Best Pet Insurance for Large Breed Dogs: Avoid the $40K Vet Bill Mistake

When you purchase through links on our site, we may earn a commission. Here’s how it works.

One emergency vet bill could wreck your finances.

Table of Contents

Cancer in dogs can run over $40,000, and it’s not the only threat.

If you think pet insurance sounds optional, think again.

Is it worth it?

Only if protecting your gentle giant matters.

Here’s how to get the right coverage, before it’s too late.

Is Pet Insurance Worth It for Large Dogs?

Large dogs are more likely to face serious medical issues like hip dysplasia, torn ligaments, and bloat, which can cost thousands to treat.

For most large-breed dog owners, pet insurance is essential.

A Liberty Mutual survey found that two-thirds of pet owners couldn’t afford an unexpected vet bill without financial strain.

Some treatments top $10,000. That’s not a worst-case scenario; it’s a common reality for big breeds.

Pet insurance gives you:

- Financial protection

- Peace of mind

- The ability to say “yes” to care without hesitation

But not all plans are equal. You need one that covers hereditary and orthopedic issues common to large dogs.

So, what should you look for in a policy? Let’s break it down.

8 Top Health Risks in Large-Breed Dogs

Before you choose a policy, know what you’re up against.

Every breed has its own genetic vulnerabilities. Start by checking with your dog’s national breed club or a trusted source like the American Kennel Club.

These are the most common health issues in large breeds:

- Hip & elbow dysplasia

- Cruciate ligament injuries

- Bloat (Gastric Dilatation-Volvulus)

- Cancer (e.g., osteosarcoma, lymphoma)

- Heart disease

- Arthritis and joint degeneration

- Eye disorders

- Hypothyroidism

Understanding these risks helps you choose a plan that actually protects your dog long-term.

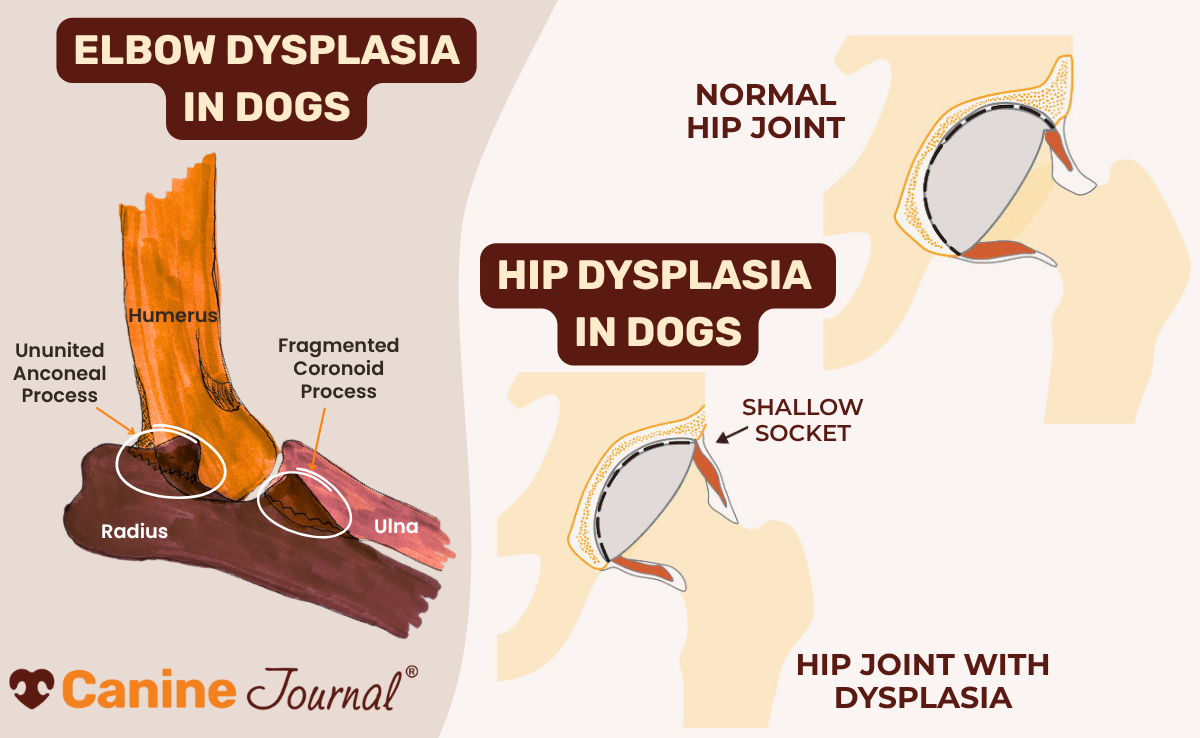

1. Hip & Elbow Dysplasia

These are among the most common health issues in large-breed dogs, especially hip dysplasia.

According to the American College of Veterinary Surgeons (ACVS), genetics is the biggest risk factor.

Even with good breeding practices and parental hip scores, your dog isn’t in the clear.

What happens:

Joint dysplasia leads to chronic pain, mobility problems, muscle loss, and eventually, arthritis.

Treatment costs: $1,700–$4,500+ per hip

In many cases, surgery is the only option for your dog to live comfortably.

And without insurance? You’re paying it all out of pocket.

2. Cruciate Ligament Injuries

Cruciate ligament tears, especially cranial cruciate ligament (CCL) injuries, are one of the most common orthopedic issues in large-breed dogs.

This injury is the canine version of a torn ACL in humans. It often happens suddenly during play or exercise, but it can also develop gradually from joint degeneration.

Signs to watch for:

- Sudden lameness or limping

- Reluctance to bear weight on one leg

- Swelling or stiffness in the knee

Why it matters:

Without surgery, your dog can suffer from chronic pain, limited mobility, and long-term arthritis.

Treatment options:

- Conservative management (meds, rest)

- TPLO or TTA surgery—often recommended for large dogs

Cost of cruciate surgery: $3,000–$6,000 per knee

And yes, both knees can go. Insurance that covers orthopedic conditions is essential for active, large-breed dogs.

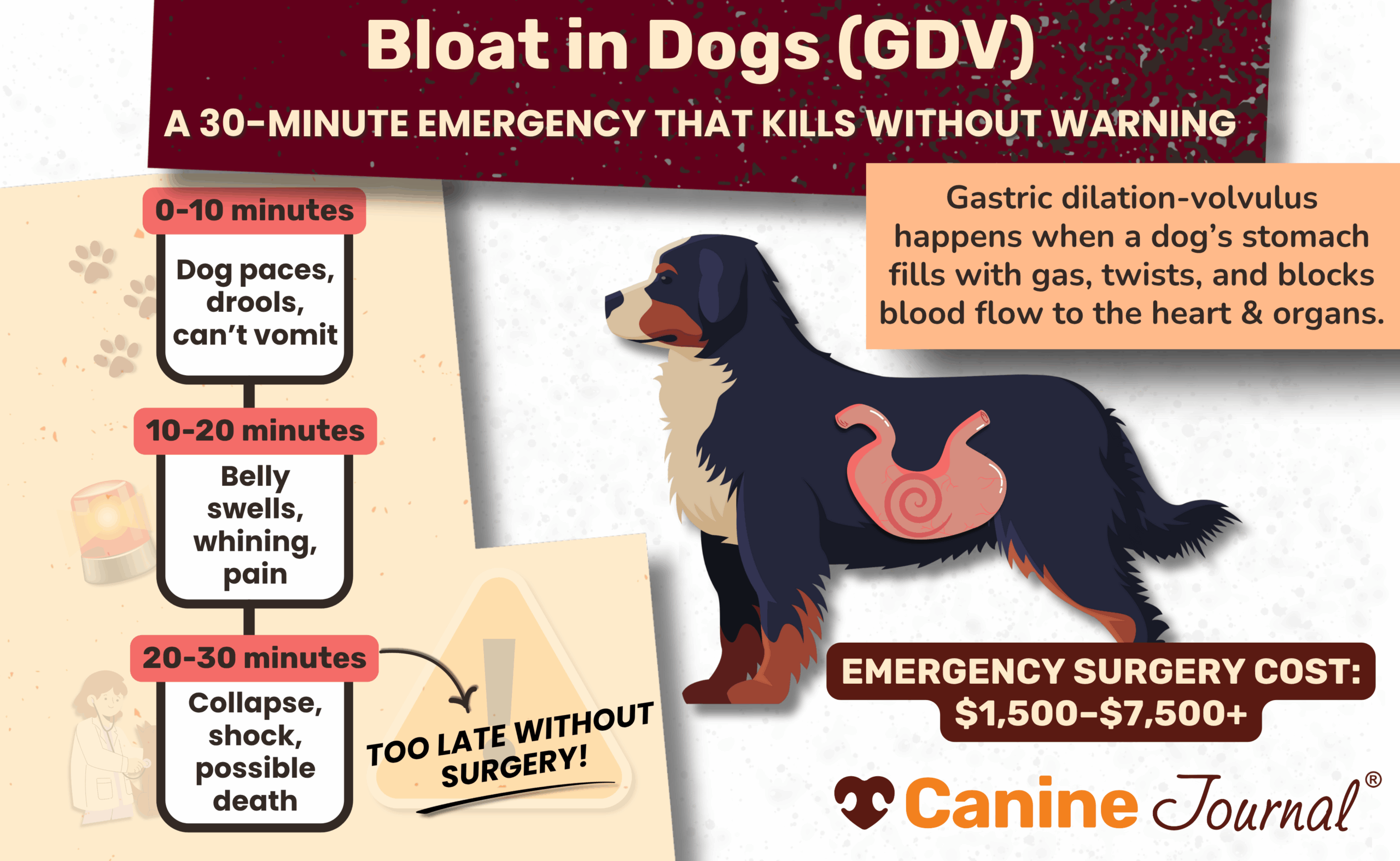

3. Bloat (GDV)

Also called gastric dilation-volvulus (GDV), this is a life-threatening emergency, and it hits large, deep-chested dogs the hardest.

What raises the risk?

- Genetics (family history of bloat)

- Feeding once a day

- Fast eating

- Exercise soon after meals

The danger?

It strikes without warning.

That’s why vets call GDV the “mother of emergencies.”

It can kill within 30 minutes if untreated.

Emergency surgery costs: $1,500–$7,500

Without fast action and deep pockets, the outcome is often fatal.

4. Cancer

Cancer is one of the leading causes of death in large-breed dogs. And when it strikes, it strikes hard.

Breeds like Great Danes, Rottweilers, and Golden Retrievers are especially prone to aggressive cancers such as:

These cancers often develop quickly and require immediate treatment to extend your dog’s life or ease suffering.

Treatment may include:

- Surgery

- Chemotherapy

- Radiation

- Palliative care

Average costs:

- Diagnostic testing: $500–$1,500

- Surgery: $2,000–$8,000

- Chemo or radiation: $5,000–$10,000+ over time

Some advanced cases can exceed $20,000–$40,000, especially with bone cancer in giant breeds.

Families are forced to choose between debt and declining treatment.

With insurance, you can focus on care, not cost.

5. Cardiac Conditions

Heart problems are common in large-breed dogs, especially dilated cardiomyopathy (DCM).

This condition causes the heart’s walls to thin and weaken, making it harder to pump blood.

DCM can develop gradually or appear suddenly, and it’s often genetic.

Management may include:

- Daily heart medication

- In severe cases, surgery to prevent heart failure

- Emergency intervention if cardiac arrest occurs

Cost of surgery: $10,000–$20,000

It’s one of the most expensive conditions affecting large dogs, and one of the most devastating if untreated.

6. Arthritis

Arthritis is nearly inevitable in large-breed dogs as they age, especially those with a history of joint issues like hip dysplasia or cruciate ligament tears.

This chronic condition causes inflammation, pain, and stiffness that worsens over time.

Signs of arthritis include:

- Slower movement

- Difficulty standing up or climbing stairs

- Limping or reluctance to walk long distances

- Irritability due to pain

Treatment is long-term and often includes:

Monthly cost: $50–$200

Over your dog’s lifetime, arthritis can become a major financial burden, depending on the meds, supplements, and therapies.

A good insurance plan with chronic condition coverage ensures your dog stays comfortable, without draining your wallet.

7. Eye Disorders

Large dogs are prone to multiple eye conditions, including:

- Ectropion

- Entropion

- Cherry eye

- Cataracts

- Progressive retinal atrophy (PRA)

Many of these can be managed with medication or routine hygiene, like antibiotic eye drops.

But in serious cases, surgery is the only option to restore comfort or prevent vision loss.

Costs to expect:

- Eye exam + drops: $100

- Cherry eye surgery: $1,100–$2,000

Prices vary based on:

- Dog’s size

- Severity

- How many eyelids are affected

Insurance that covers surgical eye treatment can make the difference between lifelong vision loss and a pain-free, functional recovery.

8. Hypothyroidism

Hypothyroidism is a common endocrine disorder in large-breed dogs, especially Dobermans, Golden Retrievers, and Great Danes.

It happens when the thyroid gland doesn’t produce enough hormones, slowing down your dog’s metabolism.

Typical symptoms include:

- Lethargy

- Weight gain (despite a normal diet)

- Hair thinning or skin issues

- Cold intolerance

Though rarely life-threatening, it’s a lifelong condition that requires daily medication and regular bloodwork.

Costs to expect:

- Initial diagnosis: $200–$500

- Monthly meds: $15–$50

- Annual monitoring: $200–$400

Left untreated, hypothyroidism can affect your dog’s heart, fertility, and quality of life.

A pet insurance plan that covers chronic conditions can make long-term management far more affordable.

4 Things to Look for in Pet Insurance for Large Breeds

Having options is great…until it becomes overwhelming.

Not every policy is built for big dogs. And the fine print? That’s where many owners get caught off guard.

Here’s what to pay close attention to when choosing a plan that actually works for your large-breed dog:

1. Age Limits & Waiting Periods

Age restrictions vary widely between providers. Some won’t enroll puppies under 8 weeks. Others deny new coverage to dogs over 14.

Large breeds often face serious issues earlier in life, so delaying coverage can backfire.

Also, check the waiting periods, the time between signup and when coverage begins.

- Accidents: typically covered after a few days

- Illnesses: may require 2–30+ days

- Orthopedic issues: sometimes carry months-long waits

Why it matters:

If your dog gets sick or injured during the waiting period, you pay out of pocket, even if you’re already enrolled.

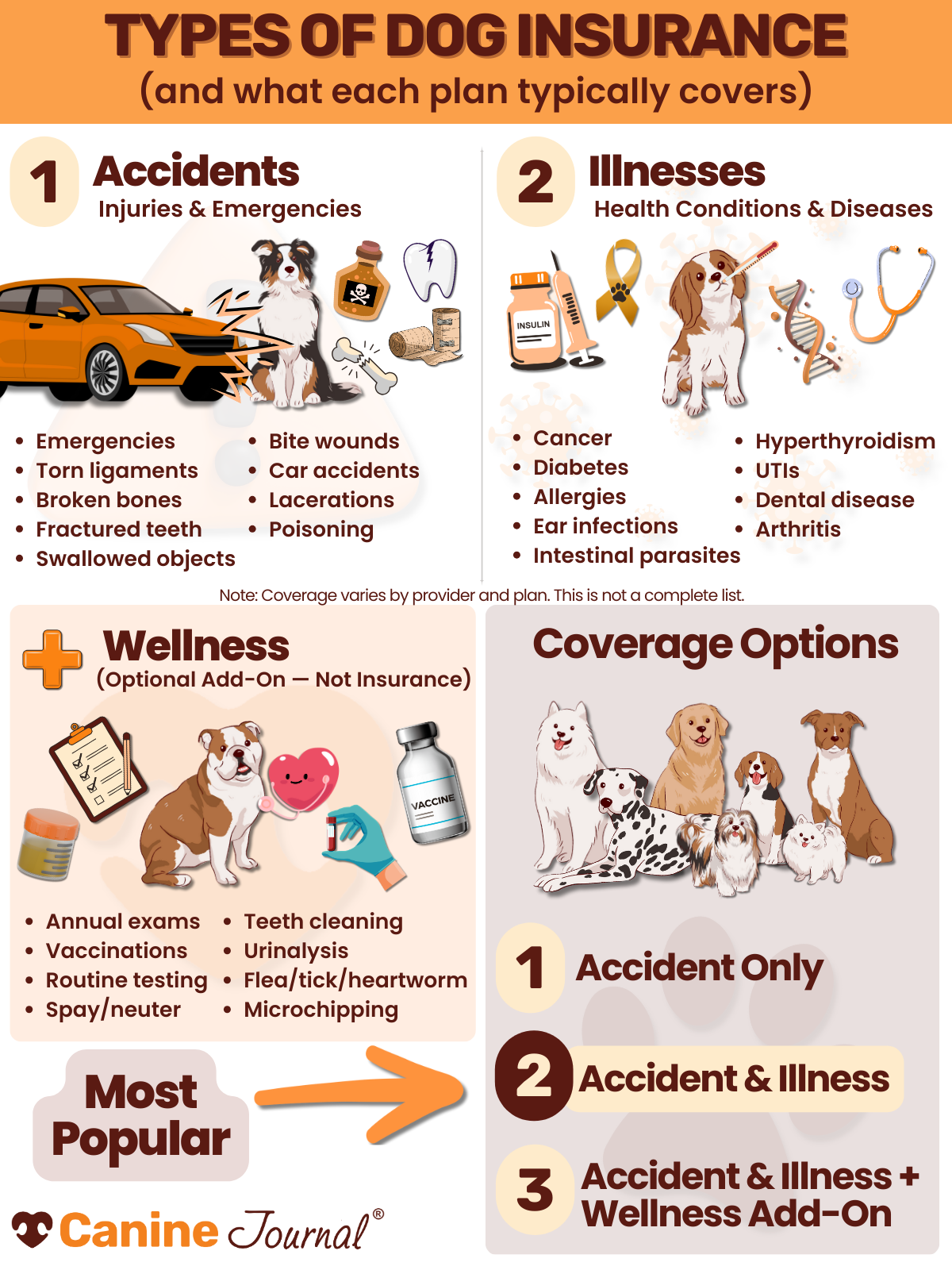

2. Coverage Types & Custom Options

There are three core coverage types:

- Accident-only – Covers injuries like poisoning, broken bones, or swallowed objects

- Accident & illness – Adds protection for things like infections, cancer, or digestive issues

- Wellness add-on – Optional plan for routine care like vaccines, dental cleanings, or exams

Tip: Wellness plans are not insurance, so coverage limits and rules may differ. Review them carefully.

Most owners choose accident & illness because it offers broad protection against unpredictable health issues.

Some providers also offer tiered plans, so pay attention to what each level includes and what’s left out.

3. Deductibles & Payout Limits

The deductible is what you pay before insurance kicks in. It might be:

- Annual (reset every year)

- Per-incident (applies to each new condition)

Higher deductibles usually mean lower monthly premiums, but more upfront cost when your dog gets hurt or sick.

Also, look at claim caps, which limit how much your insurer will pay:

- Per incident

- Per year

- Lifetime

If your large dog develops a long-term condition, like cancer or arthritis, hitting that cap early could leave you without coverage when you need it most.

4. Common Exclusions

Every policy has exclusions (things they won’t pay for).

Some are standard:

- Pre-existing conditions

- Cosmetic procedures

But others are more serious:

- Dental illnesses

- Hip dysplasia

- Bloat surgeries

- Chronic illnesses after enrollment

If your policy excludes the most common large-breed conditions, it’s not protecting your dog.

Always read the policy documents, not just the marketing claims.

Bottom line:

The best pet insurance policy for your large-breed dog isn’t just the cheapest; it’s the one that pays out when it matters most.

You’re not just comparing prices. You’re comparing outcomes.

Best Pet Insurance for Large-Breed Dogs

So, who actually delivers when it counts?

We reviewed the top providers based on coverage quality, breed-specific protection, cost transparency, and long-term value, because large-breed dogs aren’t average, and their insurance shouldn’t be either.

Here are our top picks for the best pet insurance for large-breed dogs, ranked by what matters most: real protection when your dog needs it most.

Pets Best: Best Overall Coverage

Dog premiums average $40-$64/month | Pros

| Cons

|

Pets Best offers some of the shortest waiting periods, including just 14 days for hip dysplasia, which is critical for breeds prone to joint issues. Plans are flexible, affordable, and include optional coverage for exam fees, rehab, acupuncture, and chiropractic care, key supports for large dogs recovering from orthopedic surgery.

Fetch: Best for Large Puppies

Dog premiums average $35/month | Pros

| Cons

|

Early coverage matters, and Fetch allows enrollment as early as 6 weeks old, perfect for large-breed puppies that need protection from the start. It also covers breed-specific conditions, including orthopedic issues that often emerge early in life.

Healthy Paws: Best for Unlimited Payouts

Dog premiums average $46/month | Pros

| Cons

|

When a large dog develops cancer or needs orthopedic surgery, costs skyrocket fast. Healthy Paws offers no annual or lifetime caps, making it ideal for big breeds that face some of the most expensive health risks.

Figo: Best for Fast Coverage

Dog premiums average $30-$50/month | Pros

| Cons

|

Figo has short waiting periods and one of the fastest claims systems available, perfect for when large dogs suddenly tear a ligament or face emergency bloat surgery. Its 24/7 live vet chat is a huge plus, too.

Embrace: Best for Large-Breed Senior Dogs

Dog premiums average $21-$110/month | Pros

| Cons

|

Embrace enrolls new dogs up to 15 years old and covers many chronic conditions, including arthritis and thyroid disorders. It’s one of the few insurers that considers curable pre-existing conditions after a symptom-free period, ideal for aging giants.

Lemonade: Most Affordable

Dog premiums average $48/month | Pros

| Cons

|

Lemonade’s tech-driven pricing keeps monthly premiums lower than many competitors. While it’s best for younger, healthy large dogs, it’s a smart choice for owners looking to lock in coverage early at a lower price point.

Trupanion: Best for Direct Vet Payment

Dog premiums average $60-$120/month | Pros

| Cons

|

Trupanion pays your vet directly at checkout, so you’re not stuck covering a $5,000 bloat surgery upfront. Their per-condition lifetime deductible is great for big dogs prone to recurring issues like joint disease or heart conditions.

5 Ways to Save on Pet Insurance for Large Dogs (Without Compromising Coverage)

Pet insurance isn’t cheap, especially for large breeds prone to serious health issues. But there are smart ways to keep premiums lower without gutting your protection.

Here’s how to cut costs without cutting corners:

1. Increase Your Deductible

The higher your deductible, the lower your monthly premium.

Just make sure you can comfortably afford that amount upfront in an emergency, especially since large-breed procedures like bloat surgery or joint repairs aren’t cheap.

2. Pay Annually Instead of Monthly

Many insurers charge extra fees for monthly billing.

If you can swing a one-time annual payment, you’ll usually avoid those transaction fees and potentially save 5–10% overall.

3. Take Advantage of Multi-Pet Discounts

Got more than one furry family member?

Some insurers offer up to 10% off when you enroll multiple pets. Just check whether the discount applies to all pets or just the second one and beyond.

Tailor each policy individually so your large dog’s needs, like orthopedic coverage, aren’t watered down.

4. Skip Wellness Add-Ons (If You’re Budget-Conscious)

Wellness plans cover things like vaccines and flea meds, but they rarely save money in the long run.

If you’re choosing between bloat surgery coverage and routine care, prioritize emergency protection first.

You can budget for routine costs, but you can’t predict a $6,000 cruciate surgery.

5. Look for Diminishing Deductibles

Some companies (like Figo or Embrace) lower your deductible each year you don’t file a claim, down to $0.

That means fewer out-of-pocket costs when big expenses do hit, and potential long-term savings.

How Much Should You Budget?

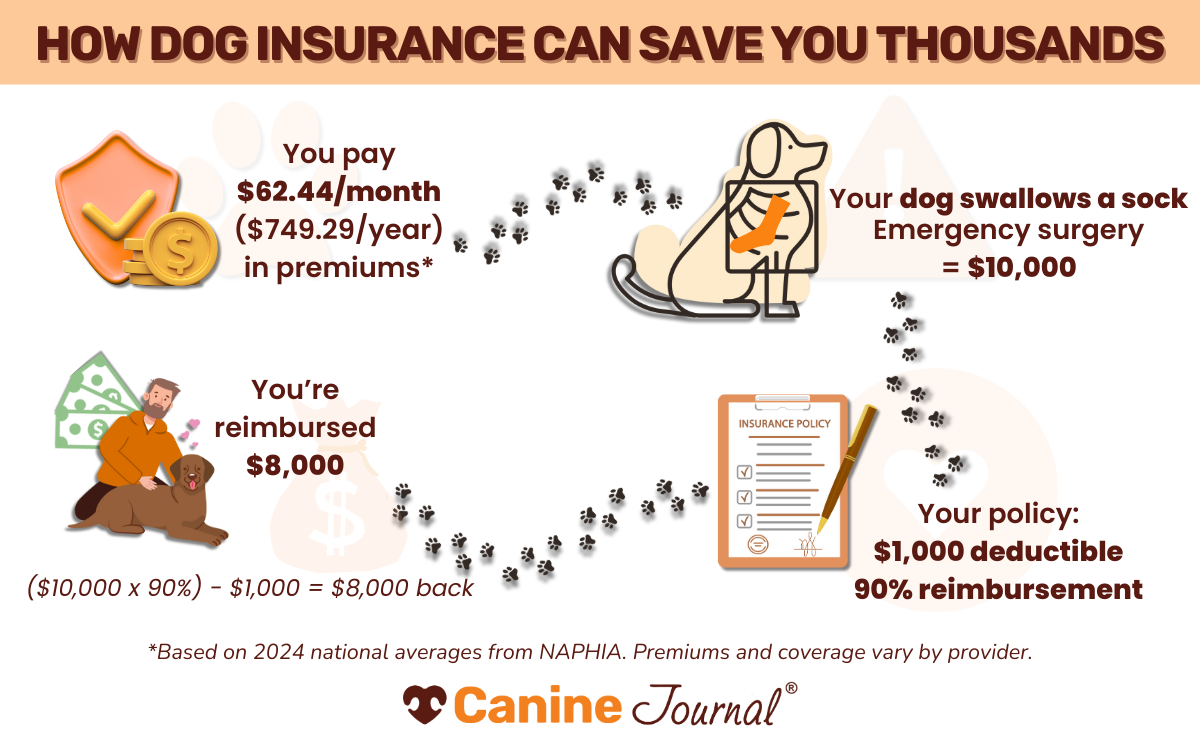

According to NAPHIA (North American Pet Health Insurance Association), the average monthly premium for an accident and illness dog insurance policy in the U.S. is $62.44 ($32.10 for cats).

If you’re looking for a more basic plan, accident-only coverage is significantly cheaper, averaging just $16/month. But keep in mind: these plans don’t cover cancer, joint issues, or chronic conditions common in large breeds.

Want to See Exact Numbers?

Use our free quote tool to compare top pet insurance companies. Just enter your dog’s breed, age, and zip code to get personalized policy options, no commitment required.

Knowing your dog’s risk factors helps you choose coverage that’s actually worth the price.

Claim Example: Why Monthly Cost Isn’t the Whole Story

Your large dog swallows a sock. Emergency surgery costs $10,000.

With pet insurance:

- Deductible: $1,000

- Reimbursement: 90%

- Your total cost: $2,000

- Insurance pays: $8,000

Without insurance:

You’re out the full $10,000, upfront and unexpected.

One emergency can blow past years of premiums.

Pet insurance isn’t just a monthly bill. It’s a financial lifesaver.

Should You Insure Your Big Dog?

If you own a large-breed dog, pet insurance isn’t optional; it’s protection.

From cruciate tears to cancer, big dogs face big risks. And with treatments often topping $10,000, a policy can mean the difference between saving your dog and financial devastation.

Insurance gives you:

- Peace of mind when the unexpected happens

- Support when costs surge

- Options, so you never have to say “we can’t afford that”

But coverage isn’t one-size-fits-all.

Not all plans cover the same conditions, and pre-existing issues are usually excluded.

What counts as a pre-existing condition?

- Know your breed’s risks

- Read the fine print

- Call the insurer or your vet if anything’s unclear

Every big dog deserves care you can afford, and a plan that won’t let you down when it matters most.