputation, claim processing, plan customization, and price.

- Embrace vs Pumpkin

- Healthy Paws vs Pumpkin

- Lemonade vs Pumpkin

- Nationwide vs Pumpkin

- Pets Best vs Pumpkin

- Trupanion vs Pumpkin

Is Pumpkin The Best Pet Insurance For My Dog?

Pumpkin is relatively new to the industry, but it’s proving to be an excellent contender in the space with its comprehensive coverage. It didn’t make it into our top pet insurance reviews this year, but you may see it listed in the future.

Methodology

My team and I conduct extensive research on the most reputable pet insurance companies, analyzing customer feedback, policy changes, and industry trends. Our licensed insurance agent fact-checks everything, and we update our reviews year-round as insurers adjust premiums, coverage, exclusions, and customer service.

We rank each U.S. pet insurance provider using a 100-point scale, ensuring an unbiased breakdown of how companies perform in real-world claims.

Our Ranking Criteria

- Coverage & Exclusions (30%) – We analyze policies, exclusions, and age restrictions, rewarding companies with fewer coverage limitations.

- Pricing (15%) – We run thousands of sample quotes and factor in extra fees, discounts, and add-ons.

- Customer Service & Reputation (12%) – We review hundreds of customer experiences, assess the sign-up process, and evaluate claim support.

- Financial Strength (10%) – We examine A.M. Best & Demotech ratings to ensure companies can pay claims reliably.

- Customization Options (10%) – Providers with more deductible, reimbursement, and payout flexibility rank higher.

- Waiting Periods (5%) – Shorter illness & accident waiting periods result in a better score.

- Claim Processing (5%) – Companies offering fast reimbursements and direct vet pay score higher.

- Innovation (3%) – We recognize unique offerings and advanced technology in the industry.

Unbiased Pet Insurance Rankings: Putting Pets First

Unlike many review sites, we don’t sell rankings—every provider earns its spot based on real performance. Our in-depth comparisons help pet parents make informed decisions, while insurers use our reviews to improve their policies. We only recommend the best because that’s what our readers deserve.

Why Trust Canine Journal?

Canine Journal has been covering the topic of pet insurance since 2012, well before other conglomerates discovered the rising popularity of health care for our pets. Many of our authors have personal experience with pet insurance, including Kimberly Alt, who has been Canine Journal’s go-to author for pet insurance for over a decade, having written about nearly every possible facet related to pet insurance. Kimberly knows the subject so well that she can answer a breadth and depth of pet insurance questions immediately. And on the rare occasion she doesn’t know the answer off the top of her head, she can find it within minutes due to her extensive list of resources.

Kimberly also consulted with Michelle Schenker, Canine Journal’s in-house licensed insurance agent, for additional expertise, to ensure accuracy, and give Canine Journal the authority to write about and assist readers in purchasing policies that are accurately represented.

Disclosure From Pumpkin

Pumpkin Pet Insurance policies do not cover pre-existing conditions. Waiting periods, annual deductible, co-insurance, benefit limits, and exclusions may apply. For full terms, visit pumpkin.care/insurancepolicy. Products and rates may vary and are subject to change. Discounts may vary and are subject to change.

Pumpkin Insurance Services Inc. (“Pumpkin”) (NPN#19084749) is a licensed insurance agency, not an insurer. Insurance is underwritten by United States Fire Insurance Company (NAIC #21113. Morristown, NJ), a Crum & Forster Company, and produced by Pumpkin. Pumpkin receives compensation based on the premiums for the insurance policies it sells. For more details visit pumpkin.care/underwriting-information and pumpkin.care/insurance-licenses.

Pumpkin Preventive Essentials is not an insurance policy. It is offered as an optional add-on non-insurance benefit. Pumpkin is responsible for the product and administration. For full terms, visit pumpkin.care/customeragreement. Pumpkin Preventive Essentials is not available in all states.