2025 Pet Insurance Comparison Charts: See Side-By-Side Coverage & Costs

When you purchase through links on our site, we may earn a commission. Here’s how it works.

Think pet insurance is just an extra expense? Think again. One unexpected accident or illness could leave you facing a $5,000+ vet bill—or worse, a heartbreaking decision. But with so many policies packed with fine print, how do you know which one actually pays out when it matters?

This guide cuts through the confusion, comparing coverage, costs, and hidden exclusions so you can choose the best plan with confidence. Don’t get stuck with a policy that leaves you hanging when your pet needs it most!

Table of Contents

Best Pet Insurance Plans In 2025

| Ranking | Company | Get Quotes | Read In-Depth Reviews |

|---|---|---|---|

| Best Overall |  | Read Review | |

| Best For Puppies & Kittens |  | Read Review | |

| Best Unlimited Payouts | Read Review | ||

| Best Value |  | Read Review | |

| Best Coverage |  | Read Review | |

| Most Affordable |  | Read Review |

Pet Insurance Company Coverage Comparison Tables

The tables below serve as a guide to help you navigate the differences in coverage among providers. By comparing policies, you can make an informed decision on the best pet insurance coverage for your pet and your budget, especially during difficult times. The items checked in the tables below indicate they are generally covered when prescribed or administered by a licensed veterinarian to treat a covered condition.

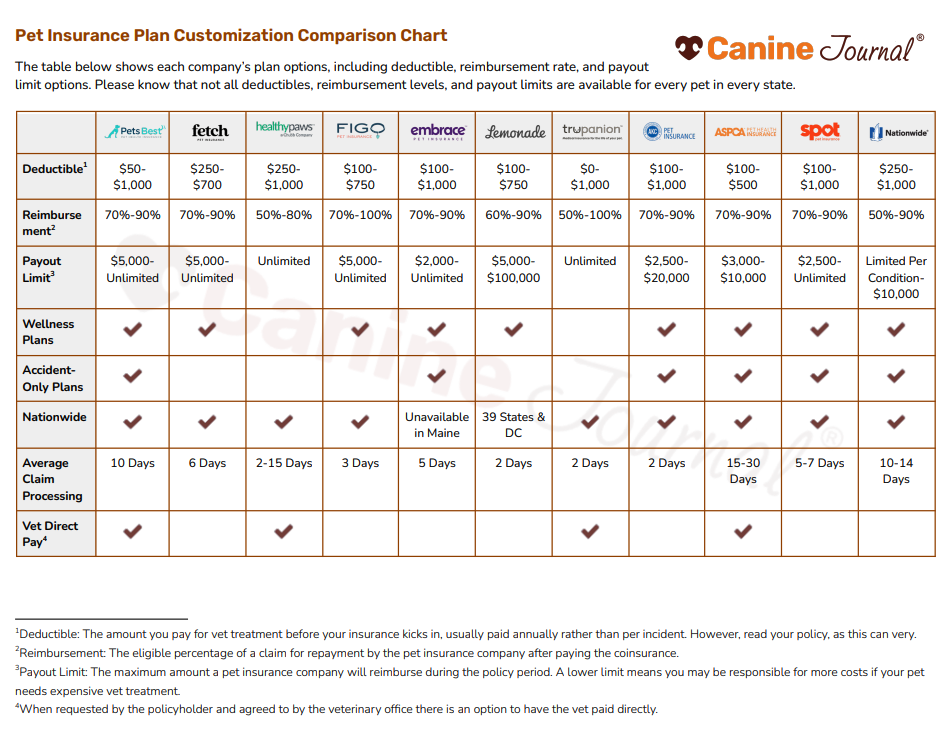

Plan Options Comparison

Determining the best pet insurance policy isn’t just about coverage—it’s about finding a plan that suits both your budget and your pet’s needs. Options like deductible amounts, reimbursement percentages, and annual limits can make a big difference in how much you ultimately pay out-of-pocket. Some providers even offer perks like wellness plans or more affordable accident-only coverage, as well as the ability to pay your vet directly. The table below lays out these essential details, so you can quickly compare policies and choose what works best for you.

Please note that plan options may vary depending on your pet’s breed, age, and location.

†Reimbursement: The eligible percentage of a claim for repayment by the pet insurance company after paying the coinsurance.

‡Limit: The maximum amount a pet insurance company will reimburse during the policy period. A lower limit means you may be responsible for more costs if your pet needs expensive vet treatment.

Conditions & Treatment Comparison

Most accident and illness pet insurance policies cover a broad range of conditions, as long as they are not pre-existing and do not show symptoms before or during the waiting period. Covered conditions typically include cancer, hereditary disorders, allergies, chronic conditions, cruciate ligament tears, diabetes, urinary tract infections, arthritis, broken bones, and more.

However, AKC Pet Insurance is an exception, requiring add-ons for hereditary, congenital, and chronic conditions.

These policies also cover various diagnostics and treatments for eligible accidents and illnesses, including X-rays, CT scans, blood tests, ultrasounds, emergency care, MRIs, surgery, hospitalization, and outpatient care.

The table below highlights how different providers compare in covering specific conditions and treatment options.

**Coverage for curable pre-existing conditions varies by provider. AKC Pet Insurance is the only provider to cover pre-existing conditions after 1 year of continuous coverage.

Dental Accidents & Illness Coverage Comparison

By age 3, up to 90% of dogs and cats develop periodontal disease (also referred to as gum disease), yet many pet insurance policies offer little to no coverage for treatment. Dental coverage options vary widely among providers, and for smaller breeds, cats, or dogs prone to dental issues, prioritizing this coverage can be crucial. The comparison table below highlights key differences in dental coverage among several pet insurance companies. For a more comprehensive look, be sure to check out my detailed pet dental insurance guide.

Therapy Coverage Comparison

Orthopedic conditions can impact dogs of all sizes. Labrador Retrievers, Rottweilers, and American Staffordshire Terriers are particularly prone to cranial cruciate ligament (CCL) tears, while German Shepherds, French Bulldogs, and Dachshunds often encounter IVDD (intervertebral disc disease). Rehabilitation therapies, such as physical therapy and hydrotherapy, are commonly recommended treatments to help dogs recover strength and mobility following an orthopedic injury. Including coverage for alternative and complementary therapies ensures that recommended treatments, such as chiropractic care or laser therapy, are more affordable and accessible.

The table below highlights the complementary and alternative therapy coverage offered by various policies. For treatments like therapeutic ultrasound, electrotherapy, and more, be sure to consult your policy or reach out to your provider to confirm what’s included. For more information, my colleague has explored the nuances of pet insurance coverage for both behavioral and physical therapy.

†Holistic treatment includes but is not limited to herbal therapy, naturopathy, and homeopathy.

‡Limited to vet consultations and medication.

§Trupanion‘s base policy includes herbal therapy, but the rider is required for homeopathy and naturopathy coverage.

Wellness Plans Comparison

Many pet owners are surprised to learn that standard pet insurance plans don’t cover routine wellness visits or preventive services. A wellness plan isn’t an insurance product; rather, it helps offset costs for annual checkups, basic diagnostic tests (like blood work, fecal exams, and urinalysis), heartworm prevention, routine vaccinations, dental cleanings, spaying and neutering, and more.

The table below compares wellness plans from different providers, outlining their costs, benefits, and the potential savings if you take advantage of all available services. For more details on what each plan includes, check out my comprehensive guide to pet wellness plans.

Waiting Periods Comparison

All pet insurers have waiting period requirements – the time between enrollment and when coverage kicks in. Companies generally have about a 14-day waiting period for illnesses and a 3-day waiting period for accidents. Additional waiting periods may exist for CCL, hip dysplasia, and other orthopedic conditions. These waiting periods can last six or twelve months, so check these details closely before signing up. All major pet insurers have waiting periods, but you can learn more about pet insurance without waiting periods.

*States are gradually adopting a Model Law for pet insurance, aiming to standardize regulations, including uniform waiting periods. In California, Delaware, Louisiana, Maine, Mississippi, Nebraska, New Hampshire, Washington, Rhode Island, and Maryland, waiting periods are:

- Accidents: 0 days

- Illnesses: 14 days

- Cruciate Ligament Conditions: 30 days

- Routine Care: 0 days

Age Limits Comparison

What are the age limits for pet insurance? The table below outlines age restrictions for some leading pet insurance companies. Once you’ve purchased and maintained a policy, these companies won’t end coverage as your pet ages.

Enrolling your dog in a pet insurance policy at a young age, ideally as a puppy, is a proactive and responsible step. It minimizes the risk of pre-existing conditions being excluded from your coverage, ensuring comprehensive protection for your furry friend.

†Lemonade Plan Restrictions: Some breeds have specific age limitations for enrollment.

‡AKC Pet Insurance: In NY, CA, FL, and WA pets must be at least 8 weeks old. Coverage can begin from birth in other states.

Pros & Cons Table

The table below highlights the most significant strengths and weaknesses, helping you understand the key differences between pet insurance providers.

Cost Comparison

I ran quotes and created price comparison tables (below) to help show how pet insurance quotes can vary by provider. I tried to compare apples to apples, but sometimes, it’s impossible since only some offer the same payout limits, reimbursement percentages, and deductible amounts. The quotes listed have the fewest treatment and condition exclusions from each provider, and pets have no pre-existing conditions.

To create a broad range of quote examples, I chose locations and breeds based on the most popular geographic areas to own a pet insurance policy and the most popular breeds in those locations. All companies have annual coverage limits except for Trupanion (lifetime) and Nationwide (per condition annually). Please scroll down to see them all or jump to a specific quote below.

Labrador Retriever In Texas

- 6-month-old

- Female (not spayed)

- Houston, Texas (77005)

French Bulldog In California

- 1-year-old

- Male (neutered)

- Los Angeles, California (90016)

French Bulldog In New York

- 3-year-old

- Female (spayed)

- New York, New York (10005)

Printable Pet Insurance Comparison Charts (PDF)

Looking for a convenient, easy-to-reference version of the pet insurance comparison charts above? You’re in luck! I’ve created a condensed version for you, with all the charts neatly organized onto eight pages (or just four if you print double-sided). Click here to view and print it. It includes comparison tables for:

- Plan Options

- Conditions & Treatment

- Dental Accidents & Illness

- Therapy Coverage

- Waiting Periods

- Age Limitations

How Is Pet Insurance Cost Determined?

The cost of each pet insurance policy is unique to your specific pet. It’s calculated based on many variables.

Plan Details

The type of plan you select (accident-only plan or accident and illness plan), as well as the annual payout limit, deductible, and reimbursement percentage for that plan impacts your pet insurance premium.

Payout Limit

The payout limit is the most money a pet insurer will reimburse during the policy term or the pet’s insured lifetime. Plans with lower payouts are less expensive than those with higher or unlimited annual payouts. However, a lower payout limit also means you’re liable for more costs if your pet has expensive veterinarian treatment.

Deductible

The deductible is the portion of the vet bill you’re responsible for paying before the provider pays out or reimburses your claim. Typically, plans with higher deductibles are less expensive than those with lower deductibles. However, a higher deductible also means you must cover more vet costs before your pet insurance kicks in.

There are two deductible types: annual and incident.

Annual Deductible

Policies with an annual deductible require you to fulfill the deductible once per policy period. Most pet insurers use annual deductibles for their policies.

Pet insurance plans with annual deductibles are easier to budget for because you know the deductible only needs to be met once during the policy term.

Incident Deductible

Plans with a per-incident deductible require you to meet the deductible once for each new emergency your pet has. Trupanion and Nationwide are the only insurers we review that utilize per-incident deductibles.

Dogs who suffer from a chronic condition may benefit from a policy with an incident deductible because you only need to pay the deductible once for each condition. So once you’ve paid the deductible for your dog’s chronic condition, you won’t need to pay that condition’s deductible again.

Reimbursement

The reimbursement is the percentage of a claim eligible for repayment by the insurance company after your deductible. Plans with lower reimbursement percentages are less expensive than those with higher reimbursement percentages. However, a lower reimbursement percentage also means your copay is higher for each pet insurance claim you submit.

Pet’s Age

Younger pets typically have lower premiums than older pets. This is because older pets are at an increased risk of experiencing an accident or illness, resulting in more costly vet bills. Policyholders with older pets should expect higher pet insurance premiums to match the increased risk and an increase in premiums as your pet ages.

Pet’s Breed

Purebred dogs have a less diverse gene pool than mixed-breed dogs, resulting in an increase in hereditary condition diagnoses. Therefore, mixed-breed dogs tend to be healthier than purebreds. Because of this, mixed breeds typically have fewer vet bills than purebreds. Less veterinary expenses lead to lower risk for insurers and often are reflected in premium prices.

Pet’s Gender

Males are typically larger than females, so they often require higher doses of medication, larger medical equipment, and additional medical supplies. All of this increases the cost of male vet care over that for females.

According to NAPHIA‘s latest report, of the top ten claims paid for dogs in North America in 2024, nine of them were for males, totaling $468,519, and one was for females, totaling $43,400.

Your Location

Where you live (your zip code) influences your premium because the cost of supplies, office space, staff, etc., impacts your vet bill. This is why medical procedure costs vary from city to city and nationwide. Each vet office must determine the cost of the procedure, including equipment, personnel, prescription medication, etc. Just as living costs vary from the country to the city, so does the cost of vet care.

What Is The Average Cost Of Pet Insurance?

According to NAPHIA (North American Pet Health Insurance Association), the average monthly premium for an accident and illness dog insurance policy in the U.S. is $62.44 ($32.10 for cats).

You should expect annual increases in your premiums from most pet insurance companies. These rates and increases will vary based on your location, changes in vet care costs, inflation, and more. Since the price for your pet from one provider may differ significantly from that of competitors, I encourage you to get your own quotes from multiple companies.

Frequently Asked Questions

Our readers frequently ask these questions after reading our comparisons.

Is Pet Insurance Worth It?

Pet insurance can be worth it, depending on your situation. It helps you avoid having to choose between your pet’s health and finances, especially in emergencies. If you can afford the monthly premium, knowing you’re covered for unexpected vet bills offers peace of mind.

But it’s not for everyone. It’s important to consider your budget and your pet’s specific needs.

For example, if you have a Frenchie, I’d 100% recommend it. They’re expensive to purchase and prone to costly health conditions. If you’re already spending a lot on the breed, insurance can be a smart choice. However, if you’re financially comfortable, self-insuring might be an option.

Which Pet Insurers Are Not Reviewed?

Are any pet insurance providers excluded from your comparison? The pet insurance market is proliferating, and new providers are continually entering. We only rank companies once they have a five-year history in the pet insurance industry due to frequent price fluctuations, and we want to ensure that they will still be around. However, we do review them.

Visit our alphabetical pet insurance company catalog for a comprehensive listing of all the providers we cover, along with basic stats, including their founding year, headquarters location, underwriter, customer service options, and support hours. We also list each company’s deductibles, payout limits, and reimbursement options so you can make a quick side-by-side comparison.

Is It Possible To Compare Insurers By Average Policy Cost?

The cost of each pet insurance policy is unique to your pet. It’s calculated based on many variables, including but not limited to your pet’s age, breed, location (i.e., where you live), health conditions, etc. You should get quotes from multiple companies with one form.

Do You Compare Pet Insurance For Exotic Pets?

It’s nice to get quotes for dogs and cats, but we have a pet boa constrictor we would like to insure. Can you help us out?

-Canine Journal Reader

Sure! We don’t want any pet to feel left out. Currently, only two companies offers pet insurance for exotic pets in the US. Find out who it is and what’s covered in our exotic pet insurance comparison.

Are There Discounts Available For Pet Owners Of Multiple Pets?

Coverage for more than one pet (in the same household) varies by provider, but you can get a multi-pet discount in many instances. Find out which provider offers the most significant discount in our article on the best pet insurance for multiple pets.

Do You Cover Rabbit Pet Insurance?

We have a pet insurance rabbit comparison that explains how rabbit insurance works, your pet insurance options, how it’s different from dog insurance, how much it costs, and more.

Do You Compare Pet Insurance Plans In Other Countries (UK, Australia, Ireland, Canada, etc.)?

My pet insurance comparisons only cover providers in the United States.

An example of a pet insurance brand that operates in several different countries is Petplan. It is the largest pet insurance provider in the UK, but it also licenses its name for use in Australia, Brazil, Canada, Germany, the Netherlands, New Zealand, and Spain. In January 2022, the company that formerly operated under the Petplan UK license in the U.S. changed its brand name to Fetch.

If there’s enough interest, we may expand our comparison of plans to include the UK, Australia, Ireland, Canada, Europe, and more.

Learn About Typical Costs And How Reimbursements Work

For those of you still on the fence, you’re probably wondering what kind of scenarios your pup might get into when pet insurance would apply. Check out our list of common dog health issues to get an idea. For example, removing lumps and bumps is one of the most frequent surgeries for dogs and can cost more than $1,000 each time (per incident).

That’s a lot of money you weren’t planning to spend, and many people only have a little cash. Getting pet insurance can lift that weight so you can focus on caring for and enjoying your time with your pets instead of worrying about the financial risk of paying for unexpected medical bills.

I break down pet insurance costs, including deductibles, reimbursements, premiums, extra fees, payout options, benefit schedules, and more, to help explain the ins and outs. I will also explain how (and how quickly) reimbursement works.

Compare Quotes & Plans Now

Methodology

My team and I conduct extensive research on the most reputable pet insurance companies, analyzing customer feedback, policy changes, and industry trends. Our licensed insurance agent fact-checks everything, and we update our reviews year-round as insurers adjust premiums, coverage, exclusions, and customer service.

We rank each U.S. pet insurance provider using a 100-point scale, ensuring an unbiased breakdown of how companies perform in real-world claims.

Our Ranking Criteria

- Coverage & Exclusions (30%) – We analyze policies, exclusions, and age restrictions, rewarding companies with fewer coverage limitations.

- Pricing (15%) – We run thousands of sample quotes and factor in extra fees, discounts, and add-ons.

- Customer Service & Reputation (12%) – We review hundreds of customer experiences, assess the sign-up process, and evaluate claim support.

- Financial Strength (10%) – We examine A.M. Best & Demotech ratings to ensure companies can pay claims reliably.

- Customization Options (10%) – Providers with more deductible, reimbursement, and payout flexibility rank higher.

- Waiting Periods (5%) – Shorter illness & accident waiting periods result in a better score.

- Claim Processing (5%) – Companies offering fast reimbursements and direct vet pay score higher.

- Innovation (3%) – We recognize unique offerings and advanced technology in the industry.

Unbiased Pet Insurance Rankings: Putting Pets First

Unlike many review sites, we don’t sell rankings—every provider earns its spot based on real performance. Our in-depth comparisons help pet parents make informed decisions, while insurers use our reviews to improve their policies. We only recommend the best because that’s what our readers deserve.

Why Trust Canine Journal?

Canine Journal has been covering the topic of pet insurance since 2012, well before other conglomerates discovered the rising popularity of health care for our pets. Many of our authors have personal experience with pet insurance, including Kimberly Alt, who has been Canine Journal’s go-to author for pet insurance for over a decade, having written about nearly every possible facet related to pet insurance. Kimberly knows the subject so well that she can answer a breadth and depth of pet insurance questions immediately. And on the rare occasion she doesn’t know the answer off the top of her head, she can find it within minutes due to her extensive list of resources. Kimberly also consulted with Michelle Schenker, Canine Journal’s in-house licensed insurance agent, for additional expertise, to ensure accuracy, and give Canine Journal the authority to write about and assist readers in purchasing policies that are accurately represented.

Pets Best Underwriter Disclosure – Waiting periods, annual deductible, co-insurance, benefit limits, and exclusions may apply. For all terms visit www.petsbest.com/policy. Products, schedules, discounts, and rates may vary and are subject to change. More information is available at checkout. Premiums are based on and may increase or decrease due to the age of your pet, the species or breed of your pet, and your home address.

Pet insurance coverage offered and administered by Pets Best Insurance Services, LLC is underwritten by American Pet Insurance Company (NAIC #12190), a New York insurance company headquartered at 6100 4th Ave. S. #200 Seattle, WA 98108, or Independence American Insurance Company (NAIC #26581), a Delaware insurance company located at 11333 N. Scottsdale Rd. #160 Scottsdale, AZ 85254. Pets Best Insurance Services, LLC (NPN #8889658, CA agency #0F37530) is a licensed insurance agency located at 11333 N. Scottsdale Rd. #160 Scottsdale, AZ 85254. Each insurer has sole financial responsibility for its own products. Please refer to your declarations page to determine the underwriter for your policy. Terms and conditions apply. See your policy for details.

Canine Journal® is a trademark of Cover Story Media, Inc.® All insurance applications and solicitations are entrusted to Michelle Schenker (NPN #19494757; CA license #4071990), a licensed insurance agent representing Cover Story Media, Inc.® Canine Journal® does not underwrite pet insurance or pay claims but receives compensation on sale and/or renewal.