Best Pet Insurance For Jack Russell Terriers

When you purchase through links on our site, we may earn a commission. Here’s how it works.

Jack Russell Terriers are spirited, fearless little athletes, but their boundless energy and genetic predispositions make them prone to certain health issues.

Table of Contents

From patellar luxation and eye diseases to dental concerns and skin allergies, Jack Russells can rack up vet bills that surprise even the most prepared pet parents.

That’s where pet insurance becomes a wise investment.

A well-chosen plan helps offset the cost of diagnosing and treating these conditions, allowing you to focus on your dog’s care instead of the bill.

In this guide, I’ll walk you through:

- The most common Jack Russell Terrier health problems

- The estimated costs of treating them

- How to choose the best insurance plans tailored for this energetic breed

Not every policy covers things equally, so let’s find the right fit for your JRT.

Best Pet Insurance For Jack Russell Terriers

I’ve researched the top pet insurance companies with Jack Russell Terriers in mind, focusing on what matters most to their owners.

Using factors like:

- Age & enrollment limits

- Monthly premium costs

- Coverage details

- Breed-specific health concerns

…I narrowed down the most reliable providers to help you find the right policy for your energetic Terrier.

Whether you’re worried about eye diseases, joint problems, dental disease, or sudden injuries from their high-energy lifestyle, the right plan can make a huge difference in your pup’s long-term health.

| Best For | Company | Get Quotes | Read In-Depth Reviews |

|---|---|---|---|

| Most Affordable |  | Read Review | |

| All-Inclusive Coverage |  | Read Review | |

| Unlimited Payouts | Read Review | ||

| Jack Russell Puppies |  | Read Review | |

| Behavioral Issues |  | Read Review | |

| Most Affordable |  | Read Review | |

| Vet Direct Pay |  | Read Review |

Most Affordable: Pets Best

If you’re looking for coverage that won’t break the bank, Pets Best consistently offers some of the lowest premiums for Jack Russell Terriers. Despite the budget-friendly price, the plans are very comprehensive and remain quite affordable when you factor in exam fee coverage and other extras. This makes it a solid choice for value-conscious owners.

Why It’s a Great Fit:

- Some of the most affordable pricing across age ranges

- Fast coverage for orthopedic conditions (14 days)

- Optional wellness add-ons for dental cleanings and preventive care

- Multi-pet discount available

Estimated Cost Summary:

- Among the most affordable options for Jack Russells

- Great value for owners seeking essential accident and illness coverage

- Pricing stays competitive even as dogs age

Bottom Line:

Pets Best offers broad coverage at a lower price point, making it ideal for Jack Russell owners who want peace of mind without high premiums.

See our full Pets Best review.

| Pros | Cons |

|---|---|

| Among the most budget-friendly options for JRTs | Claim reimbursement isn’t the fastest (averages 10 days) |

| 5% multi-pet discount | Exam fees and complementary therapy cost extra* |

| Accident-only and optional wellness plans available | |

| Covers treatable pre-existing conditions once healed | |

| Only 14-day wait for patellar luxation and hip dysplasia (vs 6 months) | |

| Short 3-day waiting period for accidents | |

| No maximum age restrictions for enrollment | |

| 24/7 vet helpline |

Best For All-Inclusive Plans: Fetch

Jack Russells are prone to both accidents and long-term health issues, so broad protection can be a lifesaver. Fetch is one of the most comprehensive options available, covering items that many providers exclude or charge extra fees for, such as veterinary exam costs, behavioral therapy, and comprehensive care.

Why It’s a Great Fit:

- Extensive coverage, including exam fees, dental illness, and behavioral therapy

- Pre-approvals available, so you’ll know what treatments will be covered before committing to a procedure

- Extras like virtual vet visits, lost pet advertising, and boarding fees are included in standard plans

Estimated Cost Summary:

- Higher premiums than budget brands, but broader coverage is included

- Good balance of cost and protection for all-inclusive plans

- Worth the price if you want exam fees, behavioral care, and extras covered

Bottom Line:

Fetch offers some of the most complete coverage you’ll find, though you’ll pay a bit more, and orthopedic waits are longer. It’s best suited for Jack Russell parents who want to guard against every “what if.”

See our full Fetch review.

| Pros | Cons |

|---|---|

| Broadest coverage, including behavioral and dental illness | Longer 6-month orthopedic waiting period (hips, knees) |

| Includes free virtual vet visits, trip cancellation, lost pet help | No multi-pet discount |

| Covers curable pre-existing conditions after 12 months with no symptoms | Premiums are higher than budget competitors |

| Pre-approval available | |

| No upper age limits for enrollment | |

| Optional wellness plan | |

| Puppies can be enrolled at 6 weeks |

Best For Unlimited Payouts: Healthy Paws

If you want complete peace of mind, Healthy Paws delivers with no caps on coverage — ever. For Jack Russells, that means you’ll never have to worry about hitting a limit if your pup needs expensive orthopedic or eye surgery.

Why It’s a Great Fit:

- Unlimited payouts on every plan (no annual or lifetime caps)

- Fast claims turnaround, often within 2–3 business days

- 15-day waiting period for patellar luxation

- High customer satisfaction and straightforward plan options

Estimated Cost Summary:

- Moderate monthly rates compared to competitors

- Strong value since every plan includes unlimited payouts

- Costs climb with older dogs, but remain fair for the coverage offered

Bottom Line:

Healthy Paws offers unlimited protection and quick reimbursements, making it a top choice for Jack Russell parents who don’t want to worry about coverage caps. Just note that hip dysplasia has a longer waiting period and restrictions if you wait too long to enroll.

See our full Healthy Paws review.

| Pros | Cons |

|---|---|

| Unlimited annual payouts on all policies | No coverage for exam fees or behavioral therapy |

| Competitive rates for unlimited coverage | 12-month wait for hip dysplasia (if enrolled under age 6) |

| Fast claims processing (avg. 2–3 days) | Hip dysplasia excluded if enrolled after age 6 |

| Short 15-day wait for patellar luxation | Some dogs may be ineligible based on age or location |

| Covers complementary therapies | Enrollment cut-off at age 14 |

| High reviews for customer service |

Best For Basset Hound Puppies: Figo

Jack Russell puppies are curious, bold, and sometimes reckless, so accidents and early health issues aren’t uncommon. Figo is an excellent fit for young pups thanks to its short waiting times and flexible plan options.

Why It’s a Great Fit:

- 1-day accident coverage (one of the shortest waits available)

- Highly customizable, with options for 100% reimbursement and unlimited payouts

- Fast claims processing (often 2–3 days)

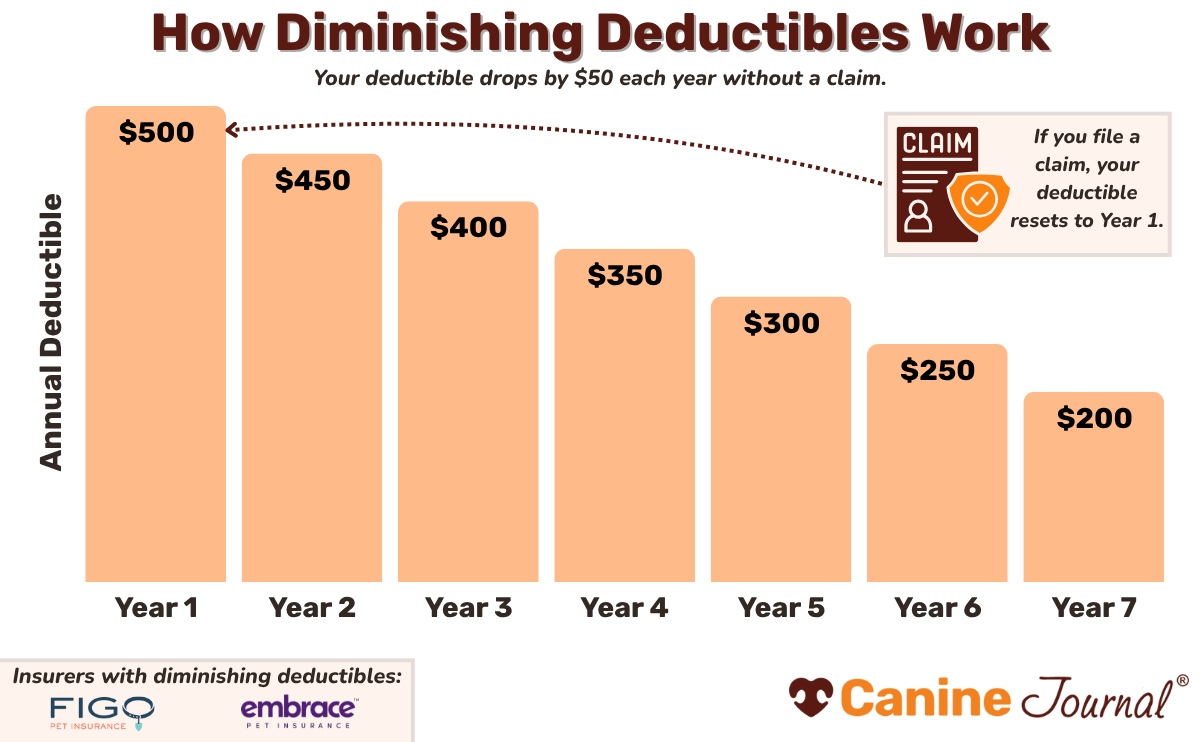

- Deductible decreases by $50 each year you don’t file a claim

Estimated Cost Summary:

- Flexible pricing with customizable deductibles and reimbursement levels

- Can be very affordable for basic coverage

- Premiums increase with richer benefits, but options help control your budget

- Maximum coverage is above average in some cases

Bottom Line:

Figo is built for puppy parents who want flexibility and speed. With short accident waits and highly customizable plans, it grows with your Jack Russell from puppyhood through adulthood.

See our full Figo review.

| Pros | Cons |

|---|---|

| 1-day accident waiting period | Exam fees require add-on |

| Customizable plans, including 100% reimbursement | 6-month orthopedic waiting period |

| Includes behavioral, complementary, and dental care | Premiums climb with senior dogs |

| Fast 3-day claims processing | |

| Deductible drops $50 every claim-free year | |

| Optional wellness plans available | |

| Multi-pet discount (5%) |

Best For Behavioral Issues: Embrace

Dental disease and problems are among the most significant health risks for Jack Russell Terriers. Embrace stands out because its dental benefits are among the best in the industry, covering non-routine dental treatment, endodontic disease, tooth infections and extractions, dental injuries, and more. It also offers coverage for behavioral therapy, which can be helpful for Terriers with anxiety, aggression, or destructive habits.

Why It’s a Great Fit:

- Includes up to $1,000/year for dental illness, including extractions and oral infections

- Covers behavioral therapy (for issues like anxiety, aggression, or chewing)

- Diminishing deductible—drops $50 each year you don’t file a claim

- Customizable plans, with options to add exam fee and prescription coverage

Estimated Cost Summary:

- Mid-range pricing compared to budget providers

- Great value for dental and behavioral coverage that many insurers exclude

- Premiums stay competitive for comprehensive accident and illness protection

- Affordable pricing for basic plans

Bottom Line:

If you’re worried about your Jack Russell’s teeth or want a plan that rewards claim-free years, Embrace offers excellent dental coverage plus perks many other insurers don’t include.

See our full Embrace review.

| Pros | Cons |

|---|---|

| Covers dental illness up to $1,000/year | Prescription and exam fee coverage require add-ons |

| Includes behavioral therapy and complementary care coverage | 6-month waiting period for orthopedic issues |

| Fully customizable plans with unlimited payout option | Dogs enrolled after 15 years old are only eligible for accident-only coverage |

| Optional wellness coverage | |

| Vanishing deductible rewards claim-free years |

Most Affordable: Lemonade

Lemonade’s à-la-carte approach to pet insurance policies gives pet parents a lot of flexibility to tailor coverage for any budget. In addition to adjustable deductibles, reimbursement rates, and coverage limits, Lemonade offers the option to upgrade with several separate add-ons, allowing you to fine-tune a plan that matches your budget.

Why It’s a Great Fit:

- Highly customizable with multiple deductibles, reimbursement, and payout options

- Add-ons available for dental, exam fees, behavior, and more

- Short 2-day accident waiting period (one of the fastest in the industry)

- Quick digital claims filing through the Lemonade app

Estimated Cost Summary:

- Affordable entry-level plans compared to most competitors

- Competitive pricing for customizable coverage

- Value depends on the options you select

- Maximum coverage with all add-ons is often pricey

Bottom Line:

Lemonade is best for Jack Russell owners who like to set their own balance between cost and coverage, with one of the shortest accident waits available.

Check out our full Lemonade review.

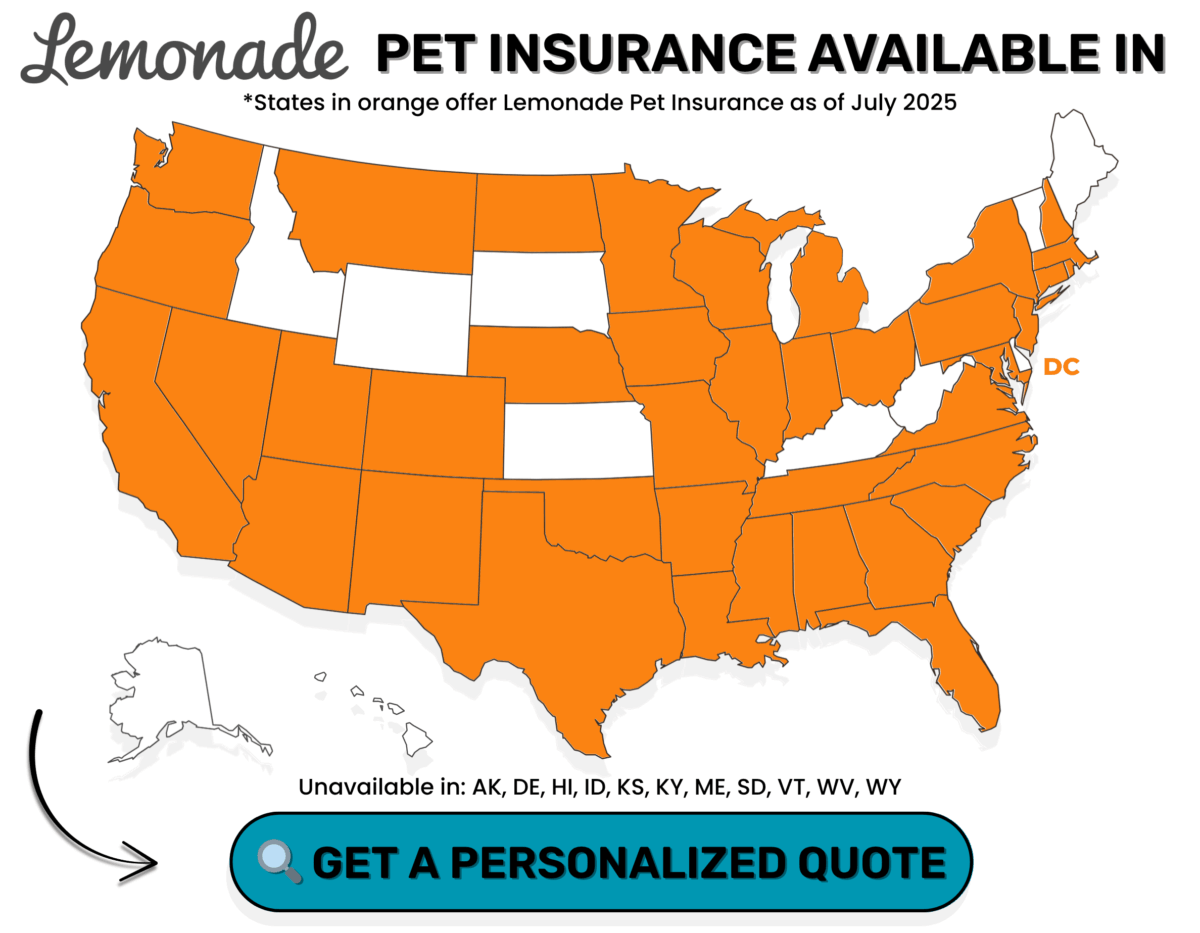

Lemonade Pet Insurance Is NOT Available In: AK, DE, HI, ID, KS, KY, ME, SD, VT, WV, WY

| Pros | Cons |

|---|---|

| Highly customizable pricing | Only available in certain states |

| 5% multi-pet discount | Must pay extra for exam fees, dental illness, behavioral therapy, and complementary care |

| Fast, app-based claims process | Phone customer support can be difficult to reach |

| Covers curable pre-existing conditions after 12 months with no symptoms | |

| Two optional wellness plans | |

| Short 30-day wait for hip dysplasia and patellar luxation (vs 6 months with other providers) |

Best For Vet Direct Pay: Trupanion

With most insurers, you pay the vet bill up front and wait for reimbursement. Trupanion is different — it pays vets directly at the time of service, so you’re not stuck covering thousands out of pocket while waiting on a claim.

Why It’s a Great Fit:

- Direct vet pay prevents large out-of-pocket expenses

- Covers hereditary and chronic issues common in Jack Russells

- No annual or lifetime payout caps on all plans

- Lifetime per-condition deductibles (set once per issue)

Estimated Cost Summary:

- Among the most expensive options overall

- Good fit if avoiding big upfront payments matters more than keeping premiums low

Bottom Line:

Trupanion is one of the pricier providers, but the direct-to-vet payments can be a huge relief if your Jack Russell ever needs costly surgery or hospitalization.

Check out our full Trupanion review.

| Pros | Cons |

|---|---|

| Pays vets directly at checkout | Higher premiums than most competitors |

| No annual or lifetime payout limits | No coverage for vet exam fees |

| Short 30-day wait for hip dysplasia and patellar luxation | Long 30-day illness waiting period |

| Covers curable pre-existing conditions after 12 months | Enrollment cut-off at age 14 |

| Quick 2-day average claim processing |

Plan Options Comparison Table

All of the providers we’ve highlighted offer accident and illness plans—the most complete coverage for Jack Russell Terriers.

Your best choice depends on your budget and needs, including:

- Deductibles

- Reimbursement rates

- Annual payout limits

Some also provide wellness add-ons or accident-only coverage if you want more flexibility.

Use the table below to compare the core features side by side.

| Company | Deductibles | Reimbursements | Limits | Wellness Plans | Accident-Only Plans |

|---|---|---|---|---|---|

| $50–$1,000 | 70%, 80%, 90% | $5,000, $10,000, Unlimited | ||

| $250–$700 | 70%, 80%, 90% | $5,000, $10,000, $15,000, or Unlimited | ||

| $100–$1,000 | 50%, 60%, 70%, 80%, 90% | Unlimited | |||

| $100–$750 | 70%, 80%, 90%, 100% | $5,000, $10,000, Unlimited | ||

| $100–$1,000 | 70%, 80%, 90% | $2,000, $5,000, $8,000, $10,000, $15,000, Unlimited | ||

| $100–$750 | 60%, 70%, 80%, 90% | $5,000, $10,000, $20,000, $50,000, $100,000 | ||

| $0–$1,000 | 50%, 60%, 70%, 80%, 90%, 100% | Unlimited |

What Type of Pet Insurance Plan Is Best For Basset Hounds?

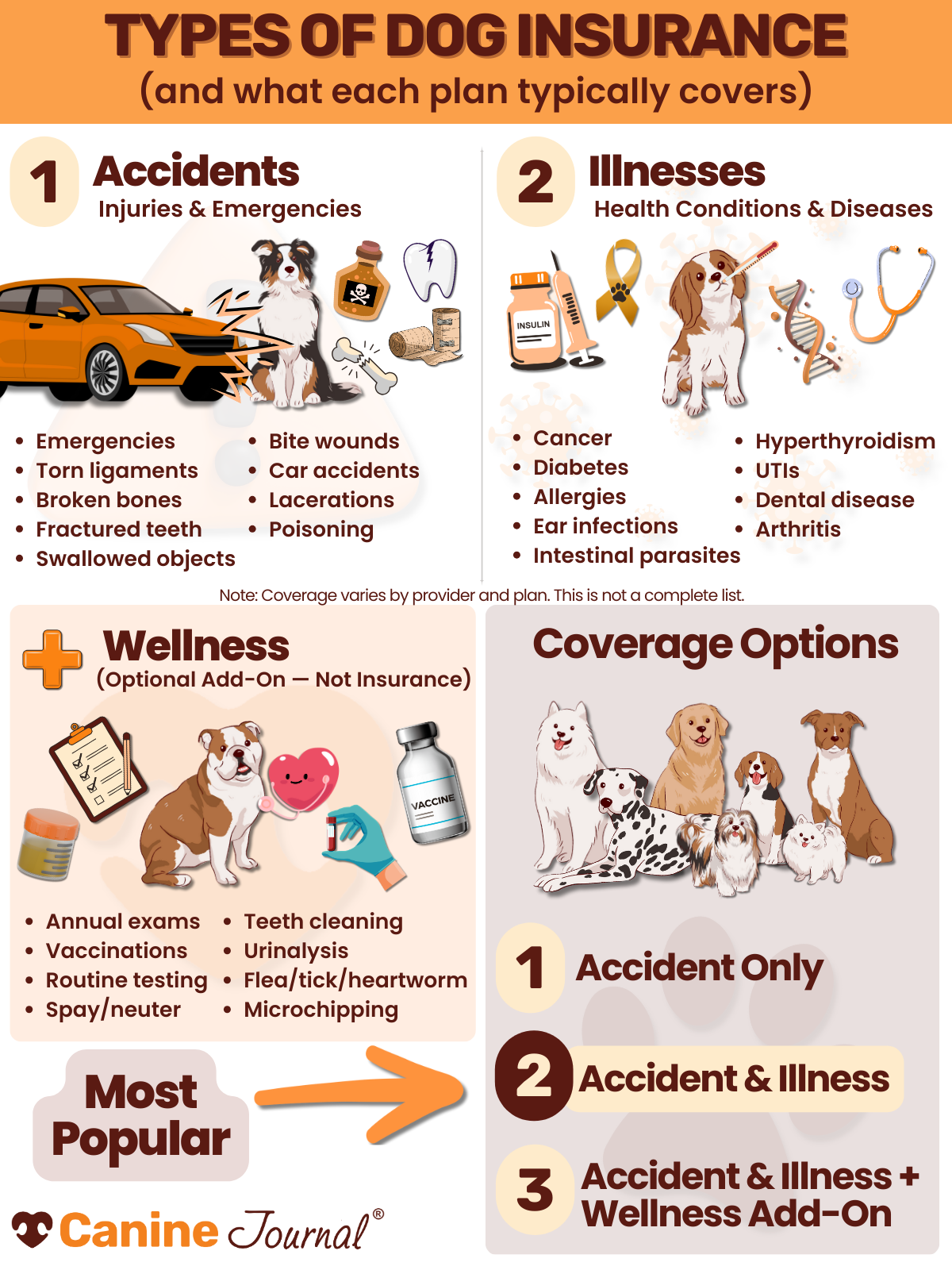

Pet insurance comes in a few different forms, but not every plan gives Jack Russell owners the protection they really need. The main categories are accident-only coverage and accident & illness coverage, with wellness add-ons available from many providers.

What Is An Accident-Only Plan?

Accident-only coverage pays for unexpected injuries, such as:

- Broken bones from a fall or collision

- Bite wounds from a dog fight at the park

- Eye trauma from rough play or accidents

- Torn ligaments (like a cranial cruciate ligament [CCL] tear)

These plans are budget-friendly but won’t cover illnesses or genetic conditions, both of which Jack Russells are at risk for.

Pricing Tip: Accident-only is usually the cheapest option, but it won’t help with hereditary issues like lens luxation, patellar luxation, or hip dysplasia.

What Is An Accident & Illness Plan?

This is the most popular and comprehensive option. It includes everything covered by accident-only plans, plus conditions common in Jack Russells, such as:

- Patellar luxation

- Lens luxation and cataracts

- Dental disease

- Skin allergies and infections

- Legg-Calvé-Perthes disease

- Chronic digestive or metabolic disorders

If you want strong protection for the conditions most likely to affect your JRT, this is your best option.

What Are Wellness Plans?

Wellness add-ons help cover routine and preventive care, like:

- Annual exams and vaccinations

- Dental cleanings

- Parasite prevention (fleas, ticks, heartworm)

- Spaying/neutering

While these aren’t technically pet insurance, they can help you budget for predictable care and encourage preventive vet visits, which is especially valuable for small breeds like Jack Russells, who often need ongoing dental attention.

Important Note: Wellness add-ons only cover routine care. They won’t help if your JRT develops an unexpected illness or injury.

What Does Pet Insurance Cover & Exclude?

Every pet insurance company designs its policies a little differently, but most accident and illness plans follow the same general pattern: they’ll cover conditions that are unavoidable and medically necessary, while leaving out things that are elective, routine, or pre-existing.

Here’s a side-by-side look at what’s usually included (and what isn’t) for Jack Russell Terriers:

| Covered | Excluded |

|---|---|

| Alternative therapies (e.g., acupuncture, physical therapy, rehab, etc.) | Boarding |

| Diagnostic tests (bloodwork, X-rays, MRIs, CT scans, ultrasounds) | Cremation & burial costs |

| Emergency care & hospitalization | Elective procedures (declawing, ear cropping, tail docking, spaying/neutering) |

| Euthanasia (if due to a covered condition) | Food & supplements |

| Hereditary & chronic conditions (e.g., IVDD, glaucoma, hypothyroidism, etc.) | Grooming |

| Illnesses (cancer, ear infections, GI issues, eye problems) | Pre-existing conditions* |

| Injuries (cuts, broken bones, bite wounds) | Pregnancy & breeding |

| Non-routine dental treatment | Preventable conditions (e.g., parasites, illnesses due to lack of routine care, etc.) |

| Prescription medications | Routine care (annual exams, vaccines, dental cleanings) |

| Specialists (cardiologists, neurologists, etc.) | |

| Surgery |

Dig Deeper Into Coverage Rules

Not every plan draws the line in the same place. Want to know exactly what’s included, what’s optional, and what’s never covered? Check out our guide to what pet insurance covers so you go in with clear expectations for your Jack Russell’s policy.

What Determines The Cost Of Pet Insurance For Jack Russells?

Pet insurance premiums aren’t random—they’re calculated using several factors tied to your dog and your choices as the owner. With Jack Russells, some elements are out of your control (like their breed risk), while others you can adjust to manage costs.

Here’s what typically affects what you’ll pay:

- Age

- Young Jack Russells are usually cheaper to insure because they’re less likely to have developed health conditions.

- Premiums increase steadily as your Terrier ages, especially once issues like patellar luxation or cataracts become more common.

- Breed

- Purebred dogs like Jack Russells often cost more to insure than mixed breeds because they’re predisposed to specific hereditary health problems.

- Gender

- In some cases, males are slightly pricier to cover since they tend to be a bit larger, which can impact medication dosages and surgical costs.

- Location

- Where you live matters. Urban areas with higher vet costs usually come with higher monthly premiums.

- Insurers factor in the average cost of veterinary care in your ZIP code when setting rates.

Ways You Can Influence Premium Pricing

You can’t change your Jack Russell’s age, breed, or gender, but you can adjust your coverage details to fit your budget.

Maximum Payout

This is the maximum amount your insurer will reimburse you.

- Annual payout: (e.g., $5,000, $10,000, unlimited) reset every year (used by most insurers)

- Lifetime payout: Max over your dog’s entire life

Pricing Tip: A lower payout means a cheaper premium, but it also increases the risk of being underinsured if your dog develops a costly condition.

Deductible Type

- Annual deductible: You pay this amount once per year before coverage takes effect. These are the most common and budget-friendly.

- Per-condition deductible: You pay once for each new condition or illness. This can be helpful if your JRT develops a long-term problem, such as luxating patellas.

Pricing Tip: The higher the deductible, the lower your monthly bill.

Reimbursement Percentage

After the deductible, this is the share your provider pays on each bill. Common options are 70%, 80%, or 90%.

- Example: At 70% reimbursement, you cover 30% of the bill plus your deductible.

If you choose 80%, you pay 20% of the vet bill (your copay) after the deductible.

Pricing Tip: Choosing a lower reimbursement level keeps premiums down but increases your out-of-pocket costs when you file a claim.

Learn More About Pet Insurance Costs

Want to dive deeper?

Explore how premiums are calculated and get tips on saving money while staying protected.

How Much Is Pet Insurance For A Jack Russell Terrier?

What can you realistically expect to spend each month?

Just enter your zip code and your JRT’s details below. You’ll get personalized quotes from top pet insurance providers tailored to your dog’s breed, age, and location.

While it’s useful to see typical U.S. pricing, keep in mind that your dog’s individual needs and where you live will shape what you end up paying.

According to NAPHIA (North American Pet Health Insurance Association), the average monthly premium for an accident and illness dog insurance policy in the U.S. is $62.44 ($32.10 for cats).

Below, you’ll find a comparison of sample monthly rates for Jack Russells across the U.S. to give you a ballpark idea.

Remember: these numbers are just averages. Your actual price may be higher or lower based on your dog’s age, location, and health history.

Keep in mind: Your actual quote will vary based on your dog’s age, location, and health history.

| Company | 6mo old male 92117 (San Diego, CA) | 1yr old female 14211 (Buffalo, NY) | 2yr old male 33604 (Tampa, FL) | 5yr old female 78731 (Austin, TX) | 8yr old male 07305 (Jersey City, NJ) |

|---|---|---|---|---|---|

| $31.40 | $24.45 | $19.24 | $29.14 | $78.95 |

| $61.89 | $33.53 | $33.09 | $43.53 | $97.45 |

| $39.93*§ | $28.48*§ | $35.44§ | $48.73*§ | $93.81**§ | |

| $40.67 | $36.57 | $36.09 | $43.18 | $126.05 |

| $33.85 | $31.73 | $27.10 | $41.30 | $67.51 |

| $40.28 | $30.75 | $19.69 | $28.62 | $68.26 |

| $110.81§ | $111.27§ | $64.34§ | $126.30§ | $223.36§ |

*80% reimbursement; **70% reimbursement; §Unlimited annual payouts

Jack Russell Terrier Insurance Cost: Low & High Estimates

To give you a clearer picture of what you might pay, here’s a look at the lowest and highest monthly premiums available for Jack Russells from major providers. These examples don’t include wellness add-ons.

I’ve included pricing for both puppies and adult dogs so you can see how costs at the time of enrollment shift as your Terrier gets older.

Tip: The earlier you insure your Jack Russell, the more affordable your monthly rate will be—and you’ll lock in coverage before any health issues appear.

| Company | 2mo old 92117 (San Diego, CA) | 5yr old 92117 (San Diego, CA) | 2mo old 14211 (Buffalo, NY) | 5yr old 14211 (Buffalo, NY) | 2mo old 33604 (Tampa, FL) | 5yr old 33604 (Tampa, FL) | 2mo old 78731 (Austin, TX) | 5yr old 78731 (Austin, TX) | 2mo old 07305 (Jersey City, NJ) | 5yr old 07305 (Jersey City, NJ) |

|---|---|---|---|---|---|---|---|---|---|---|

| $14.04-$87.26 | $16.67-$103.58 | $10.93-$69.55 | $12.98-$82.55 | $10.00-$63.48 | $10.87-$69.01 | $11.99-$68.07 | $13.03-$74.00 | $16.42-$94.49 | $17.85-$102.72 |

| $40.87-$104.23 | $76.33-$199.81 | $24.02-$50.14 | $40.01-$88.09 | $22.06-$48.25 | $36.86-$83.36 | $24.96-$51.69 | $30.85-$65.66 | $24.91-$52.25 | $40.35-$88.91 |

| $23.78-$46.97 | $35.31-$70.09 | $16.85-$34.43 | Uninsurable | $13.90-$55.62 | $25.89-$103.56 | $19.38-$61.50 | $29.36-$58.09 | $21.76-$42.36 | $30.14-$58.90 | |

| $17.97-$105.73 | $23.35-$137.38 | $15.08-$114.31 | $19.60-$148.53 | $14.77-$112.05 | $19.73-$149.64 | $12.71-$96.44 | $16.98-$128.78 | $23.27-$150.64 | $30.24-$195.75 |

| $15.09-$90.81 | $15.09-$90.81 | $11.11-$96.96 | $11.37-$99.19 | $10.61-$69.94 | $13.80-$90.92 | $15.39-$78.61 | $19.14-$97.75 | $14.34-$94.45 | $18.78-$123.73 |

| $20.26-$148.84 | $21.08-$154.54 | $19.07-$113.10 | $19.51-$115.45 | $13.78-$95.72 | $14.19-$98.98 | $19.77-$92.26 | $19.79-$92.33 | $27.41-$127.68 | $26.42-$123.58 |

| $65.57-$279.01 | $135.08-$601.67 | $58.59-$246.60 | $100.50-$441.12 | $31.77-$122.09 | $59.98-$253.06 | $39.38-$157.40 | $76.86-$331.40 | $45.07-$183.86 | $88.85-$387.08 |

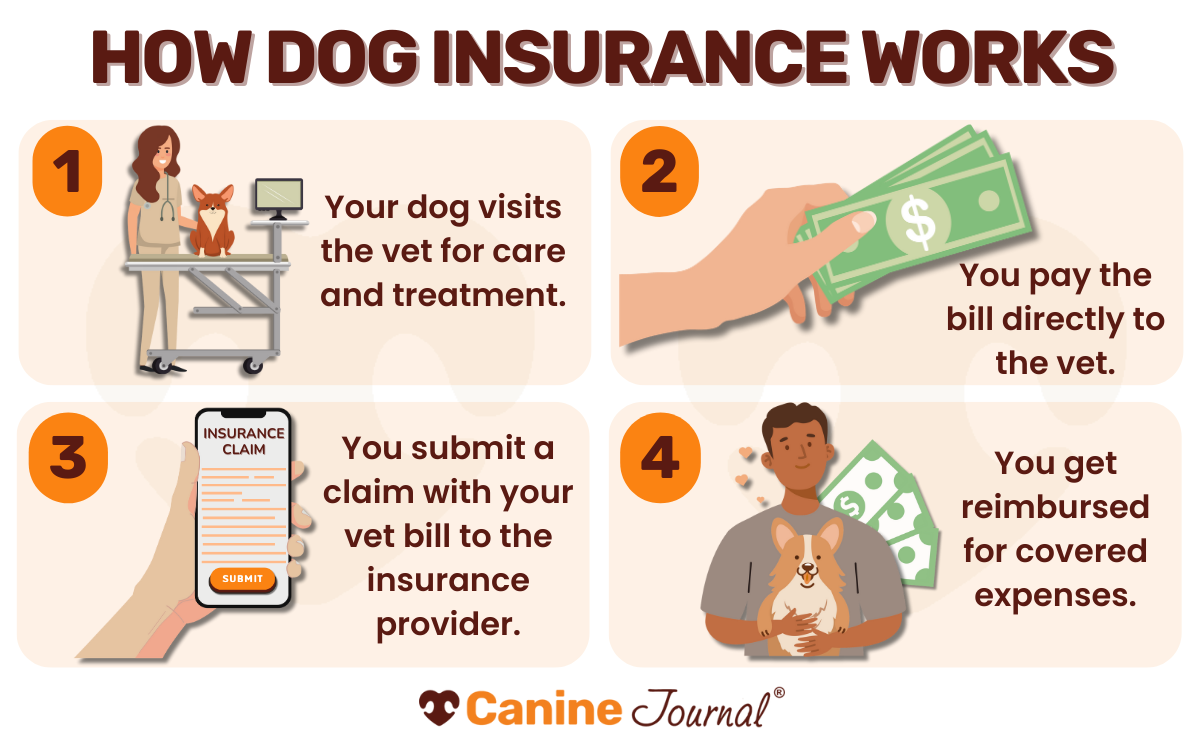

How Does Pet Insurance Work For Jack Russells?

At its core, pet insurance is designed to reimburse you for eligible vet expenses when your Jack Russell needs medical care. You pay the vet up front, submit a claim, and then get money back based on the terms of your policy.

Before coverage begins, every provider has a waiting period, usually anywhere from a few days for accidents to a couple of weeks for illnesses. Orthopedic conditions sometimes have longer waits, which is important for JRTs given their knee and hip risks.

Once your policy is active, the amount you’re reimbursed depends on:

- Deductible

- Reimbursement percentage

- Maximum payout

- What’s included or excluded under your specific policy

The good news? Using pet insurance is usually pretty simple.

How To Use Your Pet Insurance

Filing a claim for your Jack Russell is usually a simple process. Here’s what it looks like in practice:

- Visit the vet – Take your dog in for treatment, whether it’s a sudden injury or an illness.

- Pay the bill – Most providers require you to pay up front before reimbursement.

- Submit your claim – Send in an itemized receipt through the insurer’s online portal, mobile app, or by email.

- Get reimbursed – Depending on your policy setup, you’ll receive a direct deposit or check for the covered portion. Some companies even process claims within minutes, while others may take several days or weeks.

For Jack Russell parents, who often deal with recurring issues like knee or eye treatments, quick claims turnaround can make a big difference in managing cash flow.

What Are Waiting Periods For Jack Russell Terrier Pet Insurance?

A waiting period is the stretch of time between when you enroll and when your coverage actually begins. Every provider sets its own rules, and the details matter.

Here’s what you’ll typically see across insurers:

- Accident coverage: 0 to 15 days

- Illness coverage: Typically 14 days

- Orthopedic conditions (like patellar luxation or hip dysplasia): Many have extended waiting periods, sometimes up to 6–12 months

Because Jack Russells are genetically prone to orthopedic problems, it’s smart to review the fine print before enrolling. Some companies have special waiting periods specifically for those conditions.

*States are gradually adopting a Model Law for pet insurance, aiming to standardize regulations, including uniform waiting periods. In California, Delaware, Louisiana, Maine, Mississippi, Nebraska, New Hampshire, Washington, Rhode Island, Maryland, and Florida waiting periods are:

- Accidents: 0 days

- Illnesses: 14 days

- Cruciate Ligament Conditions: 30 days

- Routine Care: 0 days

Learn More About Waiting Periods

Waiting periods can be frustrating, especially if your JRT is already dealing with a potential health concern.

Want to see which insurers offer the shortest waits or even zero waiting period for accident coverage?

Check out our guide to pet insurance with no waiting periods.

10 Common Health Issues In Jack Russell Terriers

Jack Russell Terriers are tough little dogs with long lifespans, but their genetics and active lifestyles can set them up for some costly health problems.

Below are some of the most common conditions vets see in this breed — and what you might expect to pay for diagnostics and treatment.

1. Luxating Patellas

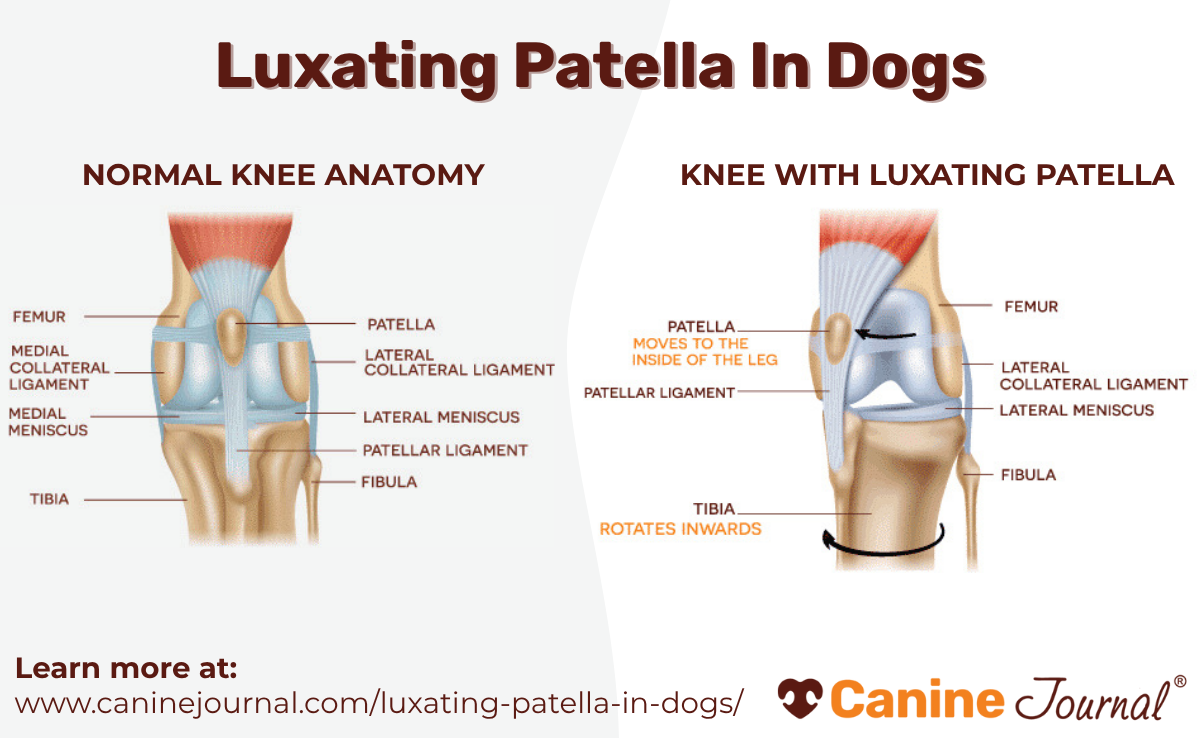

A luxating patella happens when the kneecap slips out of place, leading to limping or difficulty bearing weight. Over time, it can cause arthritis if not corrected. A luxating patella is one of the most common orthopedic issues in small breeds like JRTs.

Cost: $1,500–$3,000 per knee if surgery is required.

2. Allergies

JRTs frequently struggle with environmental and food allergies, which can cause itching, ear infections, and skin problems. Our dog allergy guide covers common triggers and treatments.

Cost: $200–$1,000+ per year for testing, medication, and ongoing care.

3. Dental Disease

With their small jaws, Jack Russells are prone to dental disease that leads to plaque buildup, infections, and tooth loss. Untreated dental problems can also affect heart and kidney health.

Cost: $300–$1,000+ for routine cleanings; extractions add significantly more.

4. Multiple Eye Conditions

Inherited eye conditions are a major concern for Jack Russells. Primary lens luxation, cataracts, and glaucoma can all appear in this breed, sometimes leading to blindness if untreated.

Cost: $1,500–$5,000+, depending on the condition and whether surgery is needed.

5. Ear Infections

Jack Russells’ floppy ears can trap moisture and debris, which makes them prone to chronic ear infections. Chronic allergies also cause recurring ear infections.

Cost: $100–$300 per vet visit, depending on severity and recurrence.

6. Legg-Calvé-Perthes Disease

This degenerative hip condition reduces blood flow to the femur bone, causing pain and lameness in young dogs. It’s less common than patellar luxation but can be devastating if untreated.

Cost: $2,000–$4,000+ for surgical correction.

7. Hip And Elbow Dysplasia

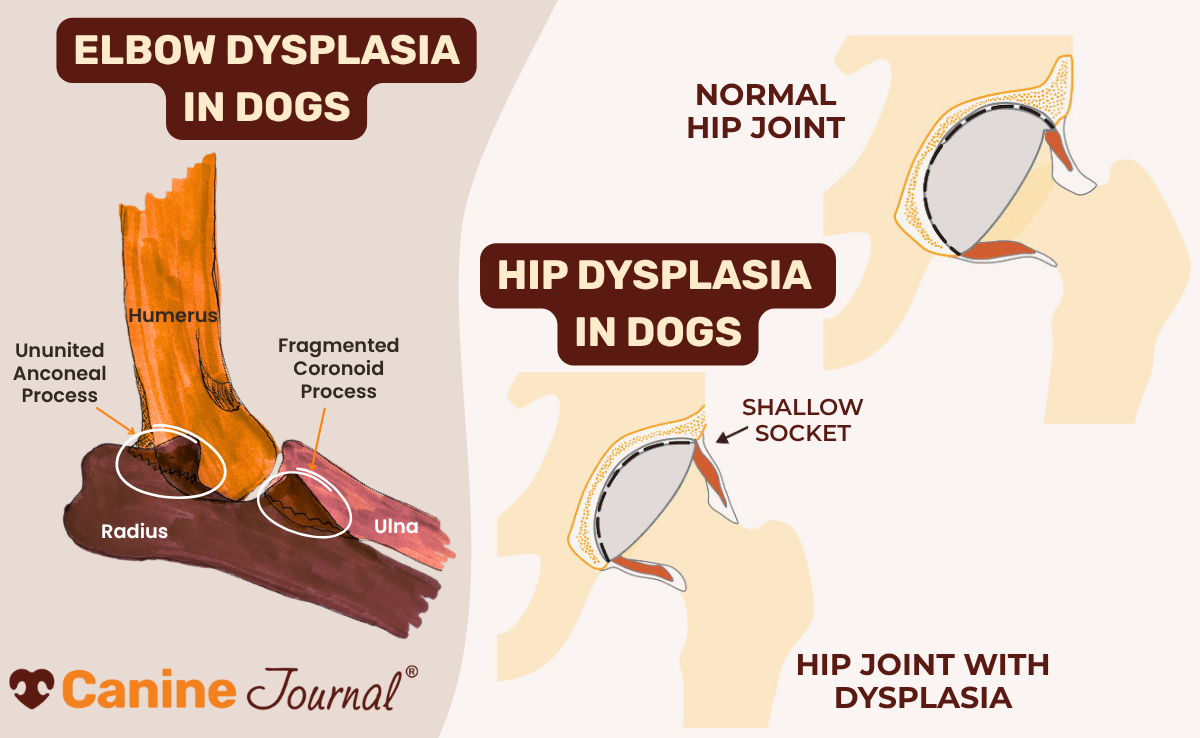

While often associated with larger breeds, Jack Russells can also develop dysplasia. These joint conditions affect mobility and comfort, especially in older or overweight dogs.

Hip dysplasia is a chronic condition where the head of the femur bone doesn’t fit correctly into the hip socket. Elbow dysplasia consists of abnormal development of the elbow joint due to defects in cartilage development, abnormal bone growth, or joint stress.

Cost: $1,500–$4,500+ for surgery; $50/month for supplements or medication.

8. Portosystemic Shunt (PSS)

A congenital liver disorder where blood bypasses the liver, leading to toxin buildup. Puppies with liver shunts often show poor growth and neurological symptoms.

Cost: $2,000–$6,000 for surgery, plus medication or dietary management.

9. Bladder & Kidney Stones

Painful urinary stones can block the urinary tract and require urgent care. Our guide to bladder stones in dogs explains causes and treatment.

Cost: $800–$3,500+, depending on severity and treatment method.

10. Pancreatitis

Pancreatitis is inflammation of the pancreas, often triggered by fatty foods. It’s painful and can become life-threatening without immediate treatment.

Cost: $500–$3,000+ for hospitalization, fluids, and supportive care.

Is Pet Insurance Worth It For Jack Russell Terriers?

Jack Russell Terriers are famously tough, but toughness doesn’t cancel out vet bills. Their genetic risks (like luxating patellas, lens luxation, and liver shunts) combined with their high-energy lifestyle mean accidents and chronic health issues are fairly common.

From allergies and dental disease to eye problems and orthopedic surgeries, Jack Russells can rack up thousands in medical costs over their 12–15+ year lifespans. And because many of these issues require long-term treatment, bills can quickly snowball.

That’s why pet insurance often makes sense for this breed. By covering a significant portion of unexpected costs, insurance helps you focus on keeping your JRT healthy instead of worrying about how to pay for care.

Curious whether coverage makes sense for your dog? Explore our guide on whether pet insurance is worth it to help weigh the pros and cons.

5 Steps To Find The Best Jack Russell Terrier Insurance

Jack Russell Terriers can live well into their teens, which is wonderful, but it also means more years of potential vet expenses. Choosing a plan early can help you secure coverage before problems appear.

Here are five smart steps to guide your decision:

- Research the company’s track record

Look for providers with strong customer reviews, a history of paying claims quickly, and good communication. - Consider breed-specific risks

Jack Russells are prone to issues like patellar luxation, eye disease, and dental problems. Make sure your plan covers these conditions without long waiting periods. - Pick the right coverage type

Accident-only plans are the cheapest, but accident & illness plans are usually the better fit for Jack Russells since they experience hereditary and chronic conditions. - Check how claims are handled

Some companies process reimbursements in a couple of days, while others take weeks. If fast turnaround matters to you, factor this into your choice. - Compare multiple quotes

Prices can vary widely, even for the same dog. Get at least three quotes to find the right balance between cost and coverage.

Methodology

My team and I conduct extensive research on the most reputable pet insurance companies, analyzing customer feedback, policy changes, and industry trends. Our licensed insurance agent fact-checks everything, and we update our reviews year-round as insurers adjust premiums, coverage, exclusions, and customer service.

We rank each U.S. pet insurance provider using a 100-point scale, ensuring an unbiased breakdown of how companies perform in real-world claims.

Our Ranking Criteria

- Coverage & Exclusions (30%) – We analyze policies, exclusions, and age restrictions, rewarding companies with fewer coverage limitations.

- Pricing (15%) – We run thousands of sample quotes and factor in extra fees, discounts, and add-ons.

- Customer Service & Reputation (12%) – We review hundreds of customer experiences, assess the sign-up process, and evaluate claim support.

- Financial Strength (10%) – We examine A.M. Best & Demotech ratings to ensure companies can pay claims reliably.

- Customization Options (10%) – Providers with more deductible, reimbursement, and payout flexibility rank higher.

- Waiting Periods (5%) – Shorter illness & accident waiting periods result in a better score.

- Claim Processing (5%) – Companies offering fast reimbursements and direct vet pay score higher.

- Innovation (3%) – We recognize unique offerings and advanced technology in the industry.

Unbiased Pet Insurance Rankings: Putting Pets First

Unlike many review sites, we don’t sell rankings—every provider earns its spot based on real performance. Our in-depth comparisons help pet parents make informed decisions, while insurers use our reviews to improve their policies. We only recommend the best because that’s what our readers deserve.